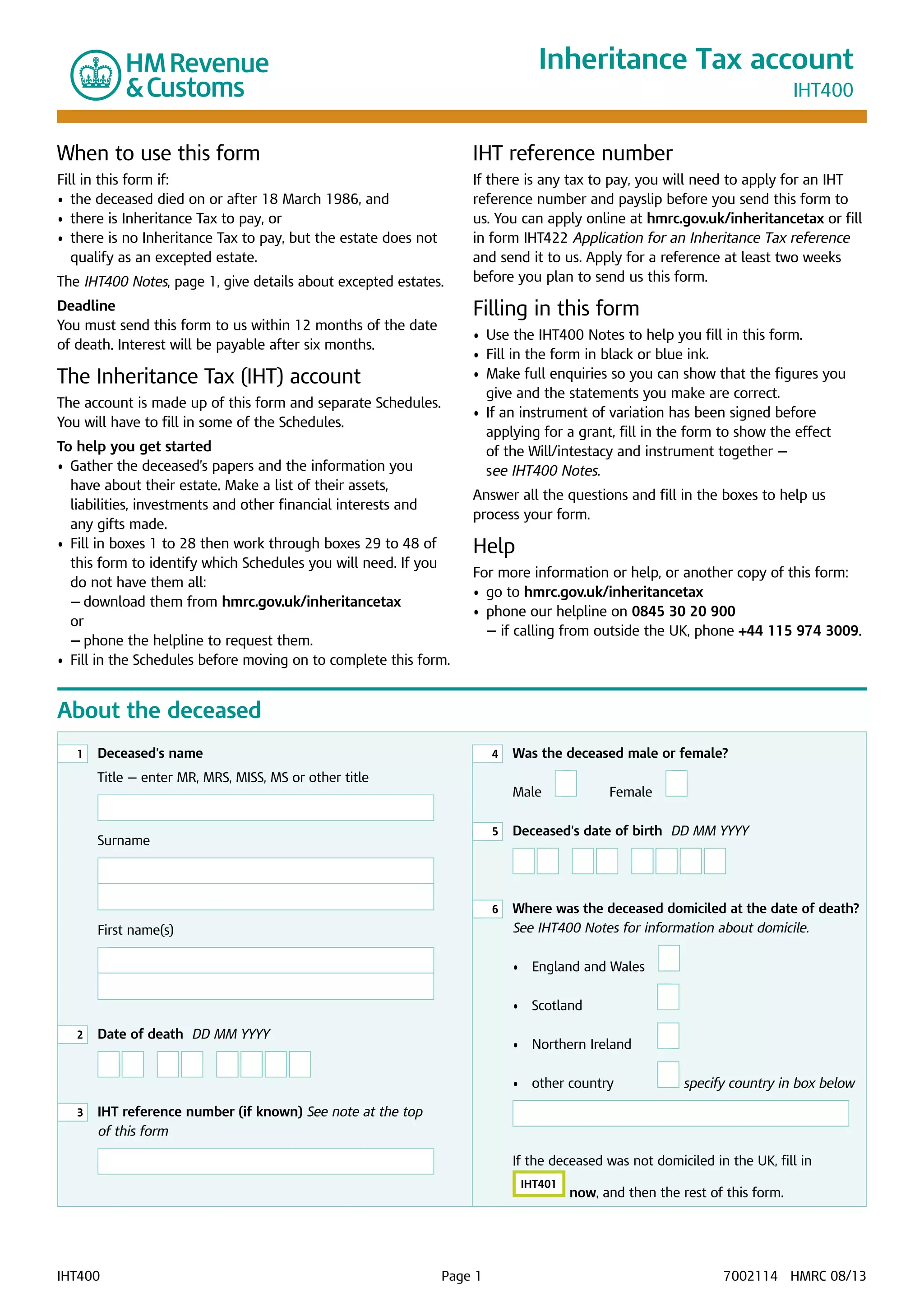

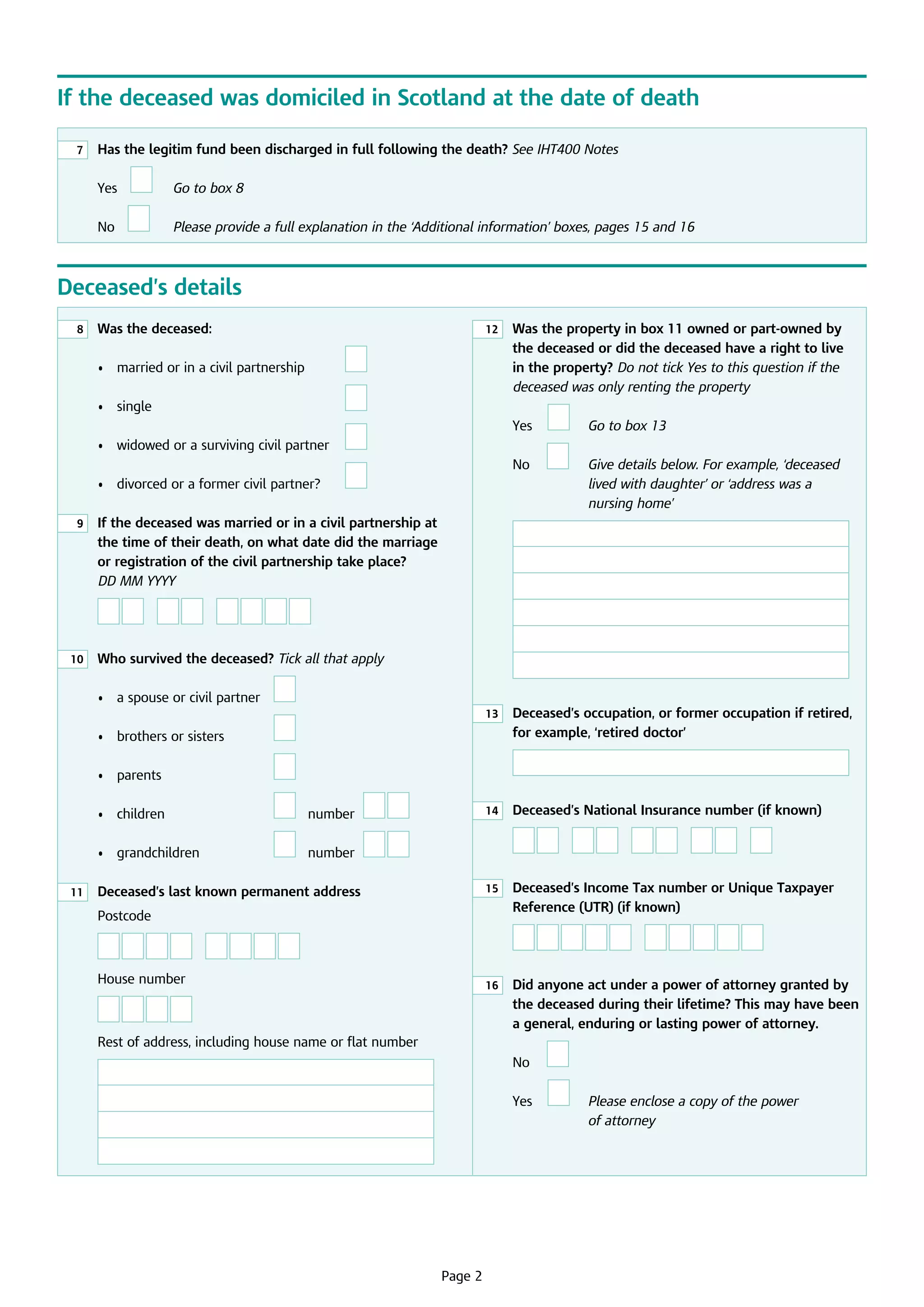

