Embed presentation

Download to read offline

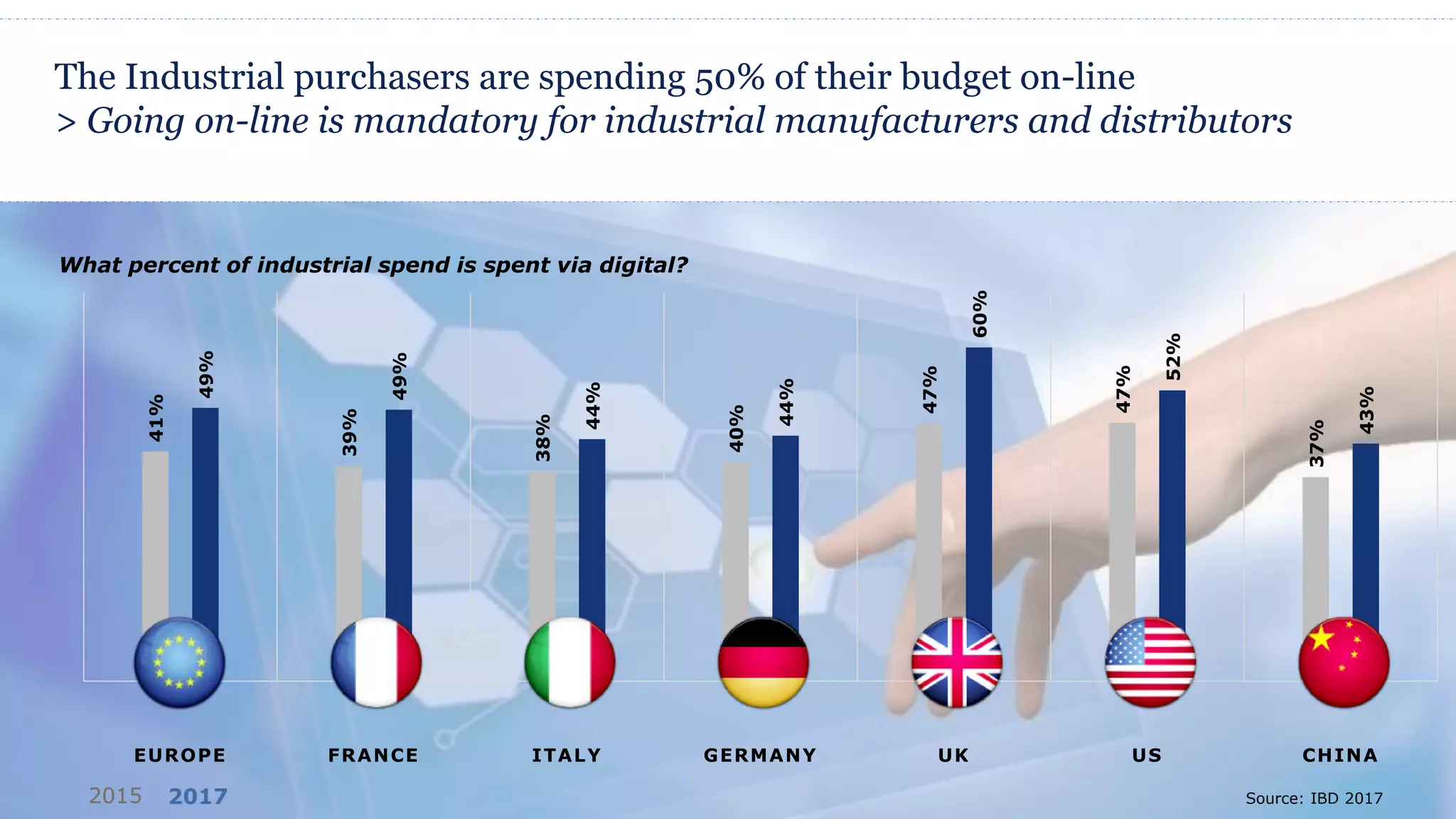

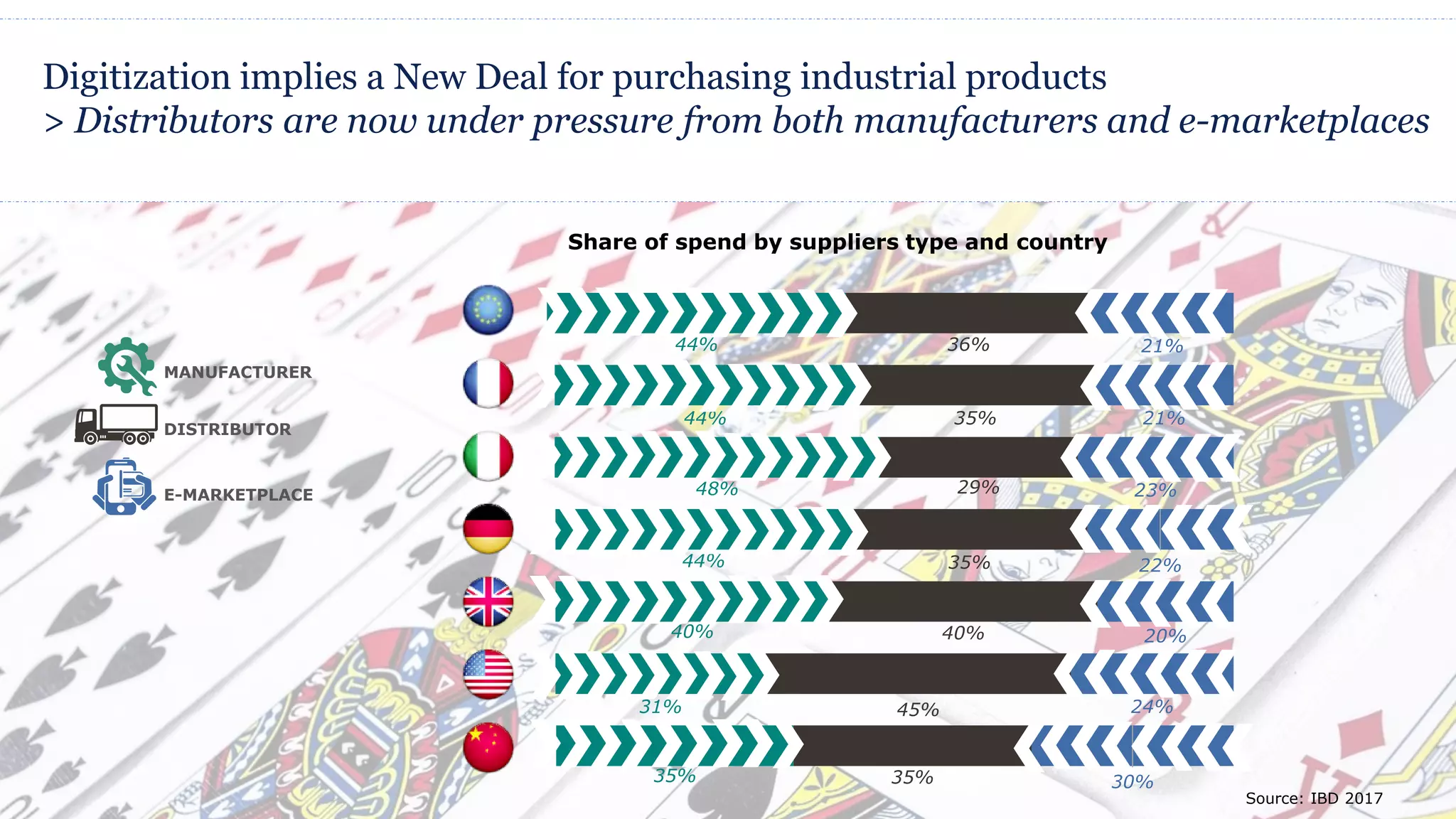

