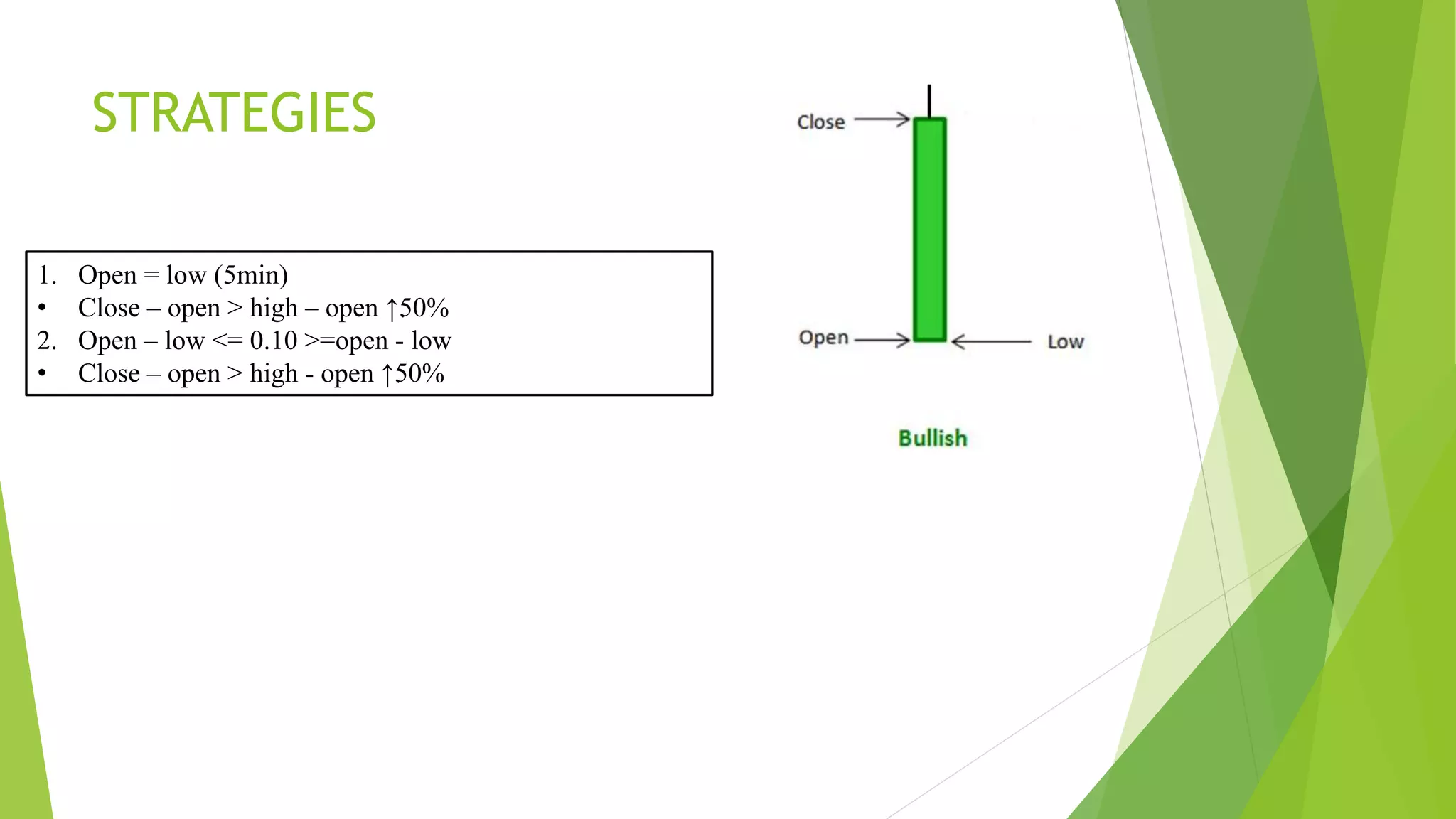

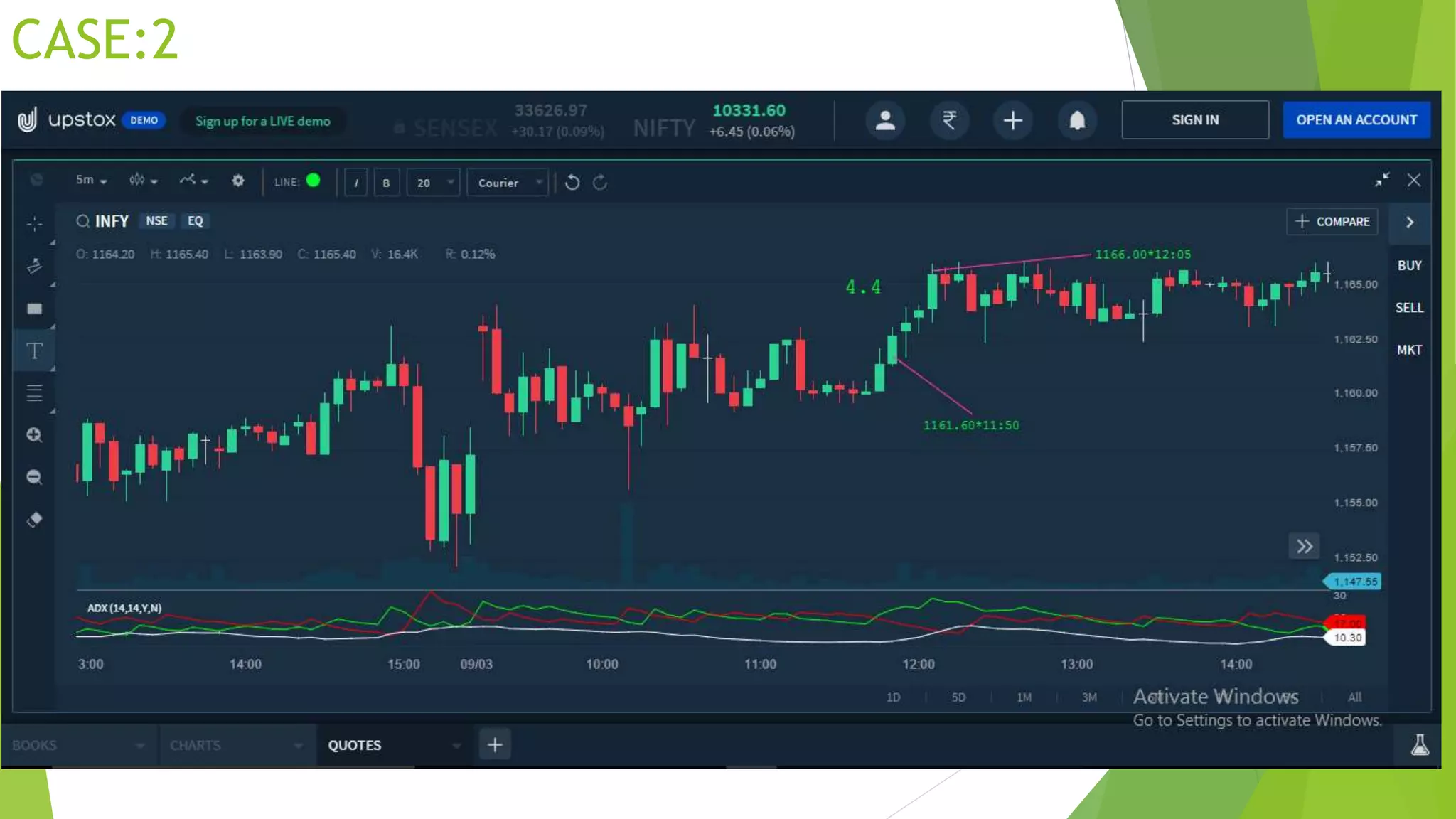

This document discusses algorithmic trading using machine learning. It introduces algorithmic trading and its advantages over human trading. The objectives are to maximize profits with minimum capital and predict stock prices using machine learning. Python is used to develop the trading platform. The architecture includes exchanges, servers to receive and store market data, and applications to interface and manage orders. Strategies discussed include analyzing candlestick patterns and volume. A proposed algorithm uses machine learning on historical data to generate buy signals. Limitations include algorithms not being 100% accurate and not universal. Future enhancements may include greater use of artificial intelligence as technology advances.

