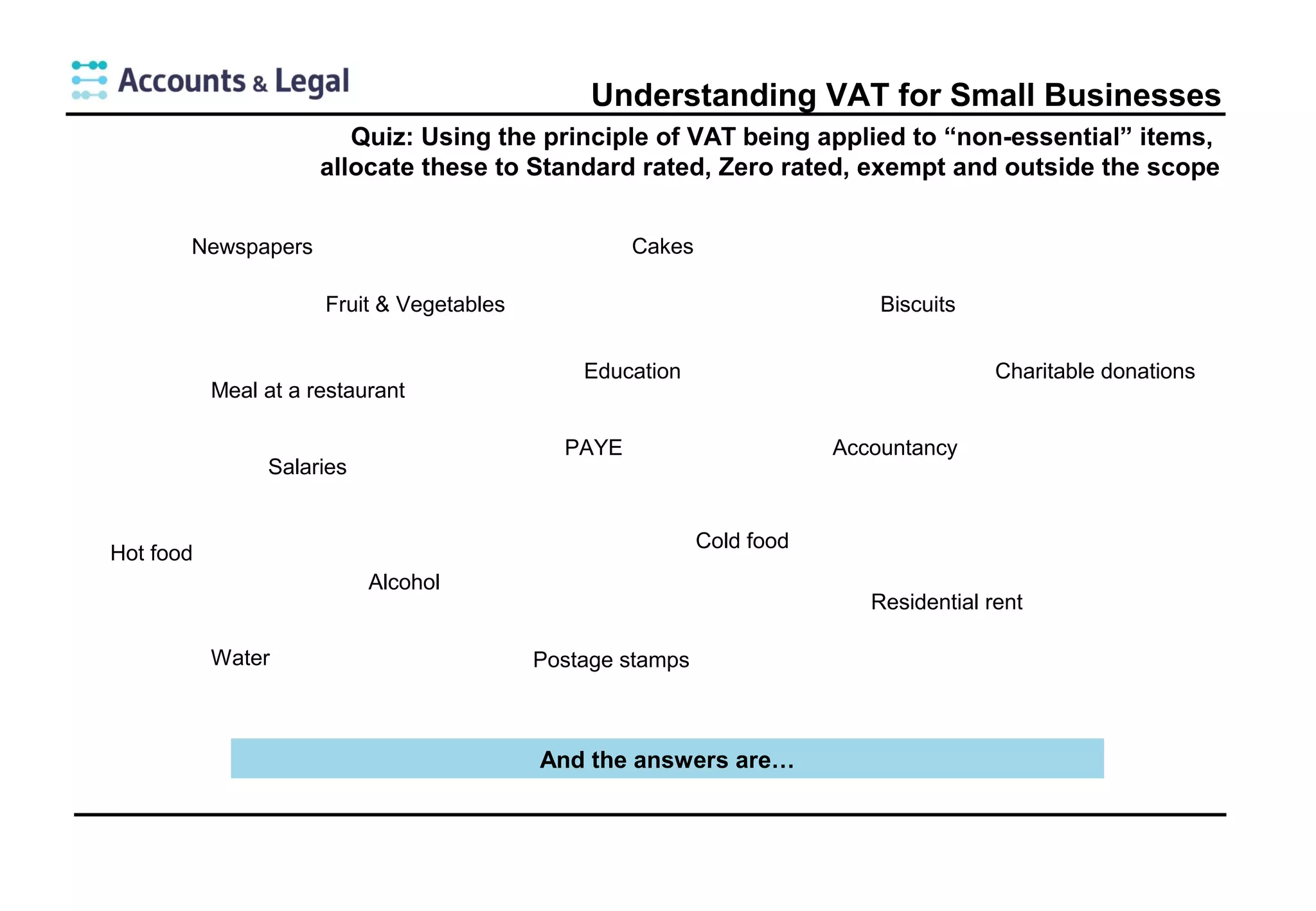