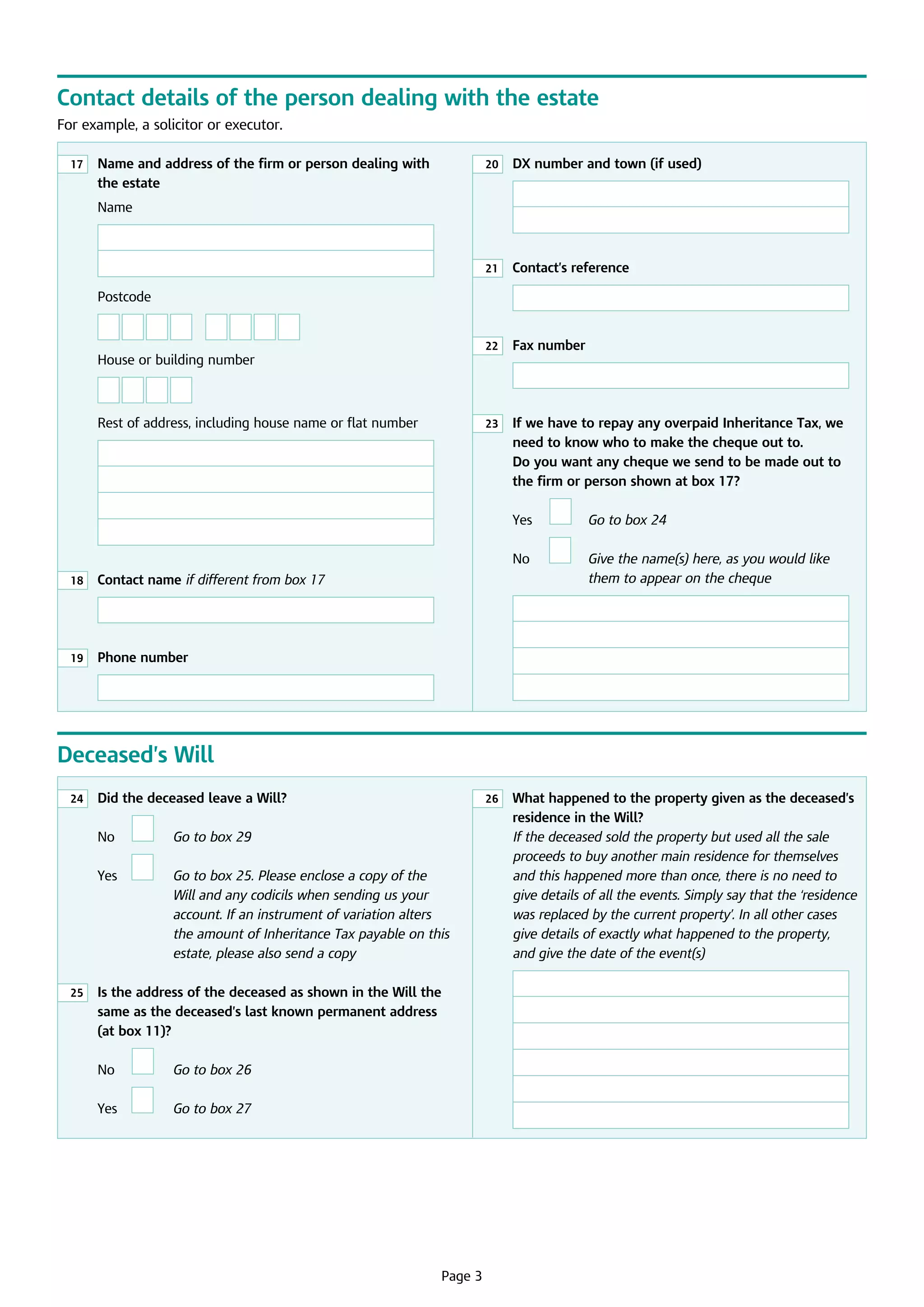

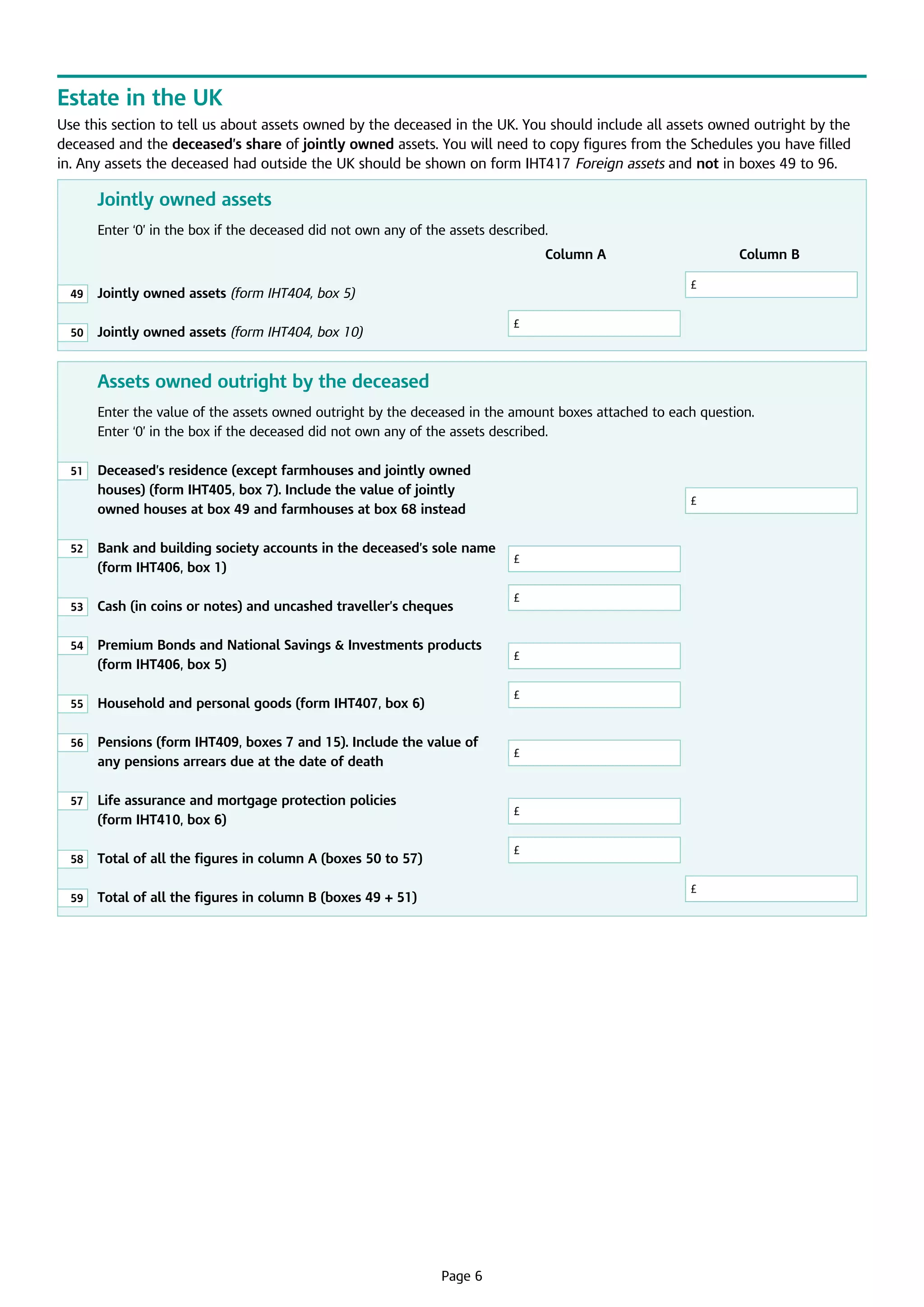

