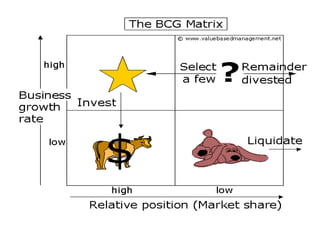

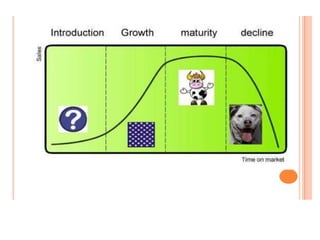

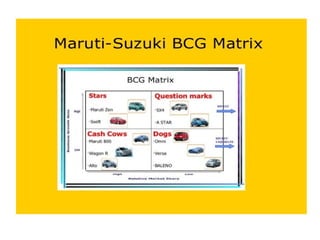

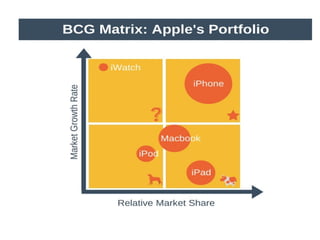

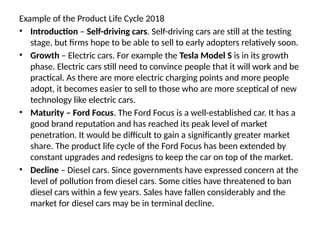

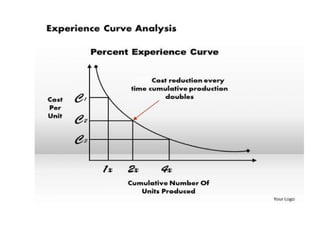

The BCG Matrix, developed by Bruce D. Henderson in 1970, is a strategic tool for analyzing business units based on market share and growth, aiding in resource allocation decisions. Products are categorized into four groups: Cash Cows, Dogs, Question Marks, and Stars, reflecting their performance and cash generation capabilities. Additionally, concepts like the Product Life Cycle, Experience Curve, and Porter's Five Forces model are discussed for assessing market positions and competitive strategies.