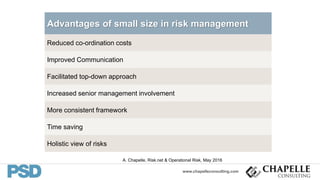

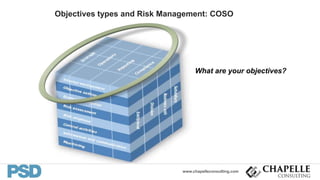

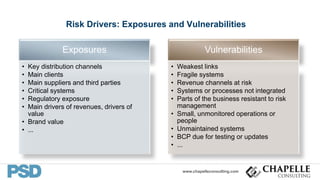

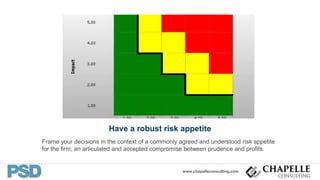

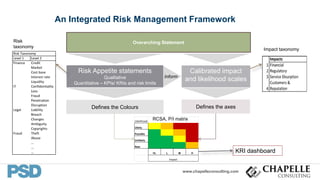

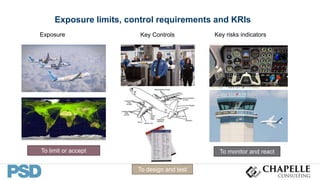

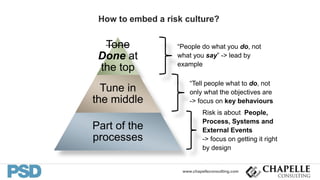

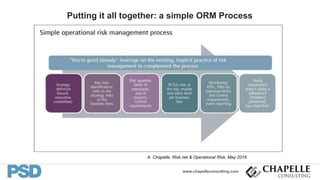

The document outlines the significance of risk management in smaller firms, emphasizing the importance of informed decision-making and strategic risk assessments. It discusses advantages such as reduced coordination costs and improved communication, alongside threats like weak links, inertia, and willful blindness. The text advocates for a robust risk appetite and integrated frameworks to foster a risk-aware culture within organizations.