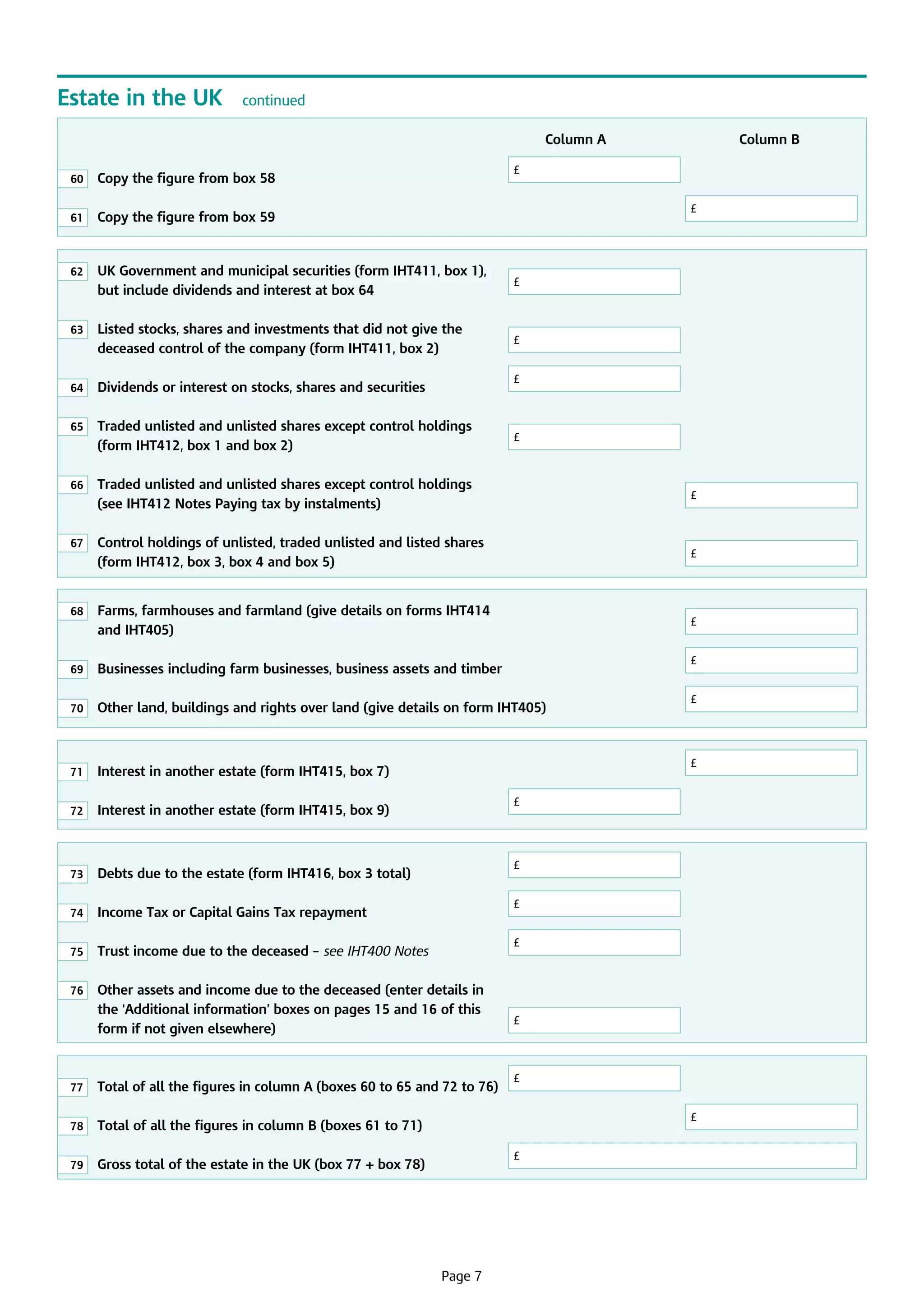

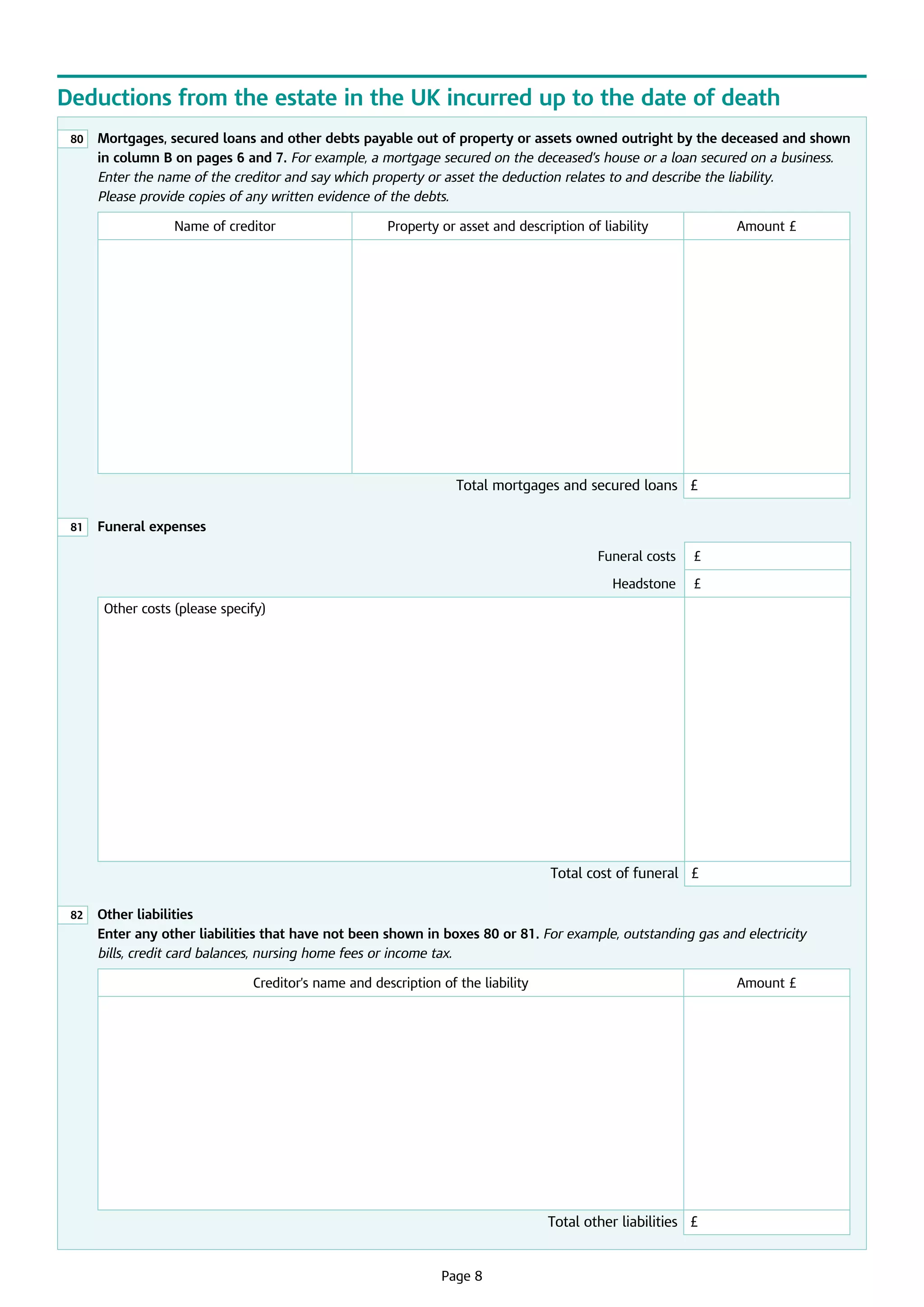

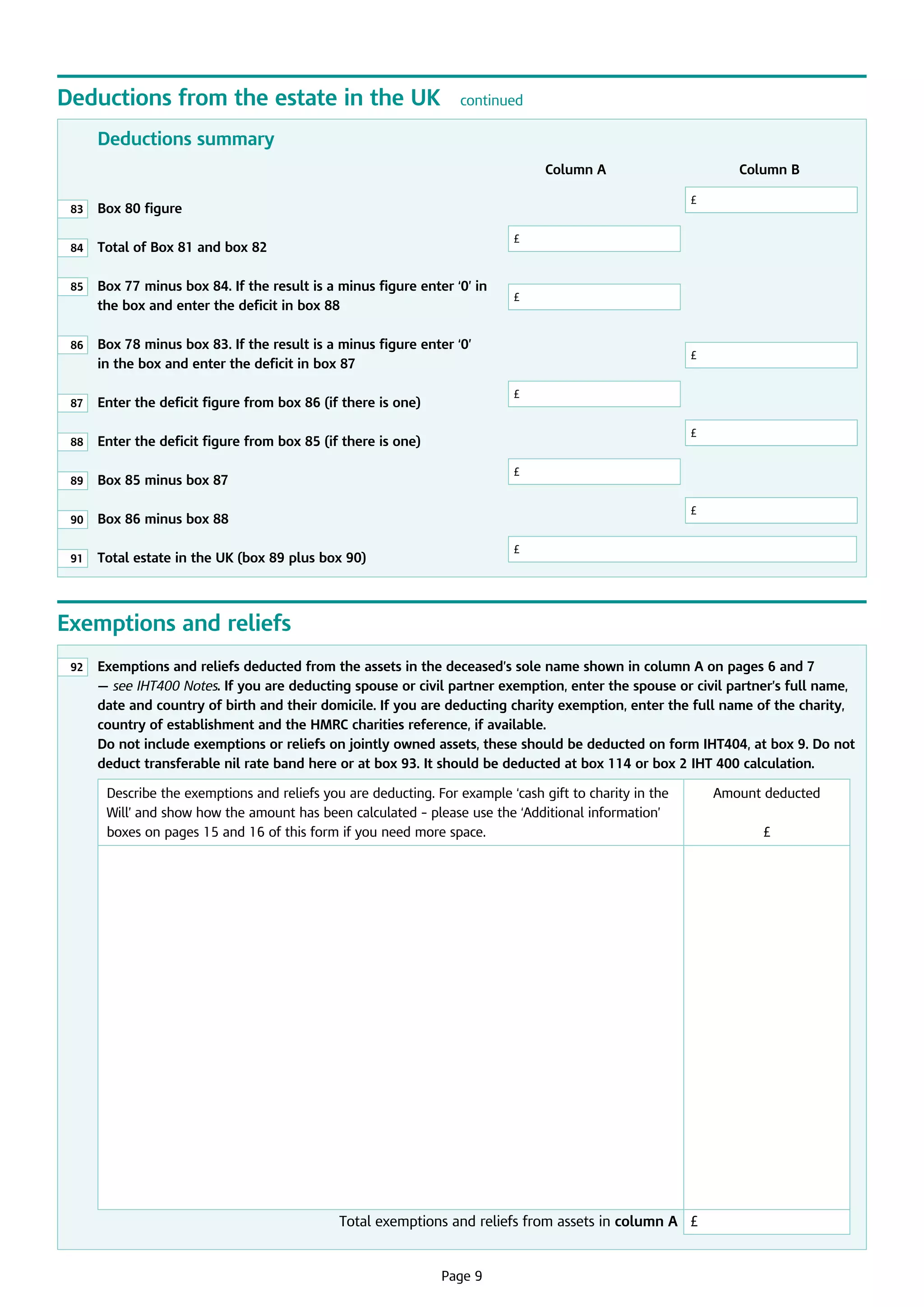

