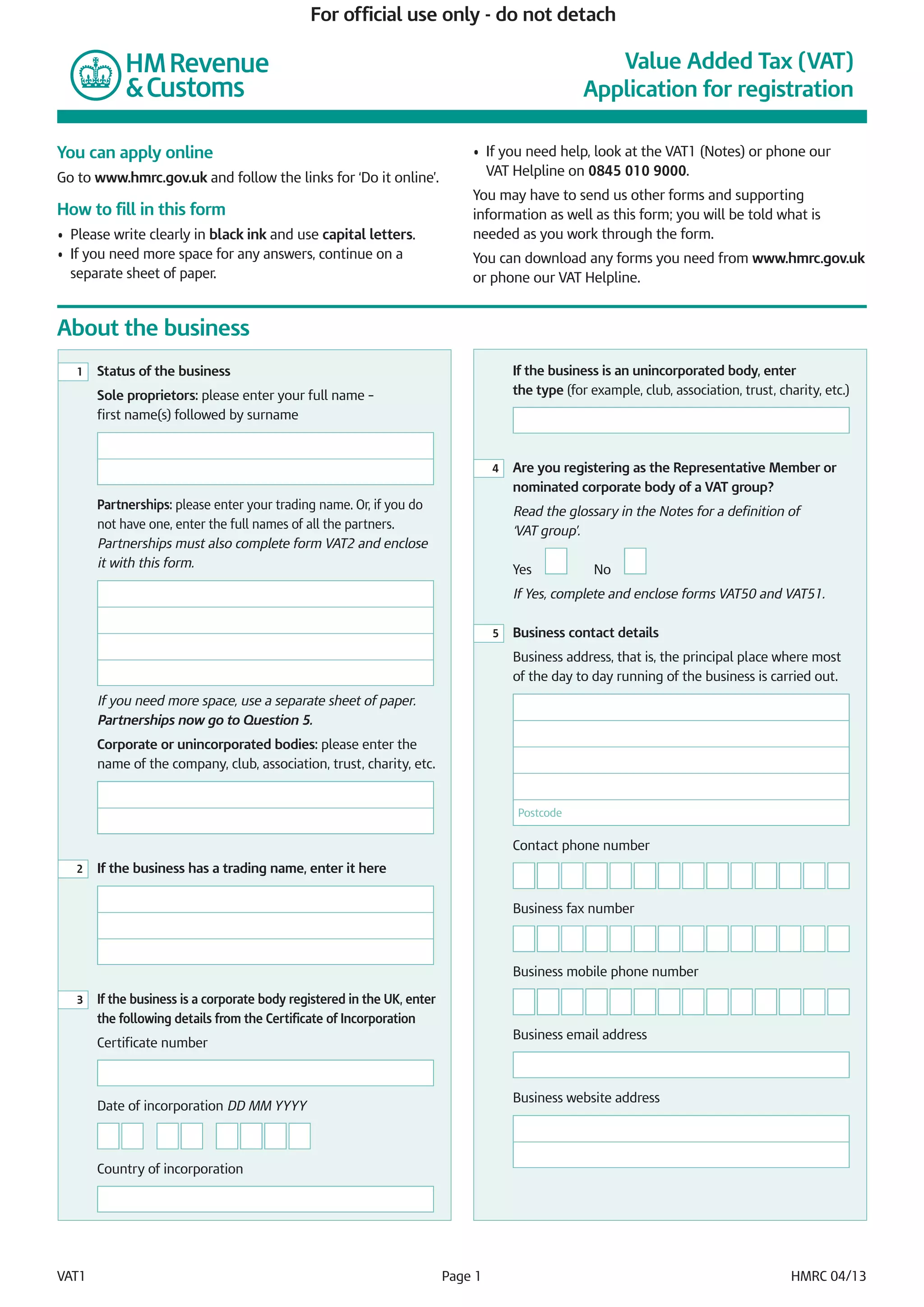

The document is a Value Added Tax (VAT) registration form from HMRC. It requests information about the applicant's business such as activities, bank account, and turnover estimates. The applicant must provide details and declare that the information is true and complete. The form should be sent to the Wolverhampton Registration Unit, except for VAT group registrations or keeping a previous owner's VAT number which are sent to Grimsby.