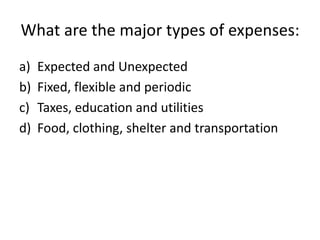

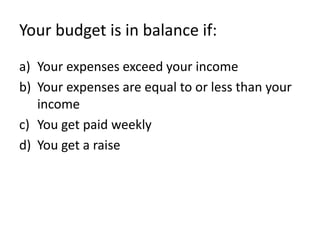

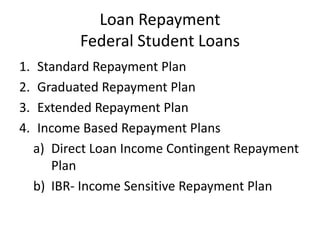

The document is a comprehensive guide on managing finances, including budgeting, student loans, and debt repayment strategies. It outlines key concepts such as types of expenses, loan repayment plans, and consequences of defaulting on student loans. Additionally, it provides resources for further information on managing student debt and financial choices.