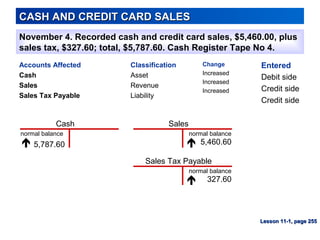

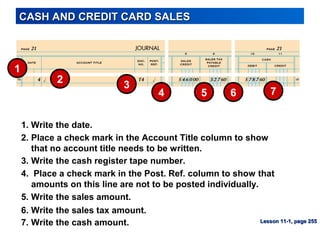

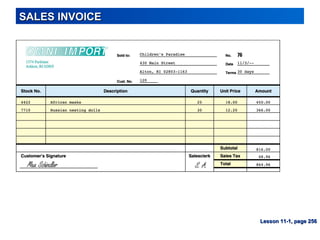

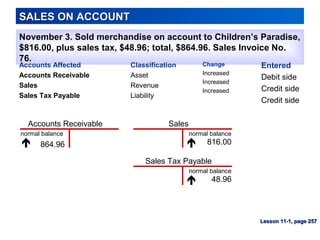

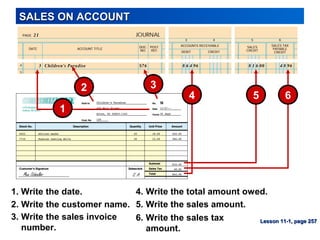

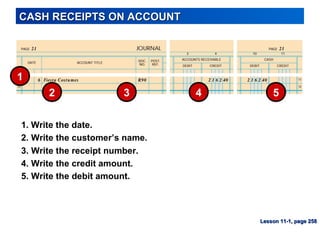

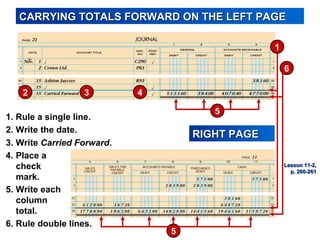

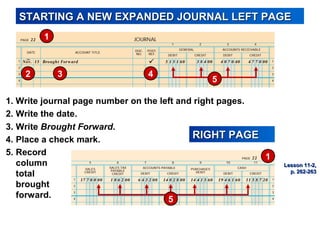

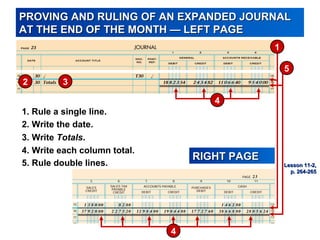

This document provides an overview of journalizing sales and cash receipts transactions in accounting. It defines key terms like customer, sales tax, cash sale, and credit card sale. It also provides examples of journal entries for cash and credit card sales, sales on account, and cash receipts on account. The document guides the reader in recording transactions in an expanded journal, including carrying forward totals to new pages and proving the journal entries at the end of the month.