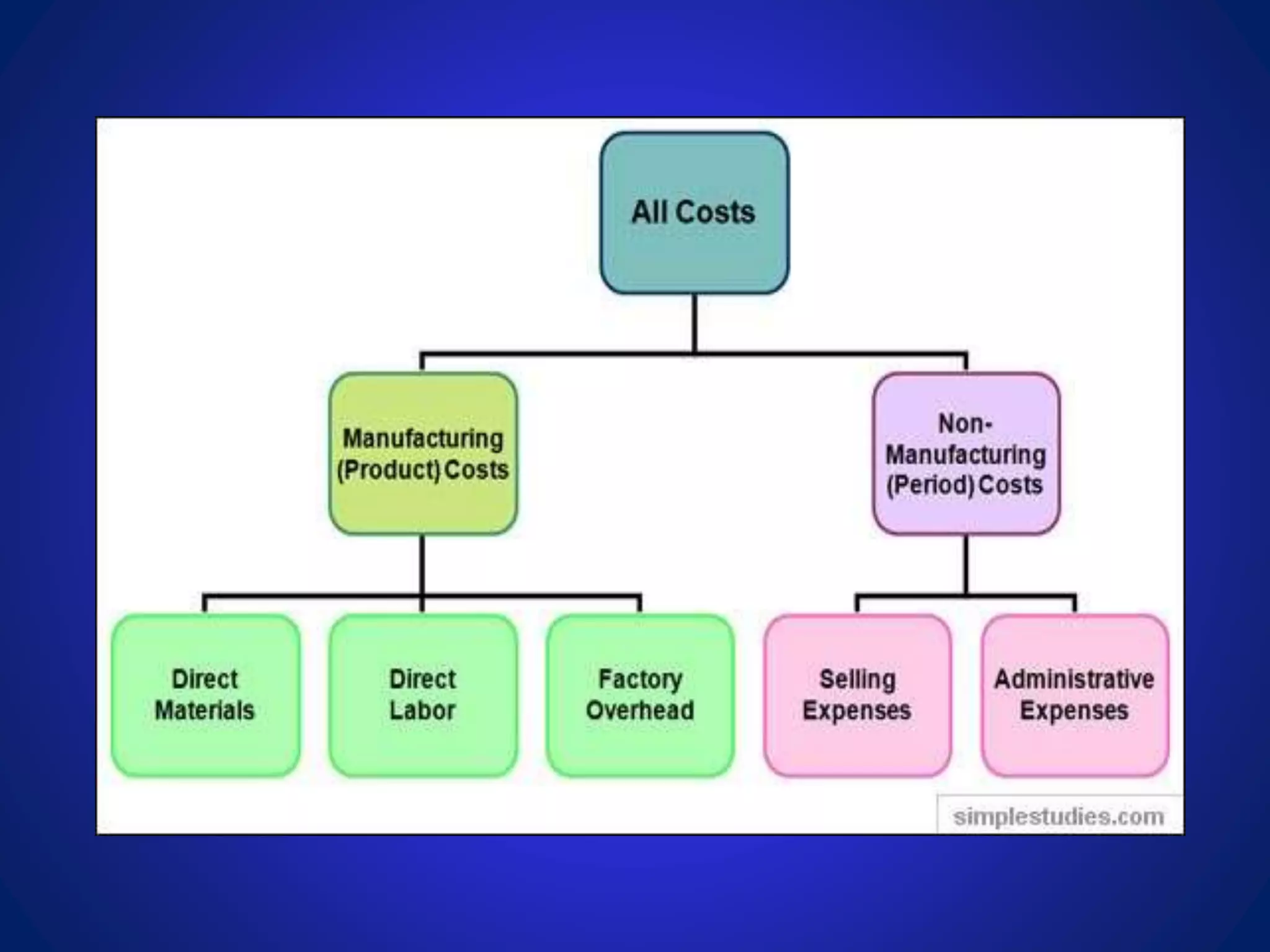

This document discusses different types of manufacturing costs including:

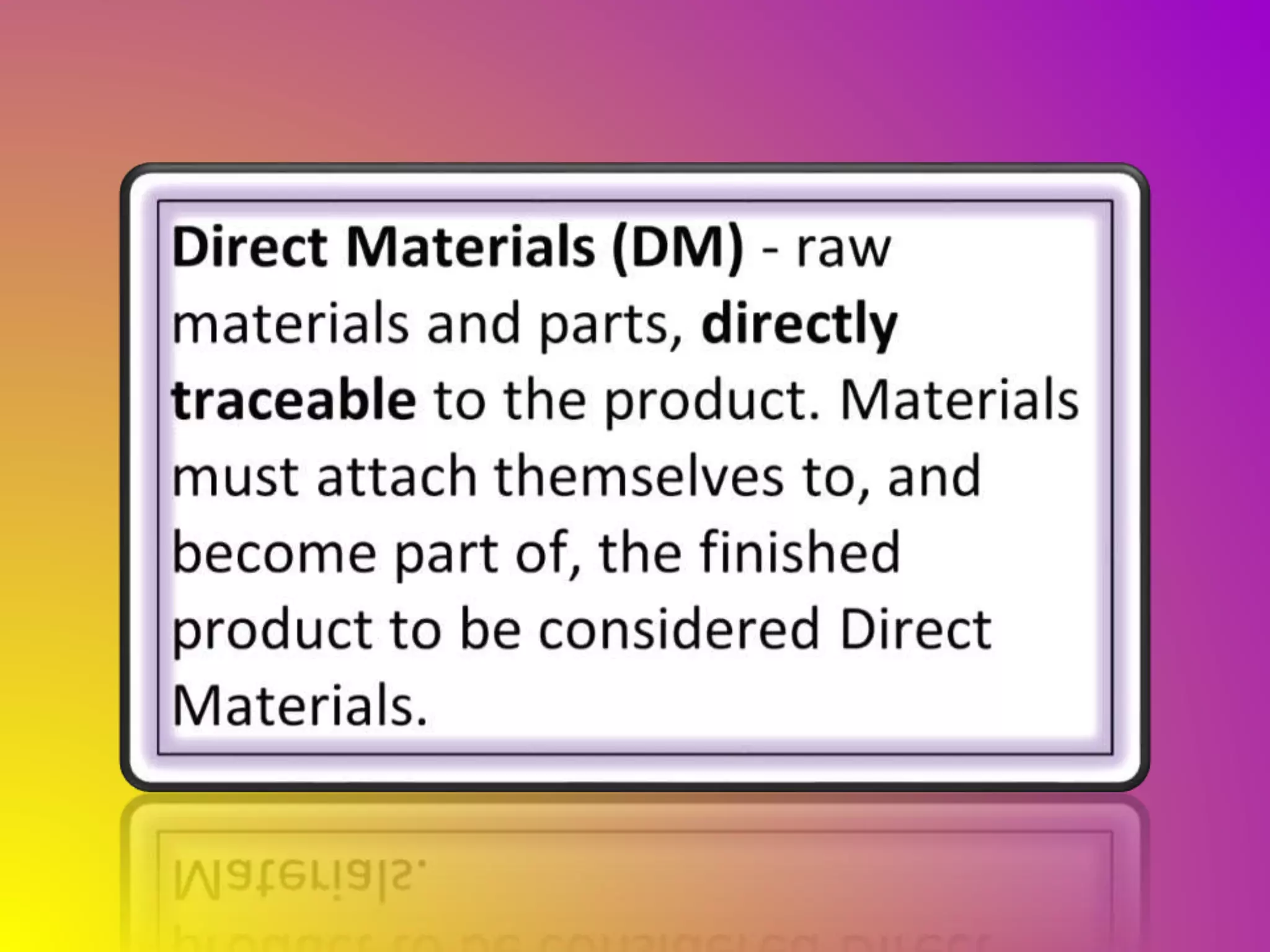

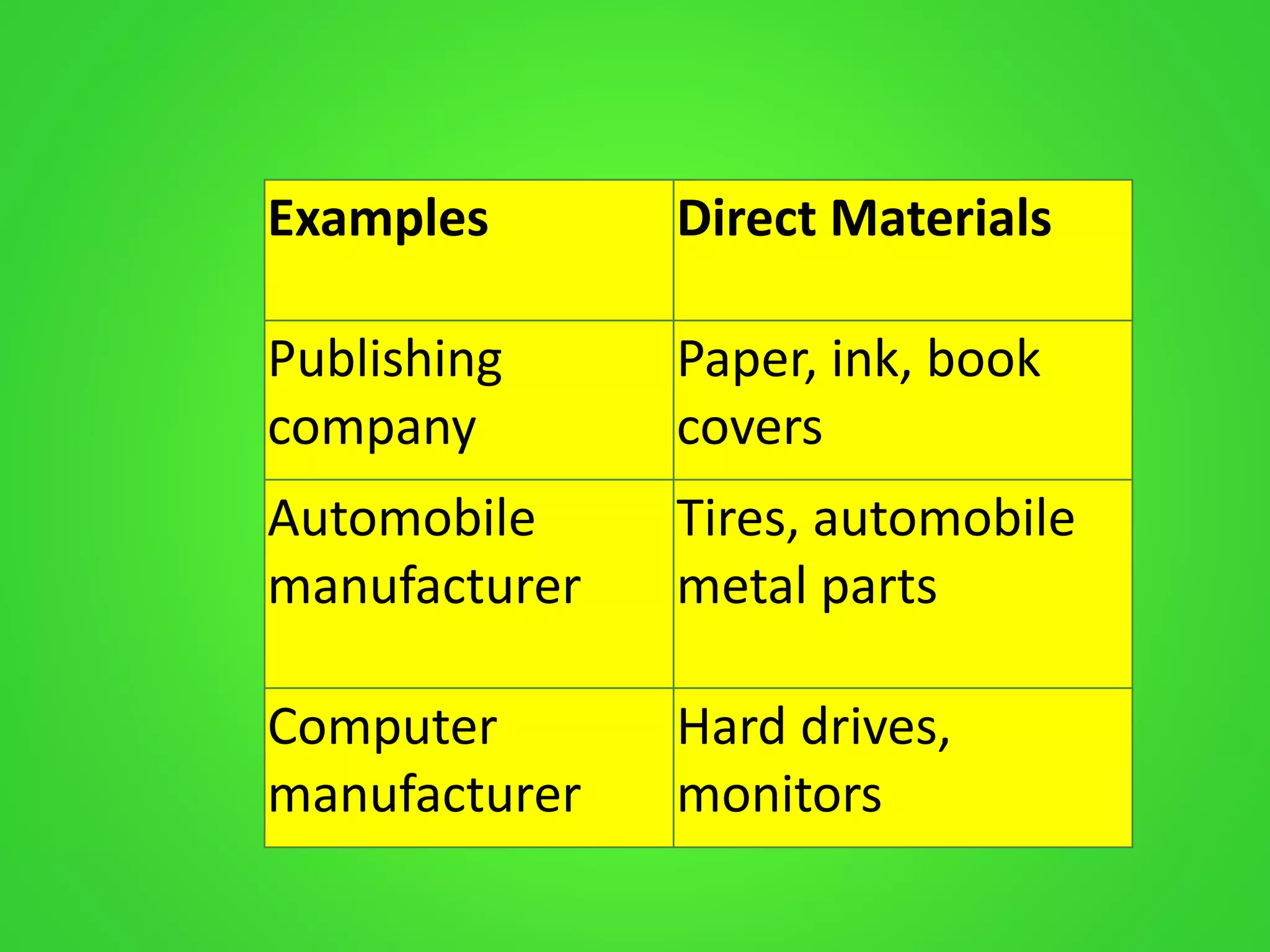

1. Direct materials - Materials that become part of the final