![ARCHITECTURE

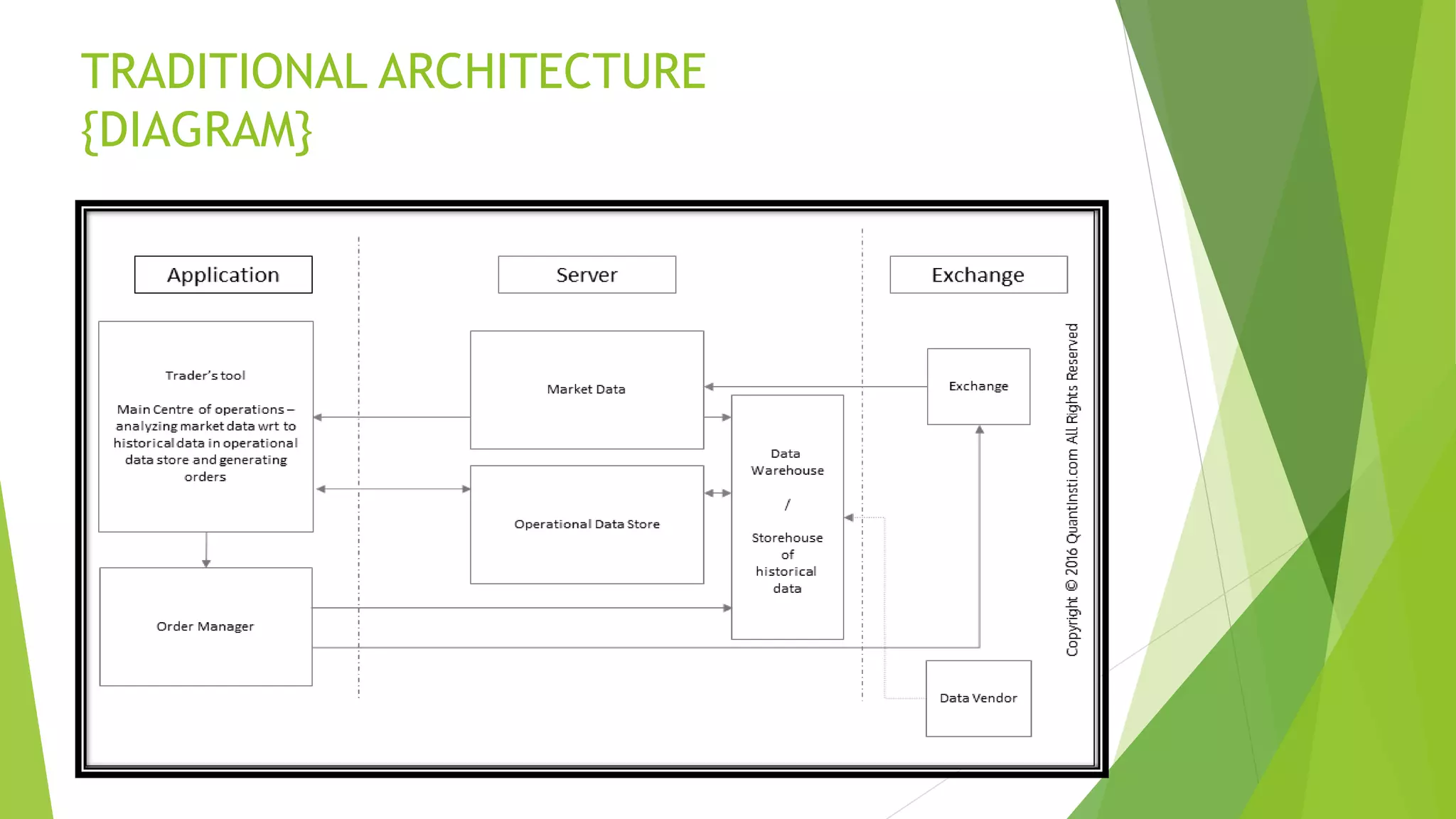

The entire automated trading system can be broken down

into 3 parts :-

[1] The exchange(s) the external world

[2] The server

• Market data receiver

• Store market data

• Store order generated by the user](https://image.slidesharecdn.com/algotradingwithmachinelearningppt-180410063619/75/Algo-trading-with-machine-learning-ppt-6-2048.jpg)