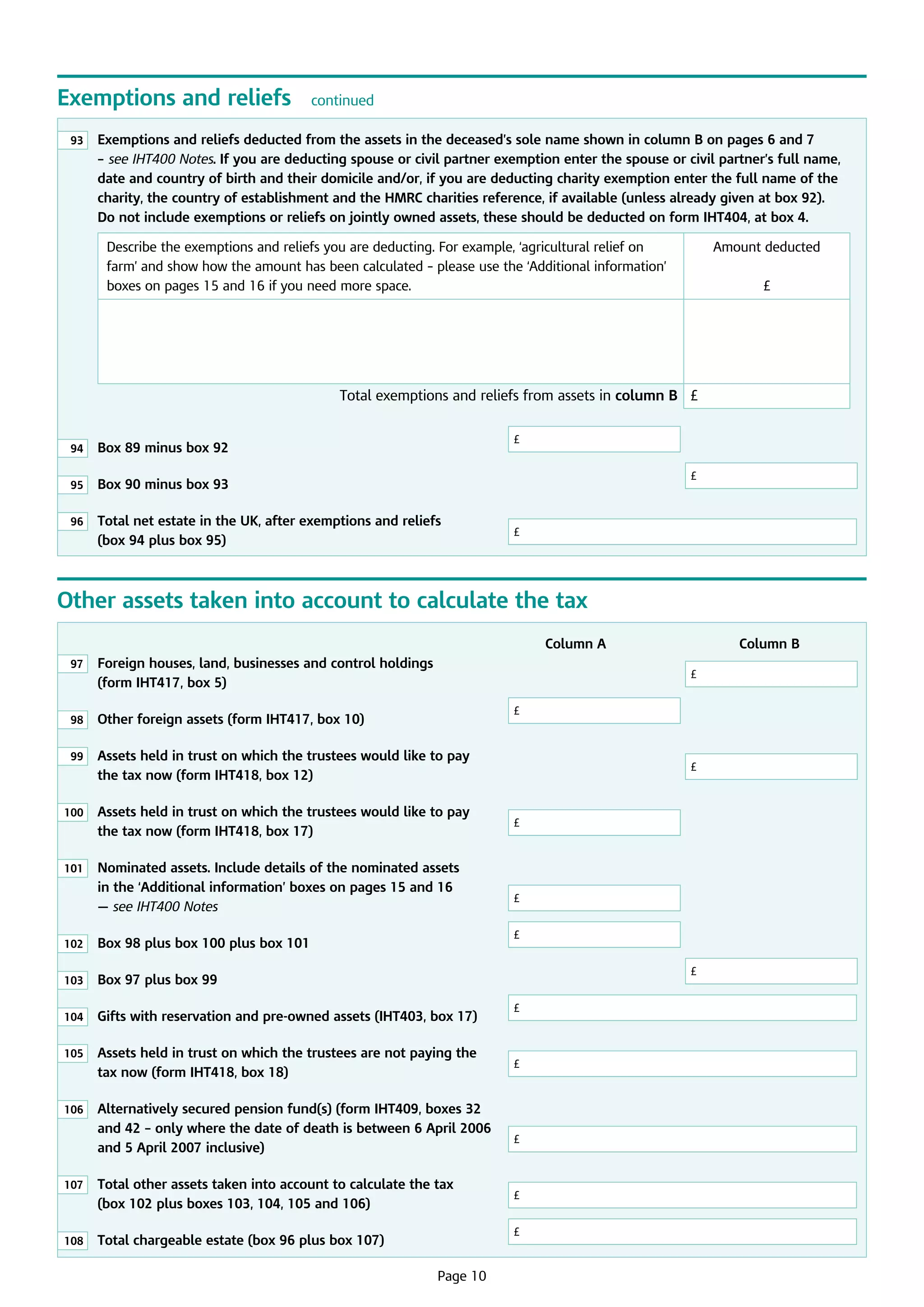

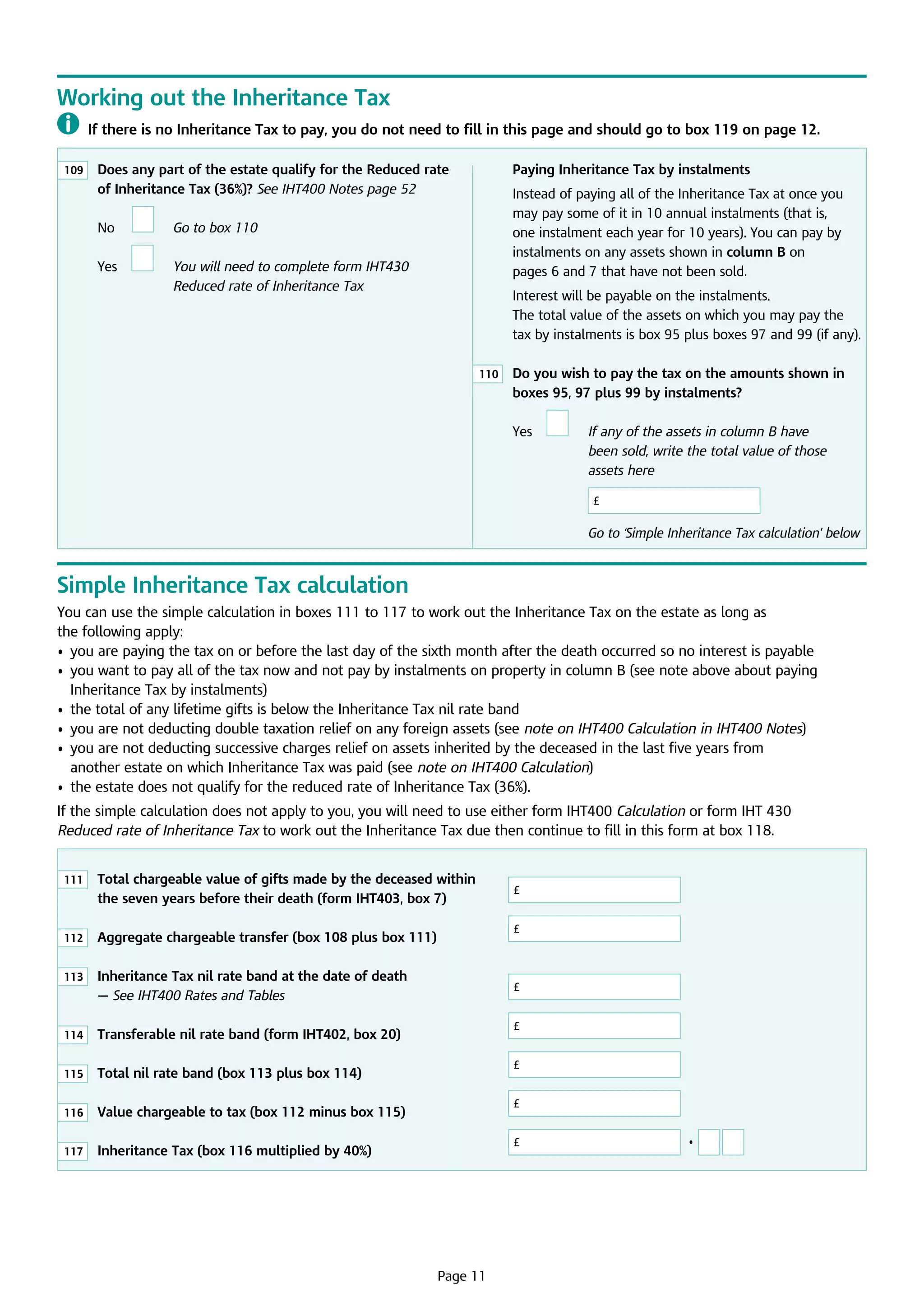

