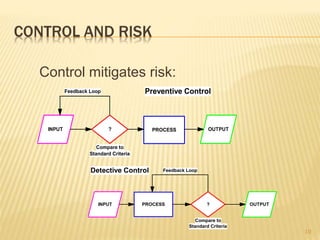

1) Internal auditing provides an independent review of an organization's activities and systems of internal control. The objective is to help management effectively carry out their responsibilities and promote reasonable control.

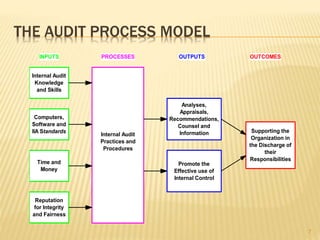

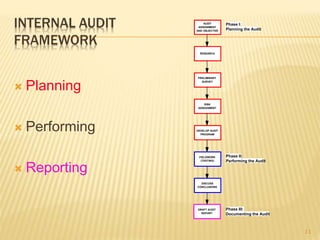

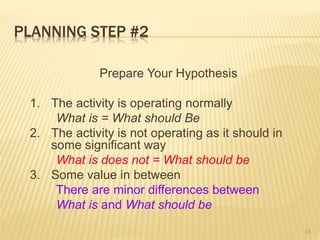

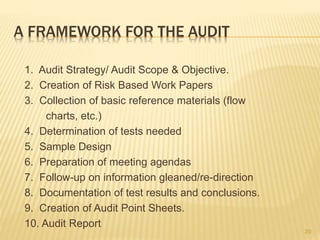

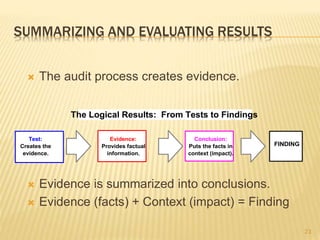

2) The audit process involves planning, performing, and reporting. Planning includes researching the audit area, assessing risks, and developing an audit program. Fieldwork involves testing controls and processes. Reporting documents the audit findings and conclusions.

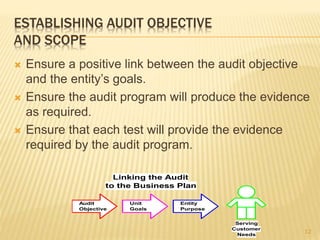

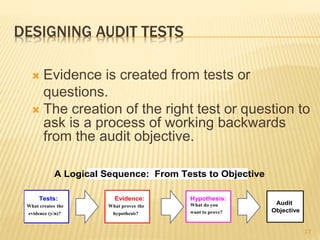

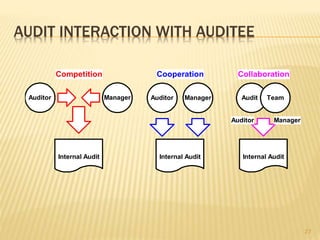

3) Effective internal auditing establishes clear audit objectives, assesses risks, designs appropriate tests, documents the work, summarizes conclusions, and provides reporting and follow-up to drive corrective actions. Regular communication and collaboration with auditees helps build trust in the audit function.