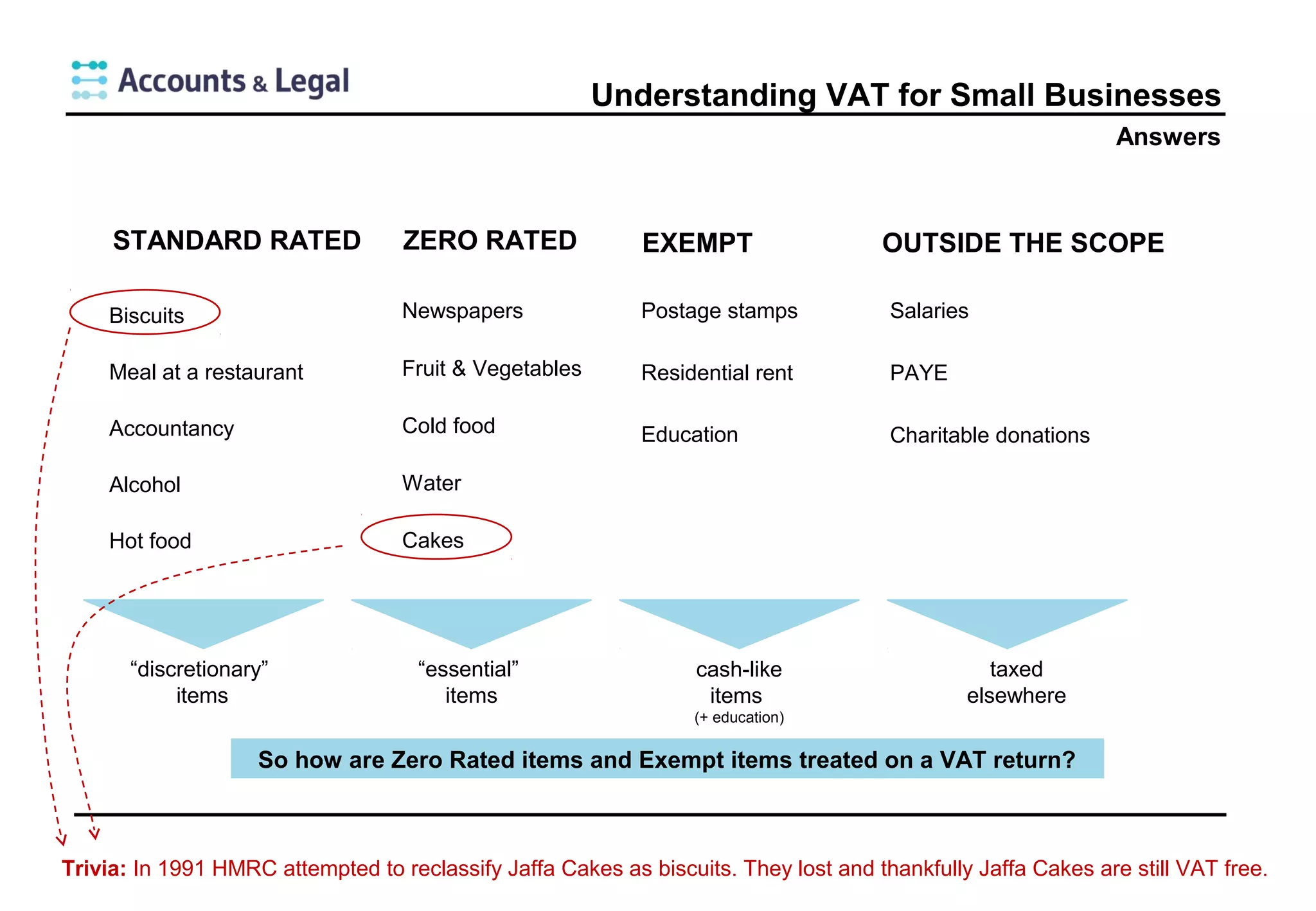

