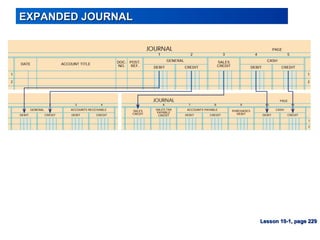

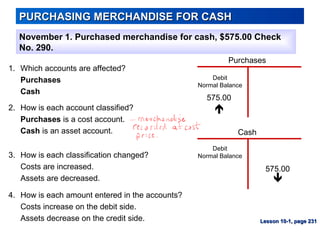

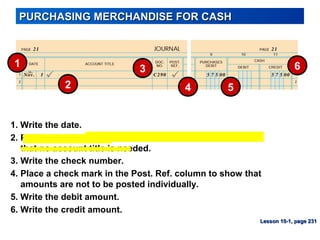

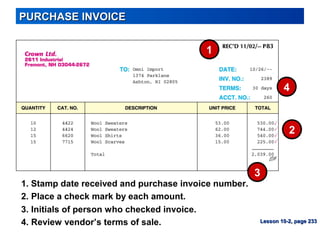

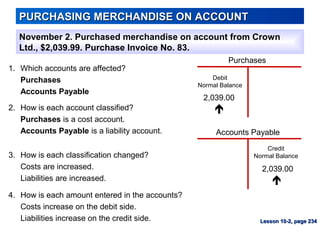

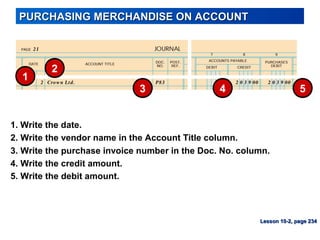

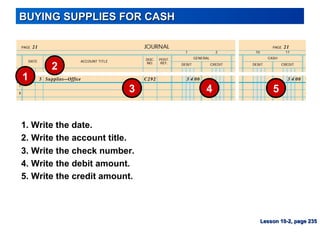

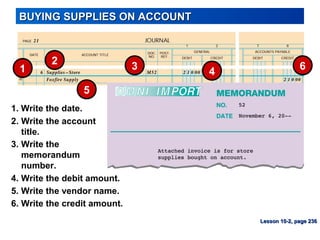

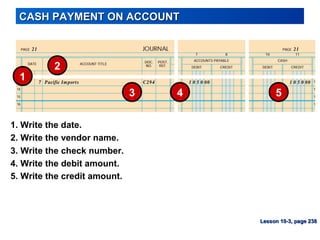

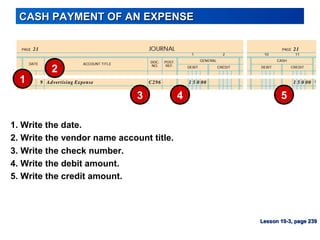

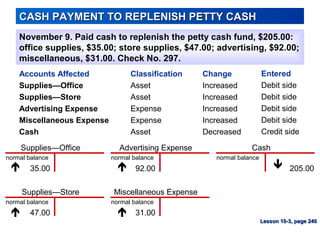

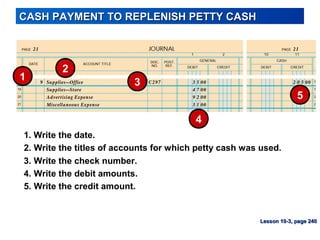

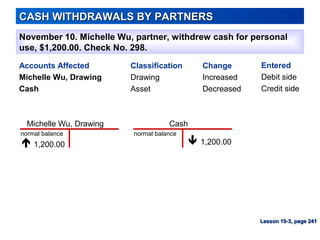

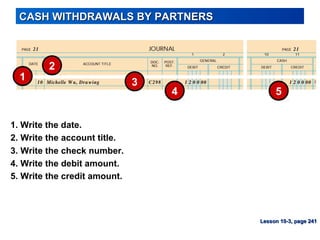

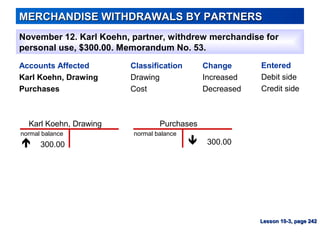

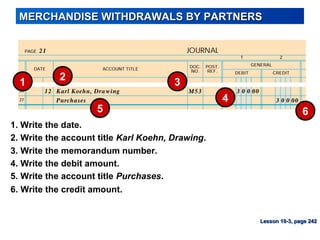

This document provides an overview of key accounting concepts related to journalizing purchases and cash payments. It defines terms like partnership, partner, merchandising business, cost of merchandise, and markup. It also provides examples of journal entries for transactions like purchasing merchandise for cash, purchasing merchandise on account, buying supplies on account, making cash payments on accounts and expenses, replenishing petty cash, cash withdrawals by partners, and merchandise withdrawals by partners. The document is intended to teach students how to properly record these common business transactions in an accounting journal.