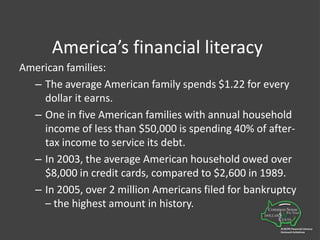

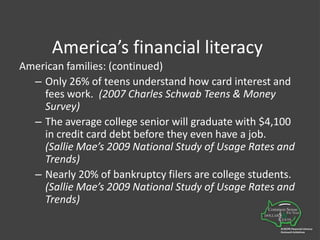

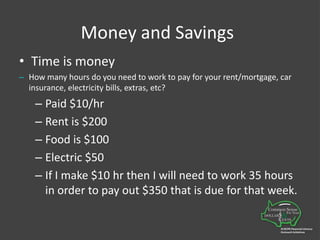

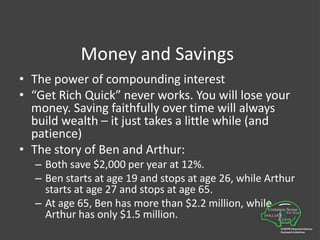

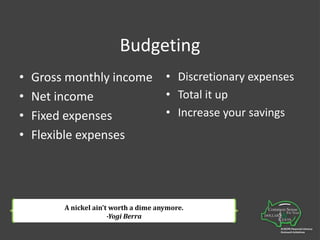

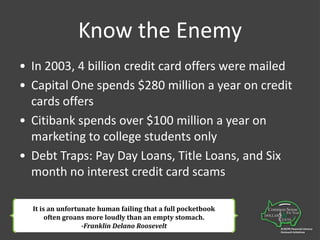

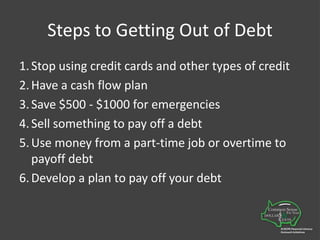

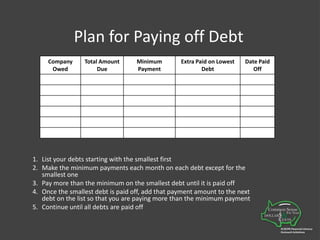

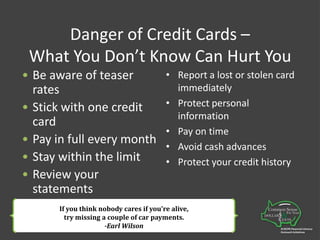

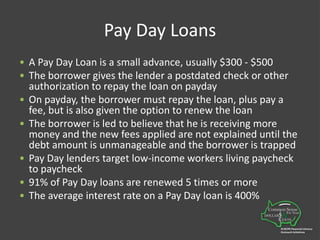

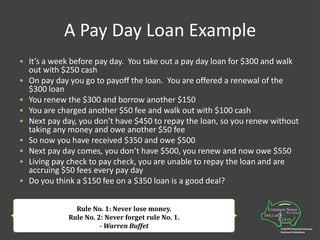

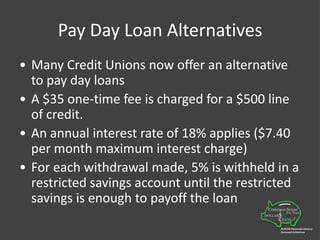

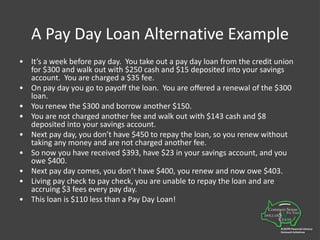

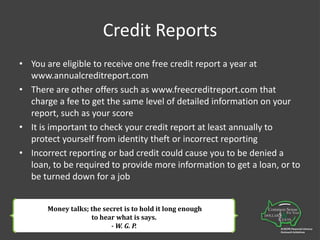

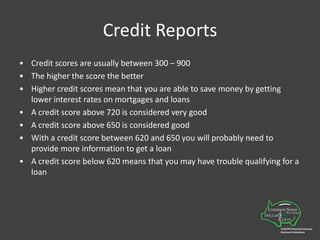

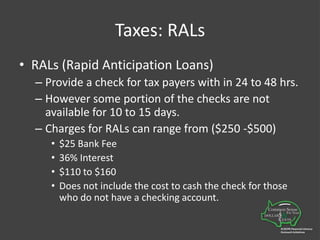

Financial literacy is defined as the ability to evaluate and manage finances effectively to achieve life goals. Many American families struggle with debt, with a significant percentage spending beyond their means, and lack of understanding of financial concepts among youth is alarming. The document covers essential topics including budgeting, debt management, savings strategies, and resources for improving financial literacy.