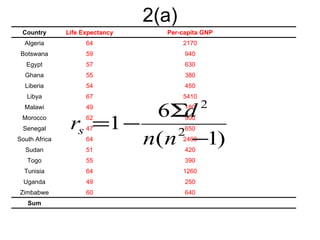

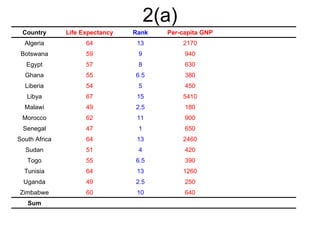

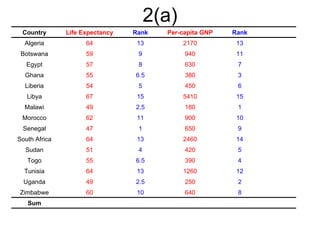

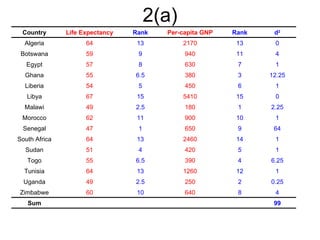

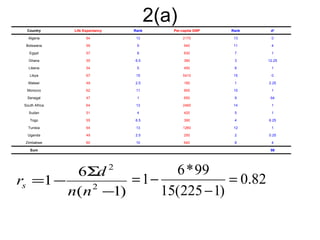

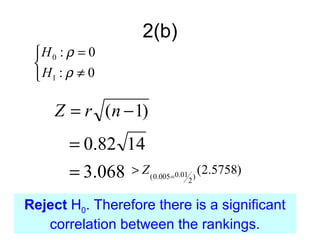

1. The document is a tutorial on inferential statistics, statistical modeling, and survey methods.

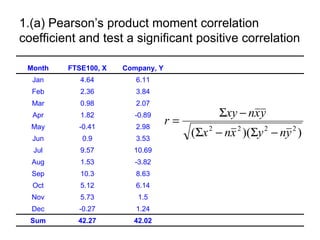

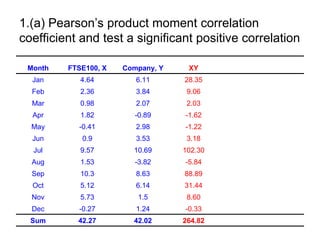

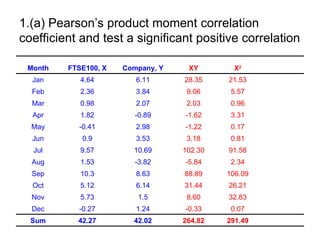

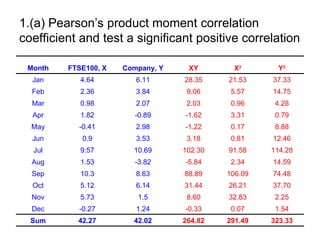

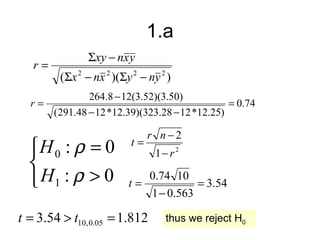

2. It includes an example of calculating Pearson's correlation coefficient between two variables and testing for a significant positive correlation.

