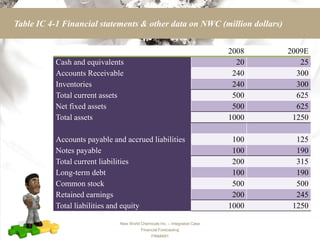

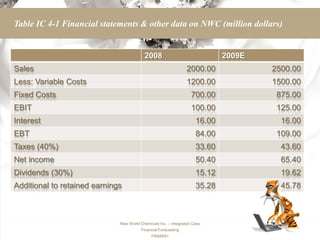

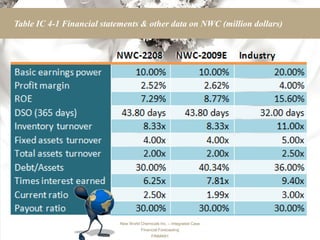

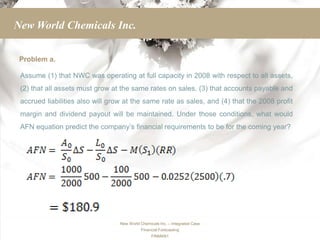

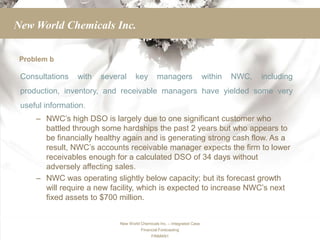

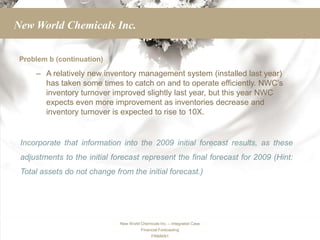

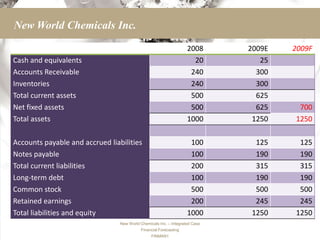

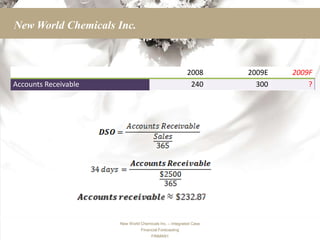

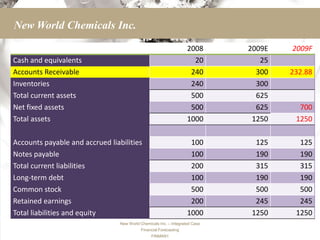

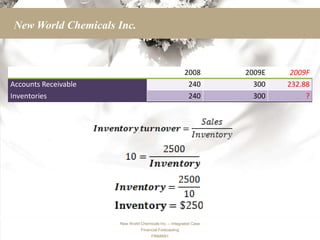

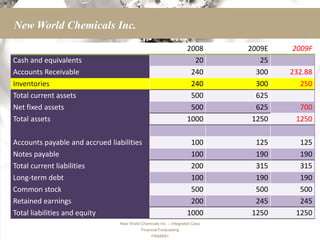

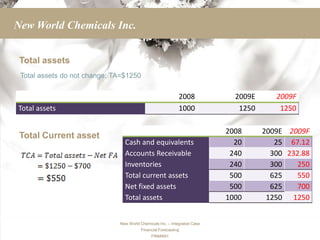

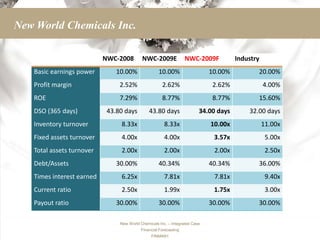

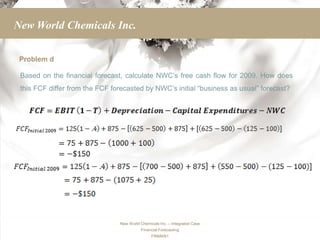

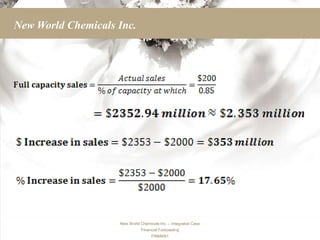

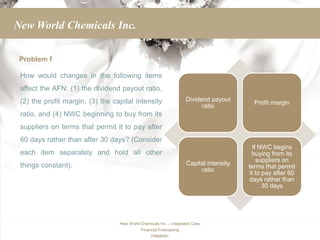

New World Chemicals' financial manager must prepare a formal financial forecast for 2009. The manager's initial forecast assumed key ratios would remain unchanged and sales would increase 25% based on marketing projections. However, consulting with managers revealed the company was operating slightly below capacity in 2008. The final forecast incorporates lower receivables and inventories based on improved management systems, and a new facility increasing fixed assets to $700 million due to projected growth requiring expanded capacity. Ratios in the final forecast show improvement over 2008 and the initial forecast, but most remain below industry averages, indicating room for further improvement in the company's financial position.