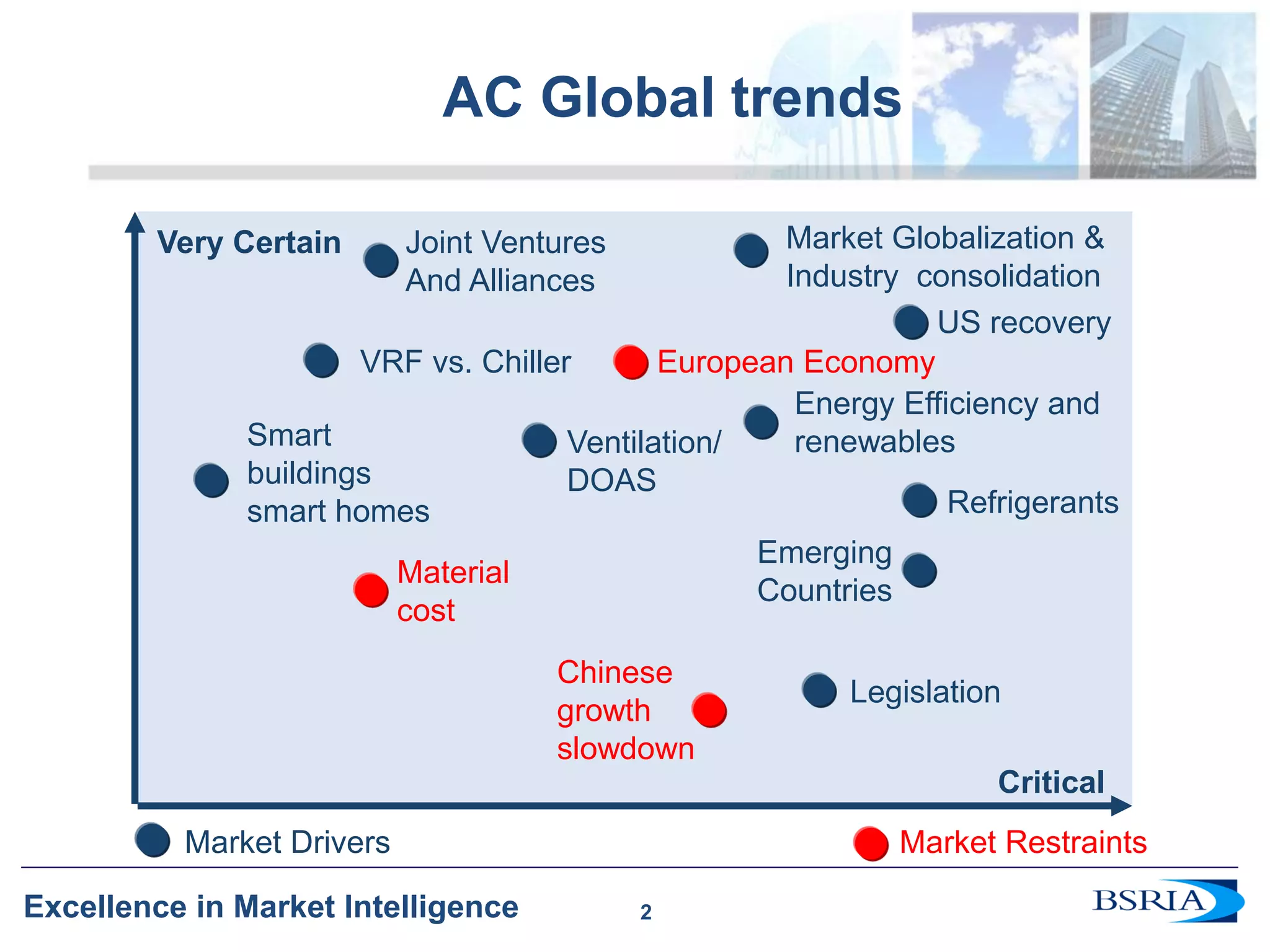

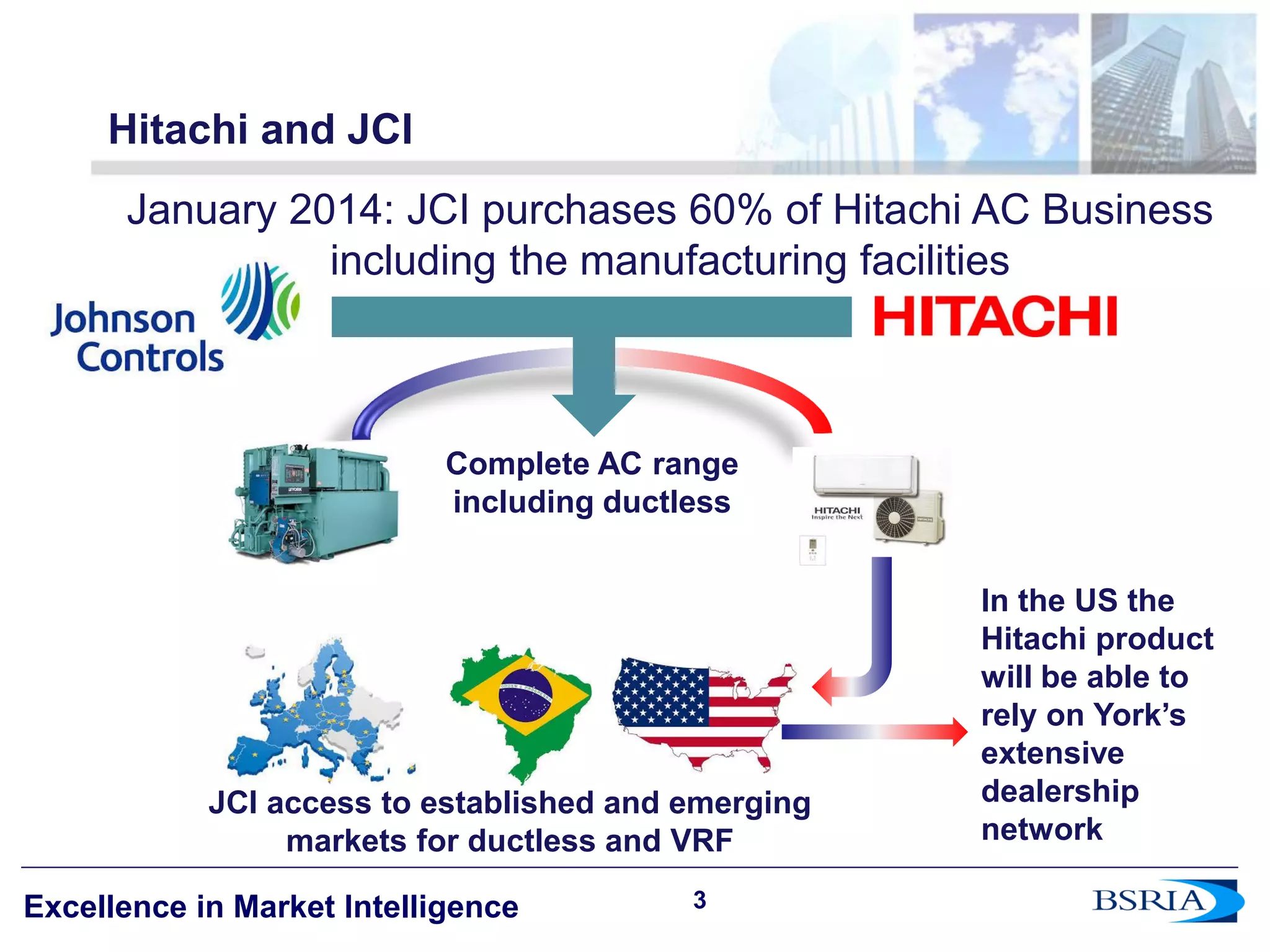

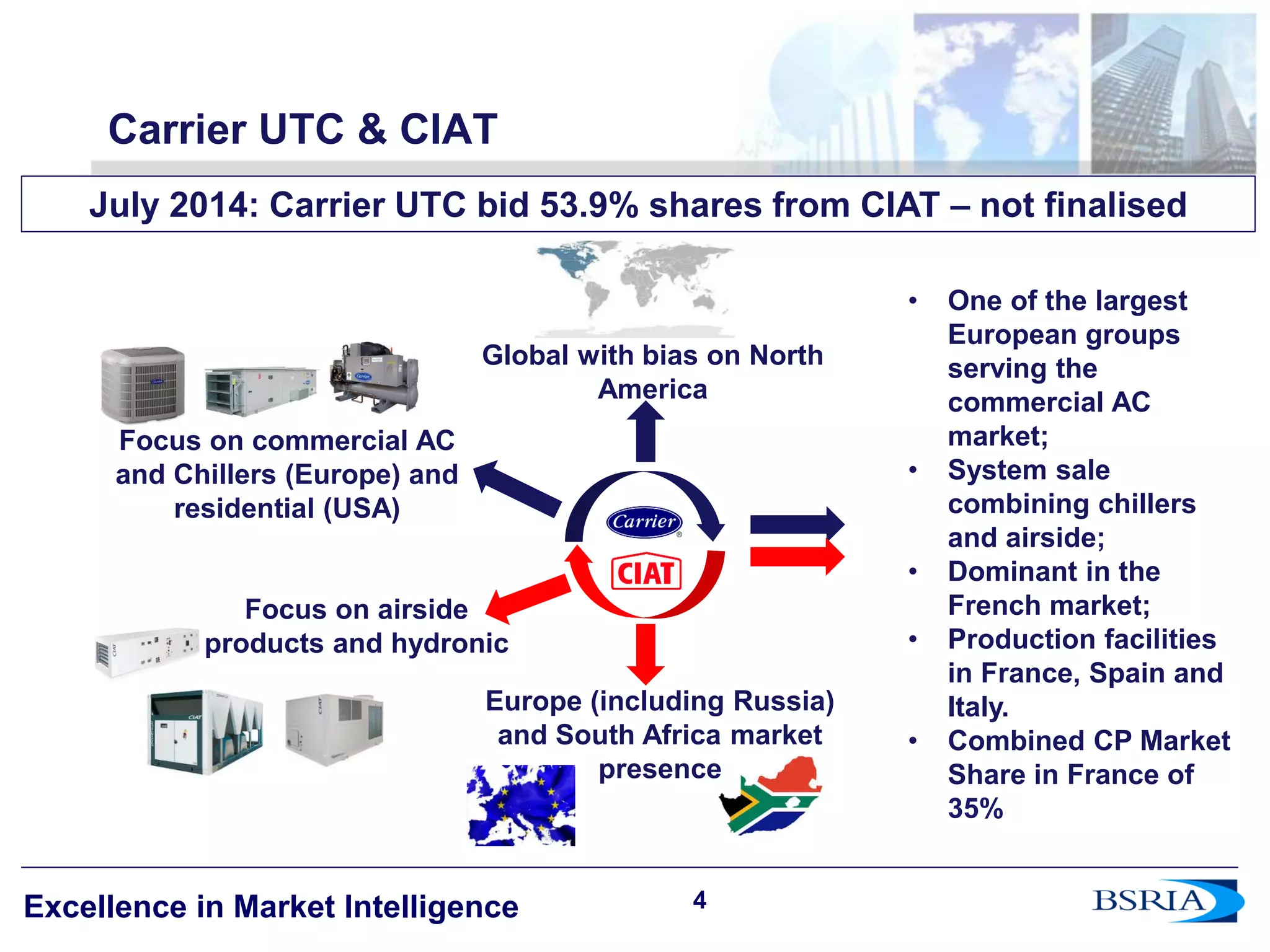

