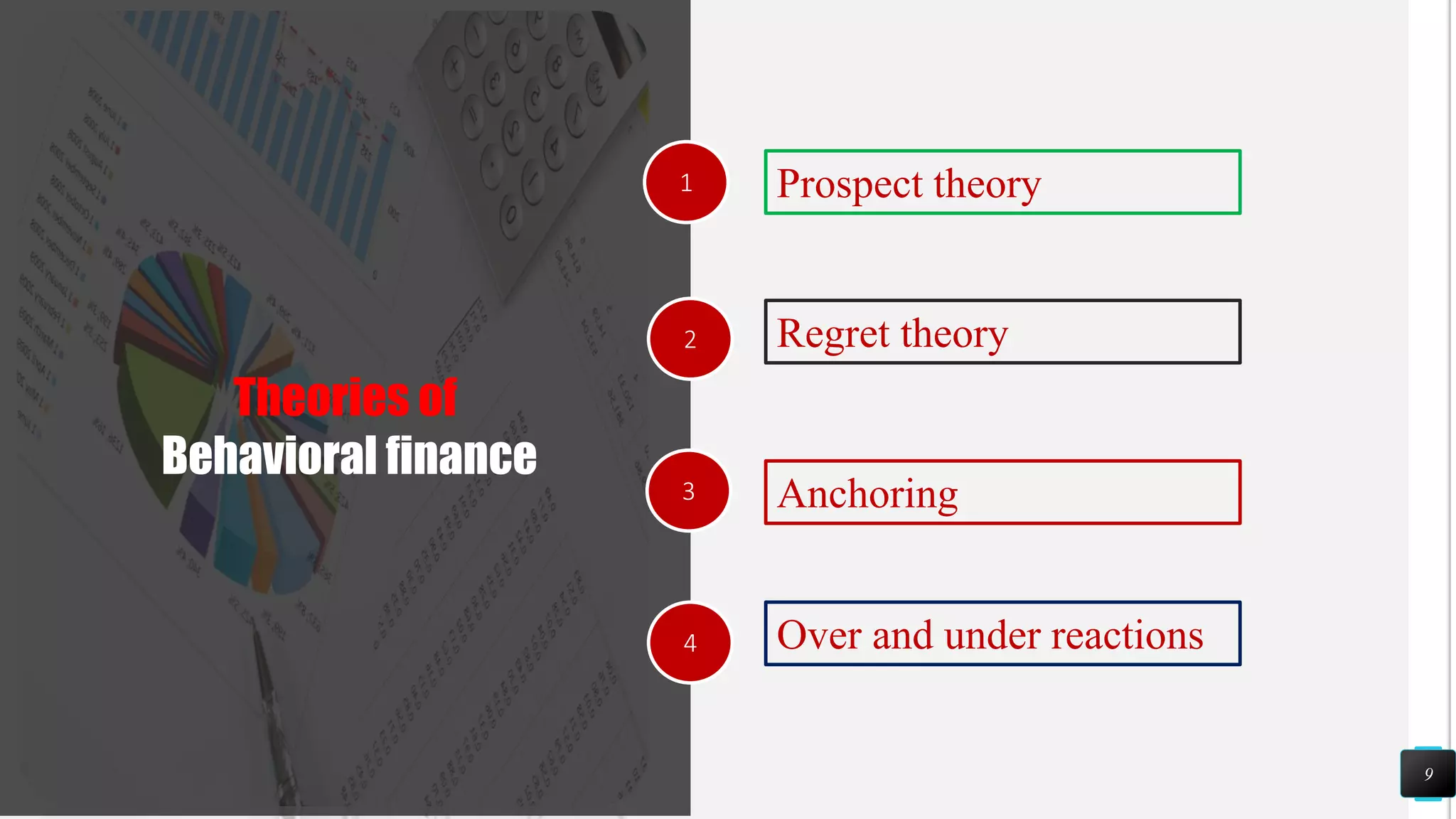

Behavioral finance is the study of how psychology affects the behavior of investors and financial markets. It challenges the assumption of traditional finance that investors are always rational. Behavioral finance argues that investors are influenced by cognitive biases and emotions and do not always act rationally. Some of the major theories of behavioral finance include prospect theory, which shows how risk is viewed differently depending on whether the context is gains or losses, and anchoring bias, where investors rely too heavily on recent information. Behavioral finance aims to understand both how individual investors behave and how their aggregate behaviors impact market outcomes.