product like metals in cars.

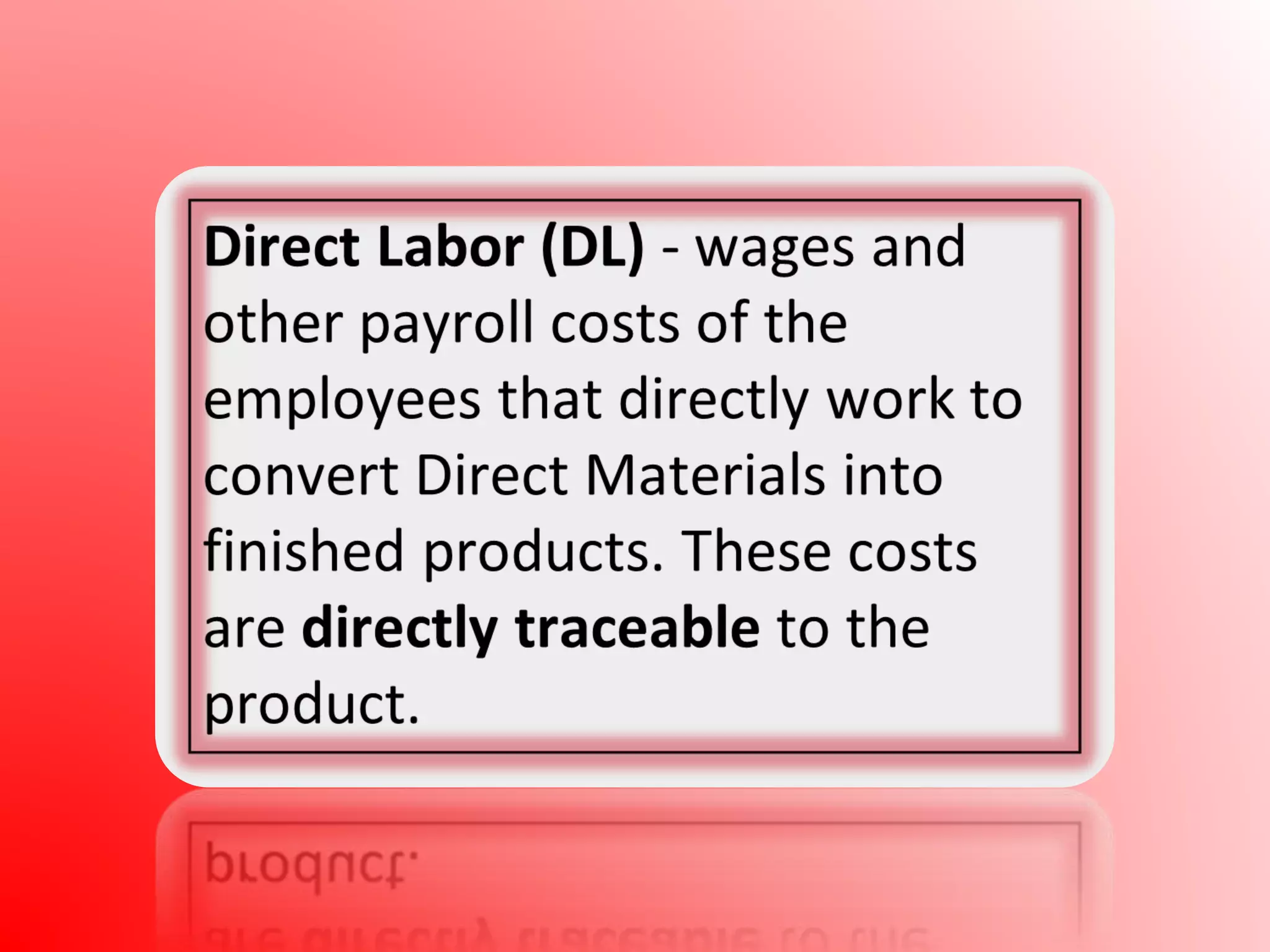

2. Direct labor - Wages paid to employees directly involved in production