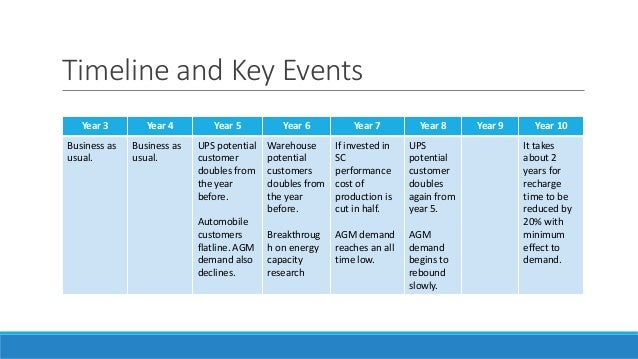

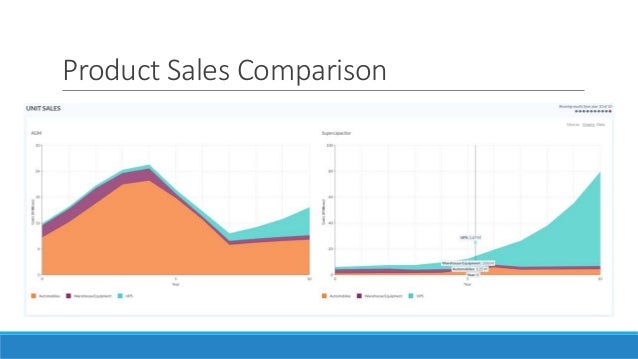

Back Bay Battery Inc. saw cumulative profits of $1.914 billion over a 10 year period by focusing research on reducing the price of supercapacitors and improving their energy density and recharge time. While AGM battery sales declined, supercapacitor demand grew rapidly starting in year 6 as their performance improved and costs decreased. The company was initially losing money producing supercapacitors but was able to use AGM profits to fund research that cut their production cost in half.