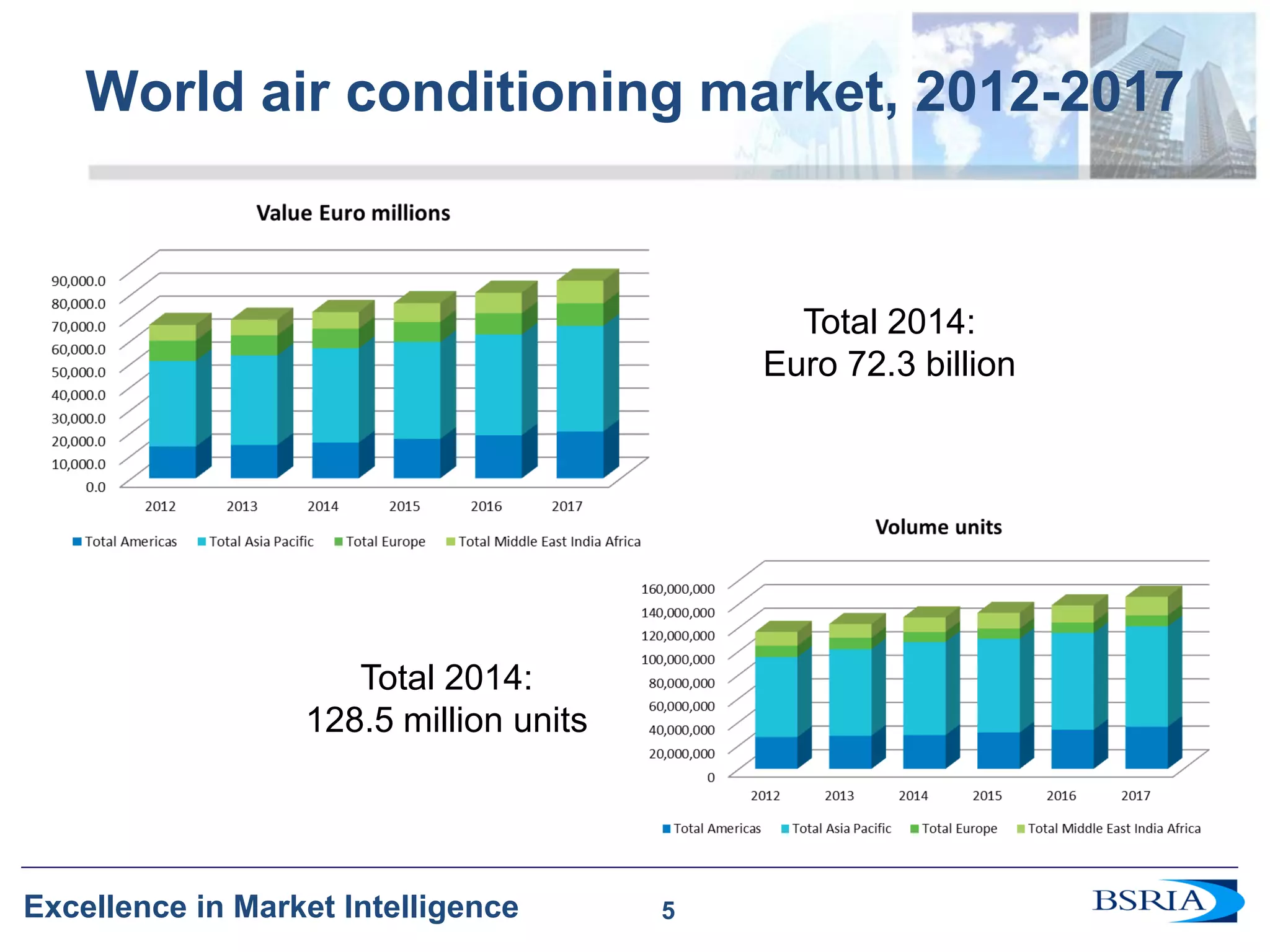

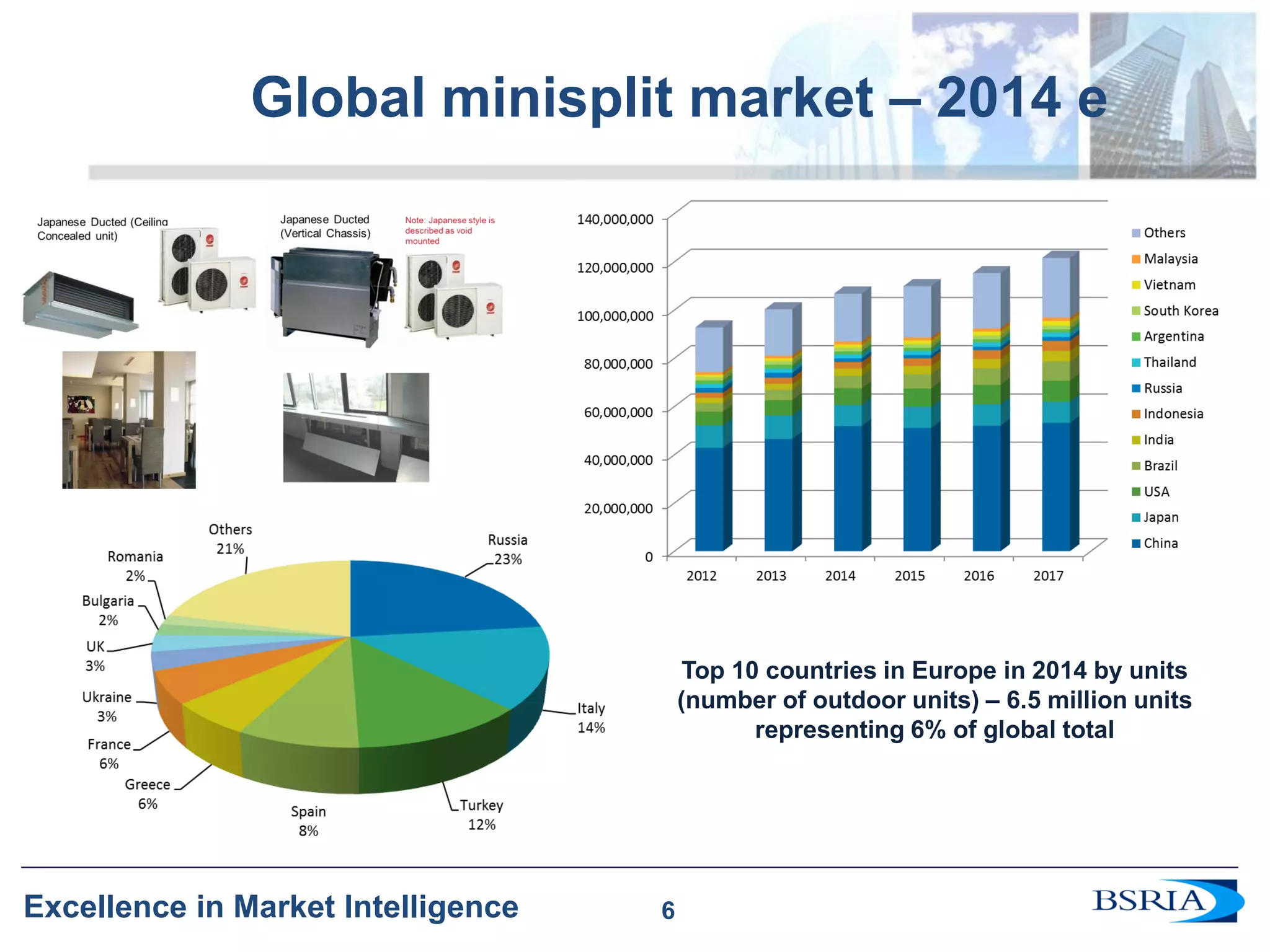

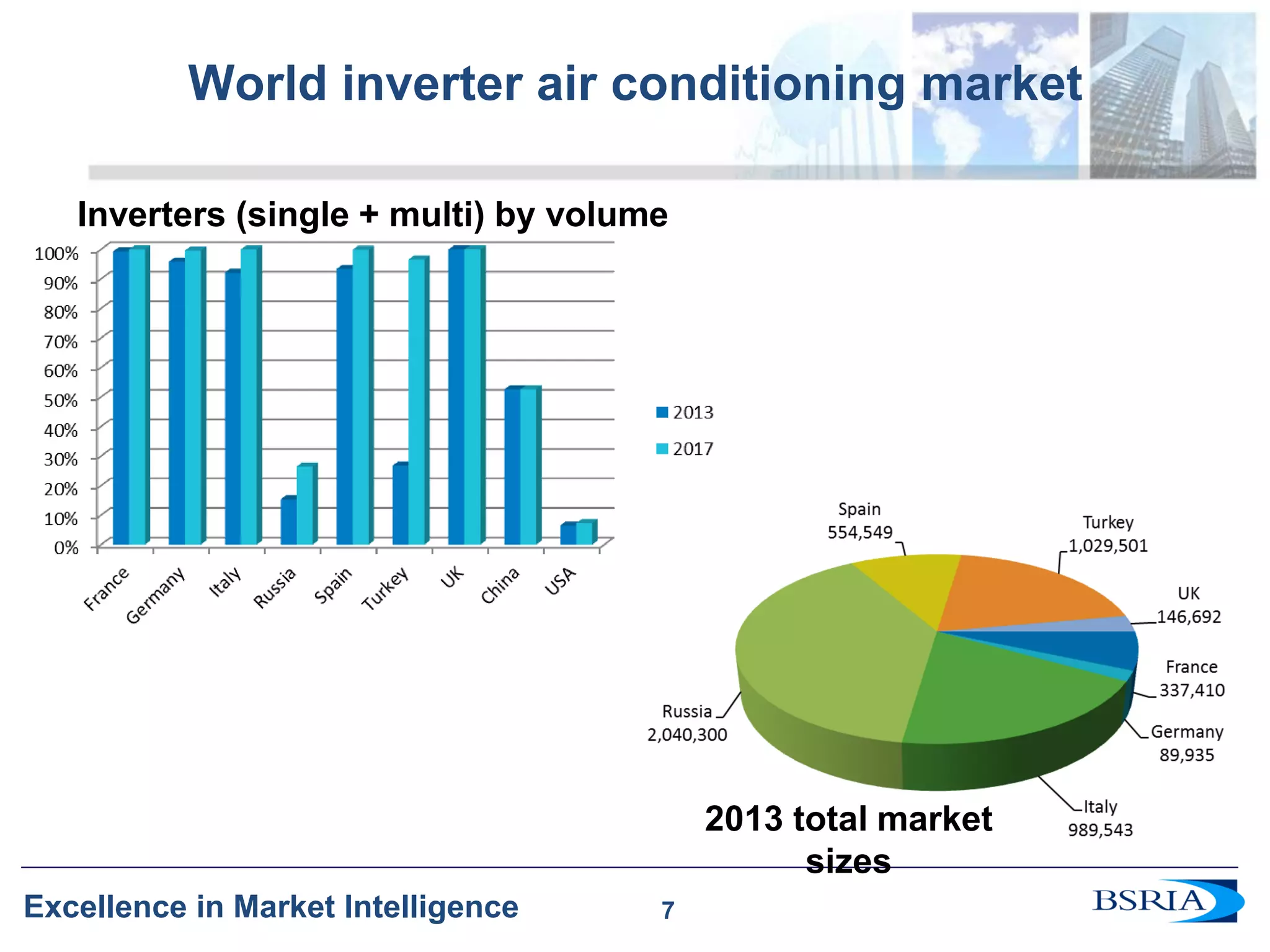

