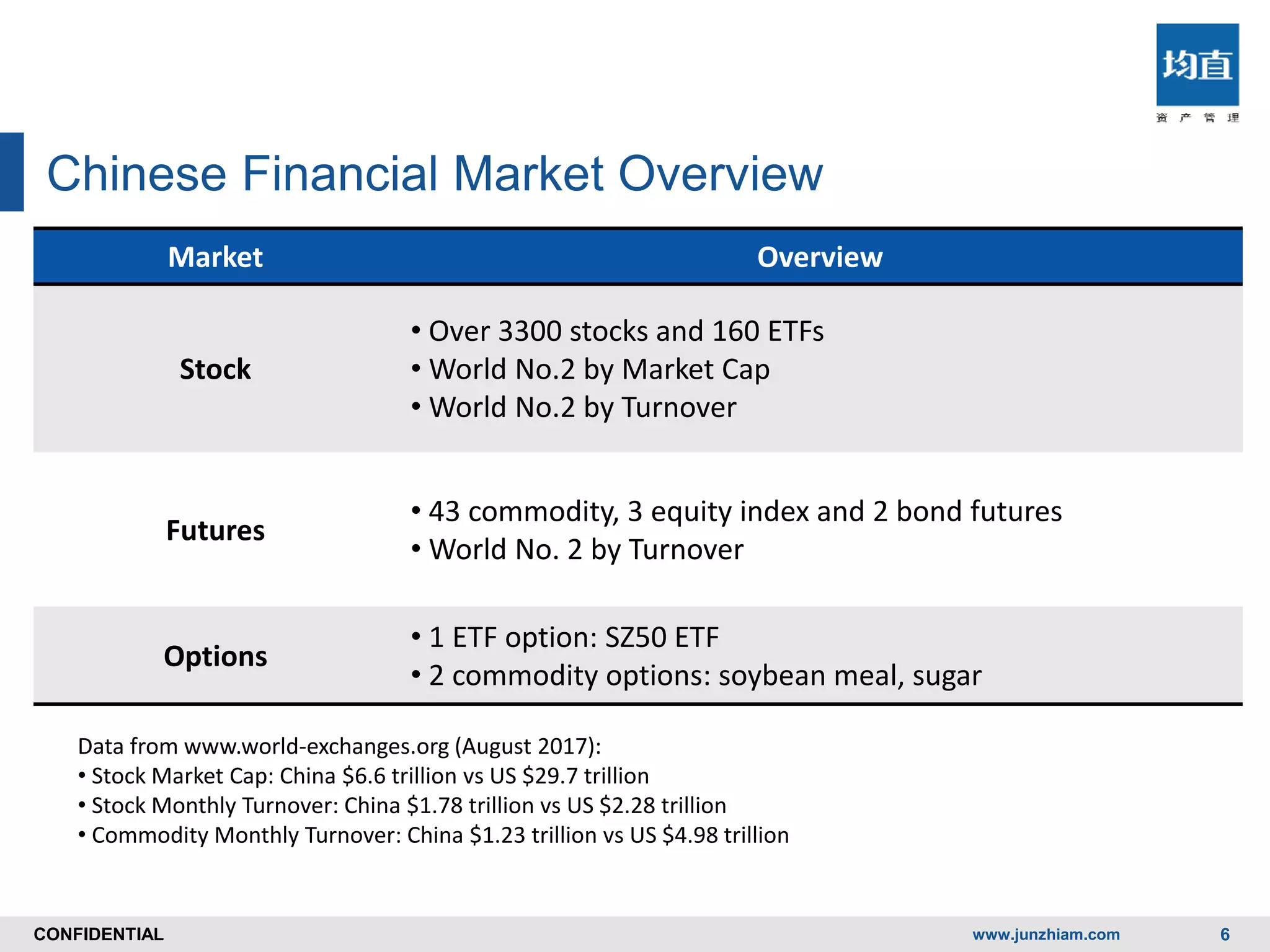

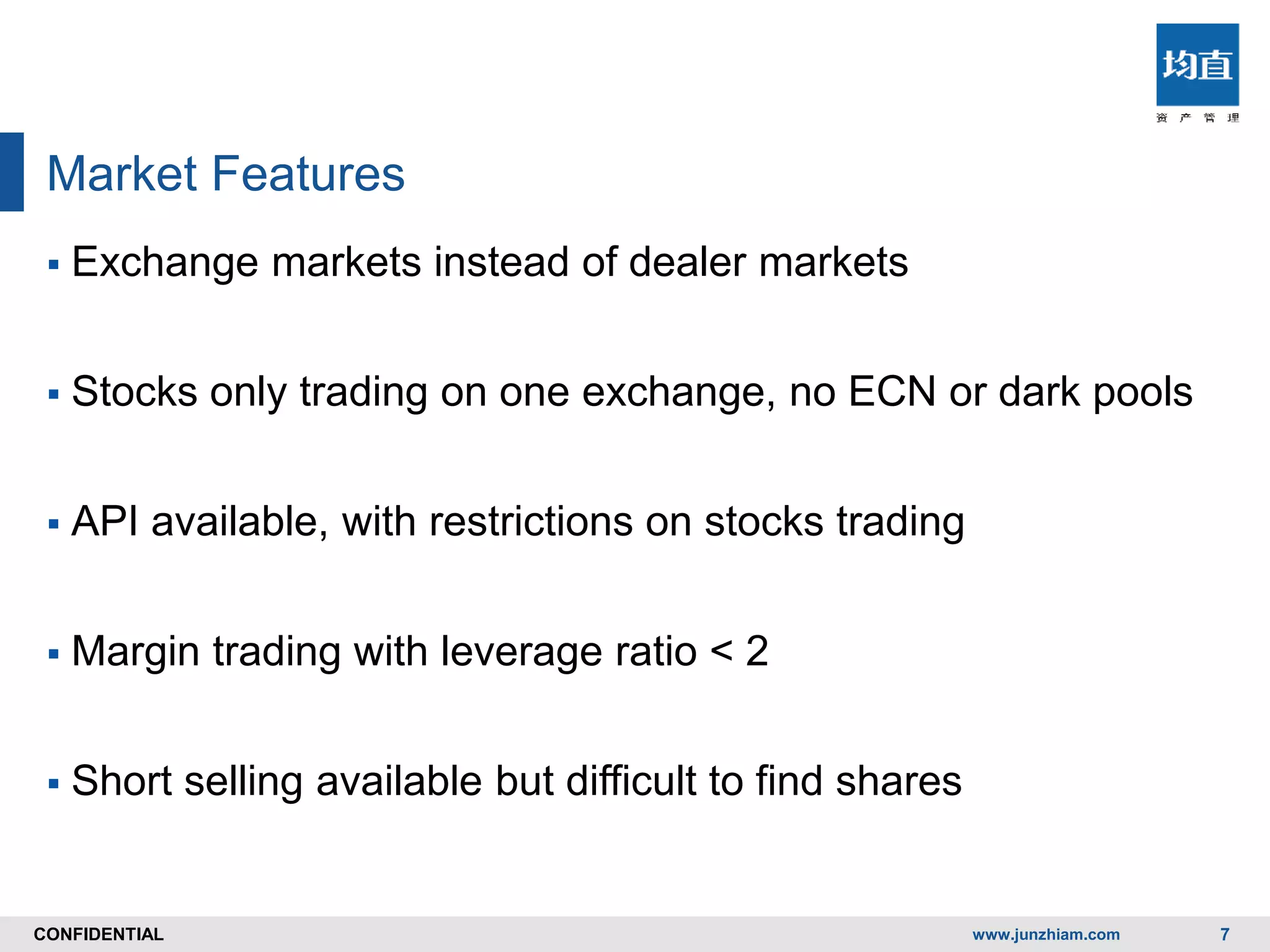

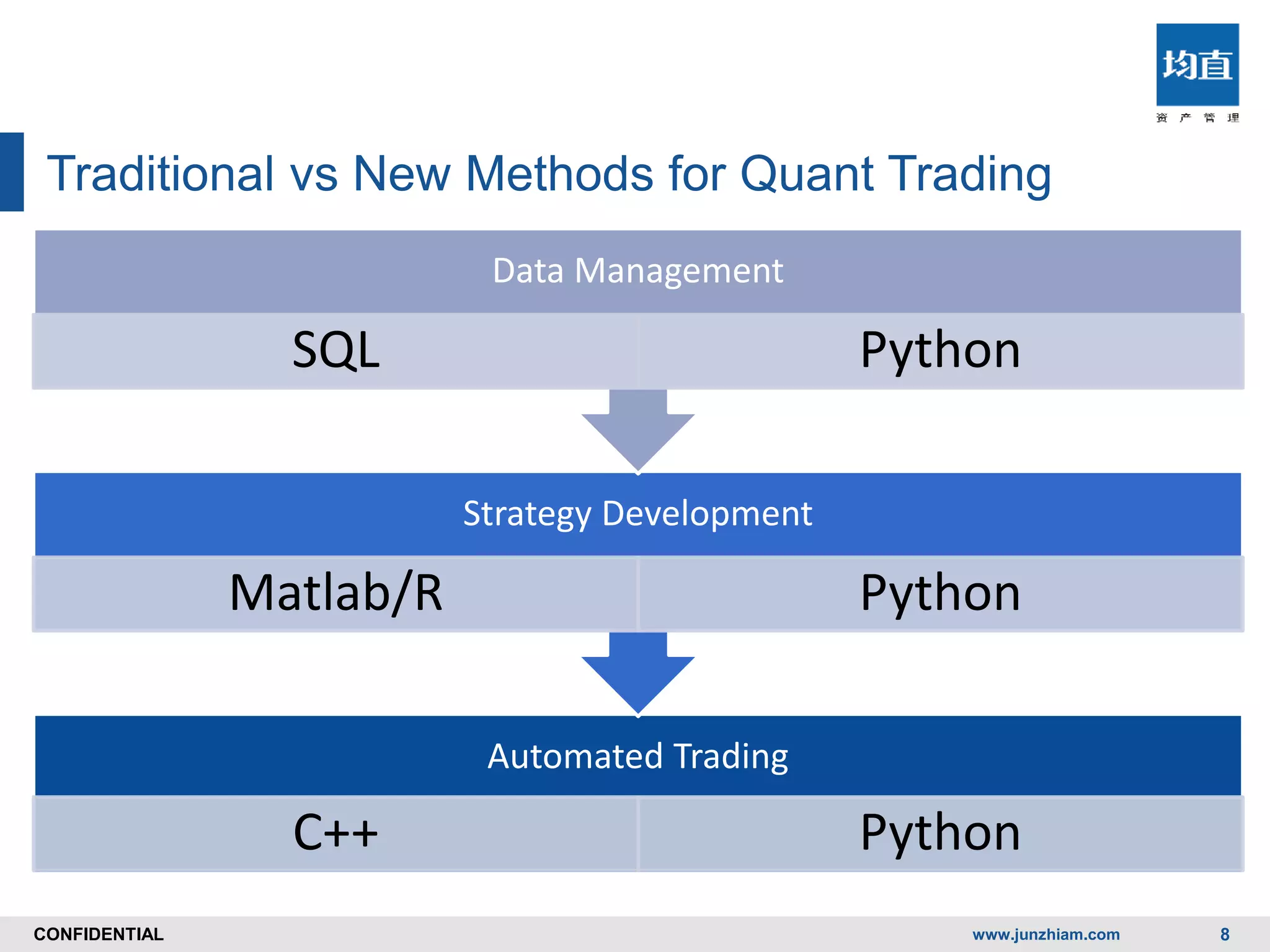