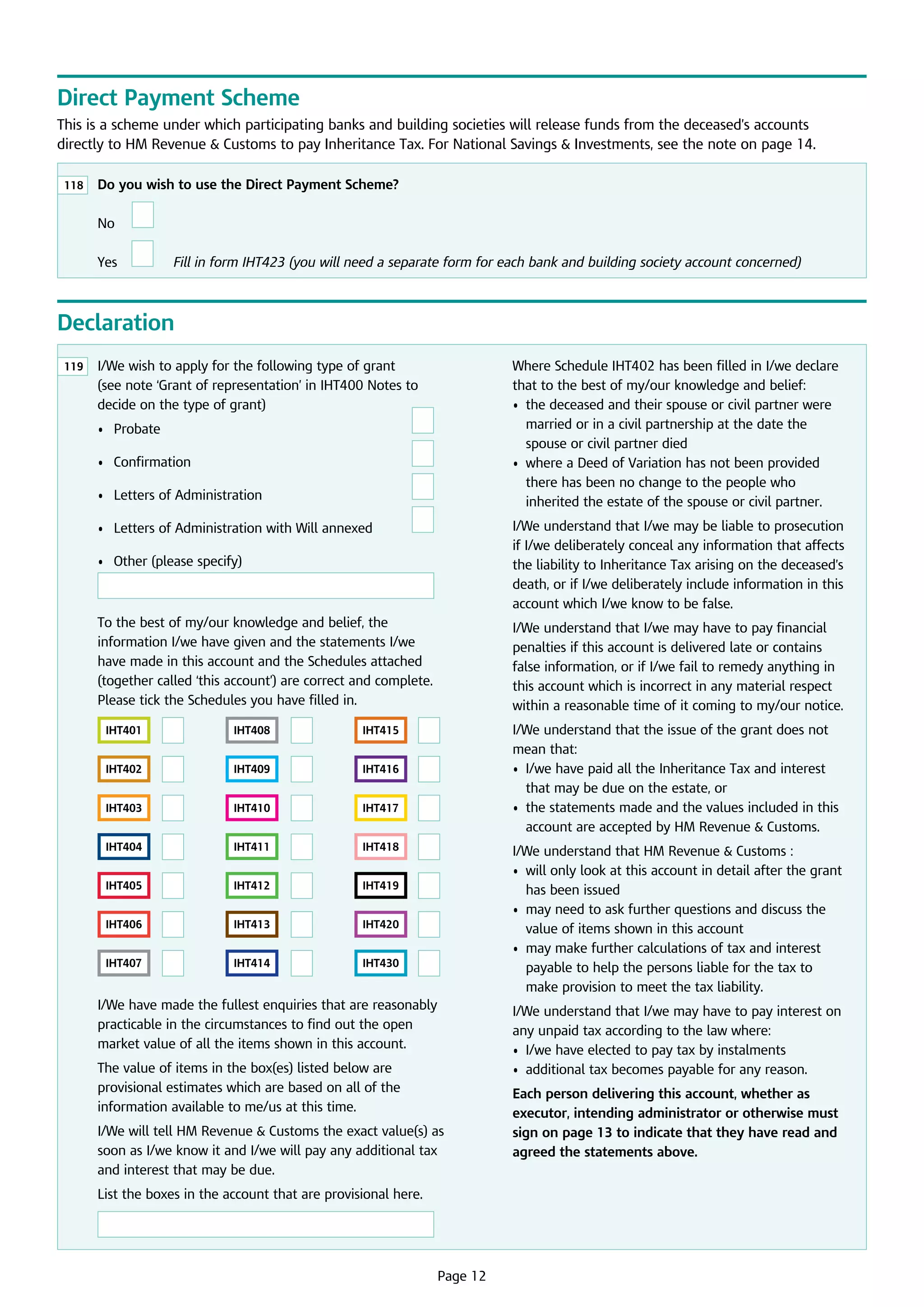

- The document provides instructions for filling out an Inheritance Tax form (IHT400) for estates in the UK where Inheritance Tax may be owed.