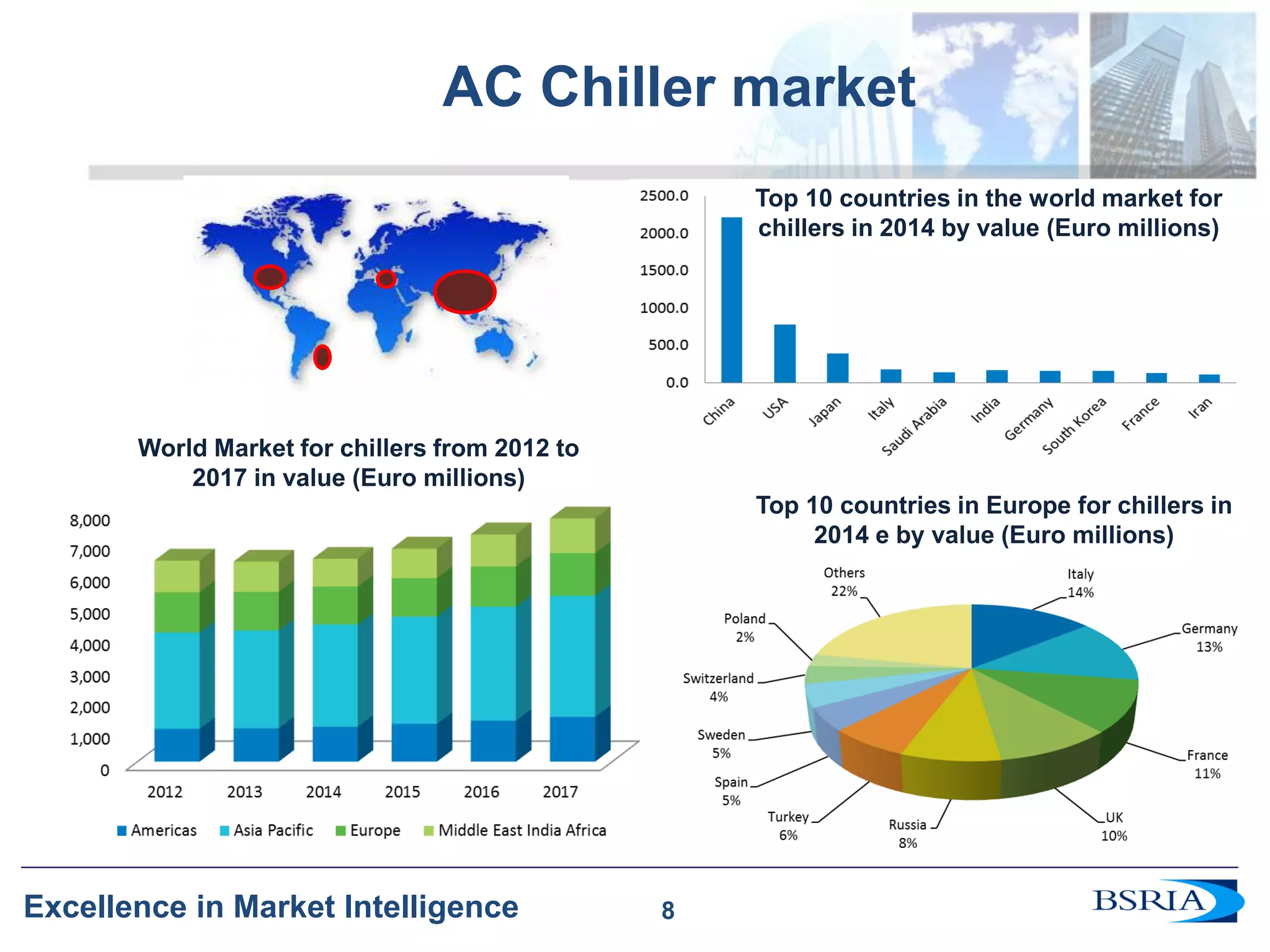

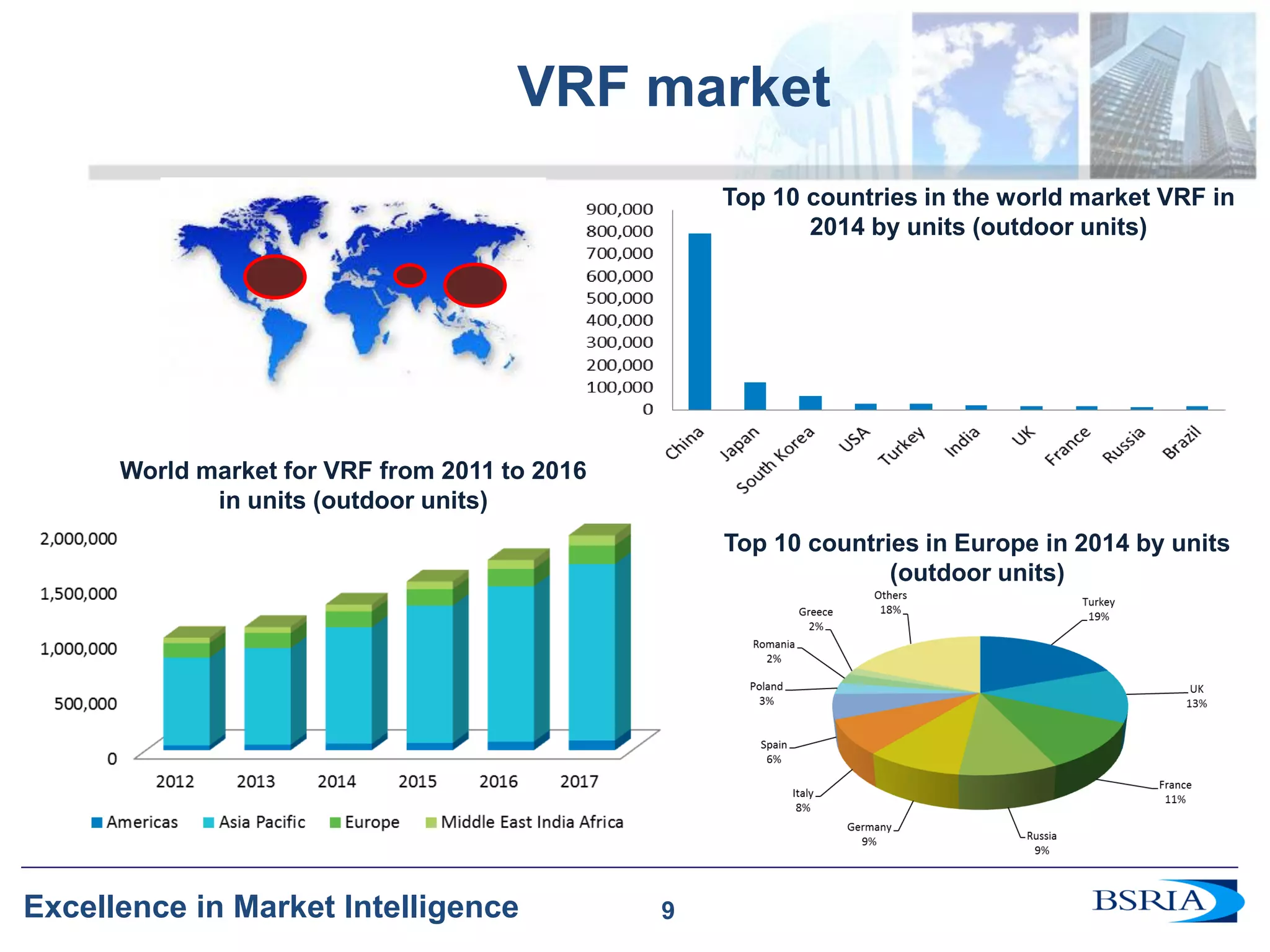

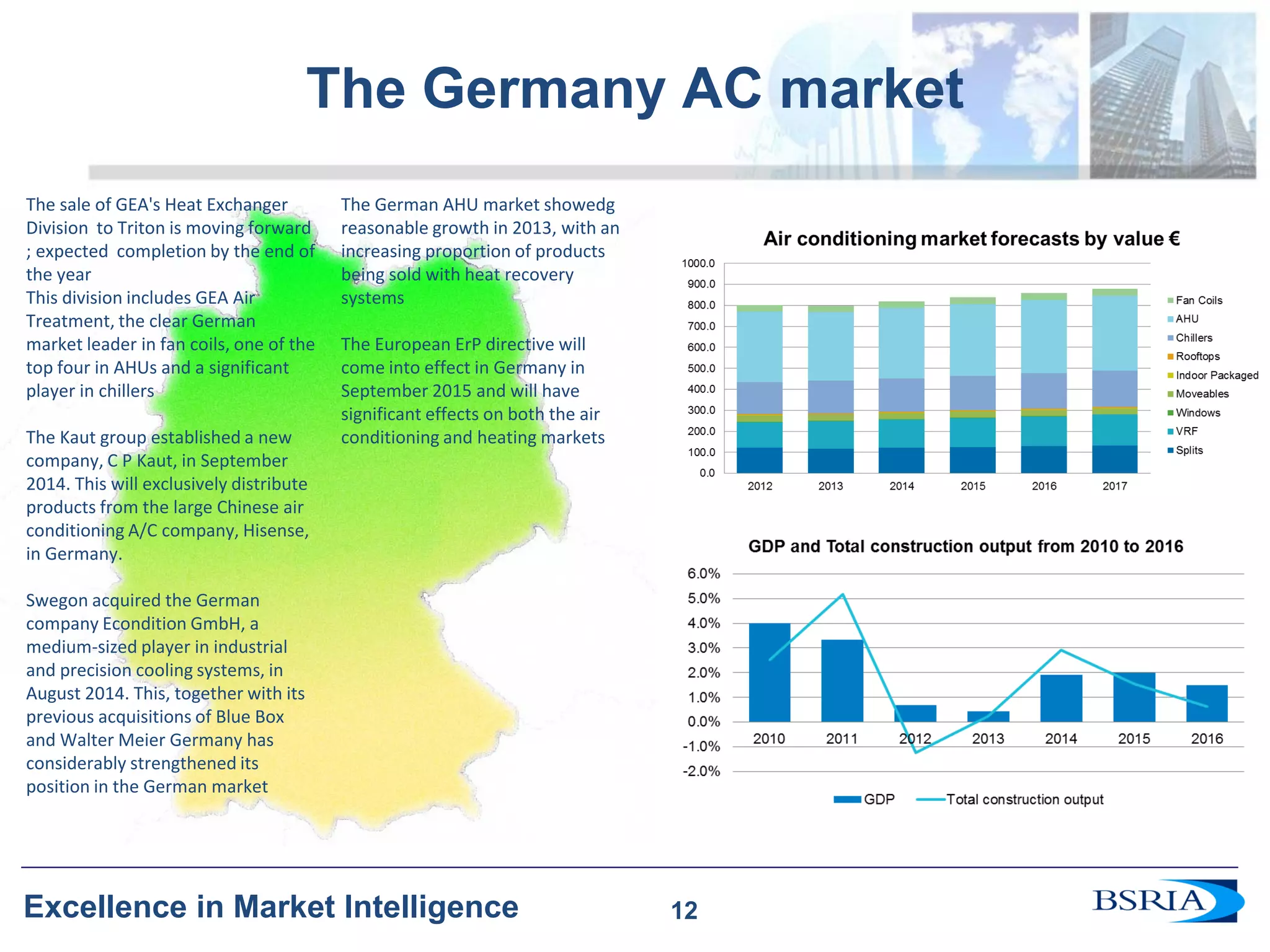

