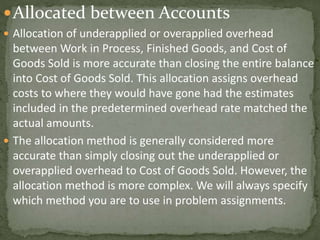

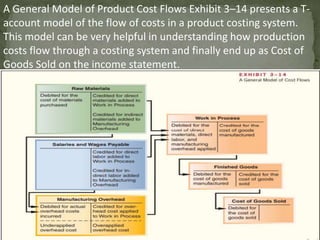

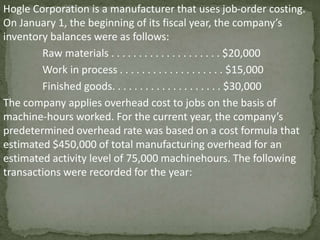

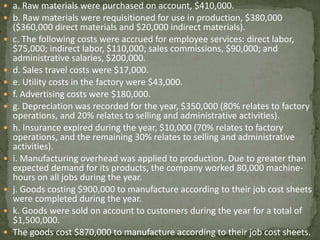

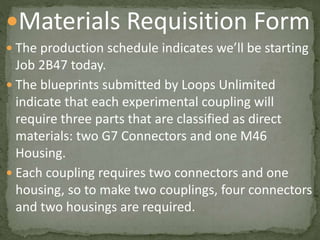

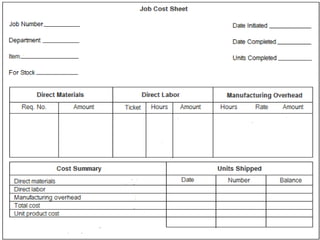

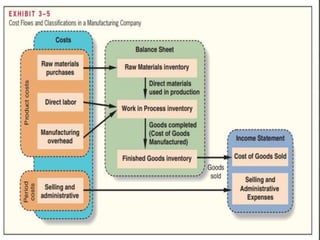

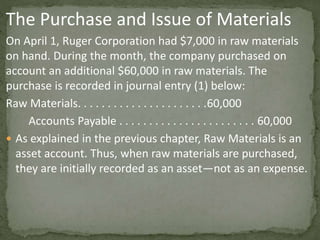

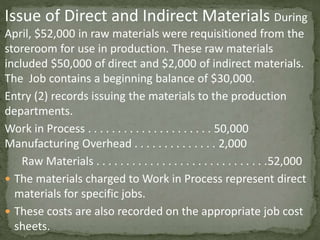

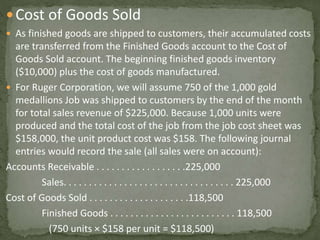

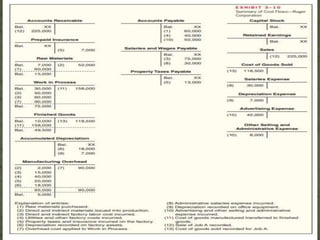

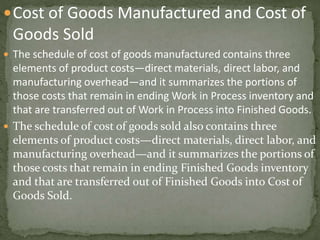

This document provides an overview of job order costing, including how direct materials, direct labor, and manufacturing overhead costs are recorded and assigned to jobs. It discusses how costs flow through a company's accounting system, ending up in work in process, finished goods, and ultimately cost of goods sold. The document also provides examples of journal entries to record direct materials purchased and issued to jobs, direct and indirect labor costs, manufacturing overhead costs, and non-manufacturing expenses.

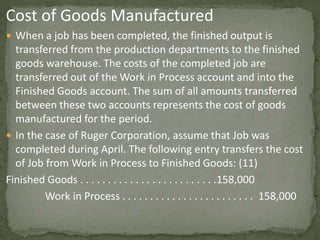

![Closed Out to Cost of Goods Sold

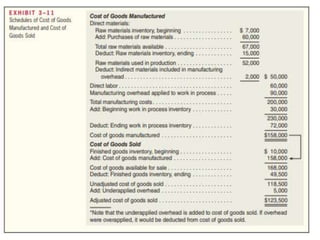

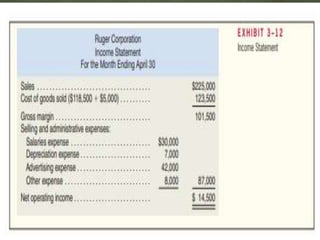

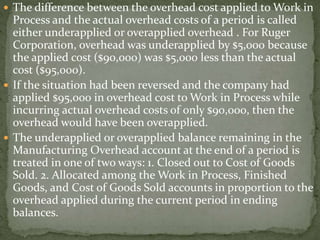

Closing out the balance in Manufacturing Overhead to Cost of Goods

Sold is simpler than the allocation method. In the Ruger Corporation

example, the entry to close the $5,000 of underapplied overhead to

Cost of Goods Sold is: (14)

Cost of Goods Sold . . . . . . . . . . . . . . . . . . . . . .5,000

Manufacturing Overhead . . . . . . . . . . . . . . . . . . . 5,000

Note that because the Manufacturing Overhead account has a debit

balance, Manufacturing Overhead must be credited to close out the

account.

This has the effect of increasing Cost of Goods Sold for April to

$123,500:

Unadjusted cost of goods sold [from entry (13)] . . . . . . . . $118,500

Add underapplied overhead [entry (14)] . . . . . . . . . . . . . . . . 5,000

Adjusted cost of goods sold. . . . . . . . . . . . . . . . . . . . . . . . . $123,500](https://image.slidesharecdn.com/cost20accounting20systems-2-230905001324-338b69bd/85/Cost-Accounting-Systems-46-320.jpg)