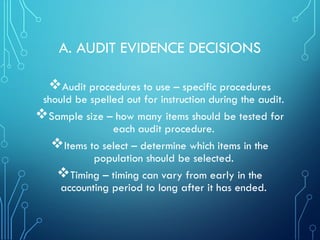

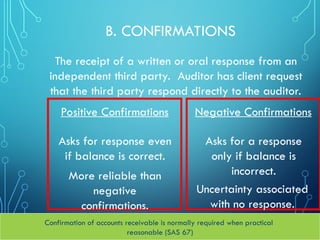

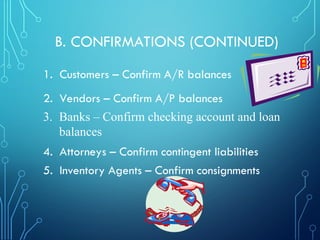

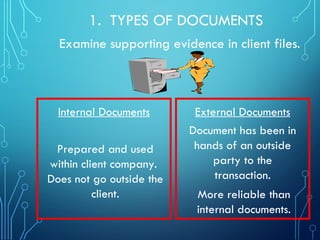

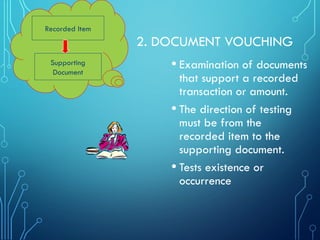

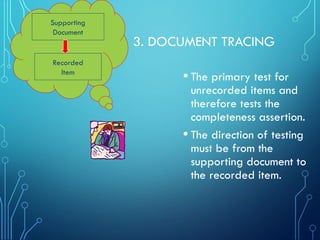

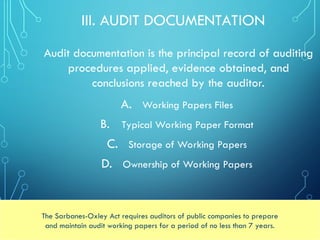

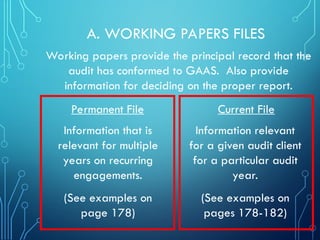

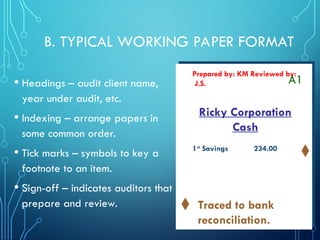

Chapter 7 covers audit planning and analytical procedures, emphasizing the importance of defining audit evidence, its types, and documentation requirements. It details the factors affecting the persuasiveness of audit evidence, such as competence and sufficiency, along with a variety of evidence types like physical examination, confirmations, and analytical procedures. Additionally, it outlines the structure, storage, and ownership of audit working papers, highlighting adherence to the Sarbanes-Oxley Act's requirements.