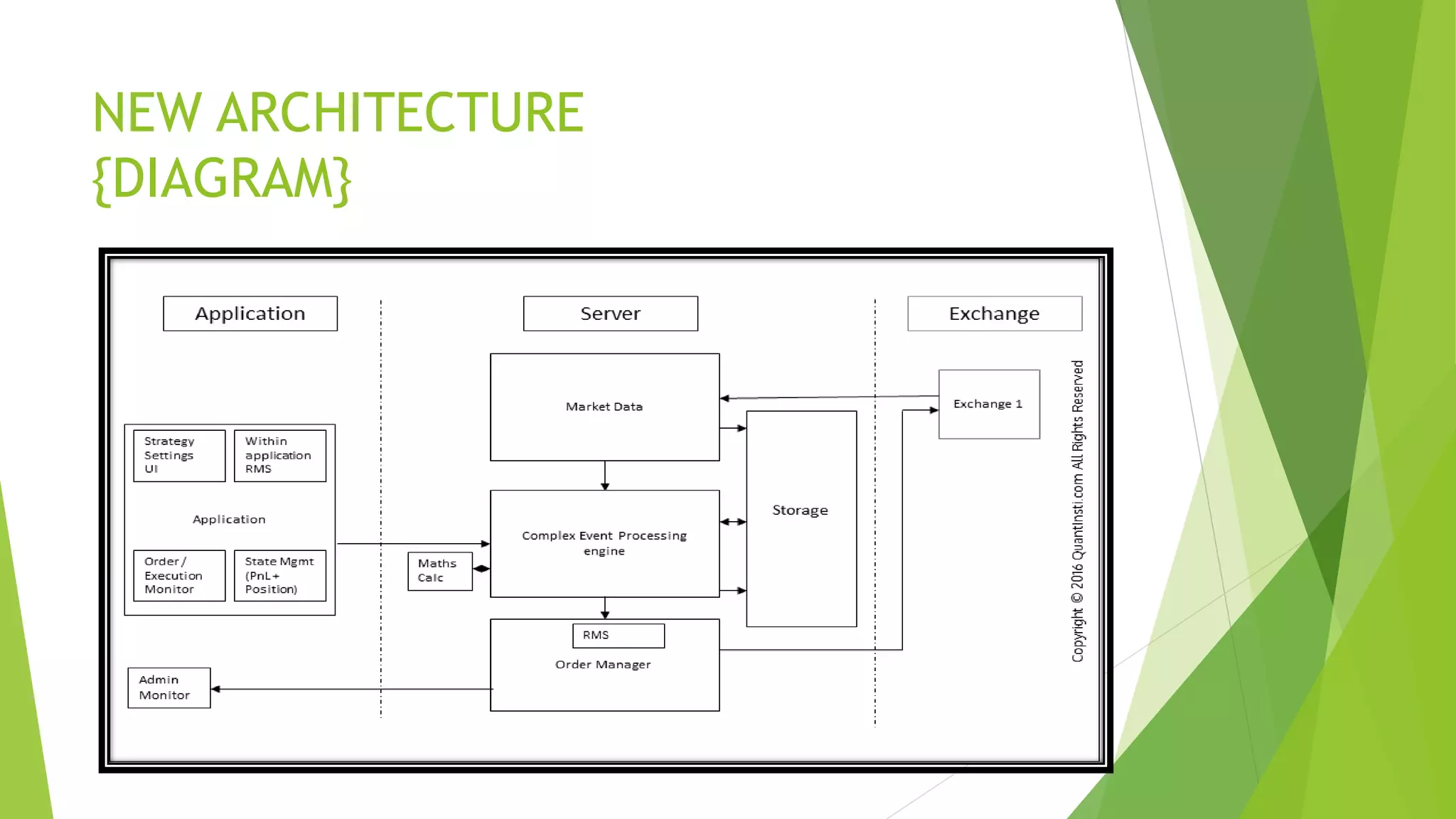

![CONTINUNED

[3] Application

• Take inputs from the user including the trading decisions.

• Interface for viewing the information including the data and

orders.

• An order manager sending orders to the exchange.](https://image.slidesharecdn.com/algotradingwithmachinelearningppt-180410063619/75/Algo-trading-with-machine-learning-ppt-7-2048.jpg)