like factory workers.

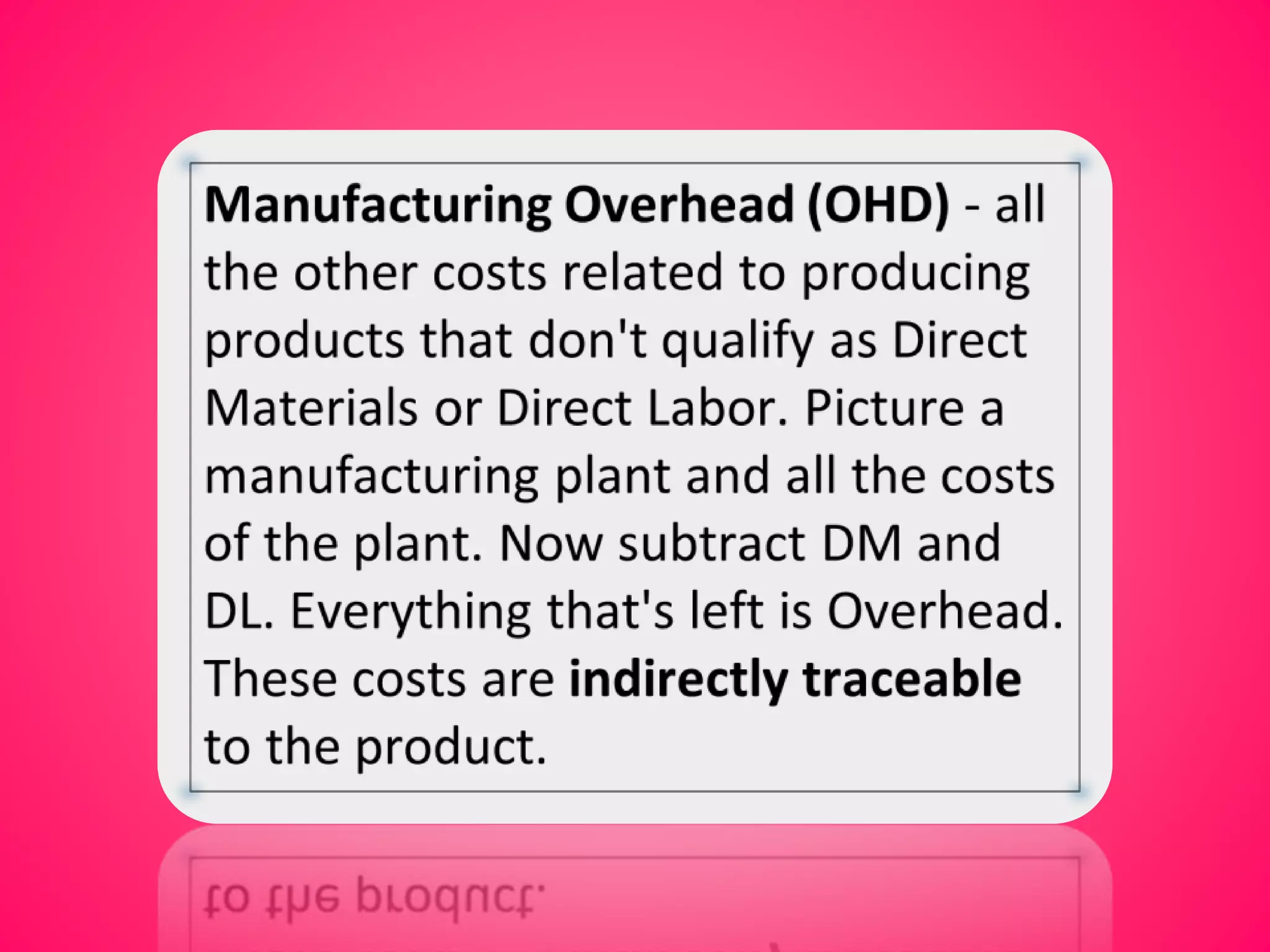

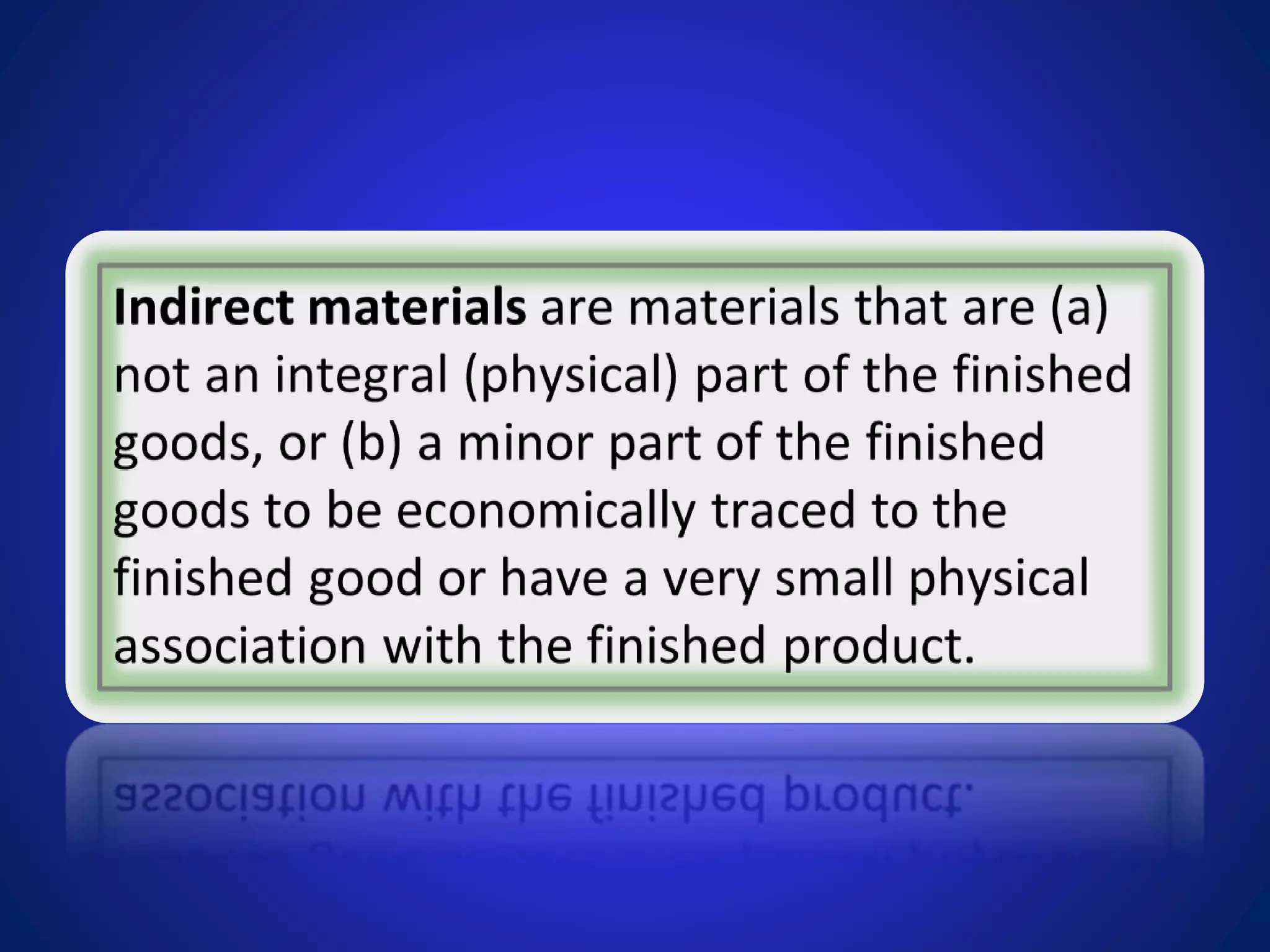

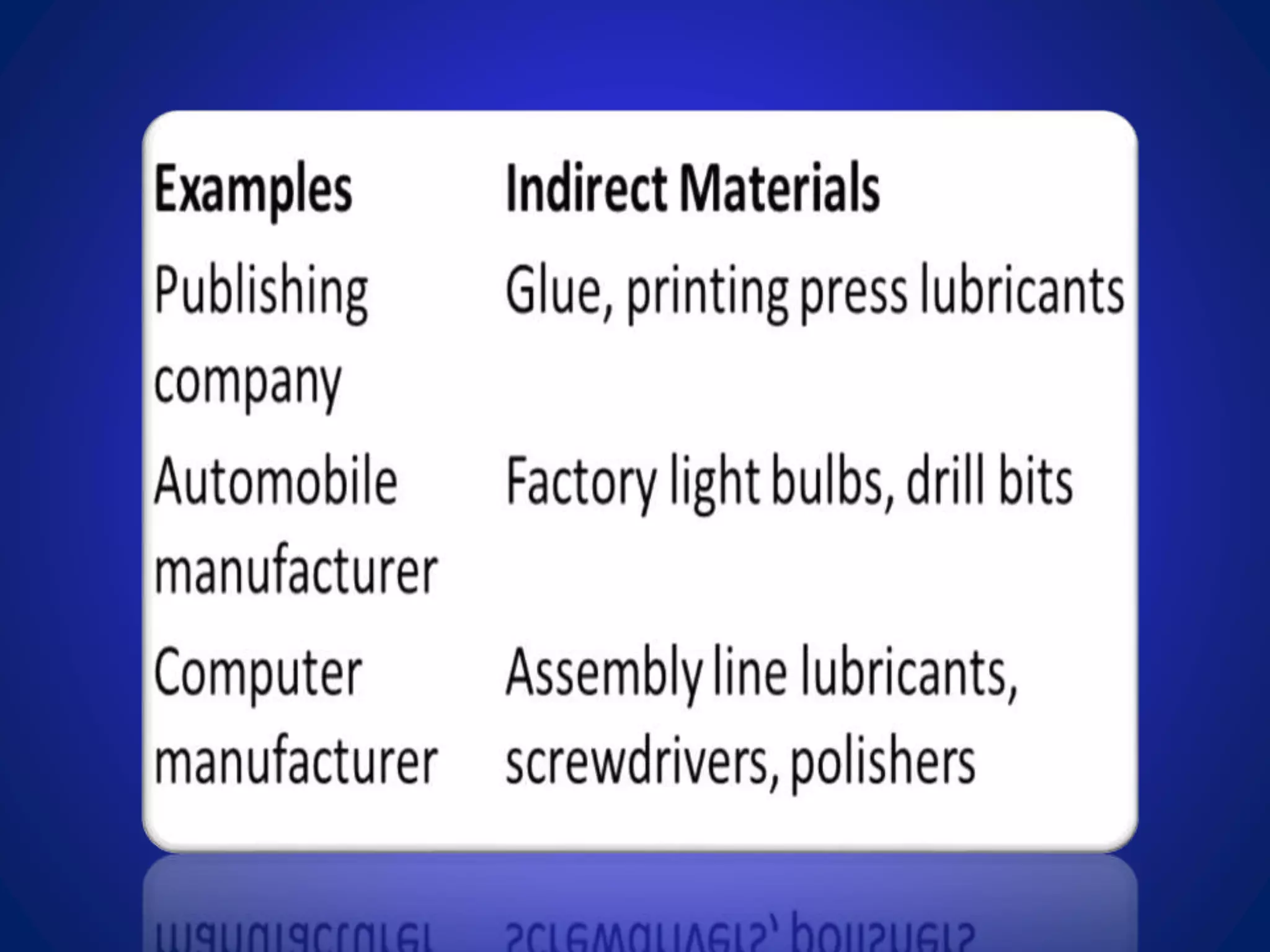