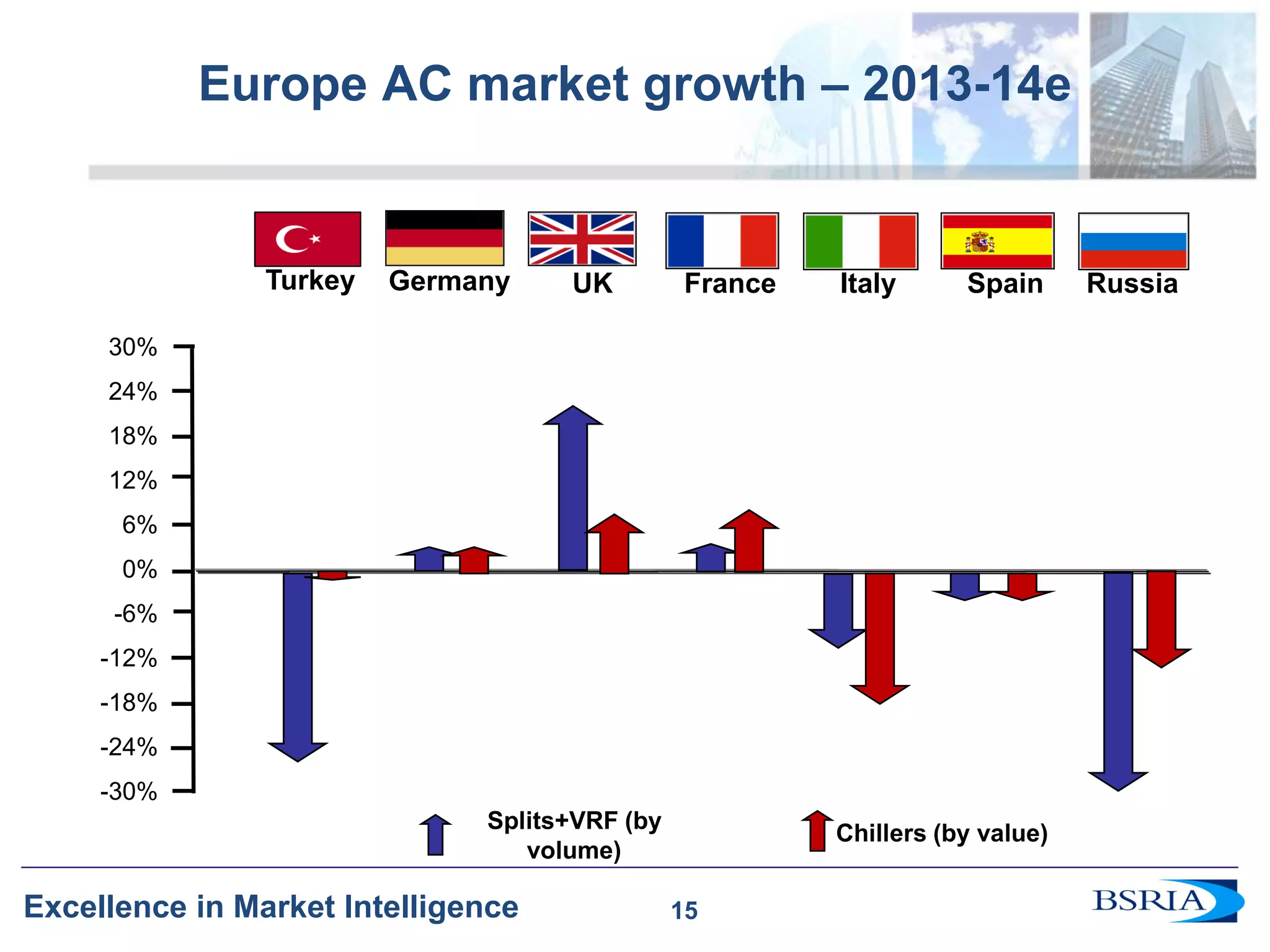

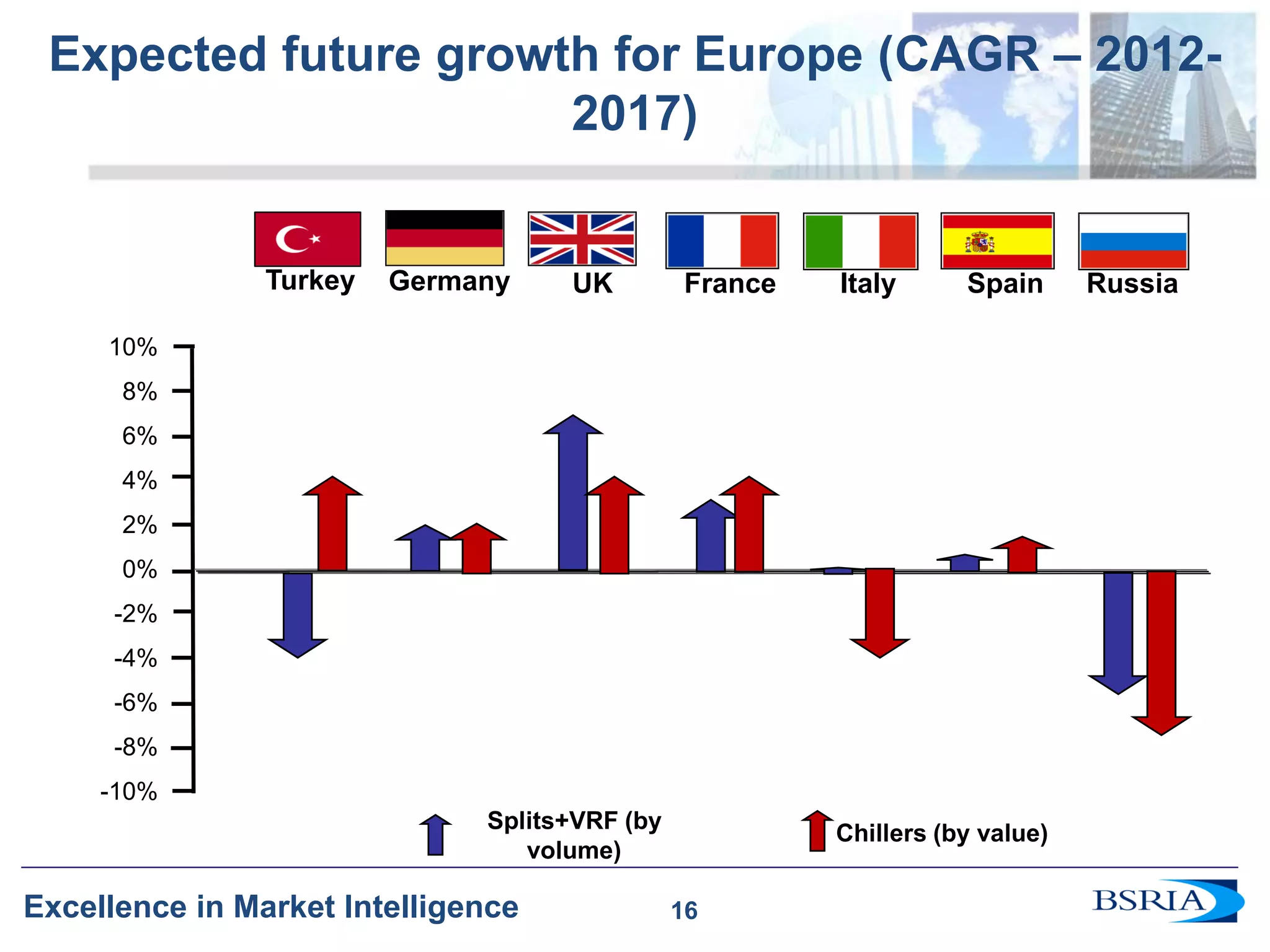

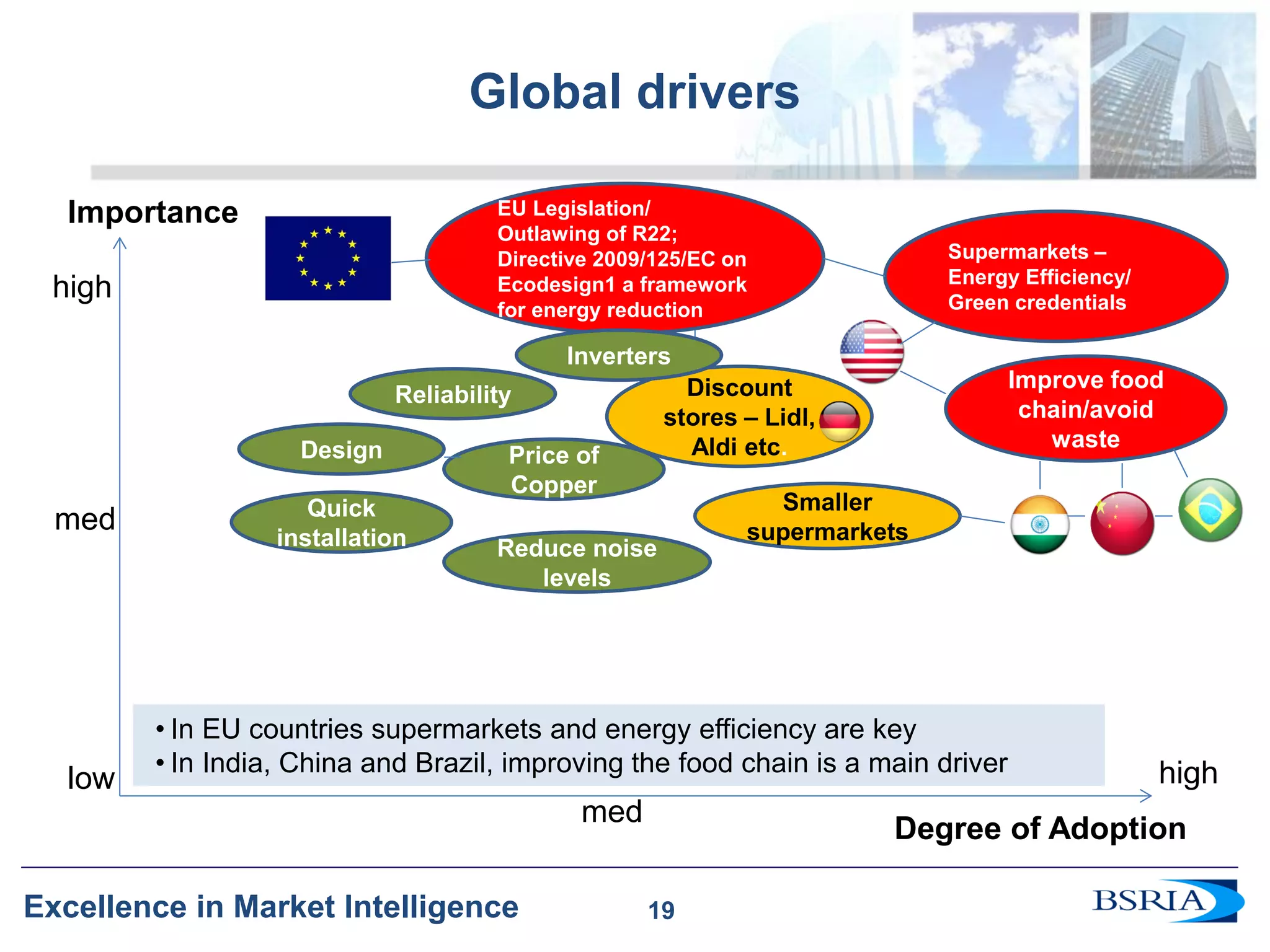

