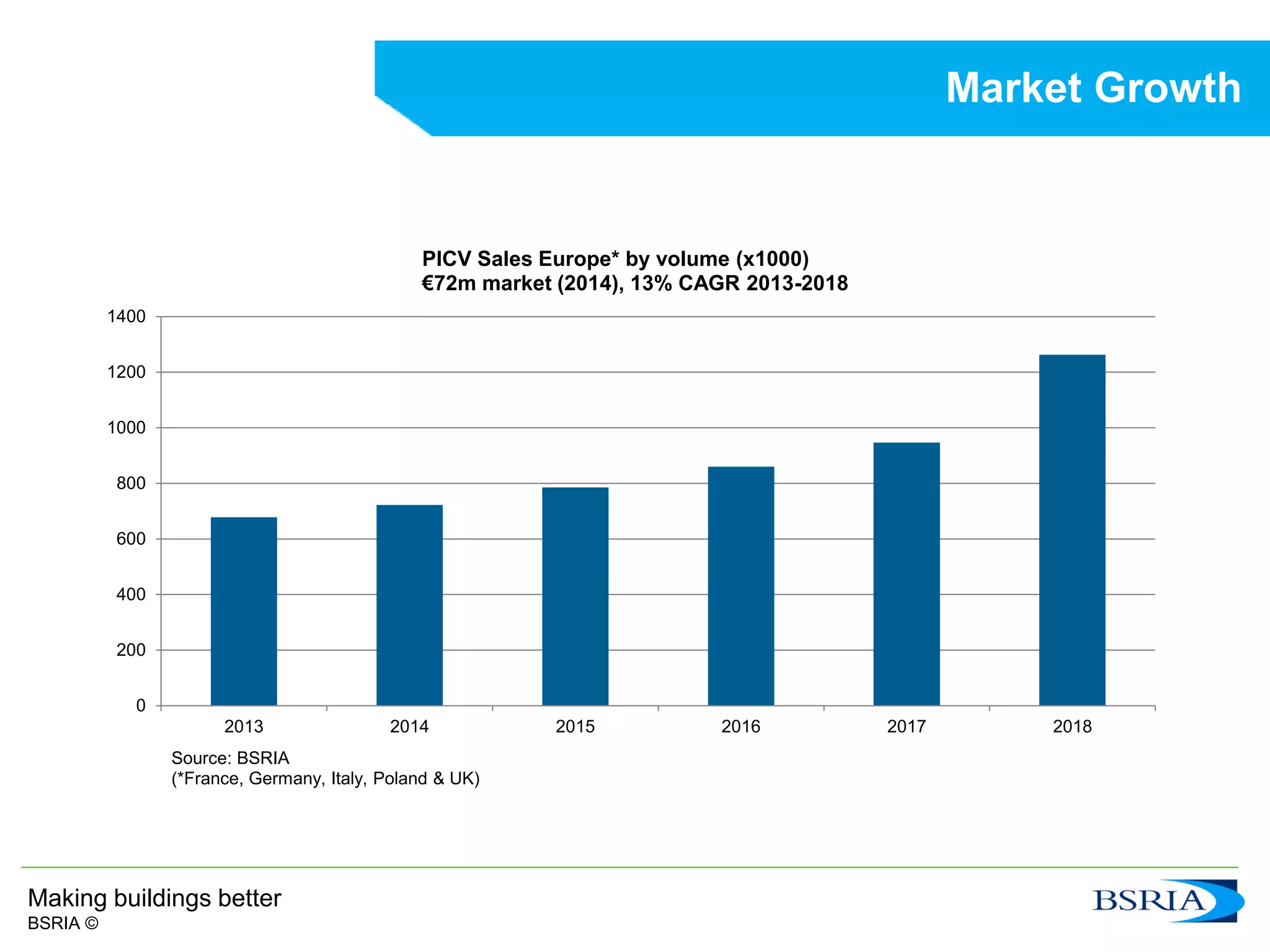

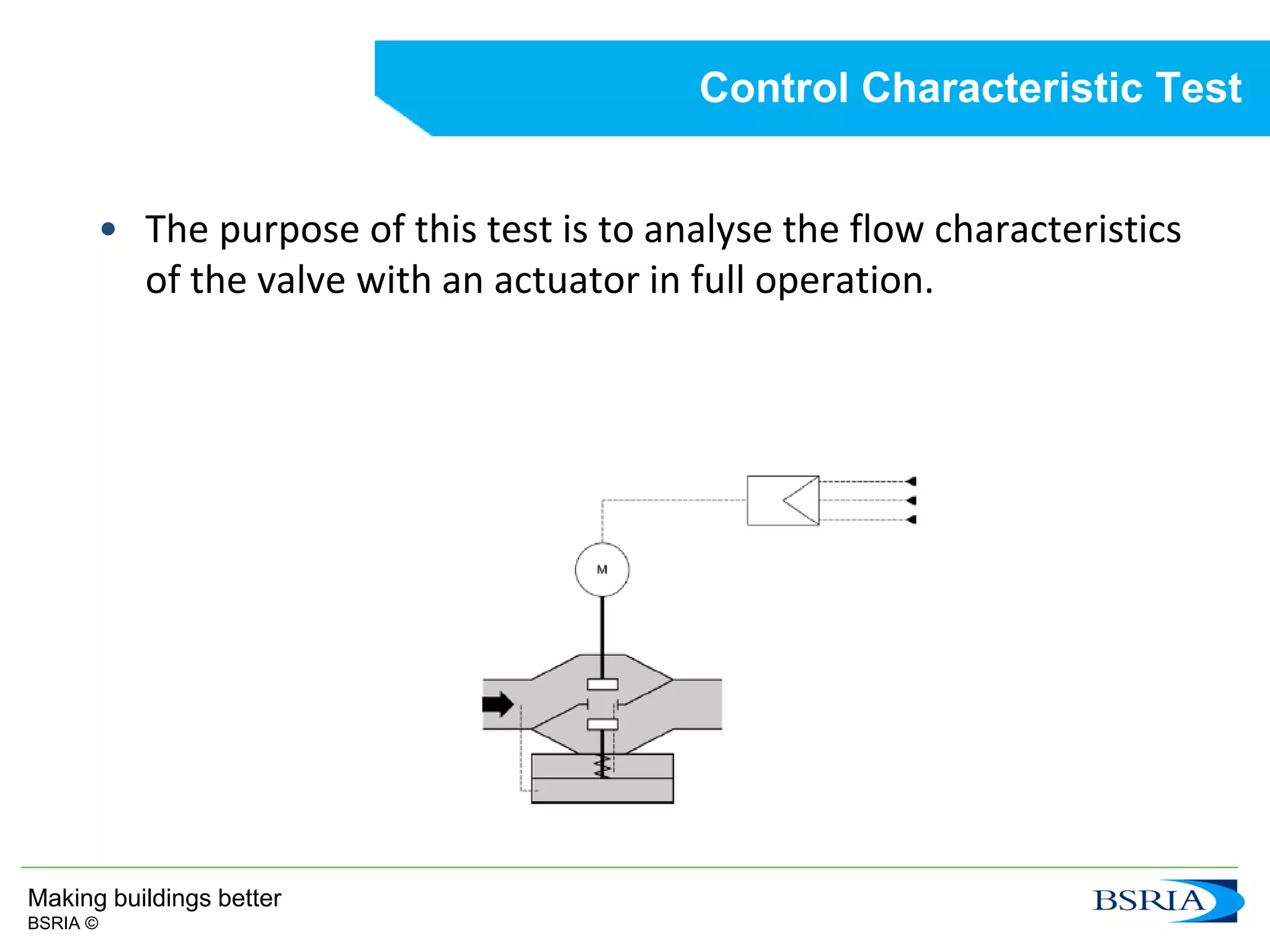

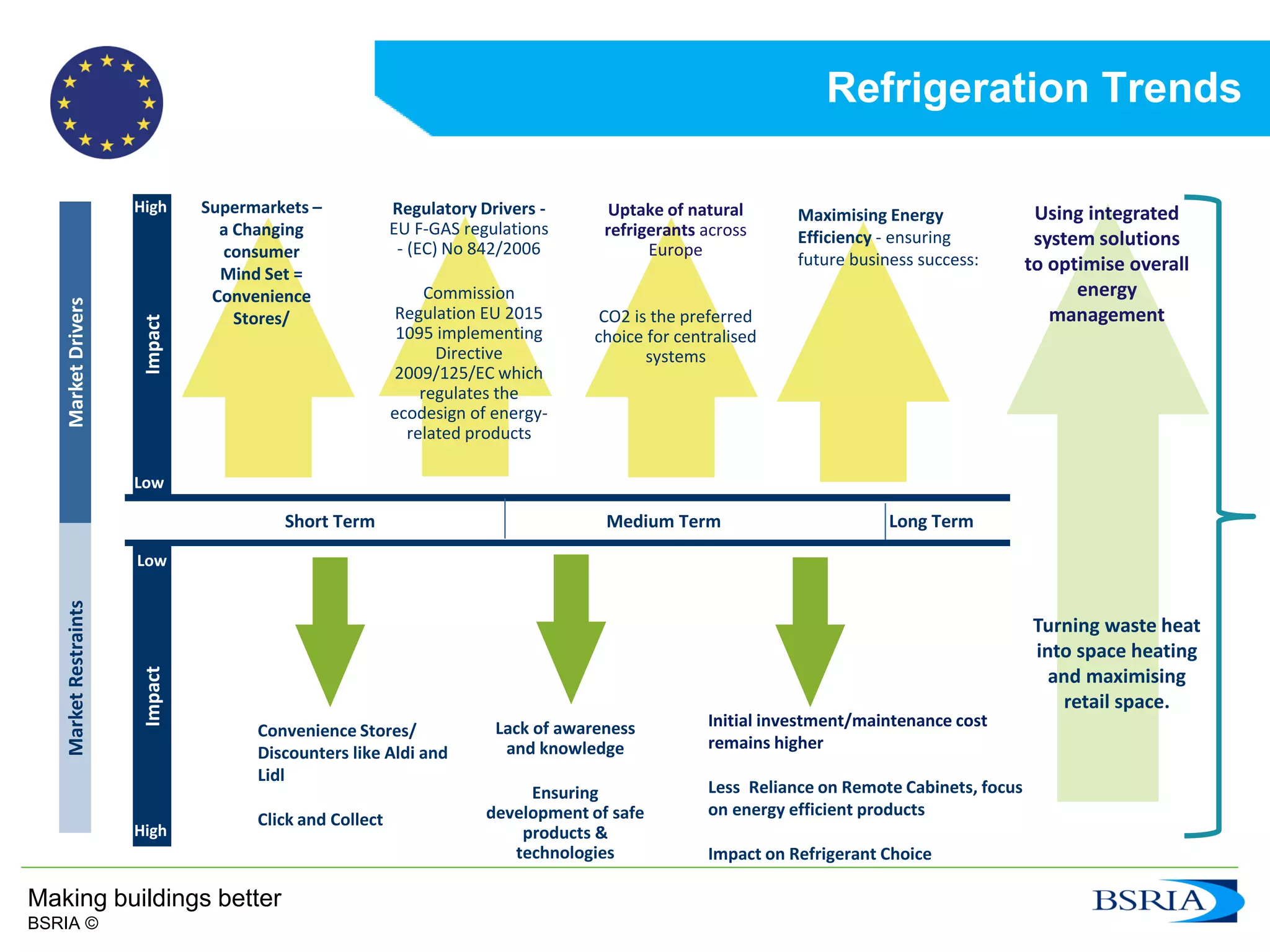