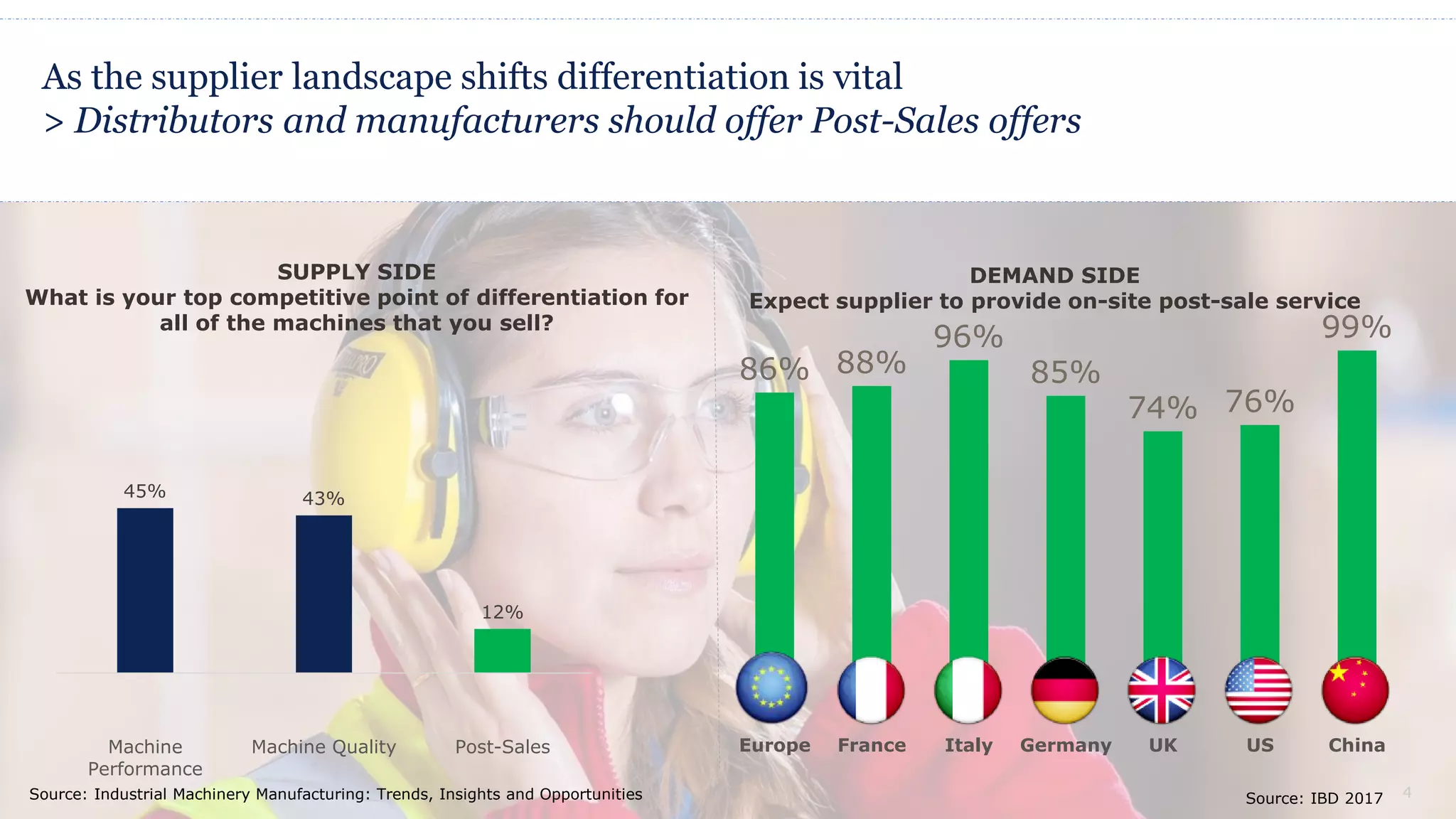

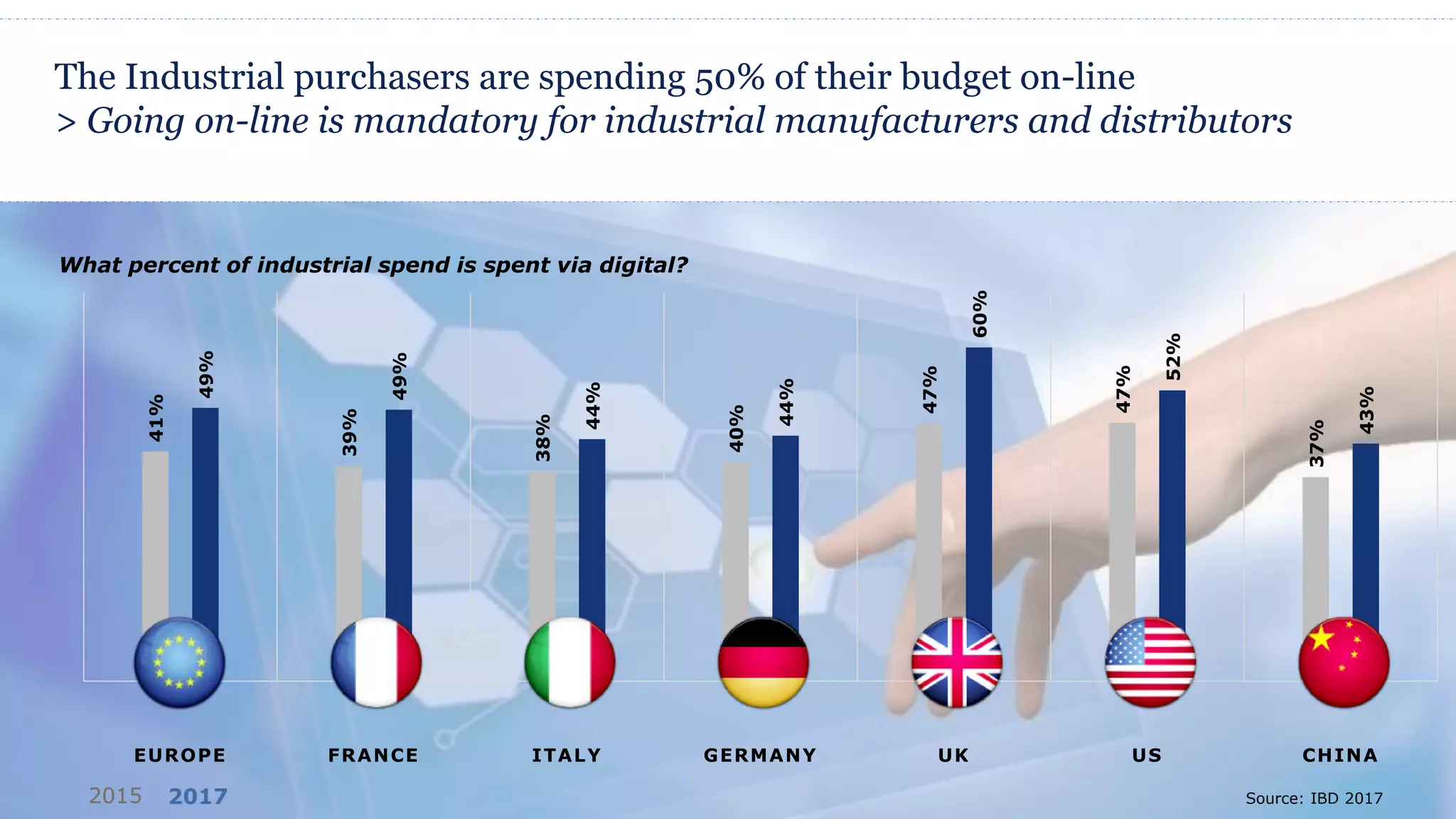

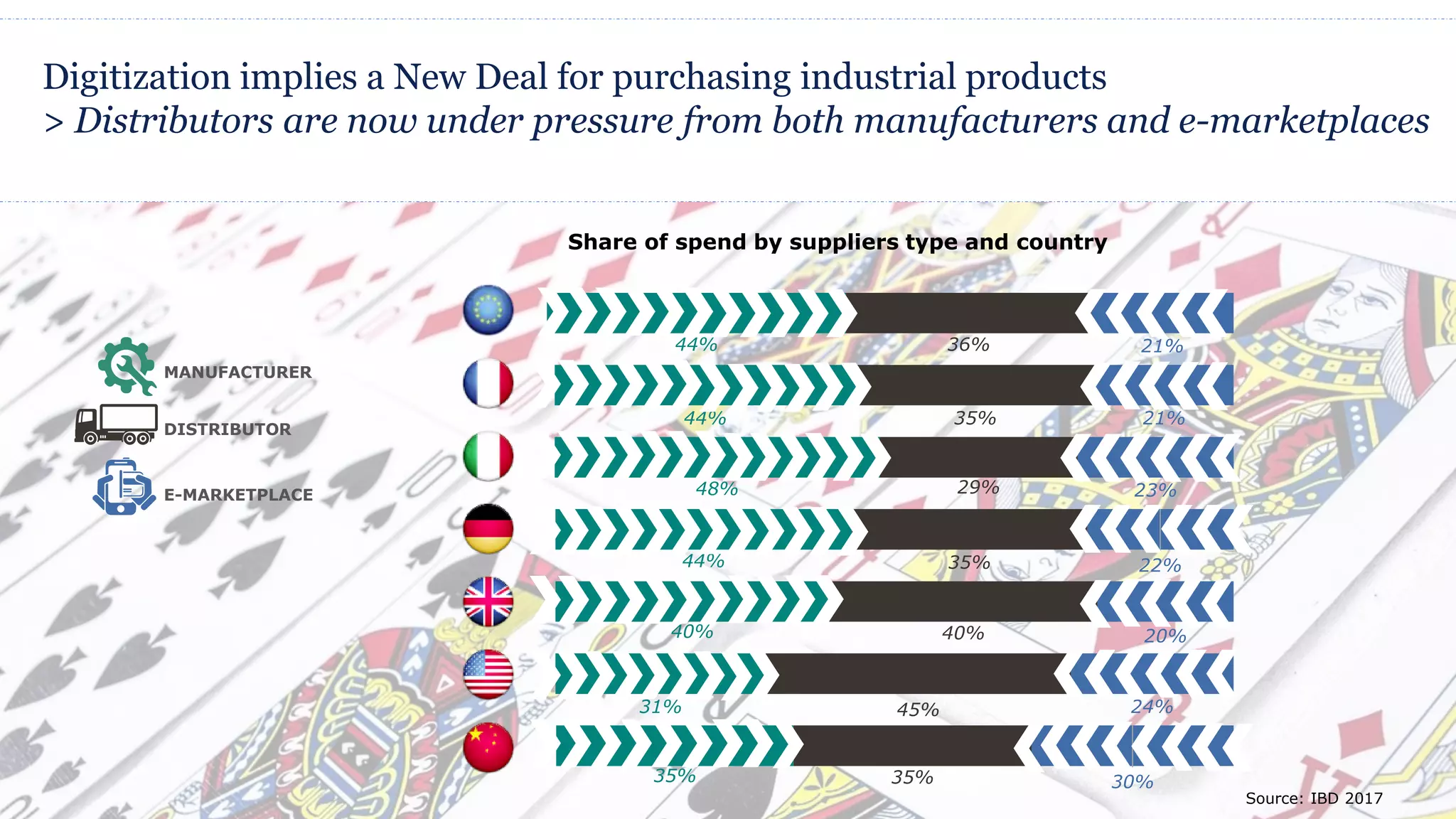

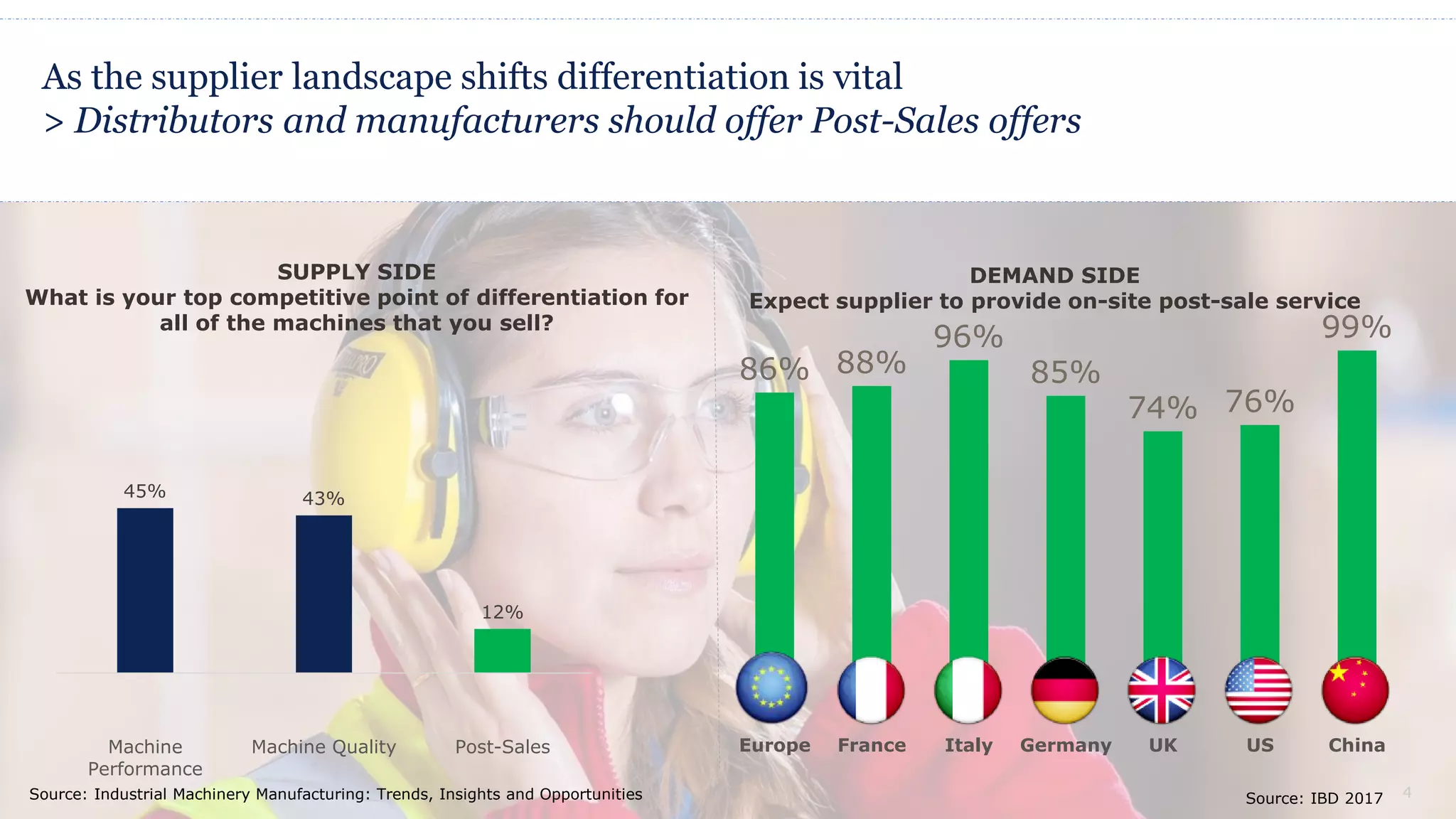

The document discusses the impact of Industry 4.0 on purchasing patterns within the industrial value chain, highlighting that industrial purchasers allocate 50% of their budgets online, making digital presence essential for manufacturers and distributors. It reveals increased pressure on distributors from manufacturers and e-marketplaces and emphasizes the importance of differentiation, particularly through post-sales service offerings. Additionally, it presents data on supplier spending and competitive points of differentiation across various countries.