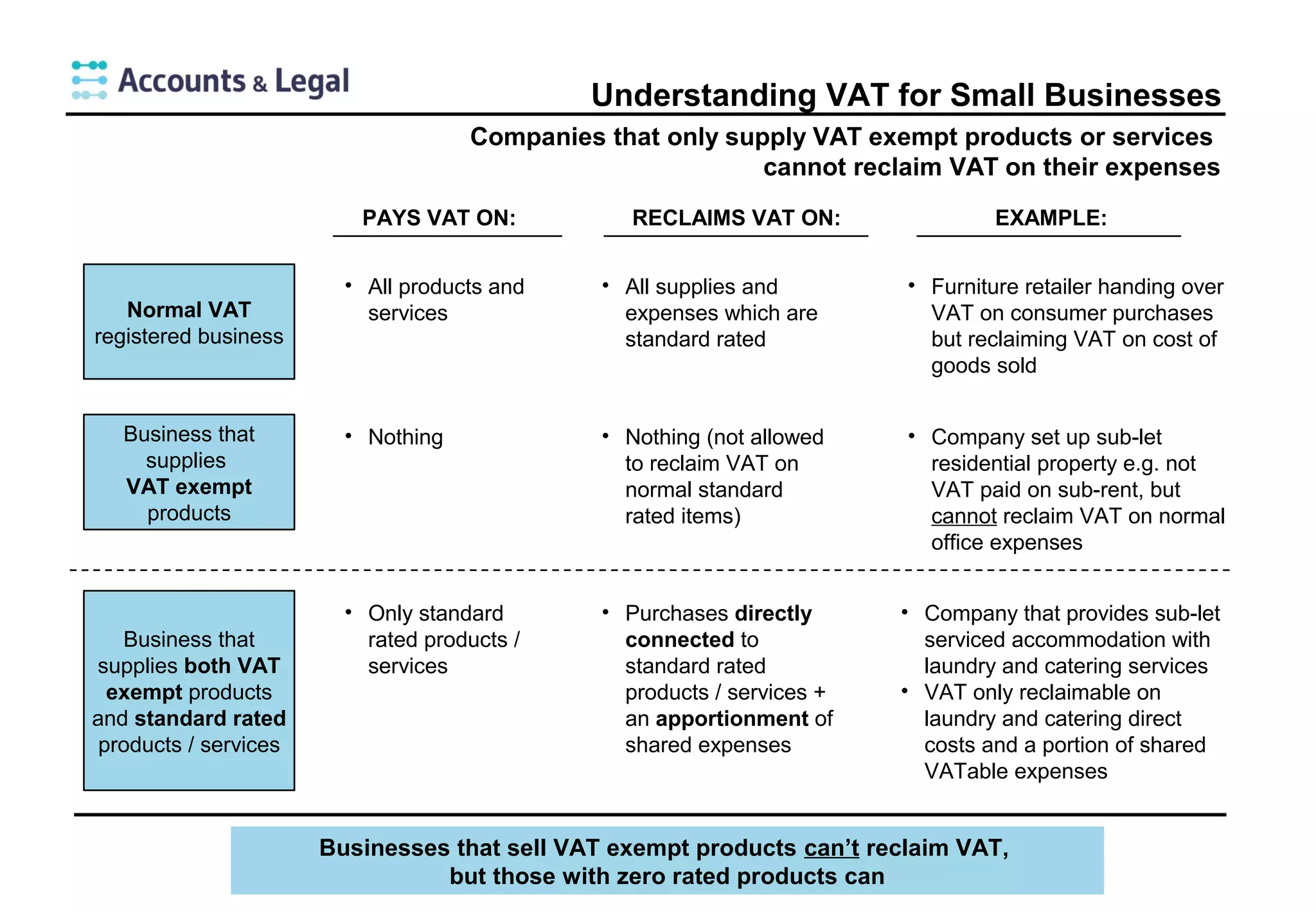