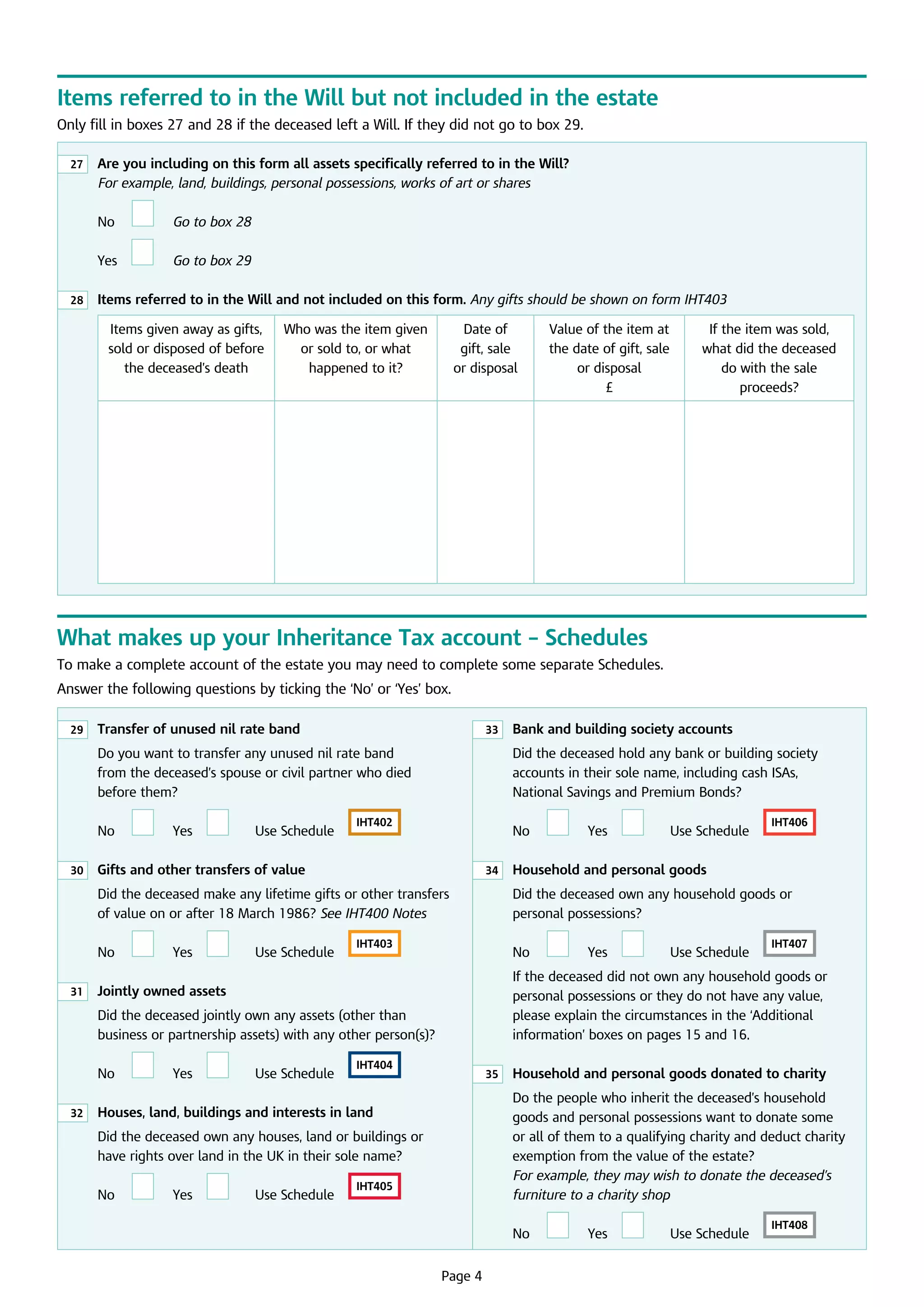

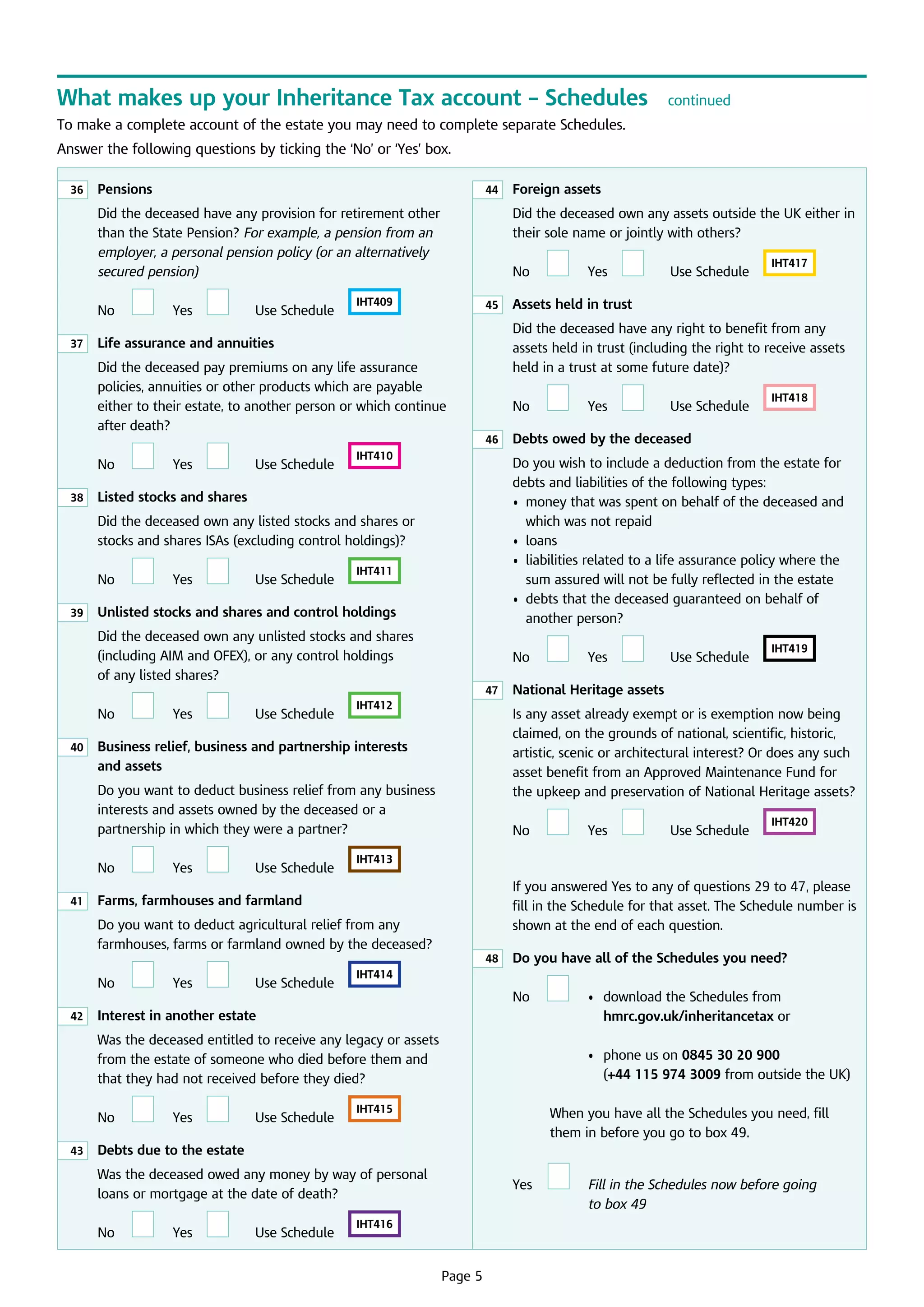

- It explains that separate schedules need to be completed depending on the assets owned, such as property, bank accounts, pensions, shares, or foreign assets.