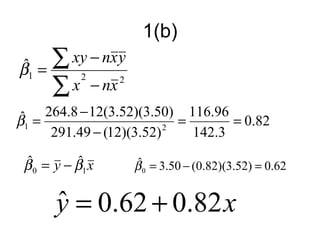

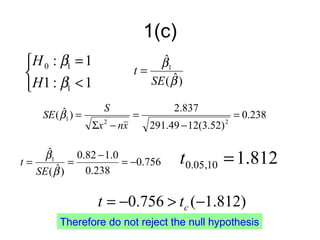

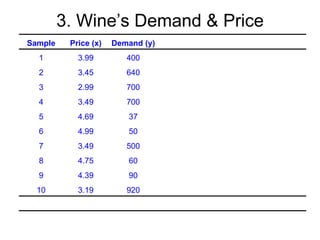

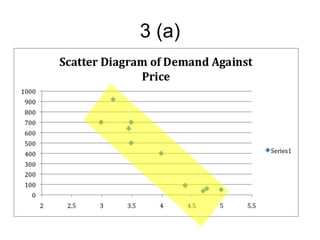

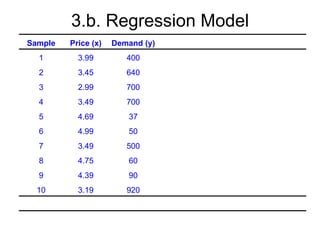

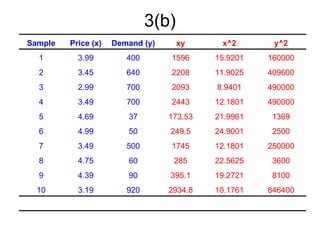

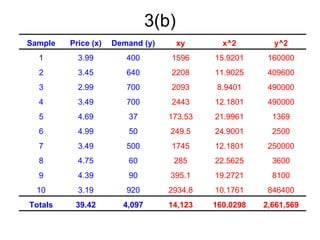

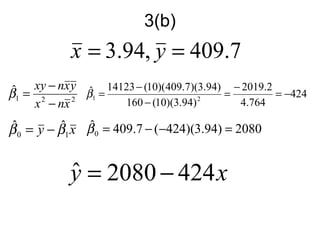

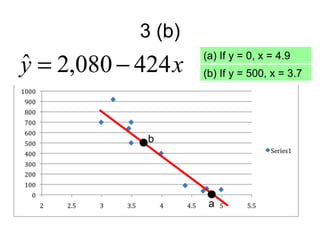

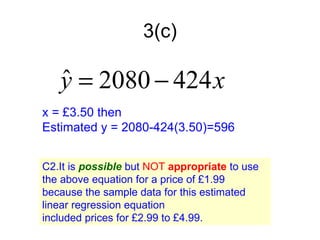

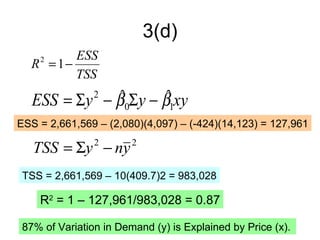

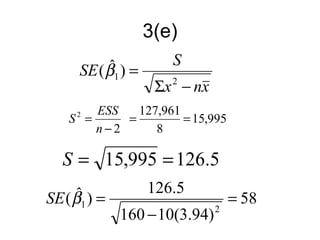

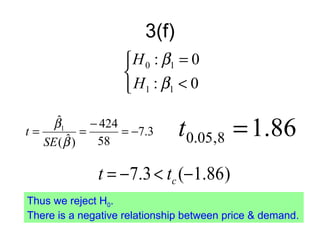

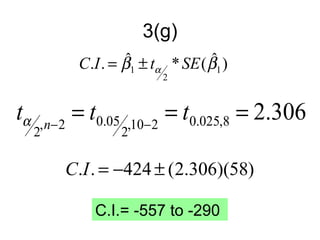

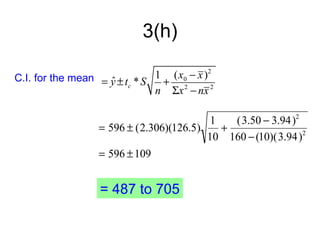

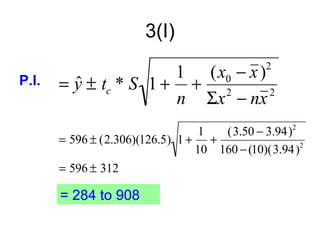

3. It also demonstrates linear regression analysis to model the relationship between two variables and test whether the slope of the regression line is significantly different from a given value.