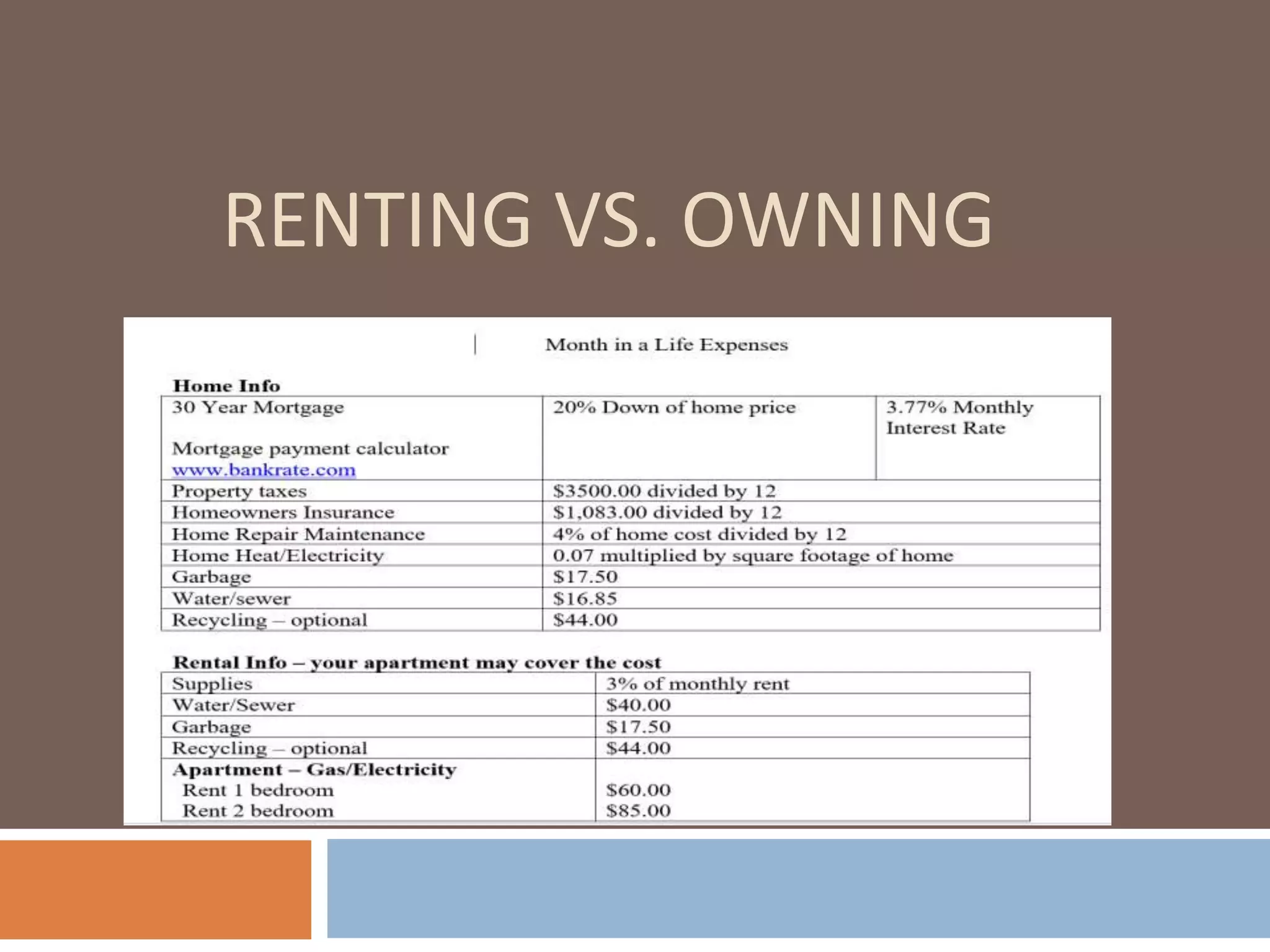

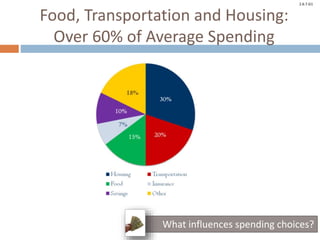

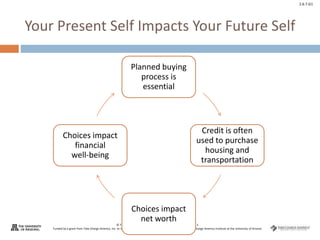

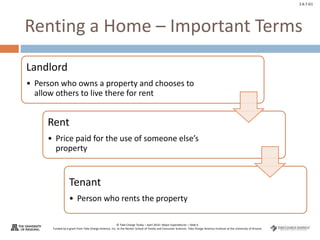

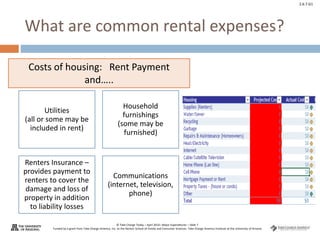

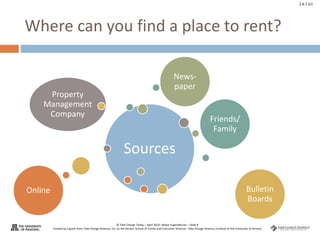

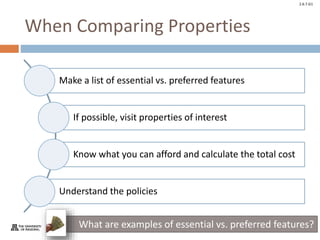

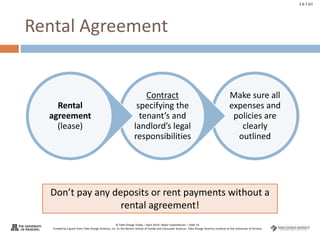

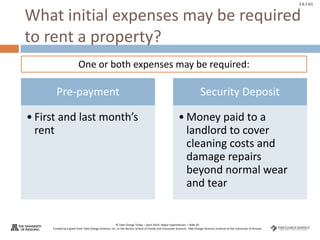

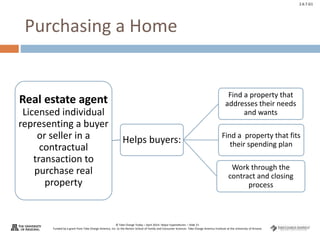

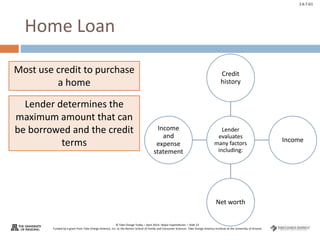

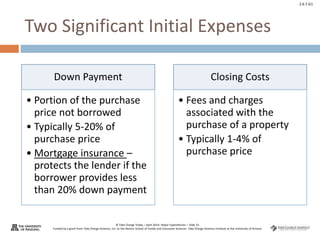

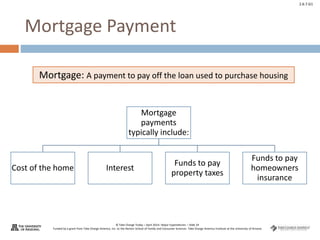

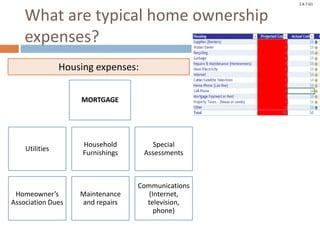

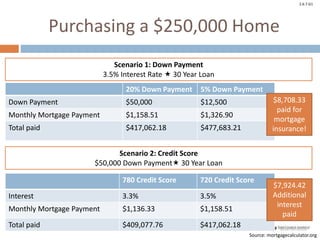