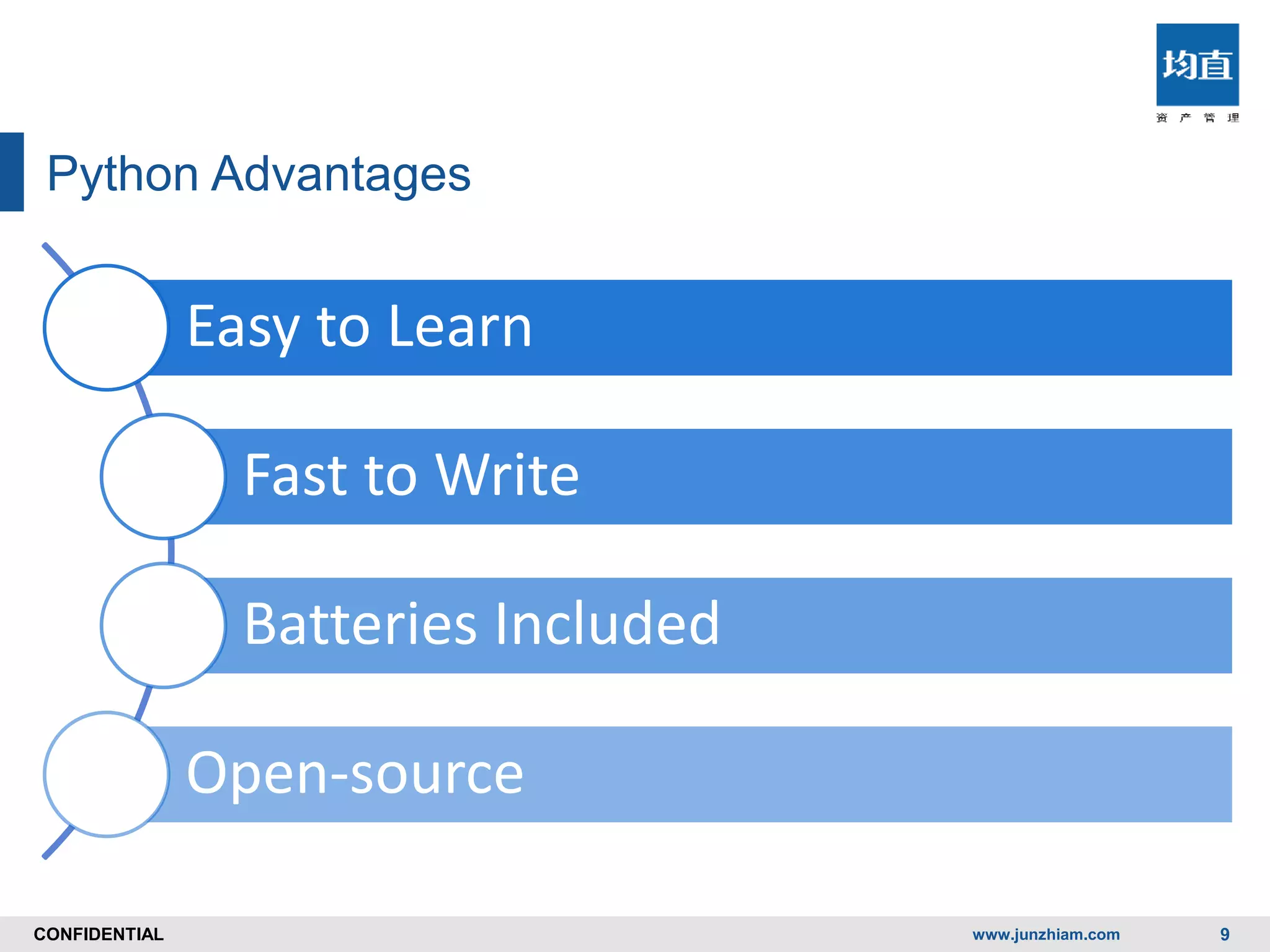

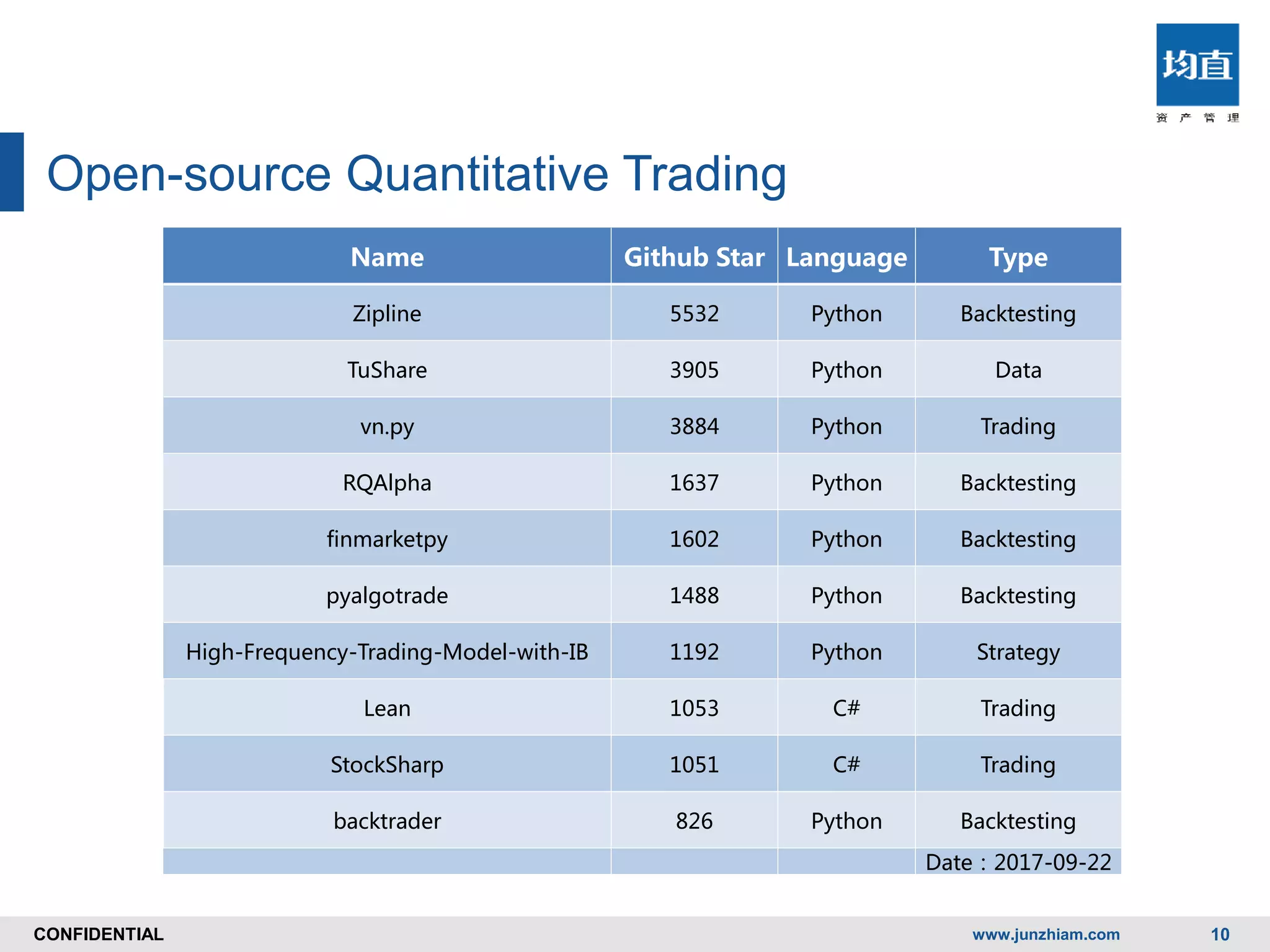

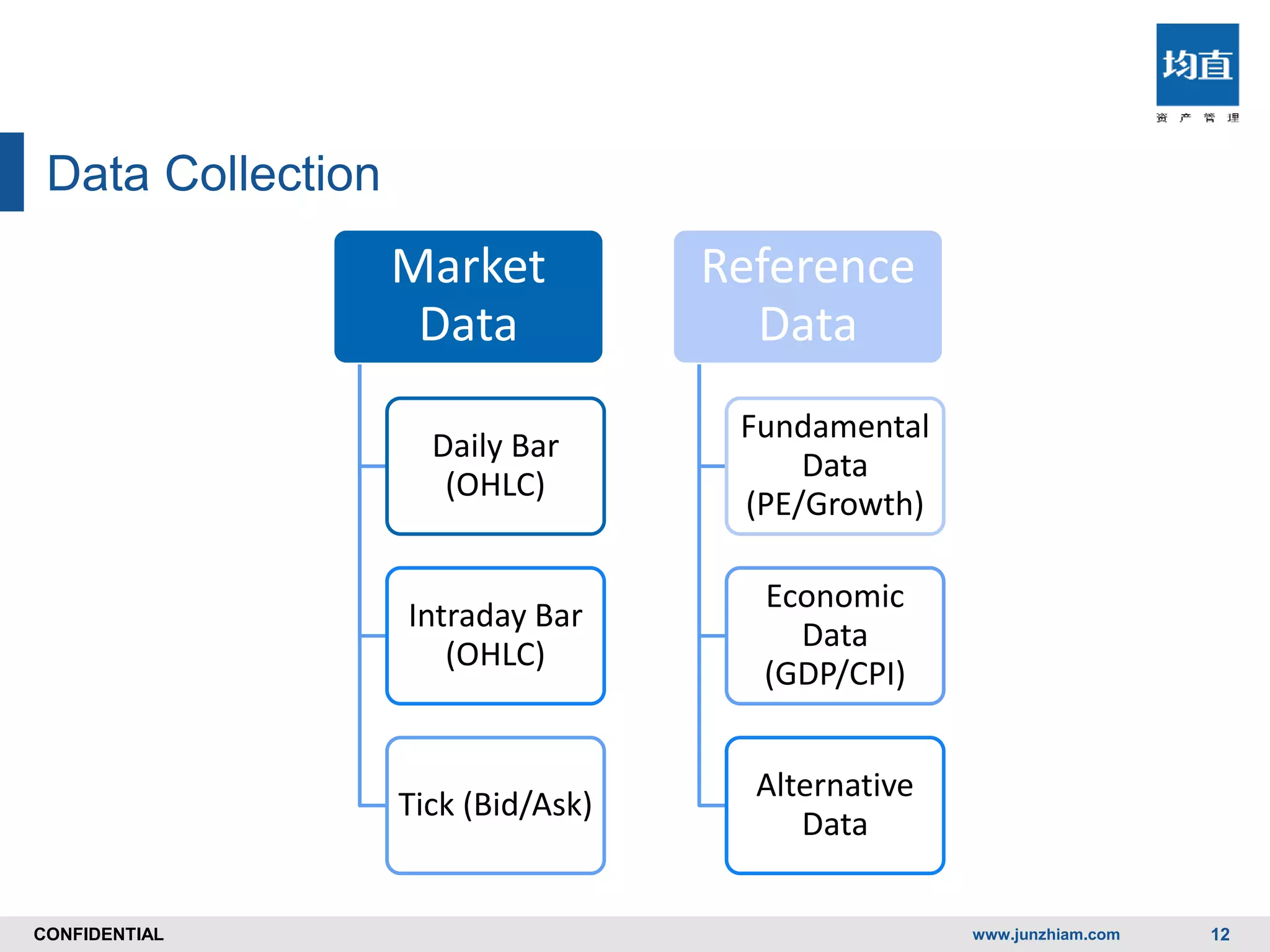

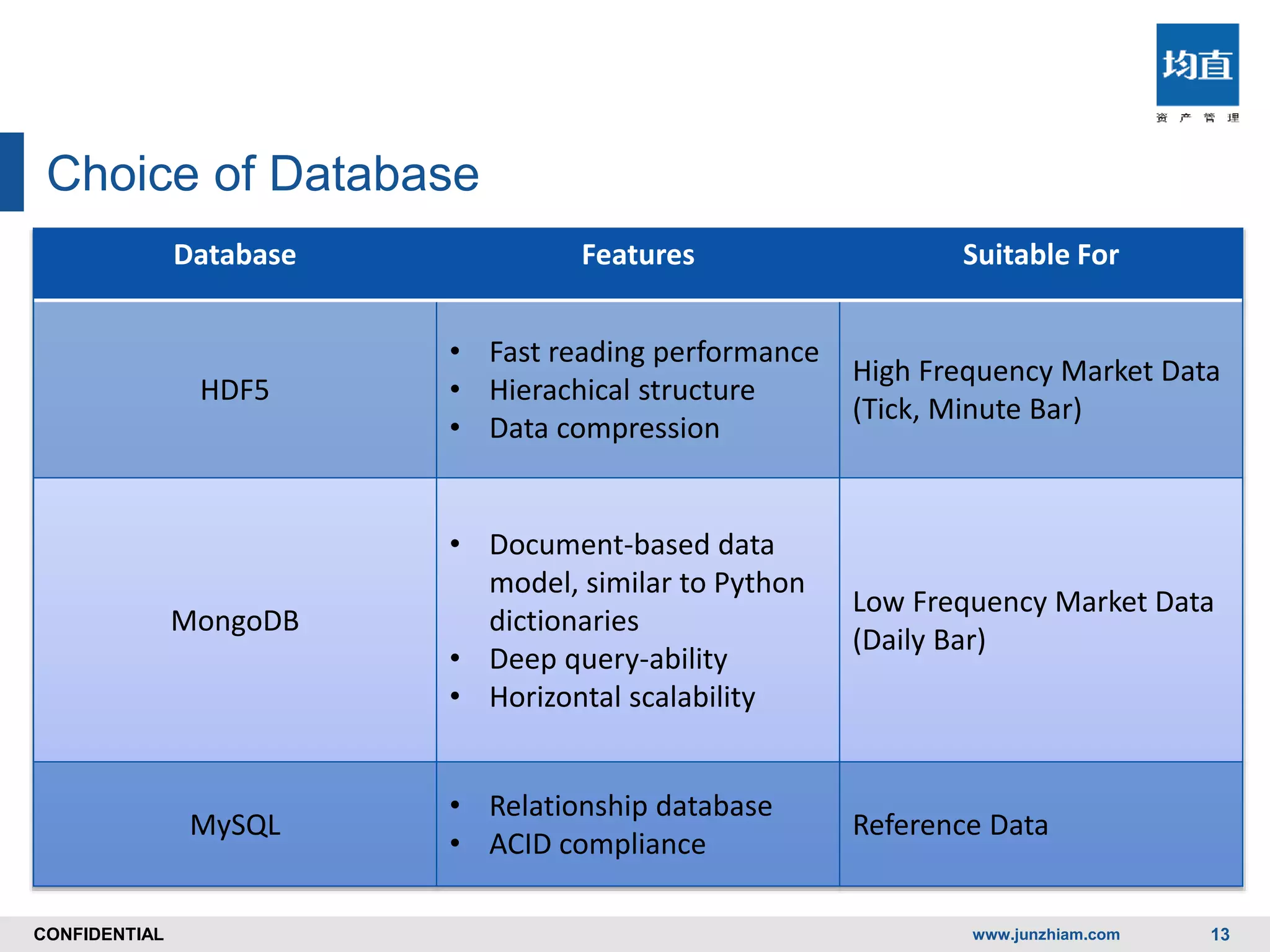

