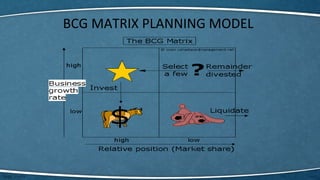

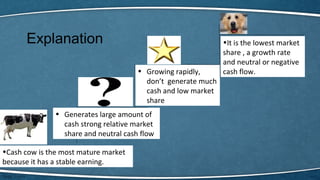

The document presents an overview of the BCG Matrix and Porter's Five Forces as frameworks for business strategy. The BCG Matrix helps in identifying resource allocation for maximizing growth and profitability by classifying products based on market share and growth rate, while Porter's Five Forces analyzes competitive dynamics within an industry. Key factors include rivalry among competitors, threat of substitutes, buyer and supplier power, and barriers to new entrants.