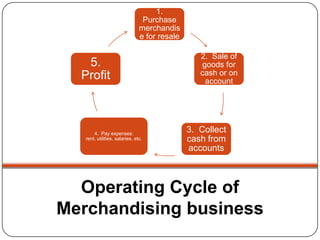

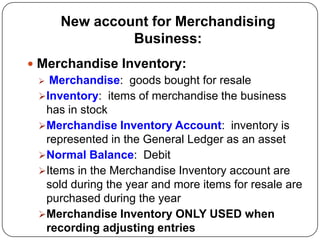

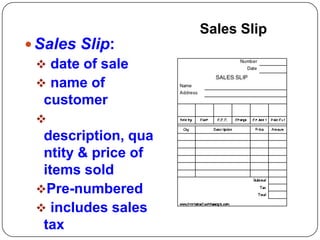

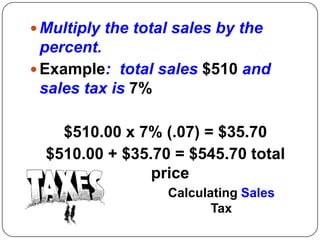

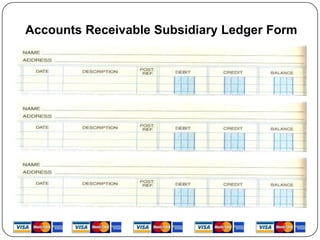

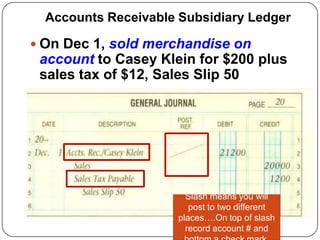

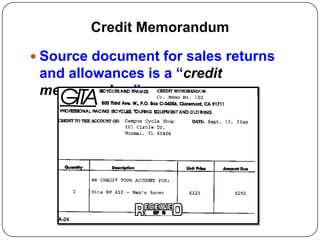

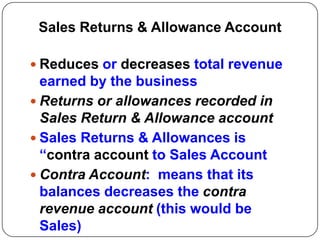

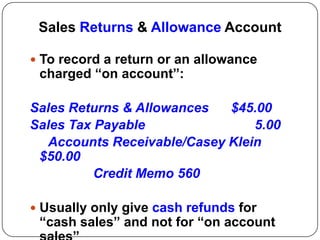

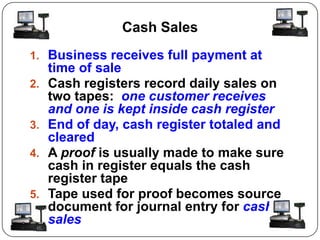

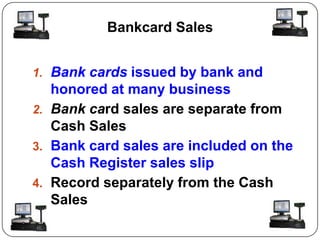

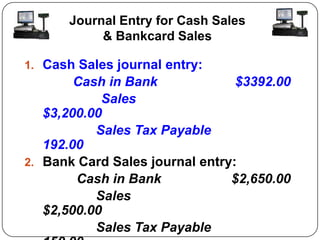

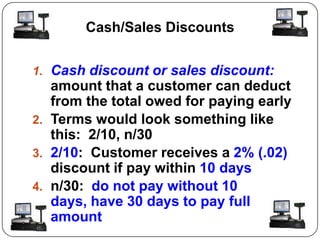

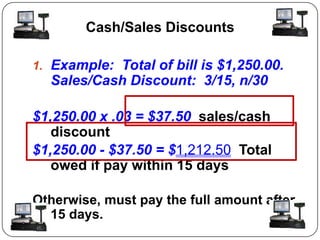

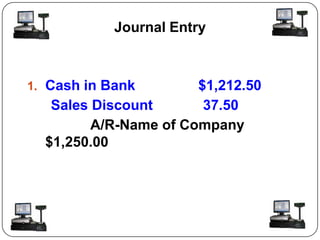

The document discusses the operating cycle and accounting process for merchandising businesses that purchase inventory for resale, including how to record sales, cash receipts, accounts receivable, sales returns, and cash/sales discounts. It introduces the merchandise inventory, sales, and sales returns and allowances accounts, and explains how to maintain an accounts receivable subsidiary ledger to track customer accounts.