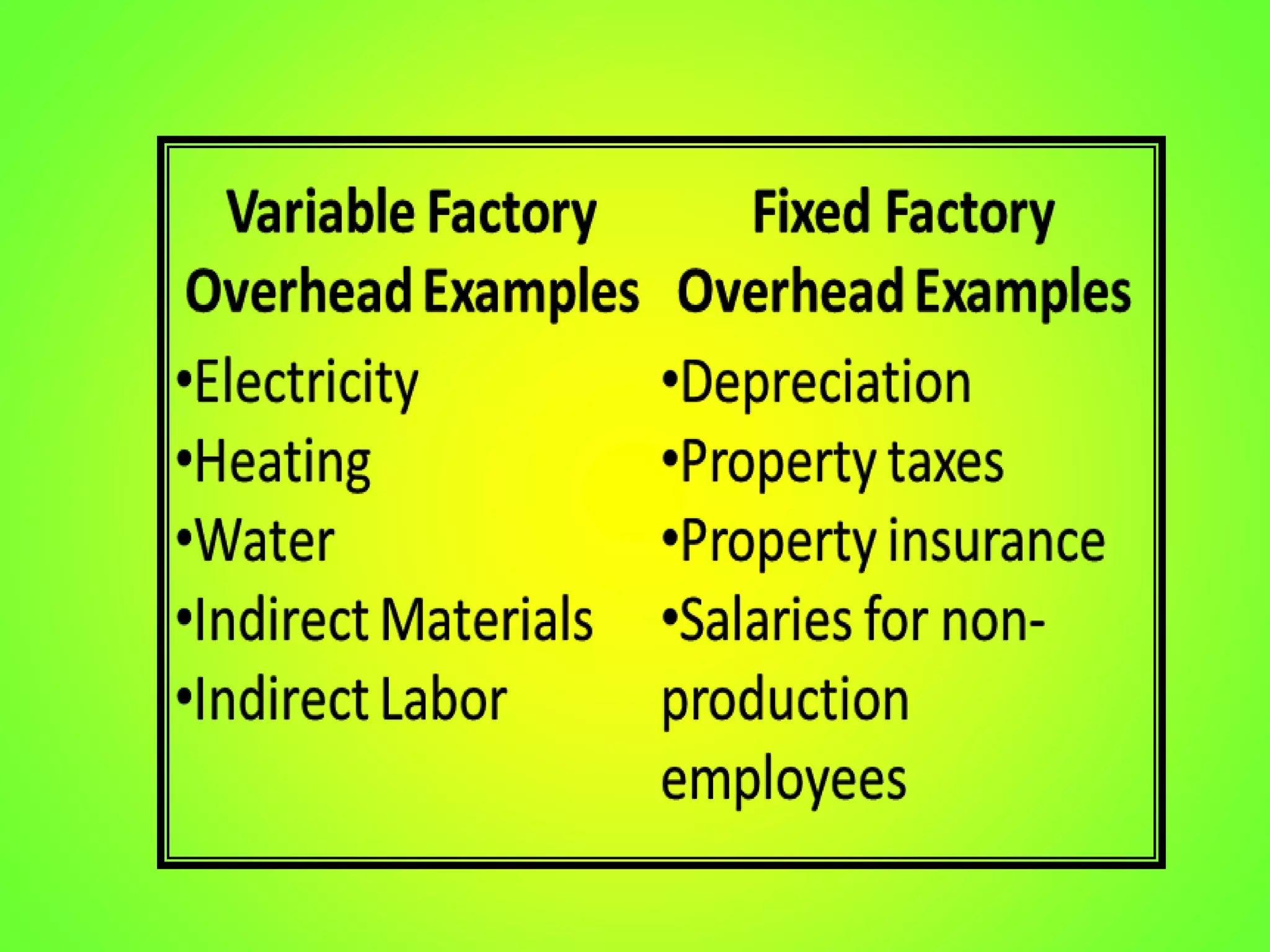

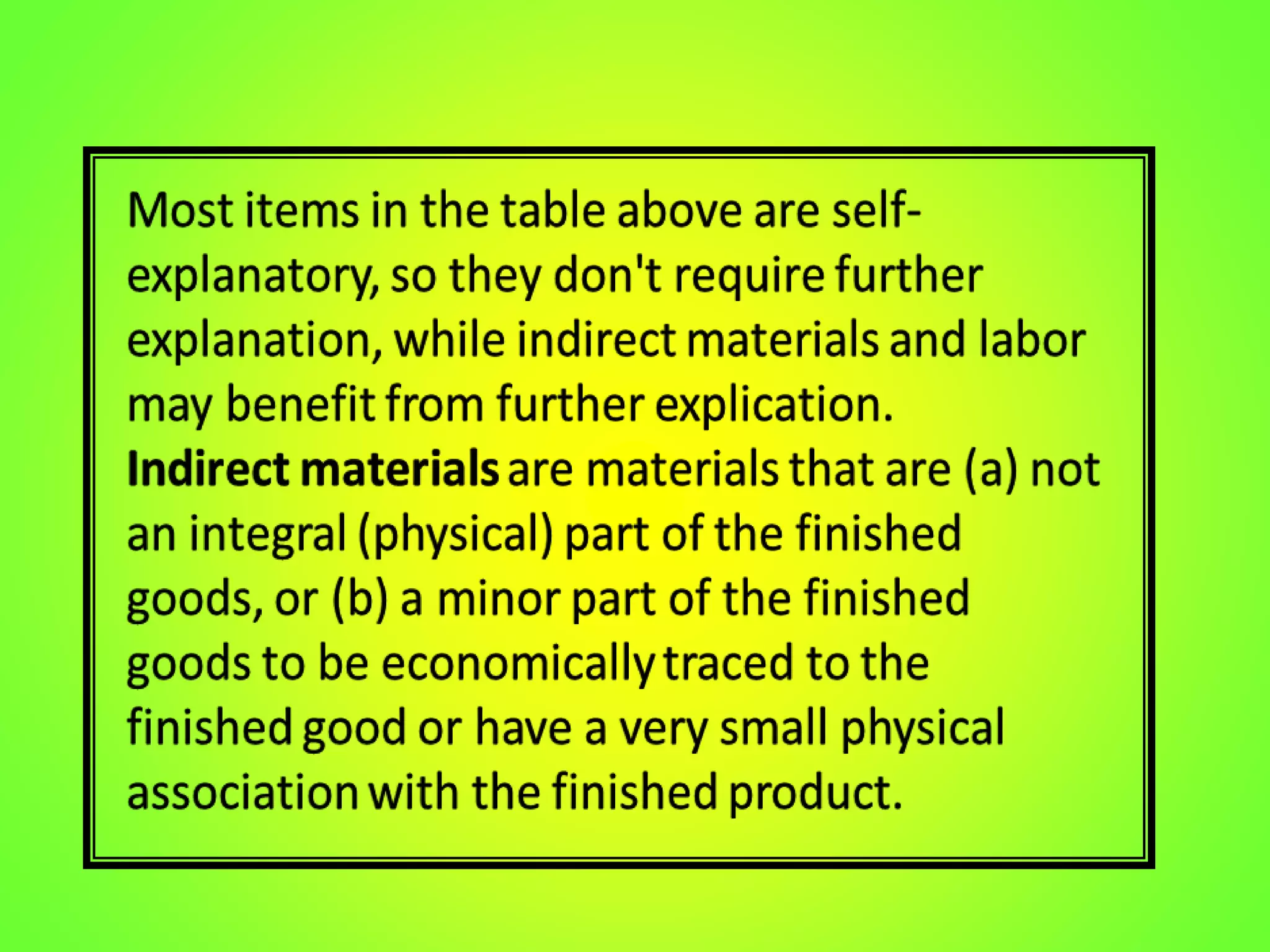

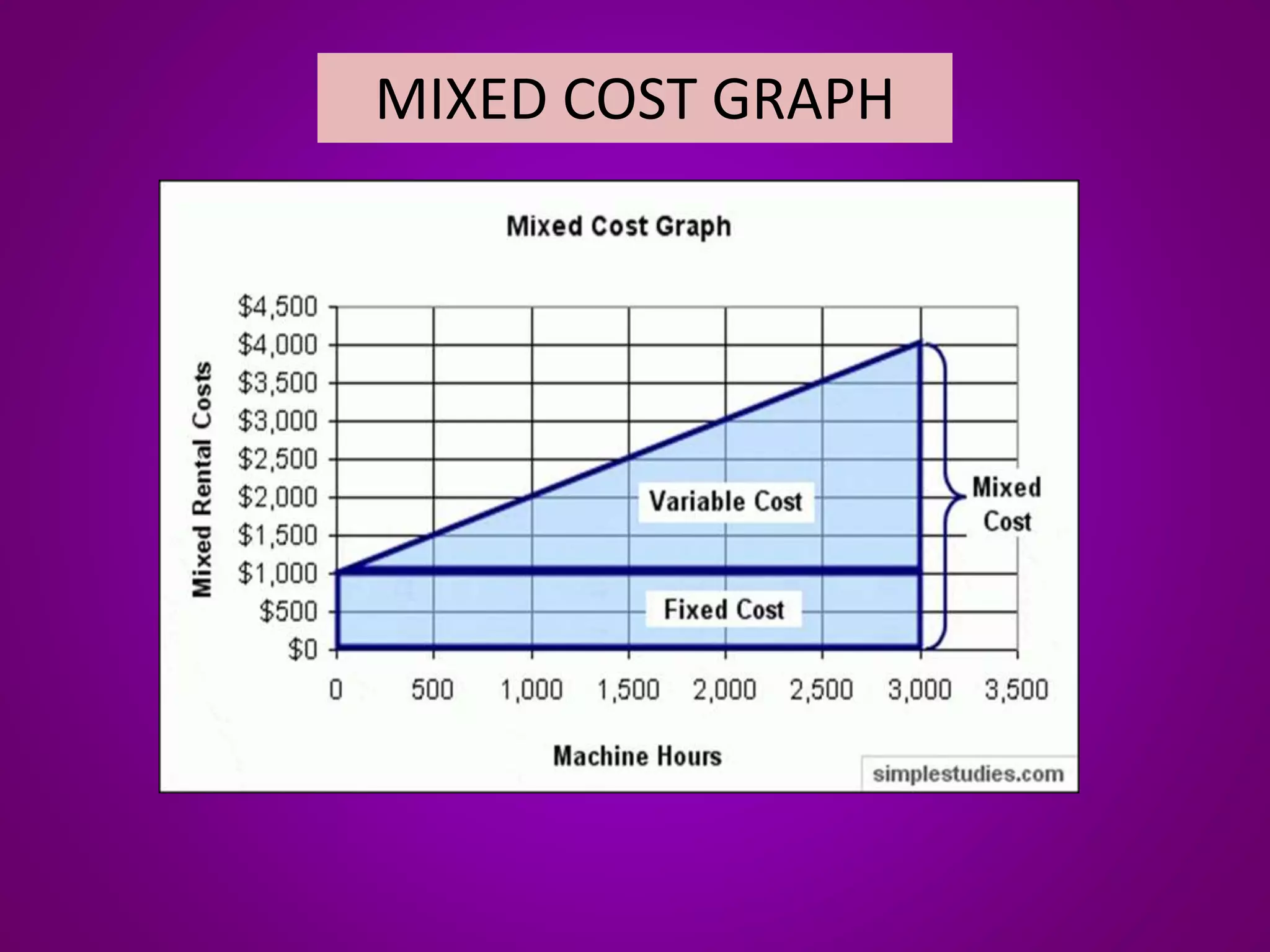

