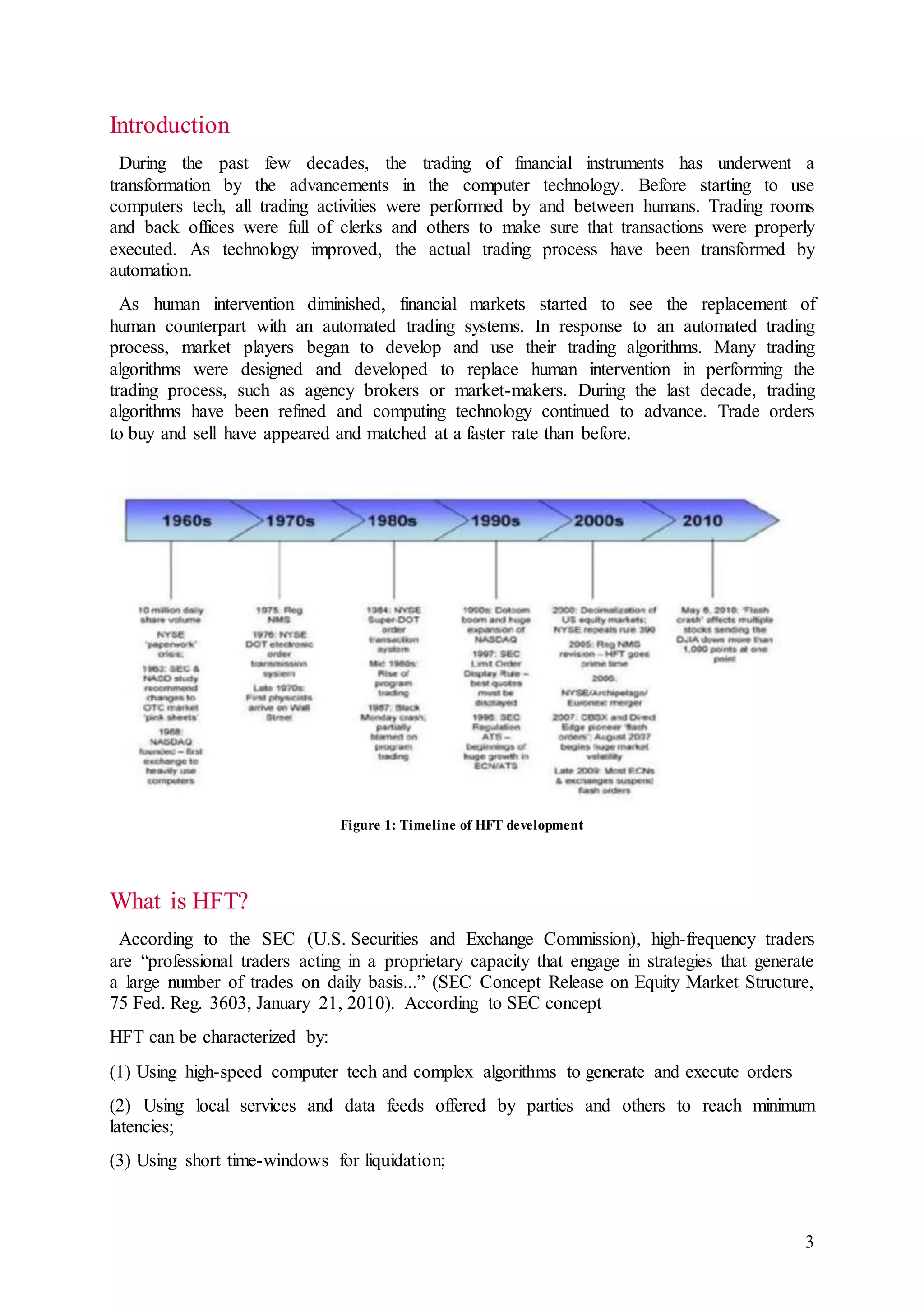

High frequency trading (HFT) uses high-speed computers and complex algorithms to generate and execute trades at extremely high speeds. It has become popular due to advances in computer technology that allow for highly low latency rates. HFT is another type of trading method that turns over market positions very quickly by exploiting these advanced technologies. It has both advantages like increasing market liquidity and challenges like potential market manipulation. The success of HFT depends heavily on technology innovations that reduce latency and develop competitive trading algorithms.

![19

References

[1] Capgemini, High Frequency Trading: Evolution and the Future 2012

[2] InfoSys, Use of Big Data Technologies in Capital Markets, 2012

[3] Jones, Charles M., What do we know about high-frequency trading? 2013

[4] High frequency trading: The application of advanced trading technology in the European

Marketplace, 2010

[5] Accenture, Future Capital Markets, 2011

[6] Fleckner, Andreas Martin, Regulating Trading Practices 2015

[7] Wikipedia, High-frequency trading

[8] Http://wheatgrassorganics.com/high-frequency-trading-platform-architecture, 2015

[9] Http://elitemarkets.com/index.php/stocks/high-frequency-trading

[10] Buchanan, M. http://www.nature.com/news/physics-in-finance-trading-at-the-speed-of-

light-1.16872, 2015

[11] Crowe, P., http://www.businessinsider.com/high-frequency-traders-dominate-the-

treasuries-market-2015-9, 2015

[12] Hortonworks, a Modern Data Architecture for Financial Services, 2014

[13] https://www.cornerstone.com/Publications/Case-Studies/Emerging-Regulation-in-High-

Frequency-Trading, 2014

[14] Edgar Perez, the Present and Future of High Frequency Trading, 2011

[15] Goldstein, Michael A. Computerized and High-Frequency Trading, 2014

[16] NW Burbs Investment & Trading Club, Ten Critical Trends and Technologies Impacting

IT over the Next Five Years 2015

[17] K. Khaldoun, F. Ionut, Y. Steve, On the Impact and Future of HFT, 2014

[18] Robert J. Kauffman, Yuzhou Hu, Dan Ma, Will high-frequency trading practices

transform the financial markets in the Asia Pacific Region? 2015](https://image.slidesharecdn.com/highfrequencytrading-160501212547/75/High-frequency-trading-20-2048.jpg)