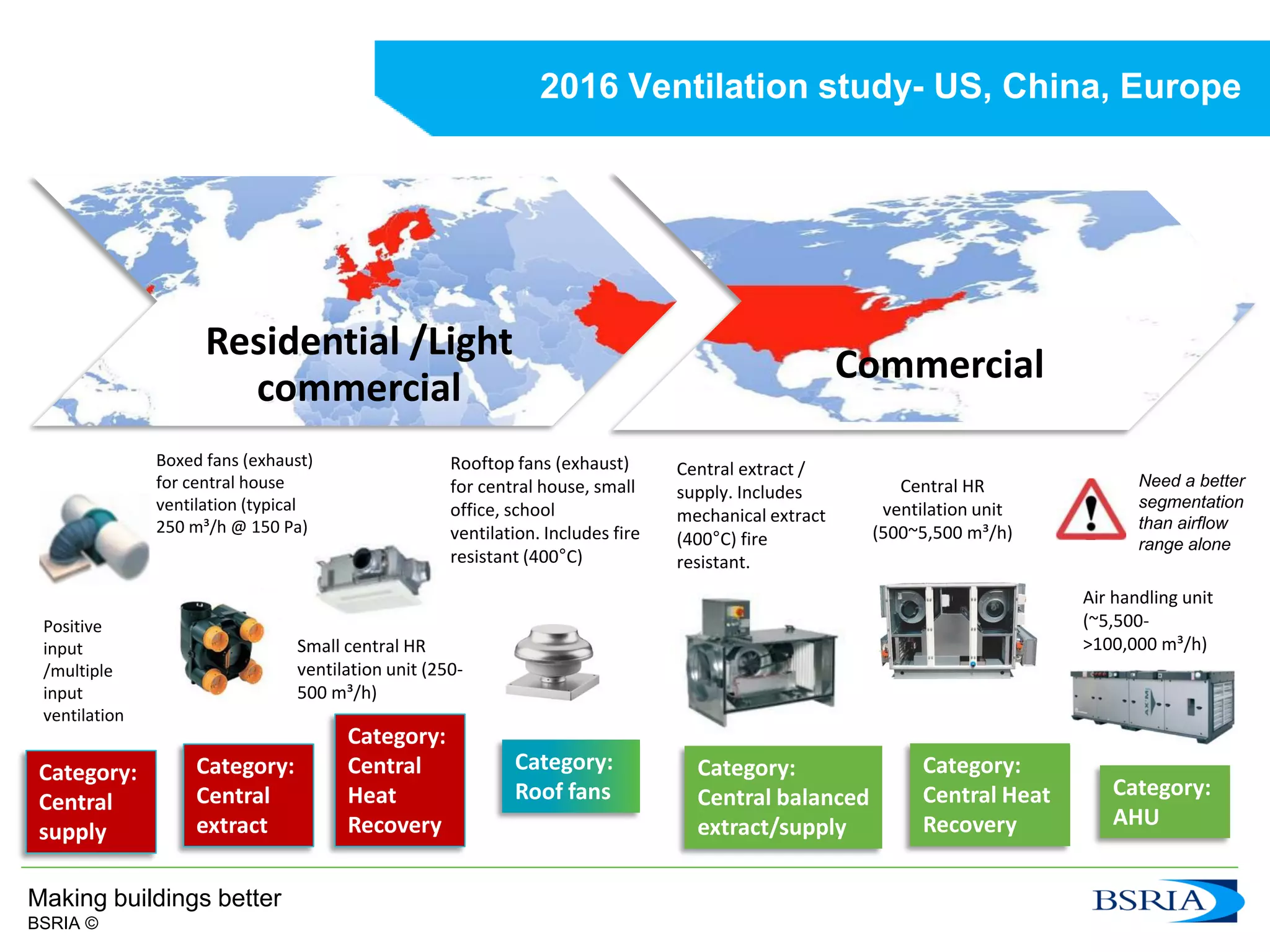

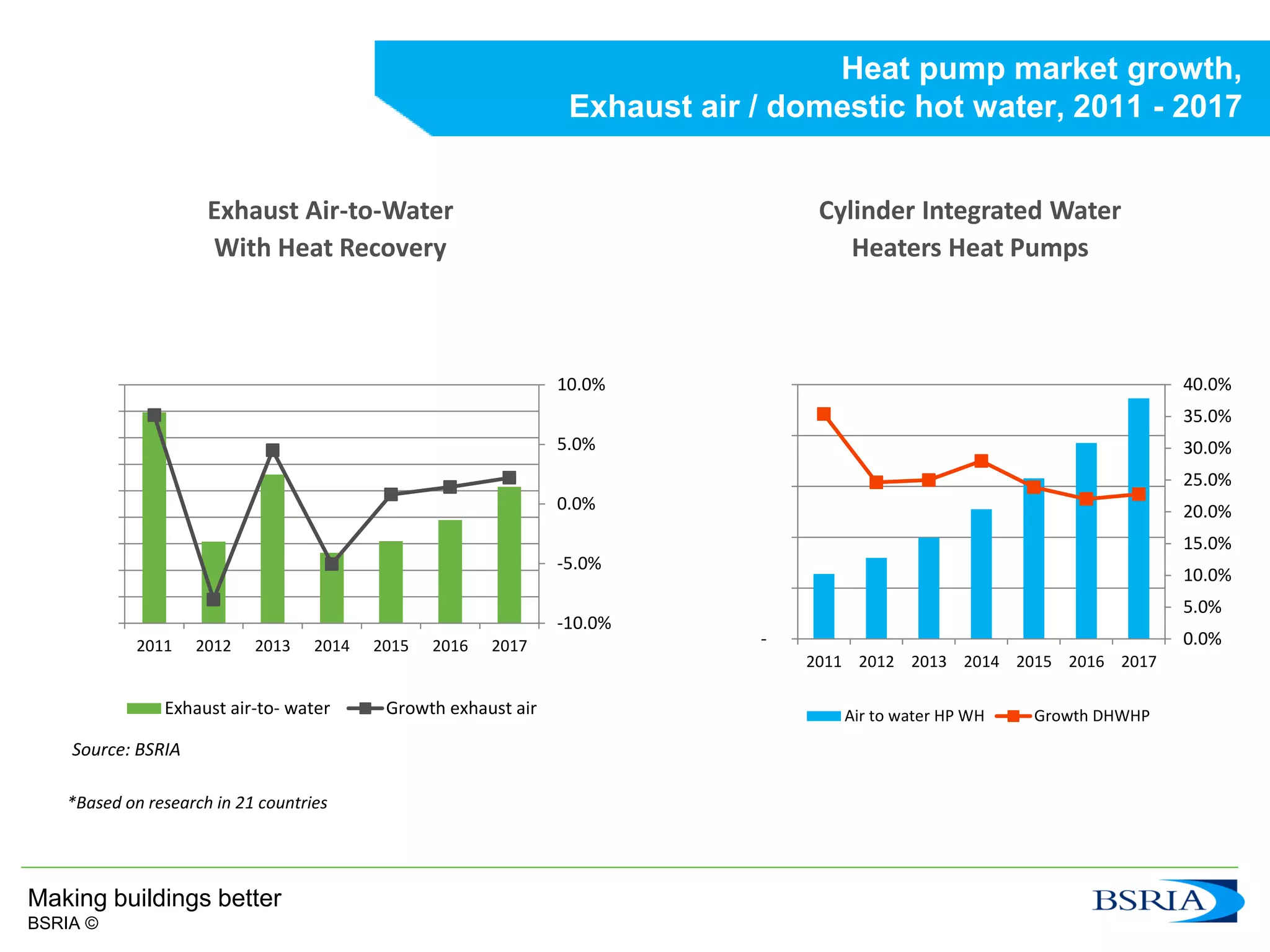

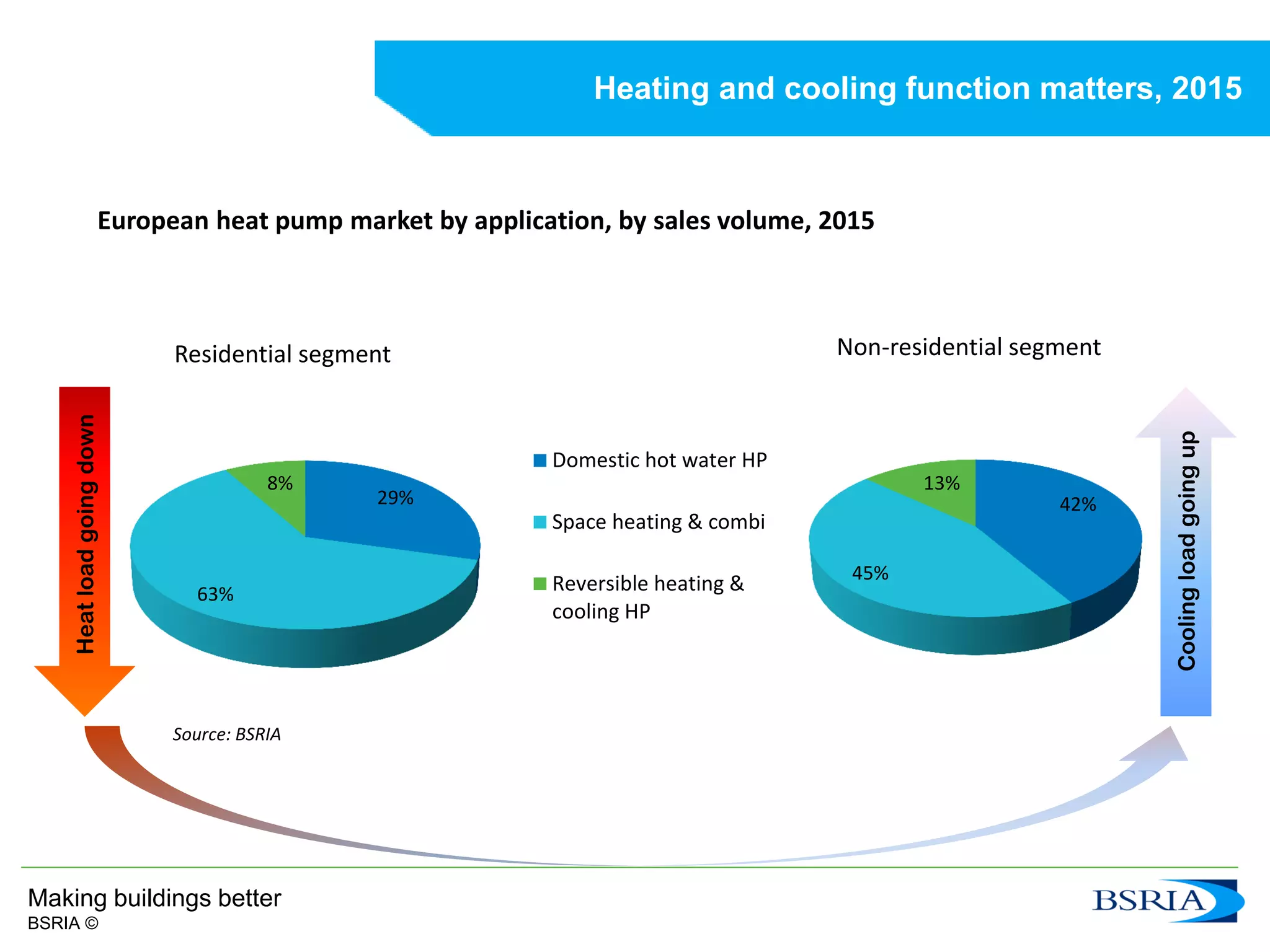