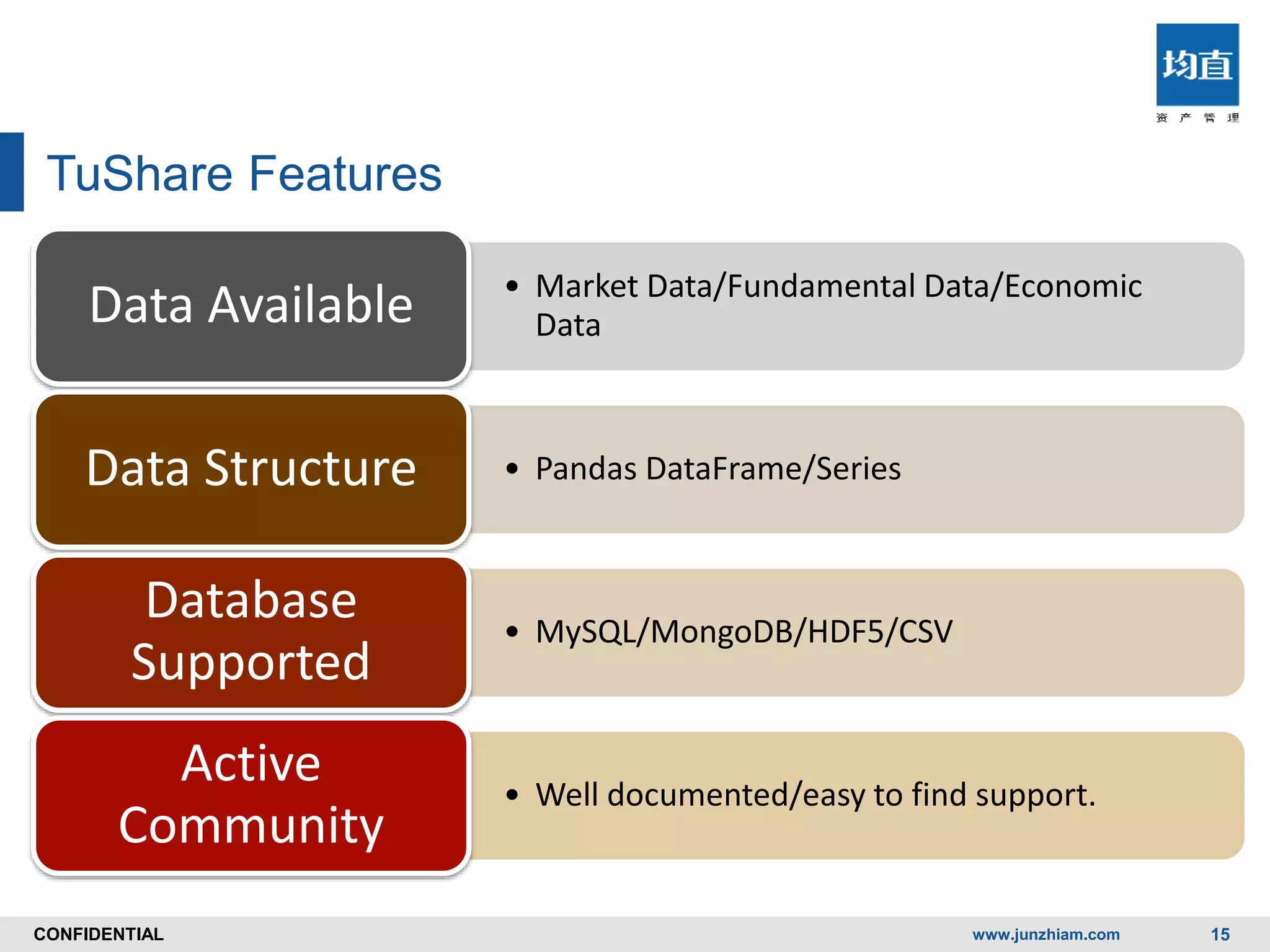

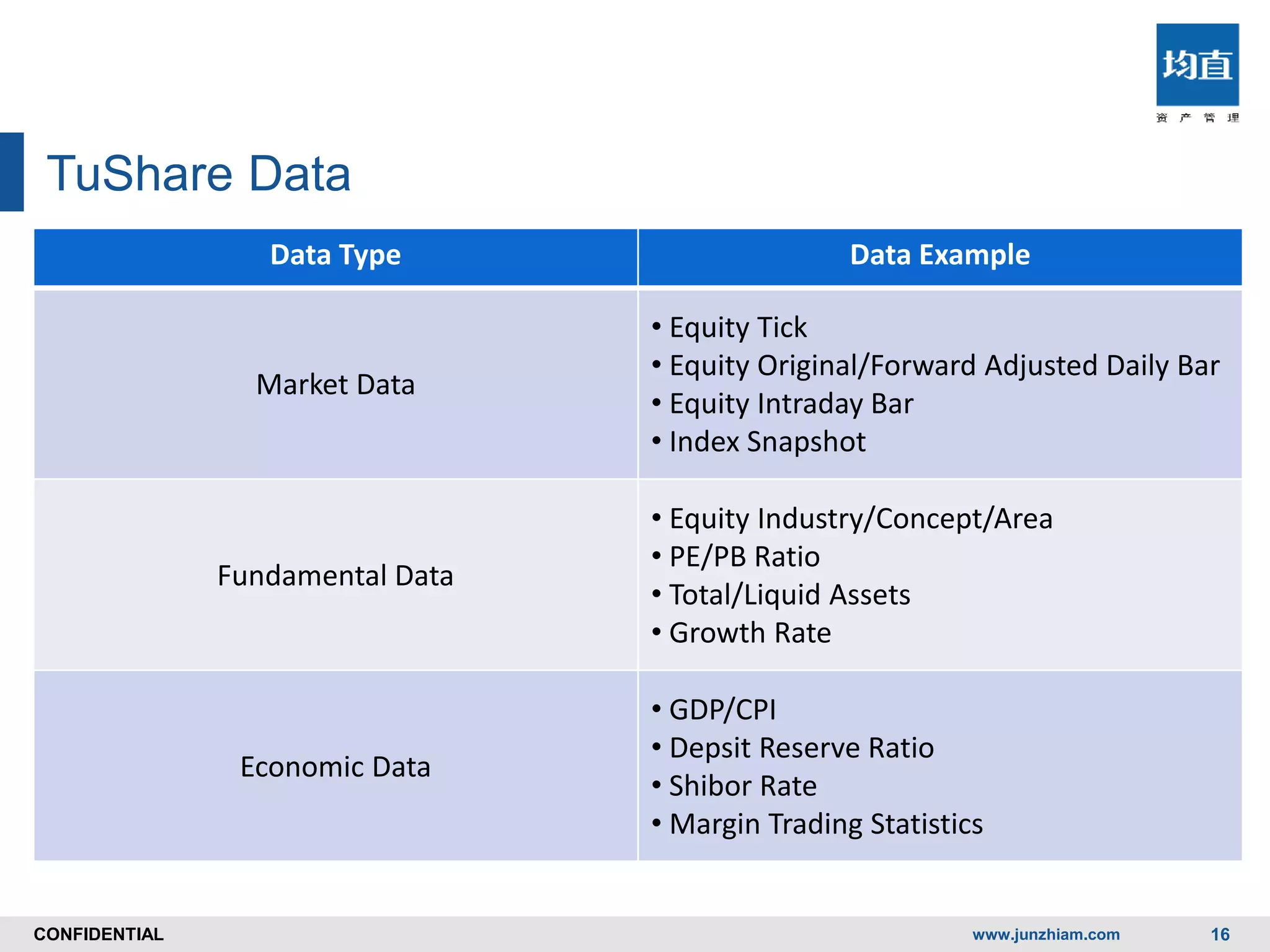

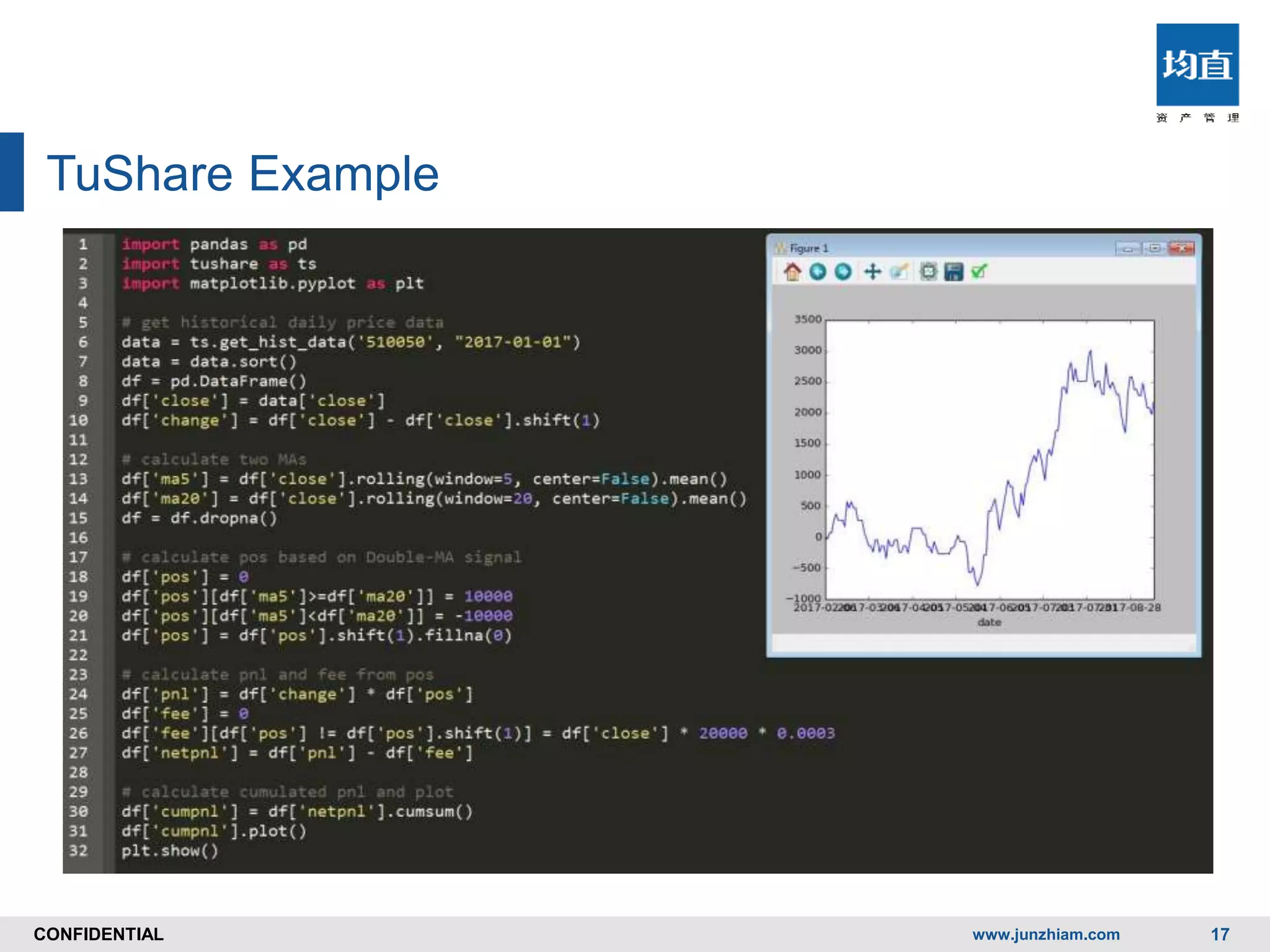

