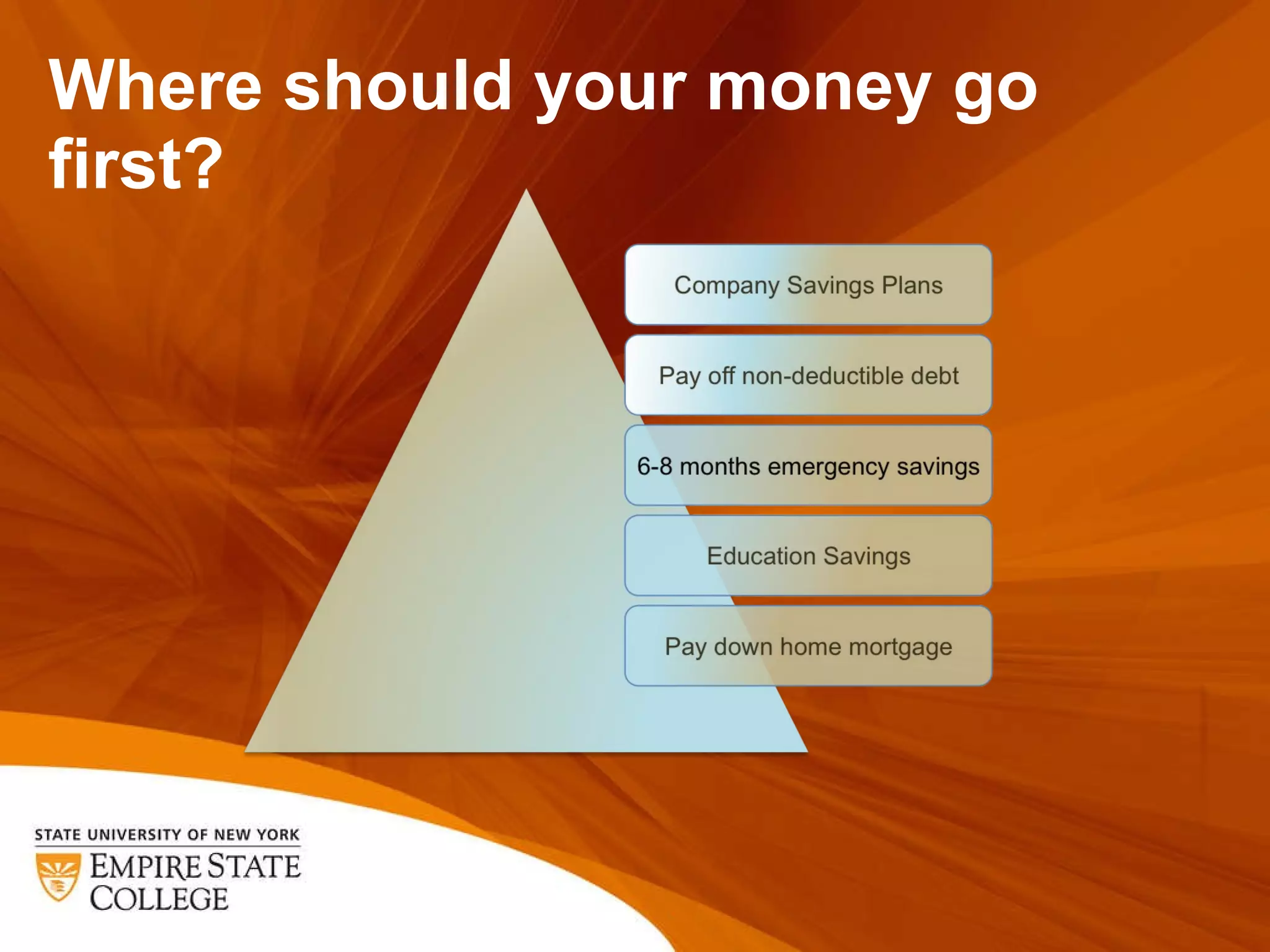

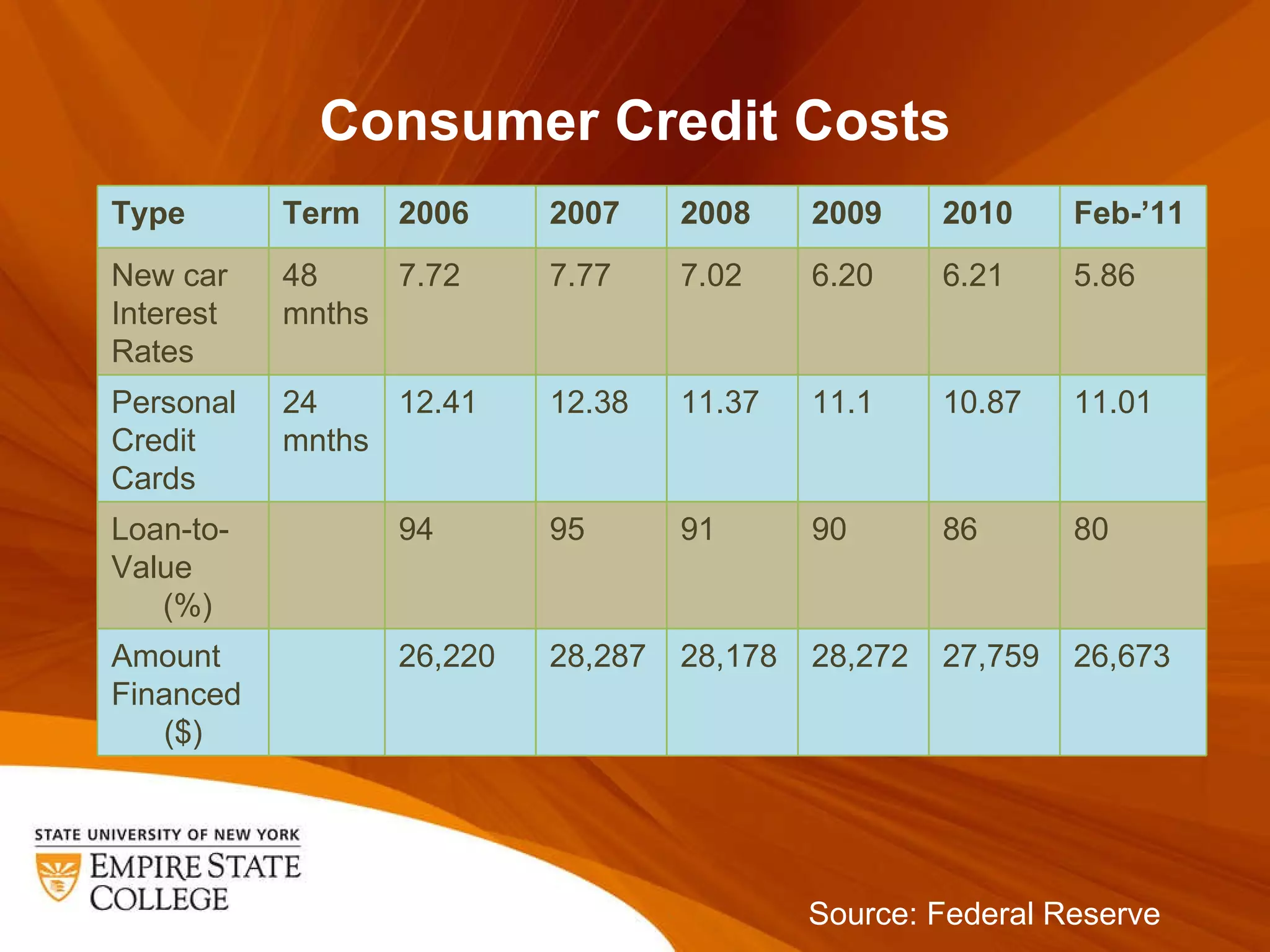

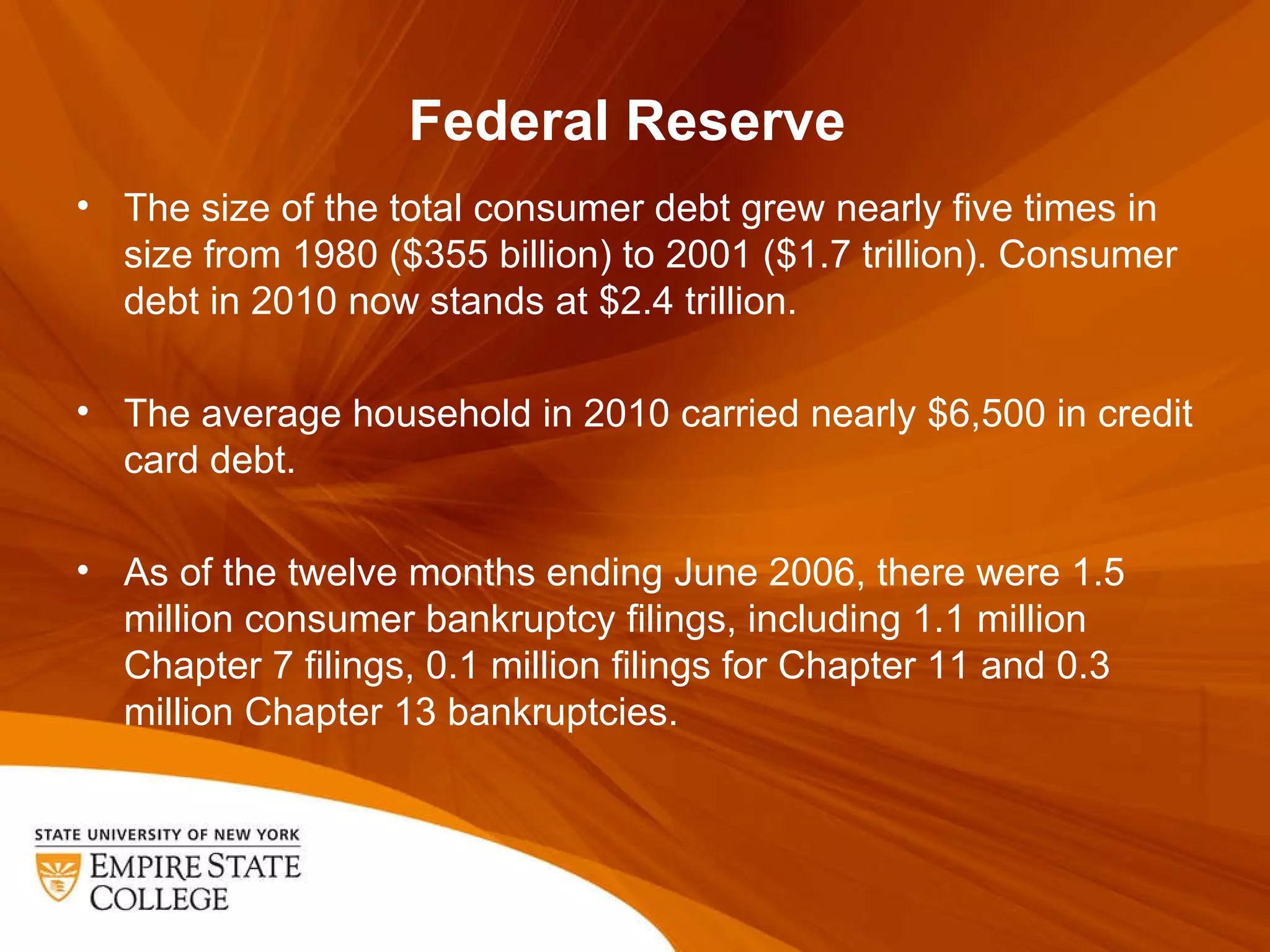

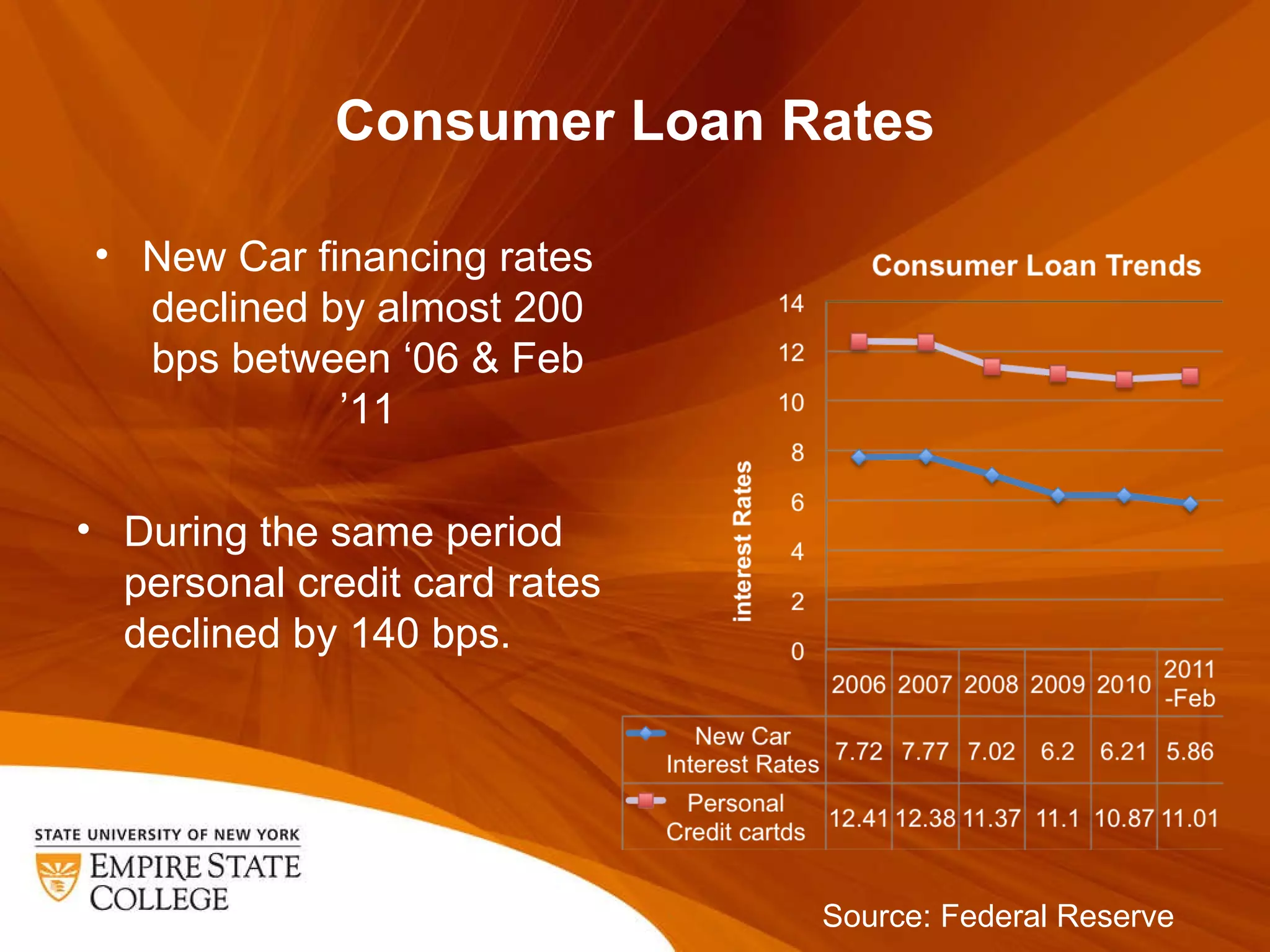

