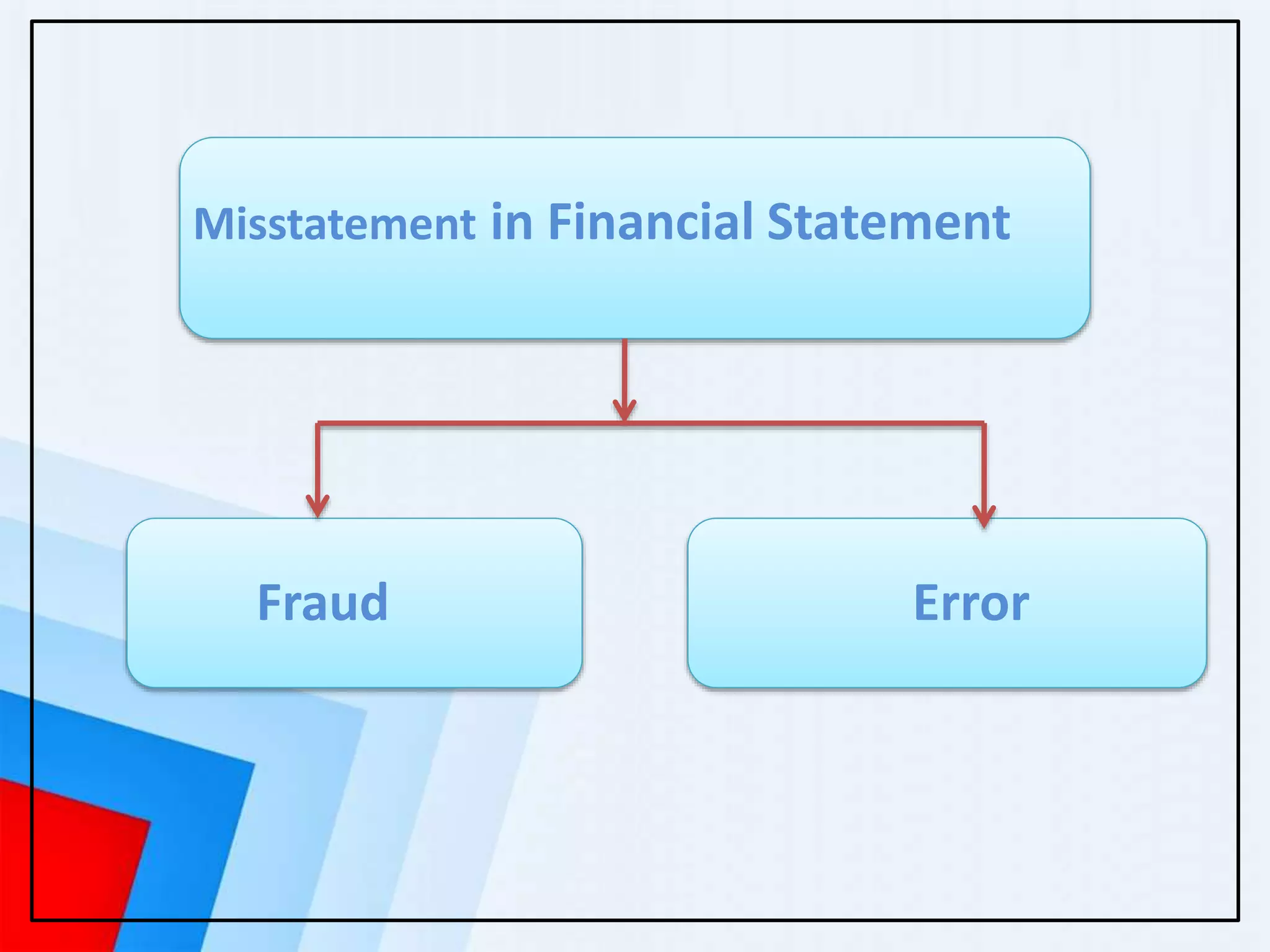

The document discusses an auditor's duty regarding detection, documentation, and reporting of fraud according to NSA 240. It defines fraud and error, and explains two types of fraud - fraudulent financial reporting and misappropriation of assets. It also outlines sources of information auditors gather to assess fraud risks, how fraud can be detected and committed by different parties, documentation requirements, and concludes with a summary of the auditor's responsibilities.