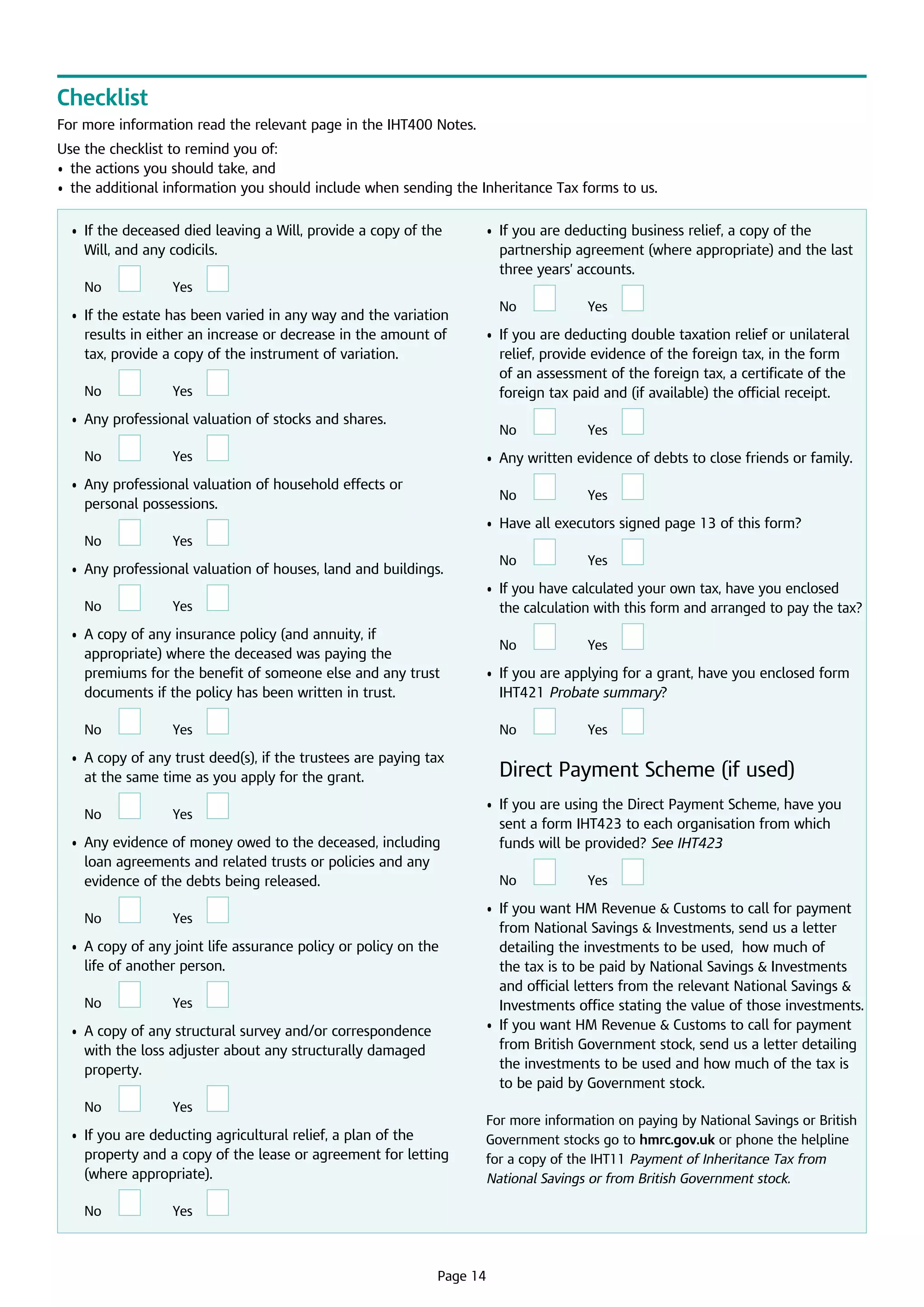

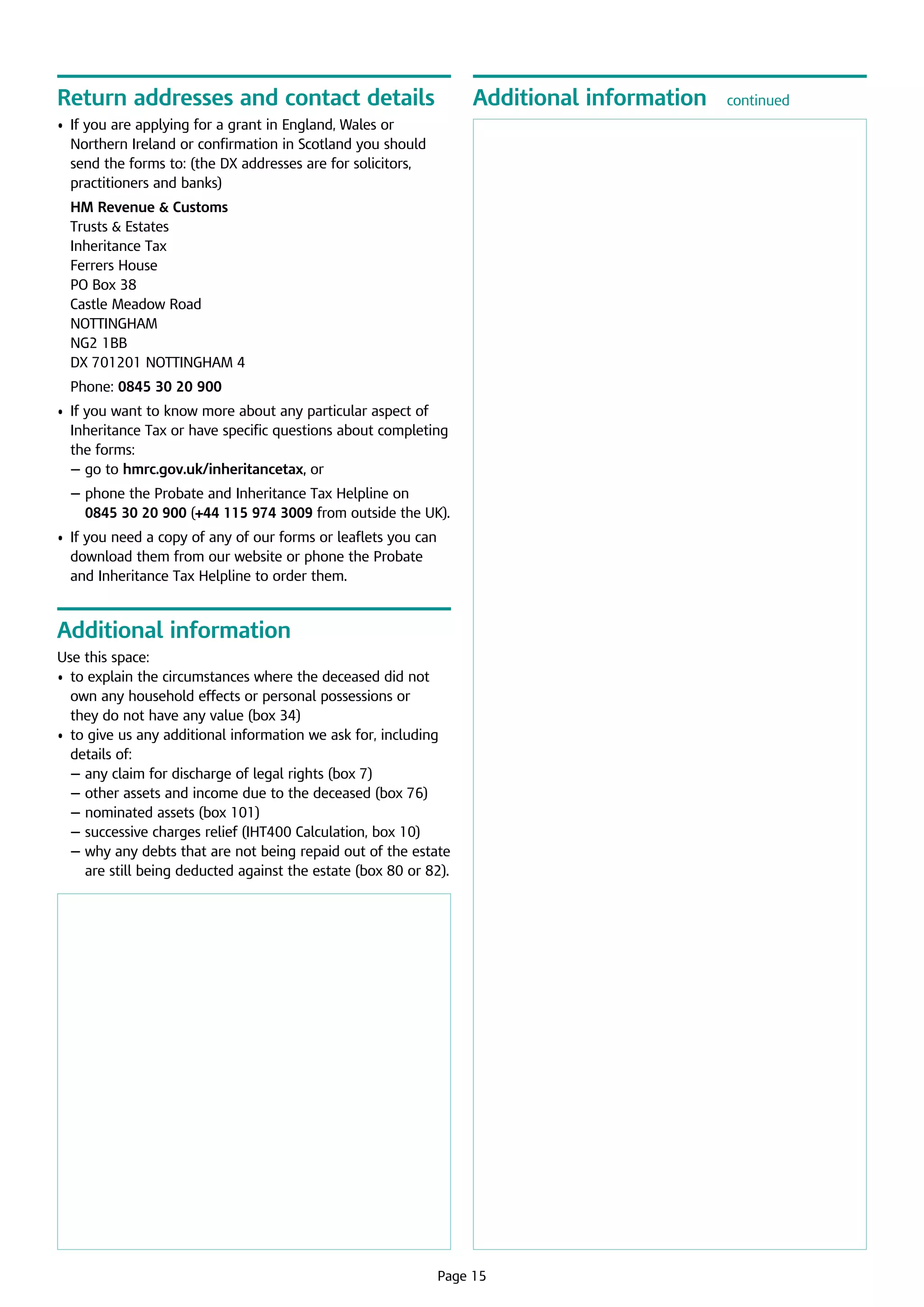

- Instructions are given on gathering information about the deceased's estate, filling out the main form, submitting any applicable schedules, and the deadline to return the completed form.