- Two or more individuals form a partnership by combining their assets and skills to go into business together. They create a partnership agreement to outline partner investments, duties, income/loss division, and contingencies.

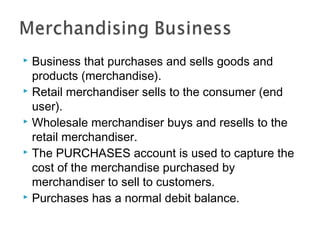

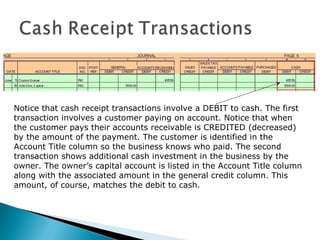

- A merchandiser buys merchandise to resell, either paying with cash or purchasing on account from vendors. The purchases account tracks the cost of goods bought for resale. Special journal columns help track transactions affecting key accounts like purchases.

- When transactions span multiple journal pages, the columns are totaled and proven to ensure debits equal credits before carrying totals to a new page. Special column totals can then be directly posted to accounts, saving time over individual posting.