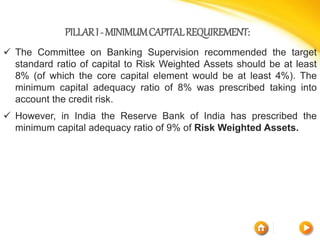

The Bank for International Settlements (BIS) provides financial services to central banks to help them manage their foreign exchange reserves. Headquartered in Basel, it has 140 central bank customers. It offers asset management and short-term credit services on a collateralized basis, but not to private individuals or entities. Important events highlighted by the document include the Herstatt Crisis of 1974, the Basel Concordat of 1974 establishing supervision guidelines between countries, and the Basel Capital Accords of 1988 and beyond establishing capital adequacy standards for banks.