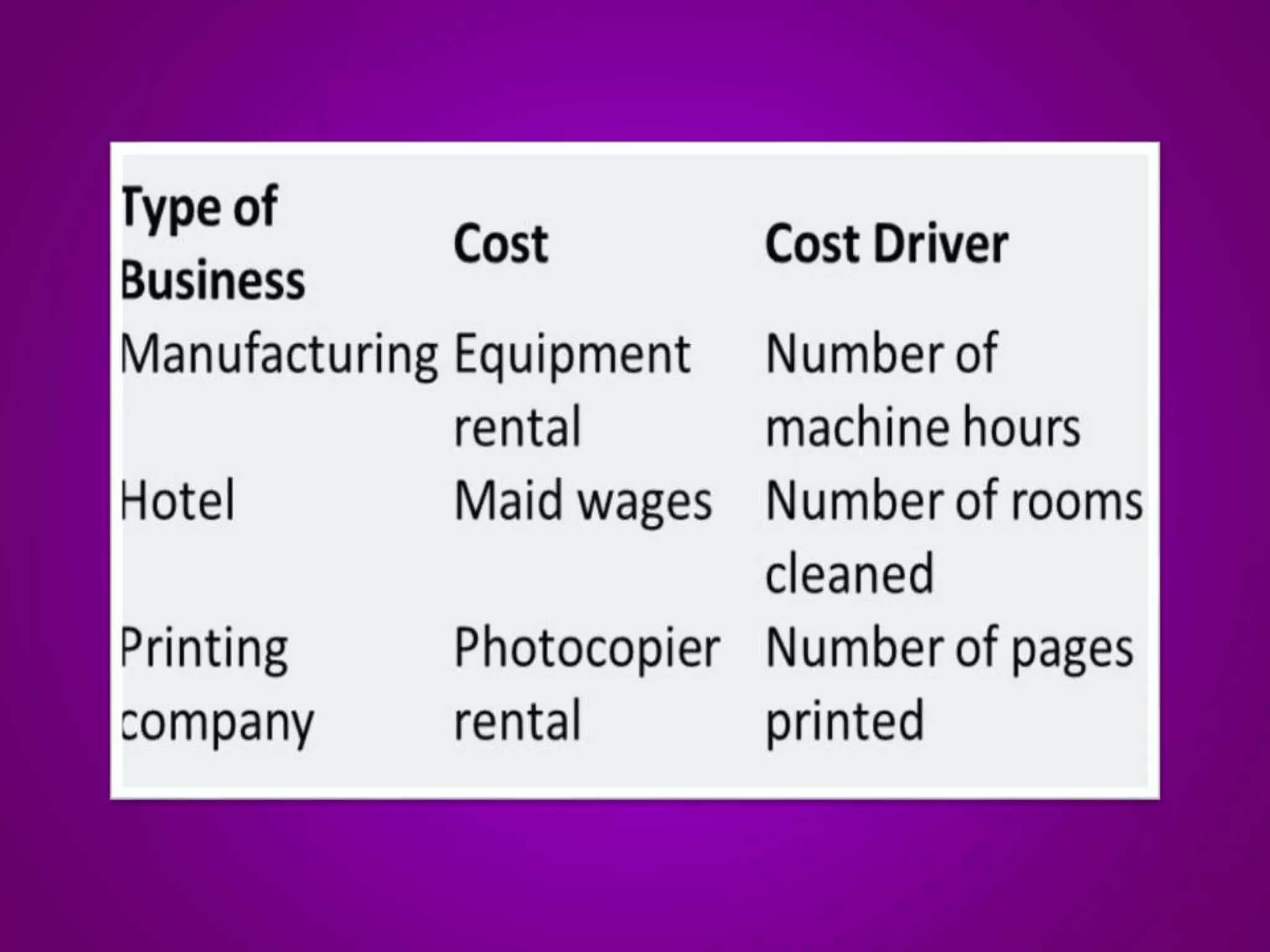

3. Overhead - Additional costs that cannot be traced to a specific product like utilities, rent, and supervision.

