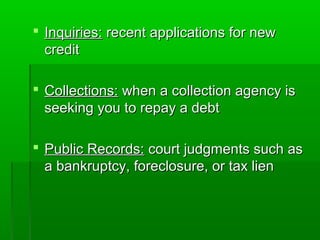

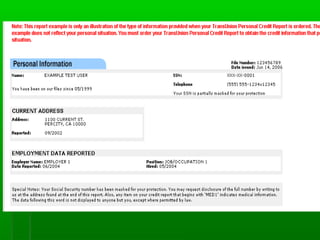

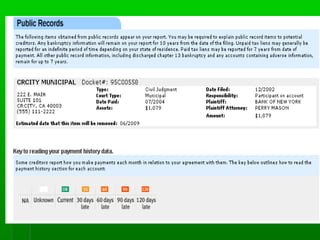

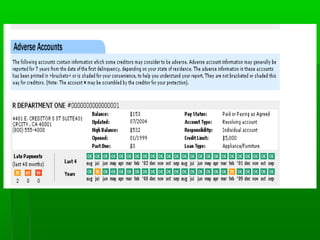

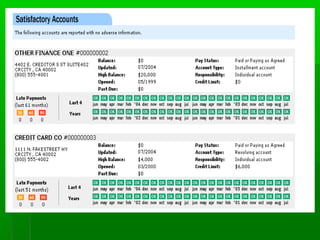

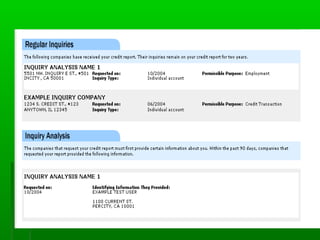

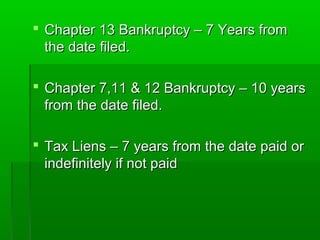

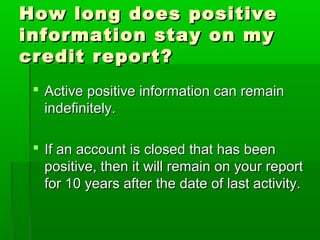

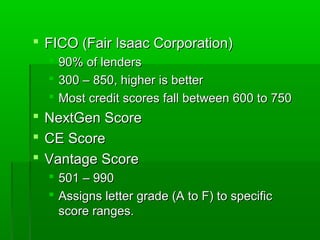

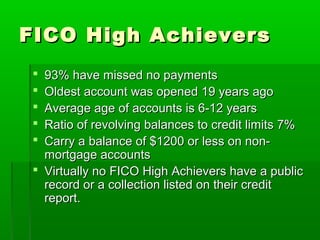

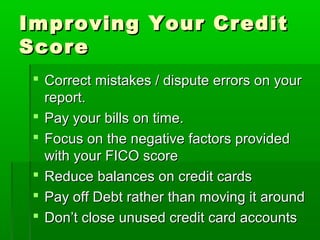

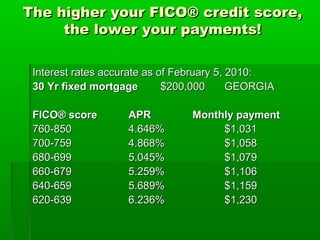

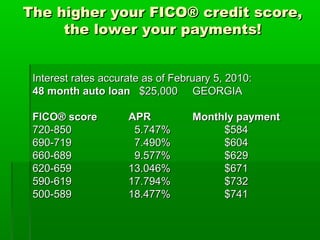

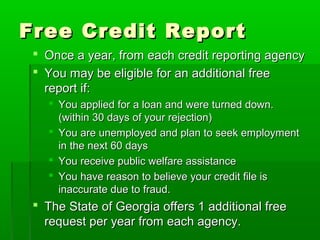

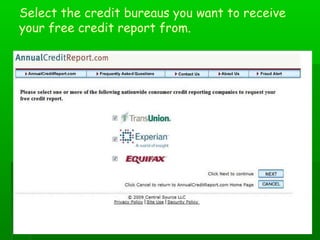

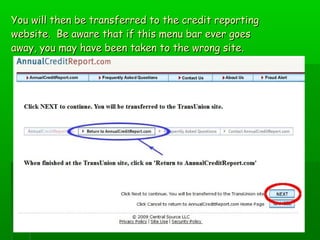

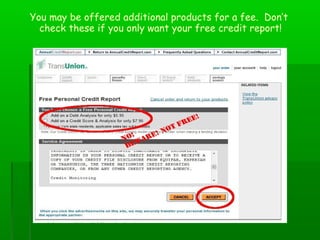

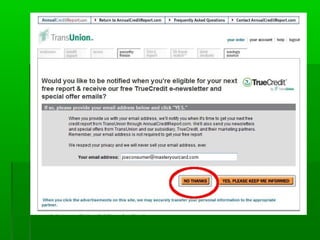

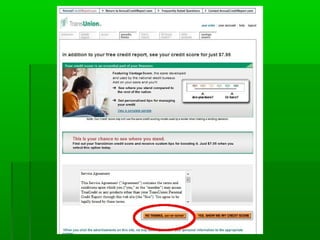

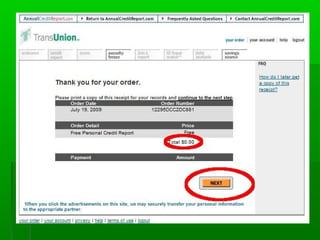

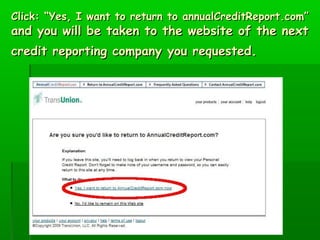

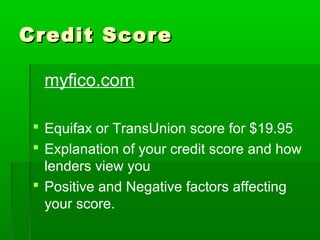

The document provides a comprehensive overview of credit reports, detailing their components, the duration of negative and positive information, and the significance of credit scores. It explains the factors influencing credit scores, their implications for creditworthiness, and offers guidance on improving scores. Additionally, it discusses resources for obtaining free credit reports and scores, as well as consumer credit counseling options.