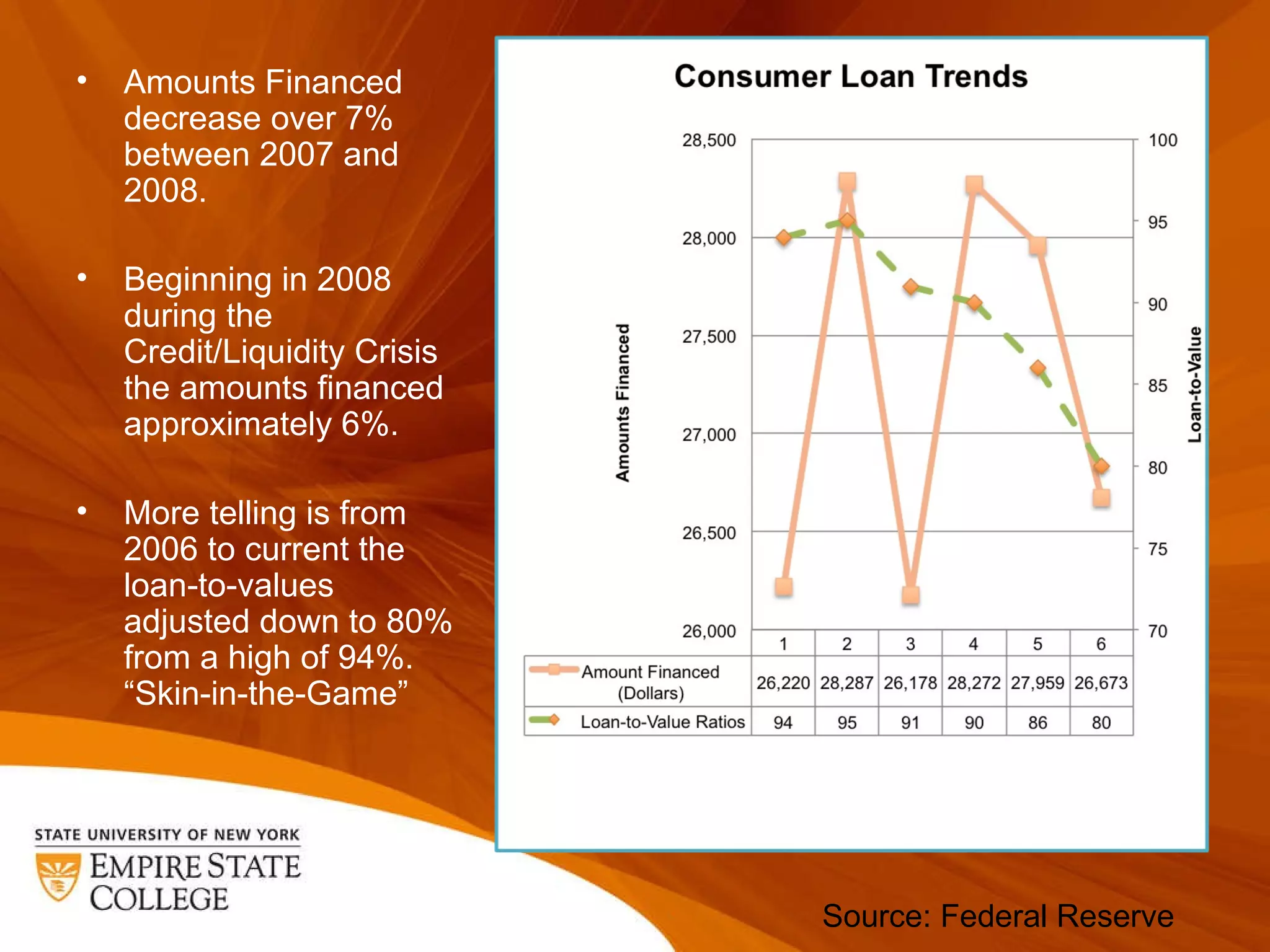

The document discusses personal finance topics such as paying down high-interest debt, creating an emergency fund, saving for retirement and education. It notes that consumer debt in the US grew nearly 5 times from 1980 to 2001 and currently stands at $2.4 trillion. Credit card interest rates and amounts financed for auto loans have declined in recent years. Many college students take on significant debt, with the average debt per borrower rising to $22,700. Those seeking credit counseling typically have $43,000 in total debt, with $20,000 in consumer debt and $8,500 in revolving credit card debt.