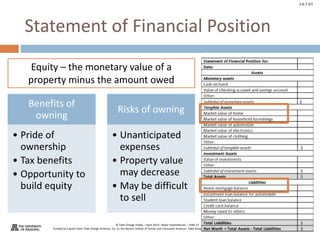

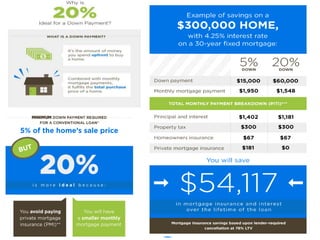

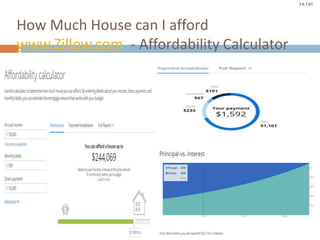

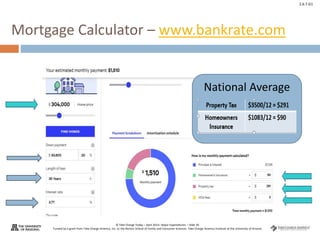

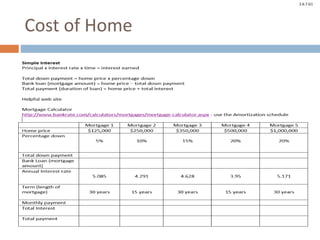

The document discusses the major financial decision of whether to rent or own a home. Renting is the cheaper option upfront but the rent payments do not build equity, while owning requires a large down payment and closing costs but the monthly mortgage payments do contribute to building home equity over time. The document provides information about factors to consider for both renting and owning as well as costs associated with each option.