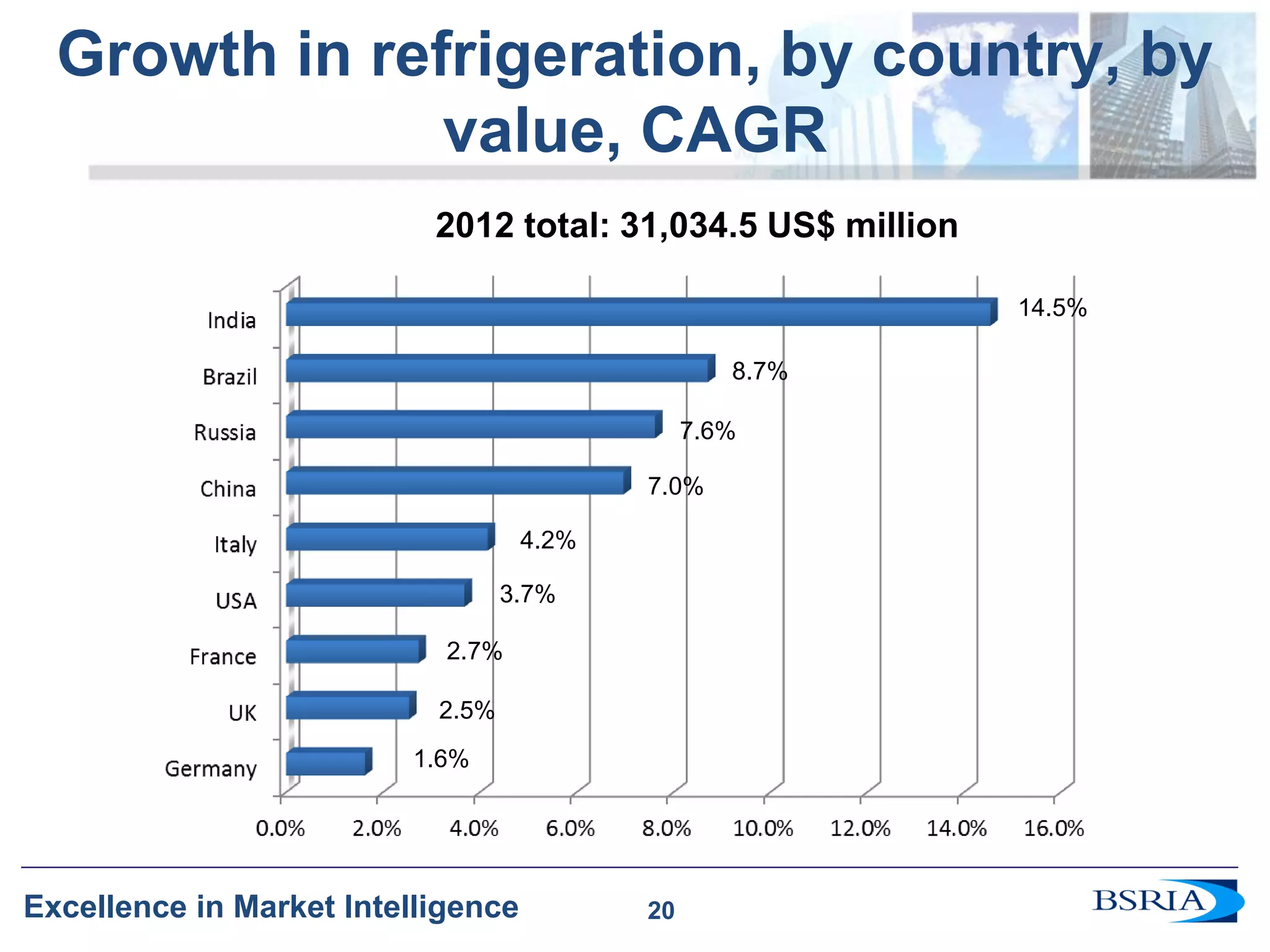

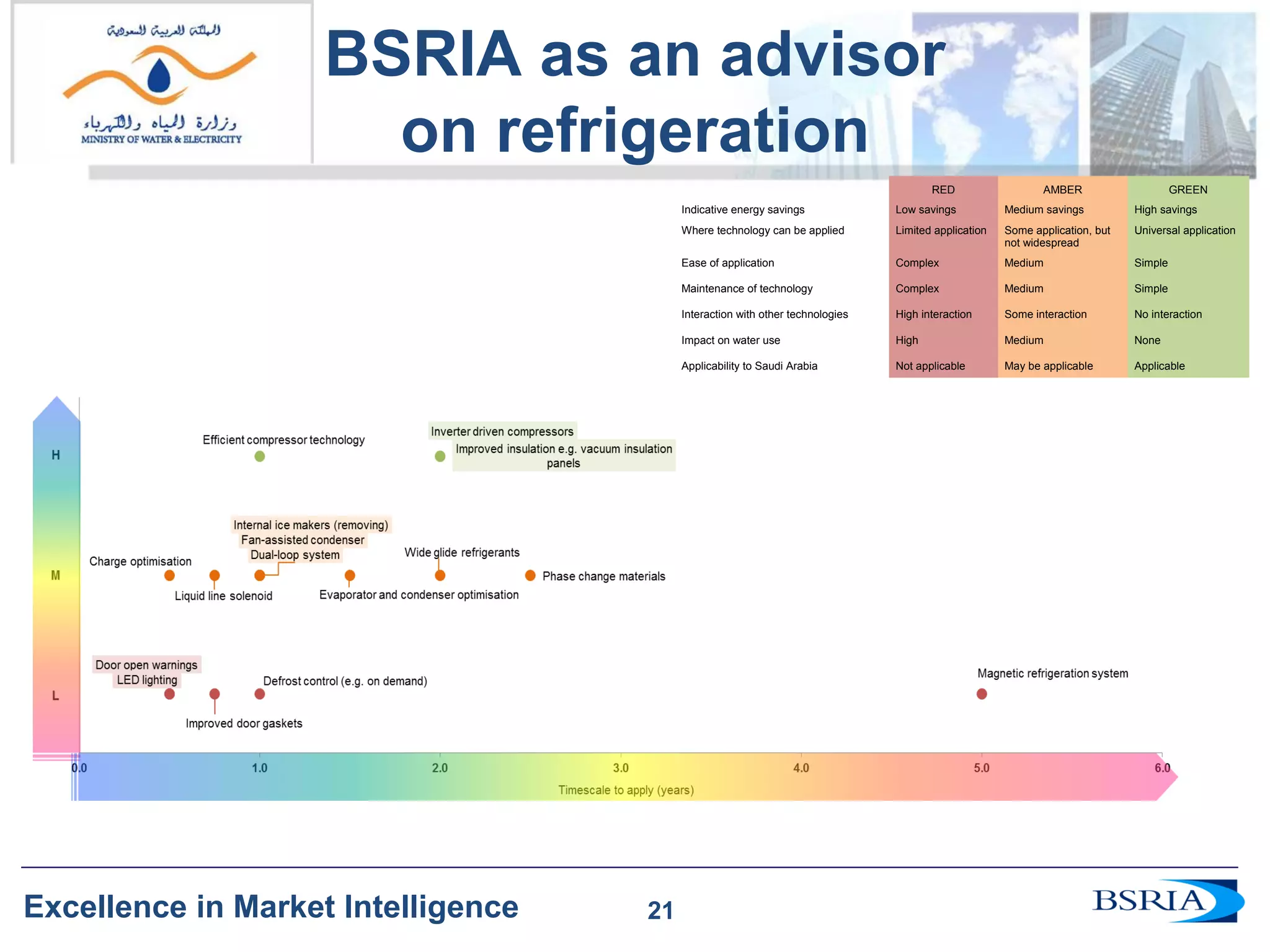

The document discusses global trends in the air conditioning market, focusing on energy efficiency, market globalization, and emerging technologies. Key developments include corporate acquisitions, market growth rates by region, and the impact of legislation on refrigerants and energy standards. It also highlights the significant market presence of various companies and the overall growth forecast in the air conditioning and refrigeration sectors.