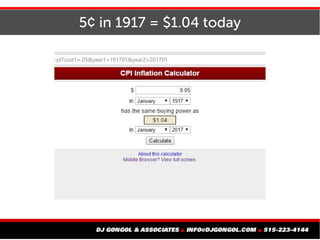

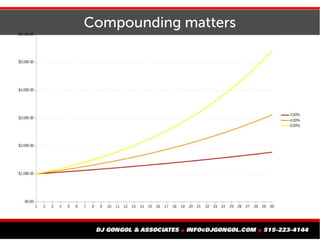

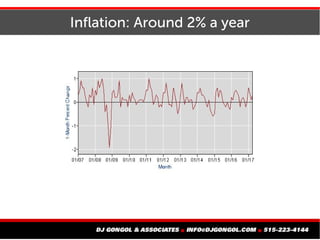

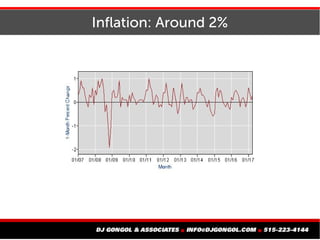

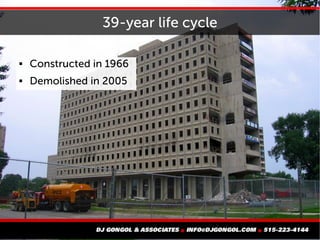

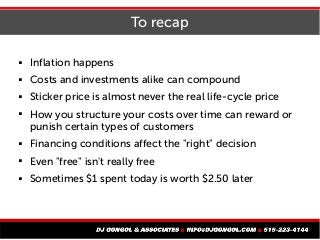

The document discusses how inflation impacts costs over long periods of time. It notes that a 5 cent Coke in 1900 would cost over $1 today when adjusted for inflation. It also discusses how small differences in annual returns, like Warren Buffett achieving 11.1% annual returns compared to the S&P 500's 9.7%, can lead to huge differences over 50 years. The document advocates considering total life cycle costs, like purchase price, ongoing costs, maintenance, when making investment decisions rather than just initial sticker price.