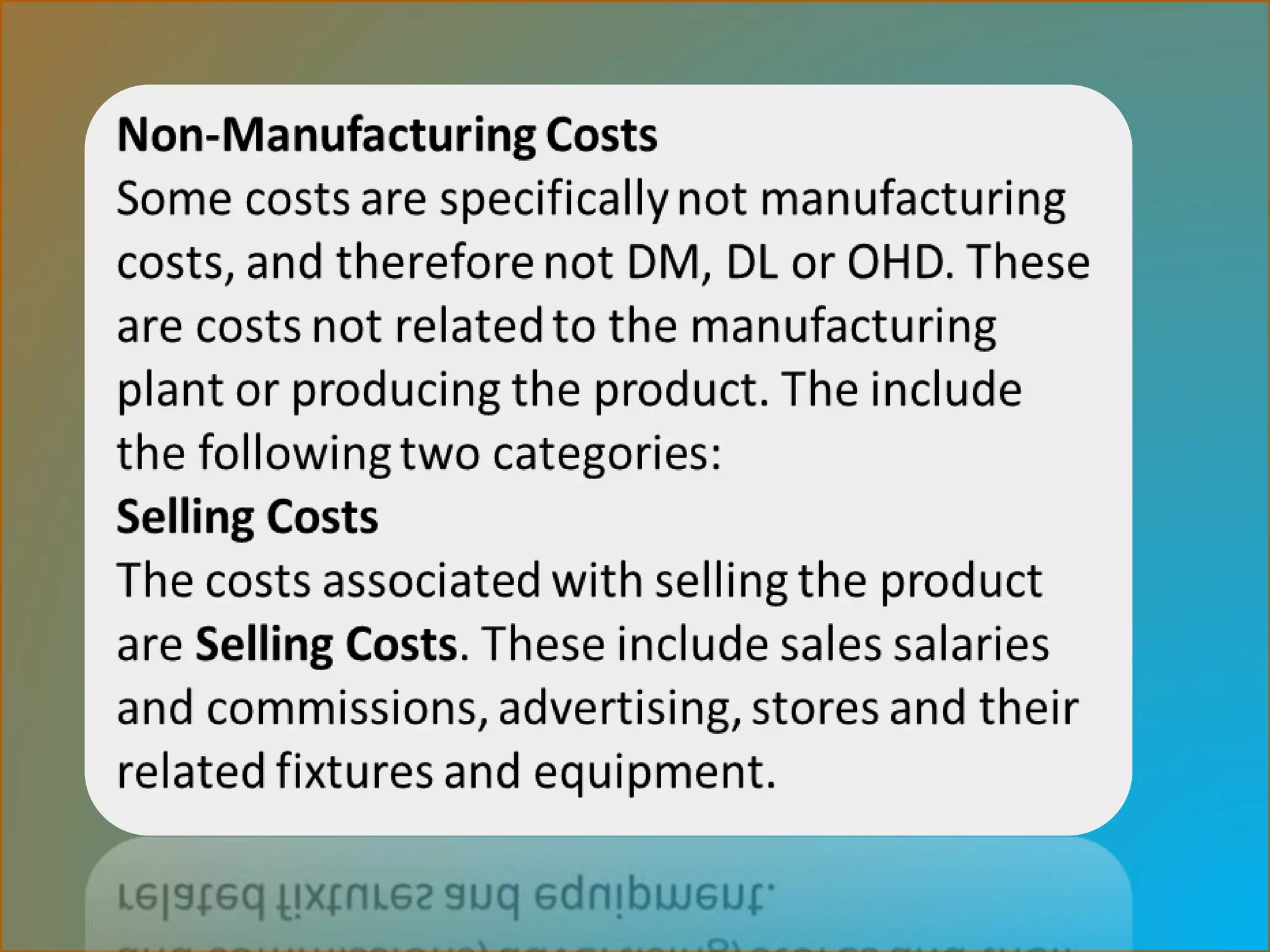

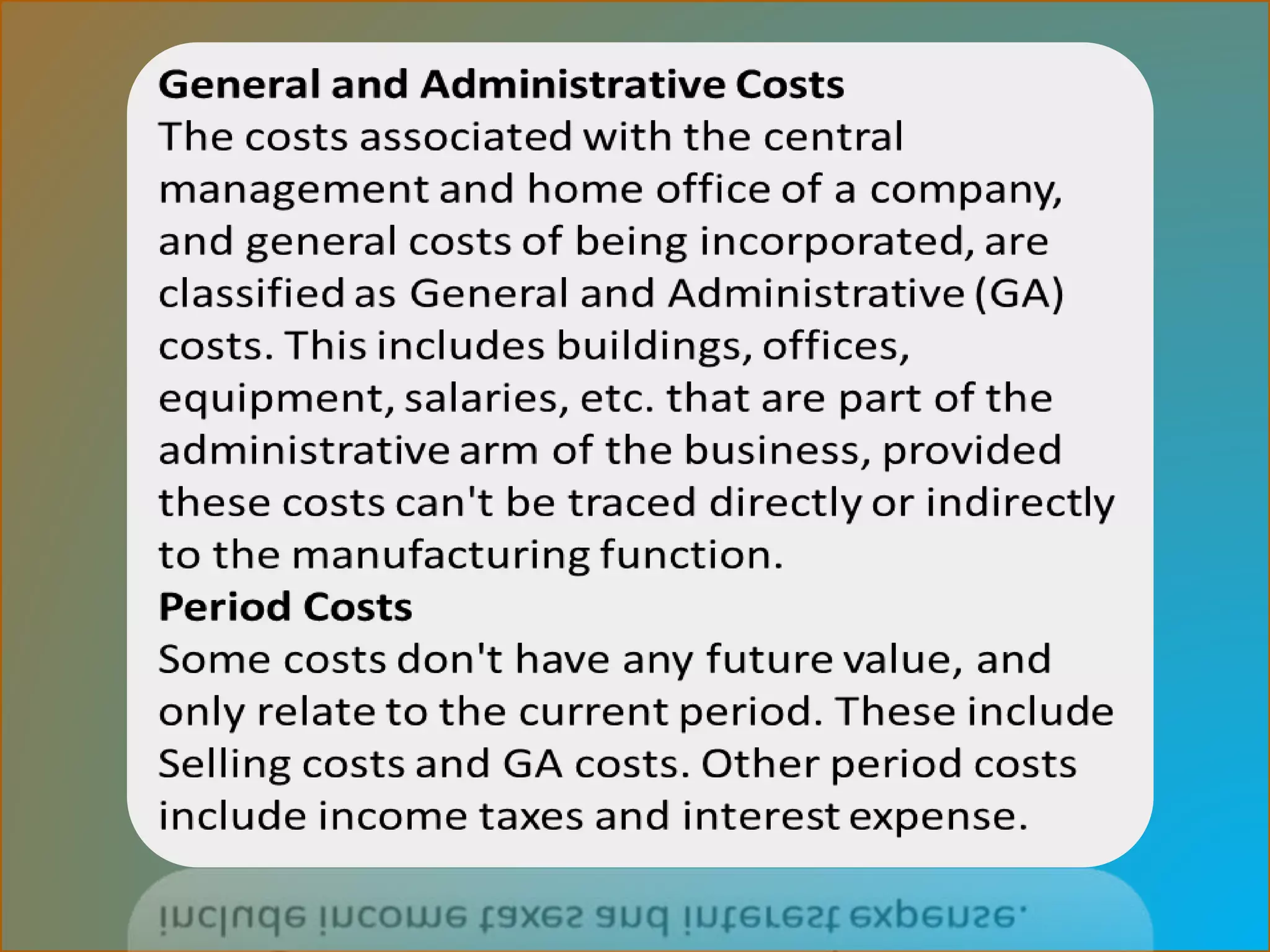

The document separates costs, provides examples of different direct costs, and discusses how labor costs like overtime are treated. It also mentions identifying different categories of overhead costs.