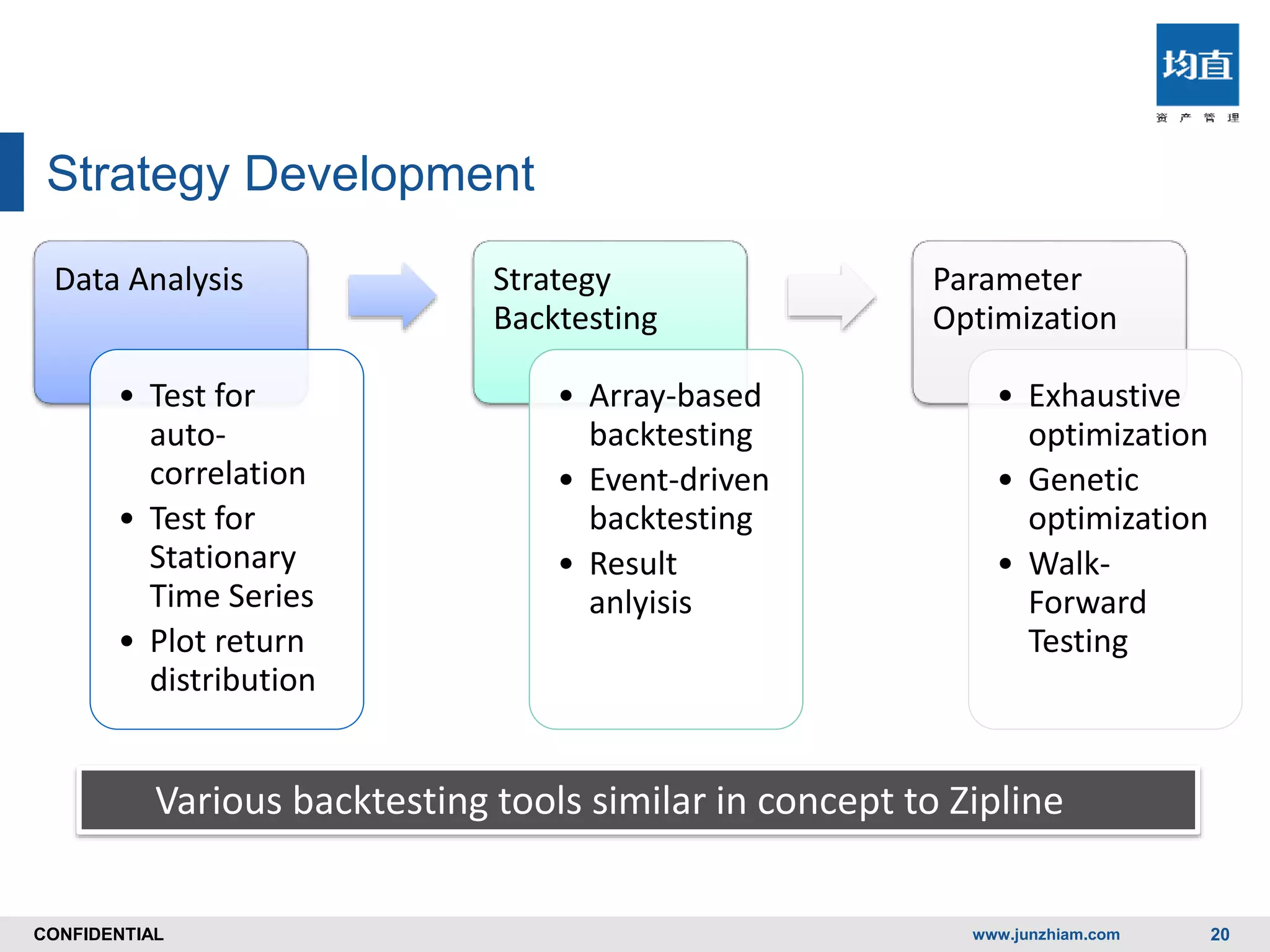

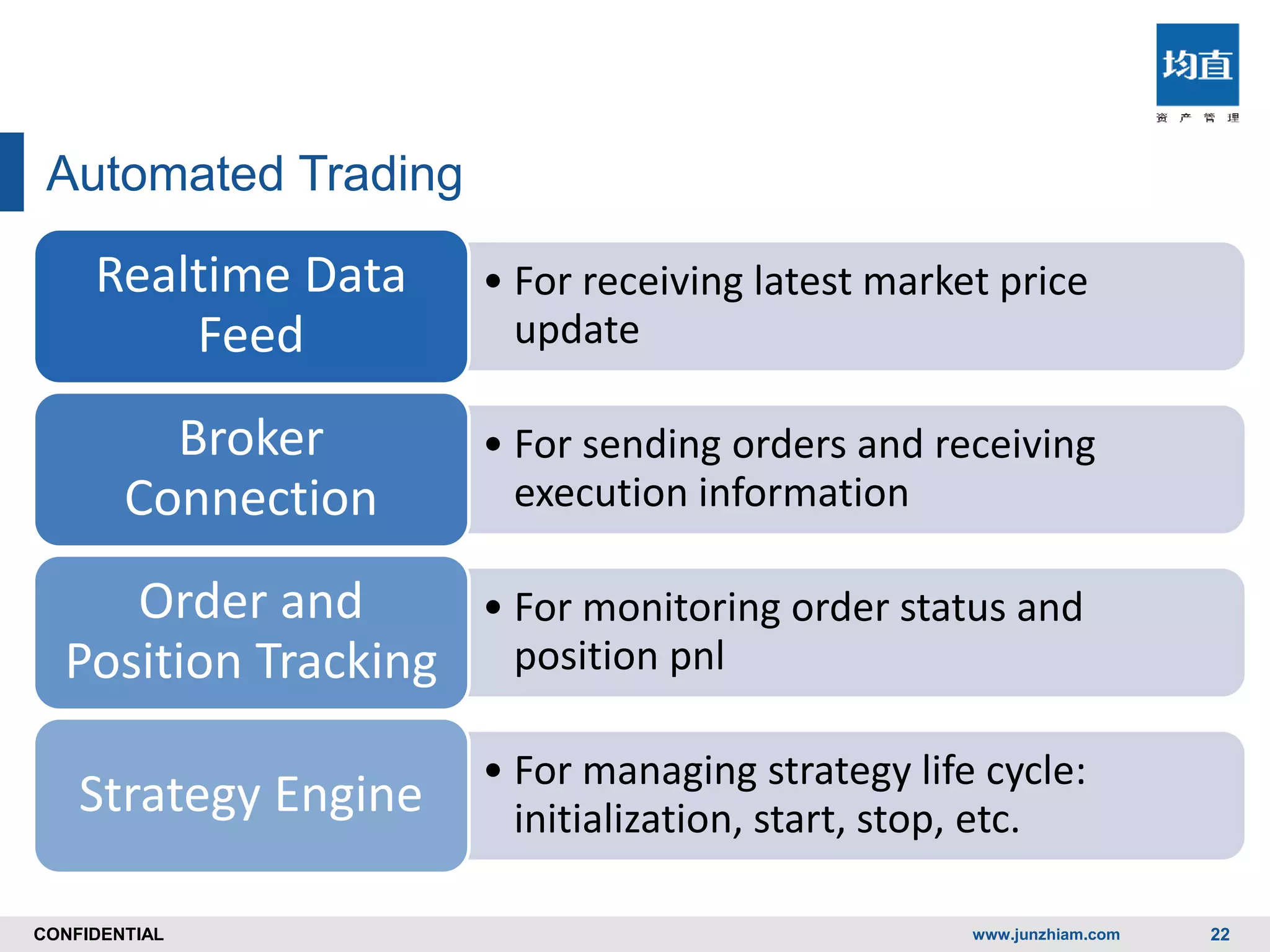

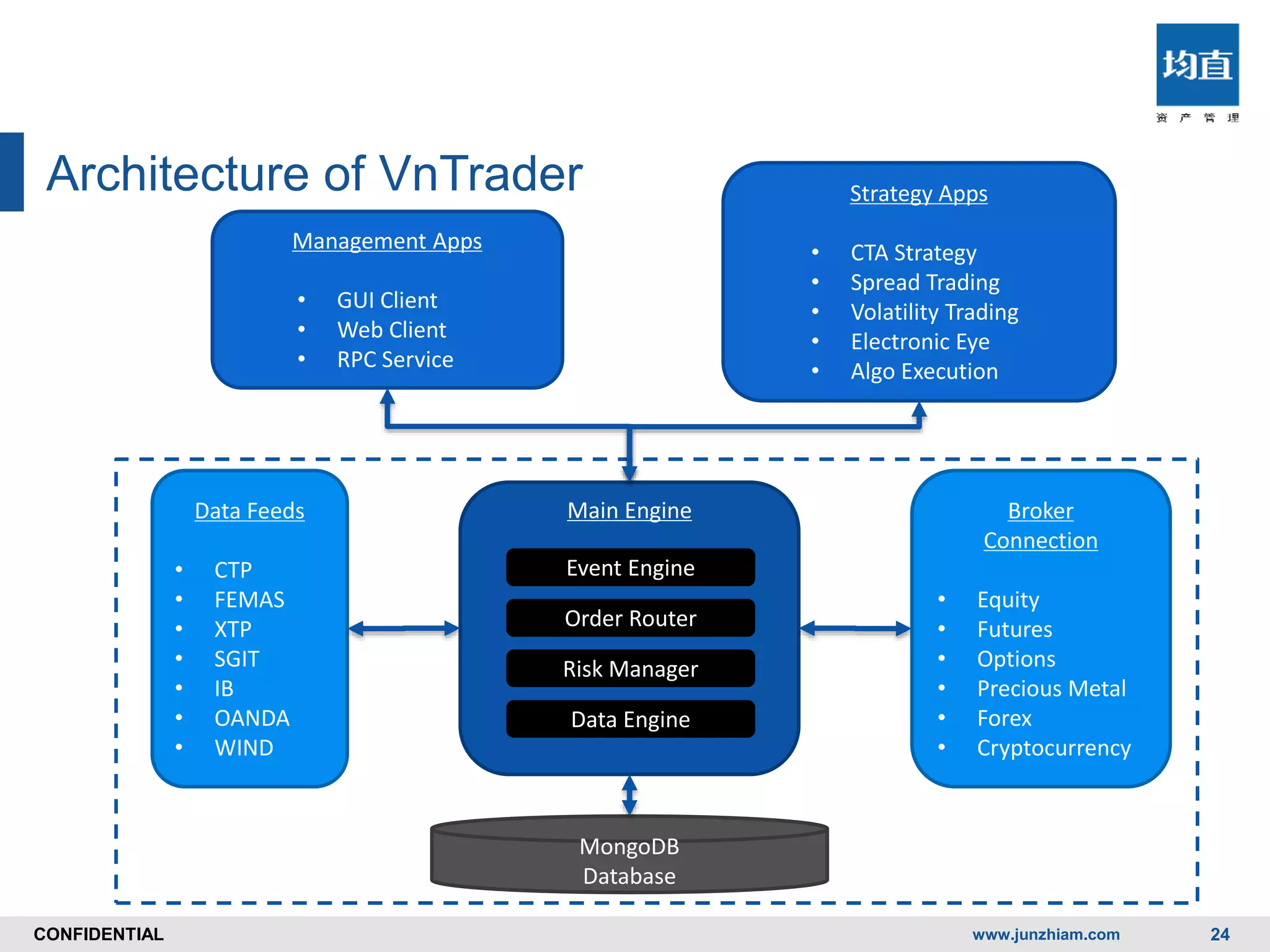

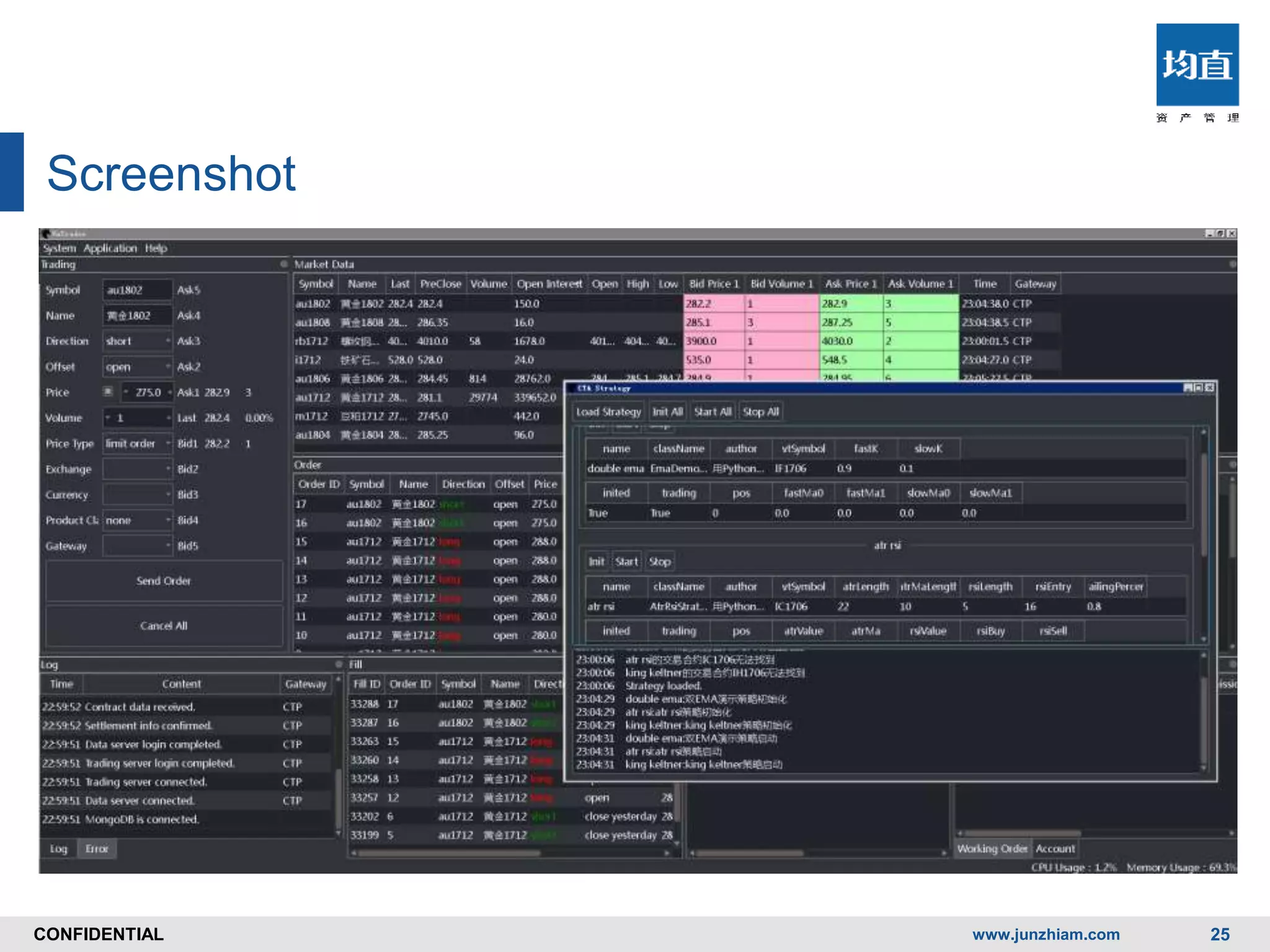

