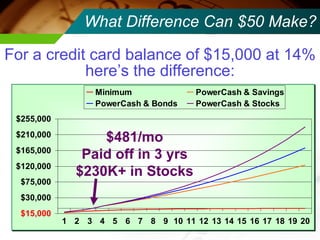

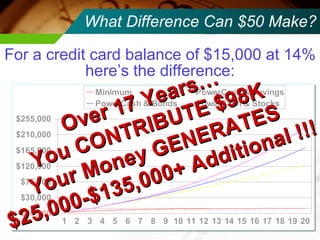

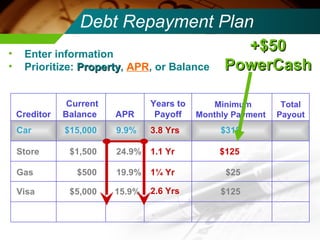

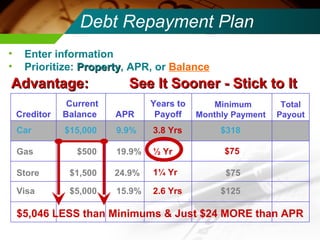

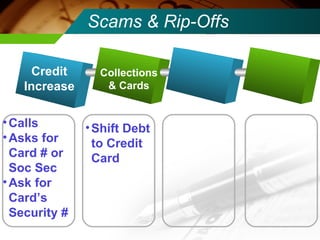

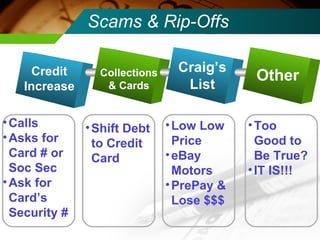

This document summarizes tips and strategies for managing household finances and avoiding debt. It discusses signs of financial trouble, first steps to debt-proof living like creating a spending plan, and types of spending personalities. It also covers managing current debt through prioritizing payments and contacting creditors, as well as tips for attacking debt like finding extra money each month to pay down balances faster. Options for assistance programs or credit counseling are presented along with warnings about scams.