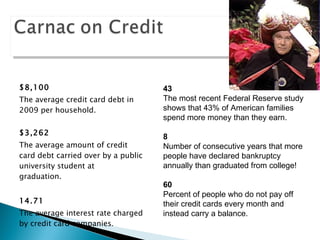

The document provides information on credit and money management. It discusses understanding credit reports and credit scores, different types of credit cards and fees, calculating debt-to-income ratios, establishing good credit, and repairing credit. Tips are provided such as paying bills on time, keeping credit card balances low, and ordering free annual credit reports to monitor your financial health and credit standing.