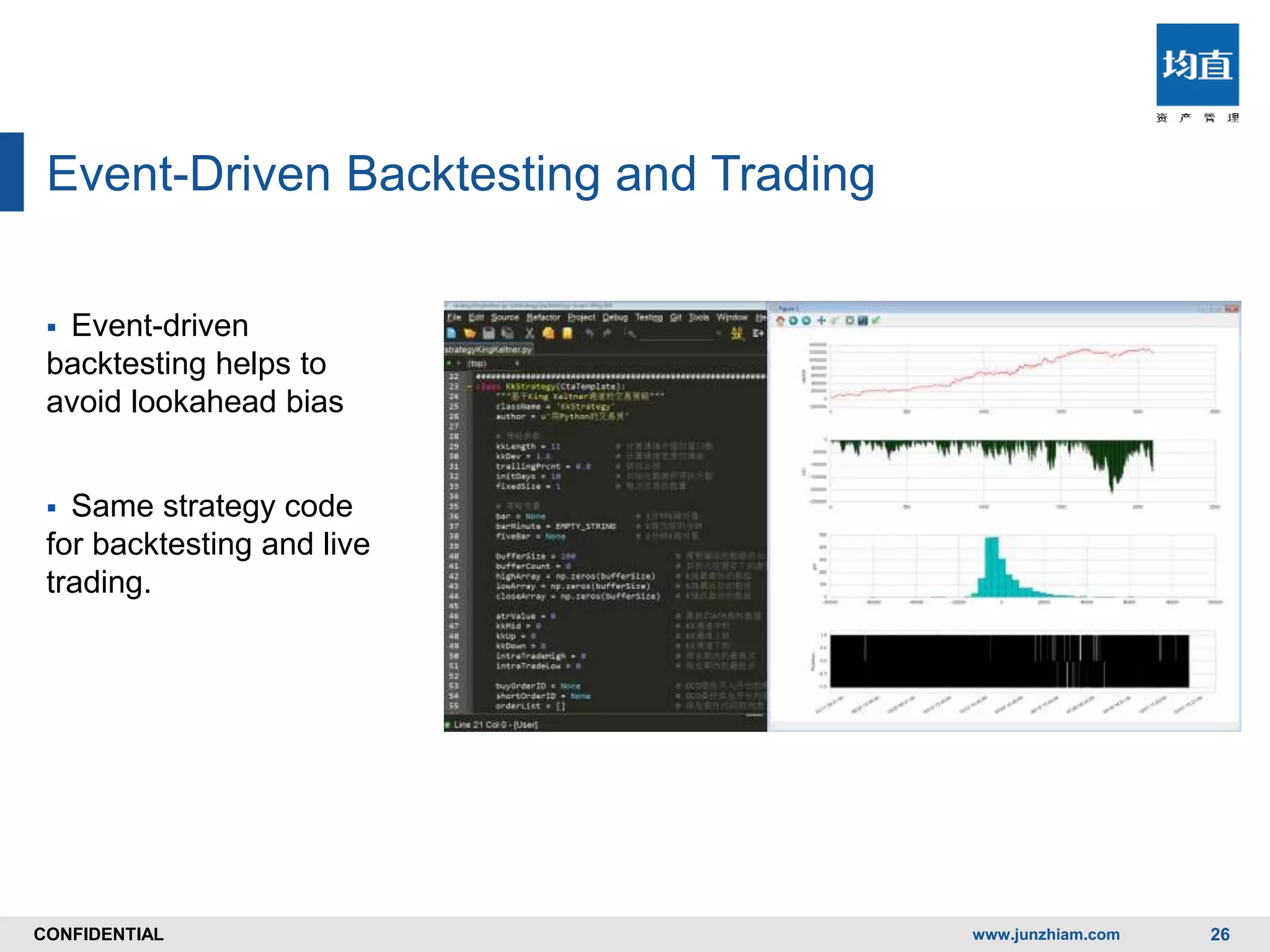

The document provides an overview of running a quantitative trading business in China using Python, covering the Chinese financial market, data management with Tushare, strategy development, and automated trading with vn.py. It highlights the advantages of Python in this context and outlines the features and tools available for quant trading, including backtesting and data analysis. The summary emphasizes the growing attractiveness of the Chinese market for quant trading and the role of open-source tools in facilitating these activities.