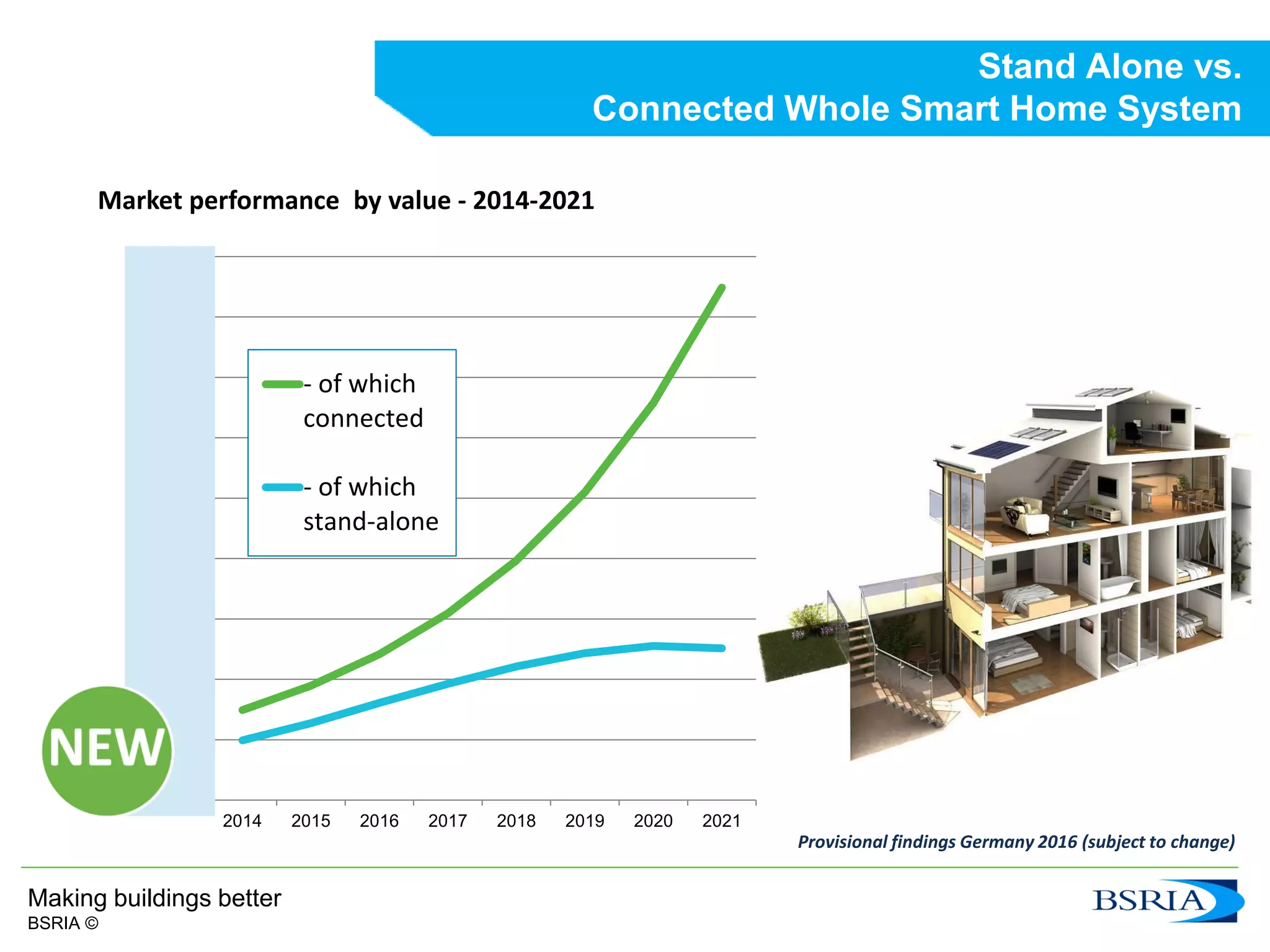

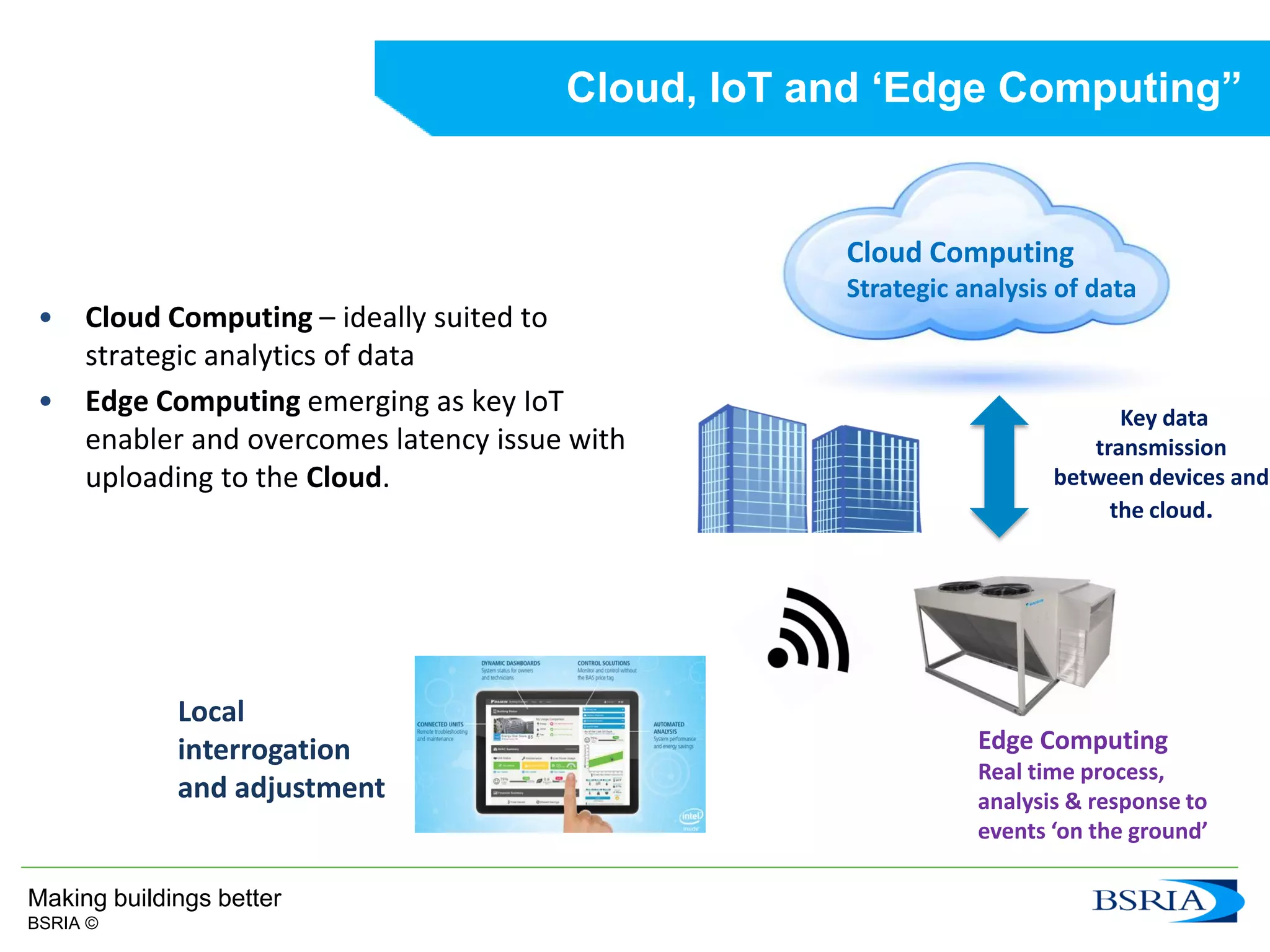

The document outlines a presentation hosted by BSRIA at Chillventa 2016, discussing various aspects of HVAC systems, including testing methods for pressure independent control valves (PICVs), global trends in air conditioning and refrigeration, and the growth of renewable energy technologies in heating markets. Key highlights include market growth projections, the benefits of using PICVs, and the impact of energy efficiency legislation on heating systems. The event featured multiple experts covering topics from energy efficiency to the integration of smart technologies in building management.