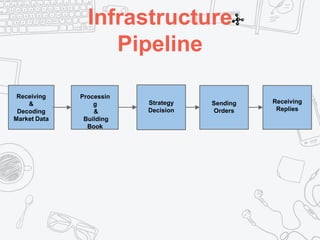

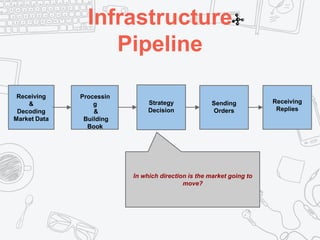

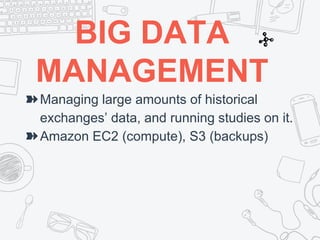

This document discusses automated trading and the role of computer science. It describes how traders observe markets to detect patterns and build prediction models. A system is proposed that learns patterns automatically using machine learning. Computer science helps by developing very reactive systems using algorithms to efficiently process high-dimensional market data and make objective trading decisions. Challenges include developing accurate prediction models that address overfitting, non-analytical objective functions, and reducing the dimensionality of order book data to determine a fair price. The document outlines how computer science areas like networks, operating systems, hardware, data management, and design practices help build high-performance automated trading infrastructure.