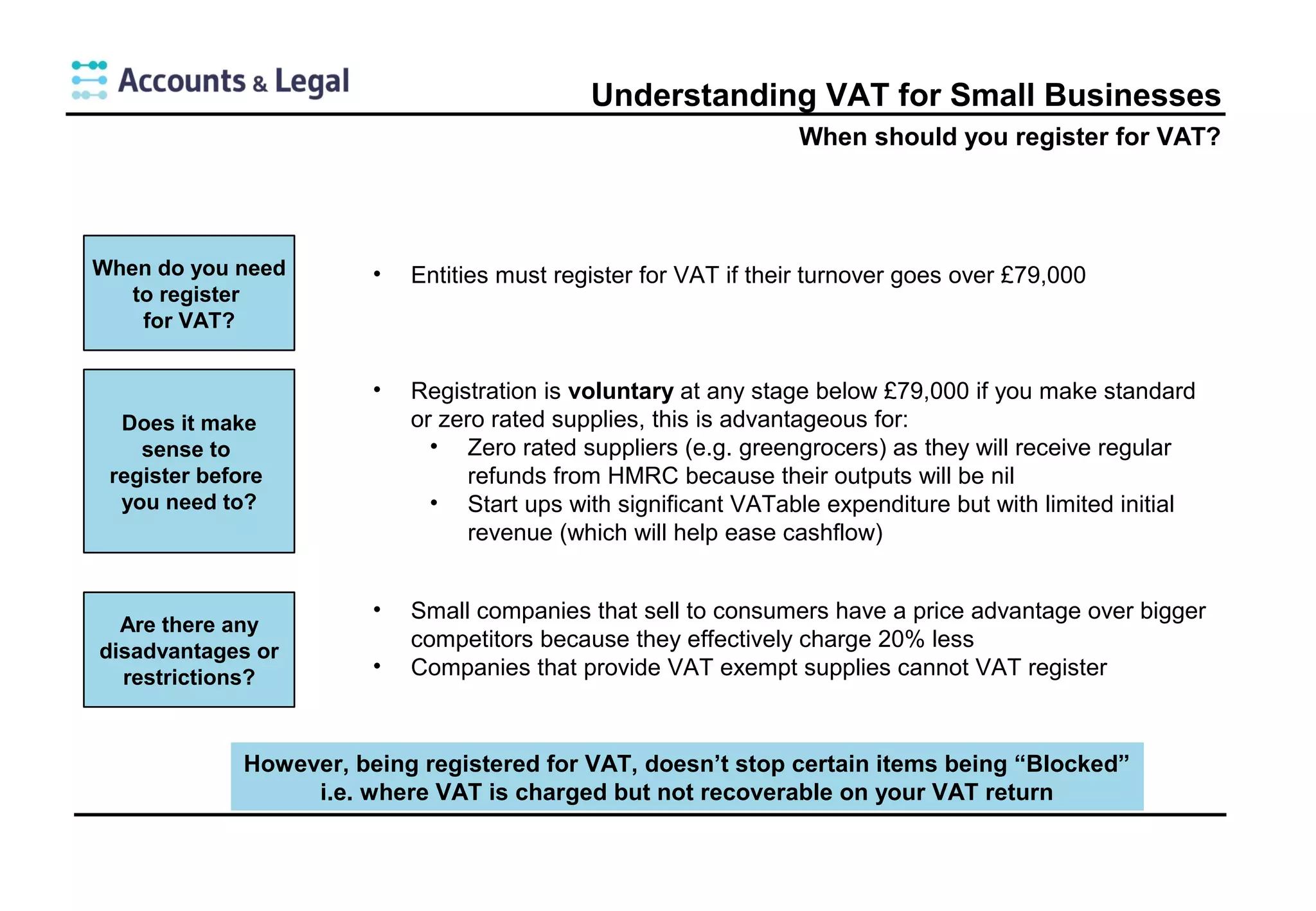

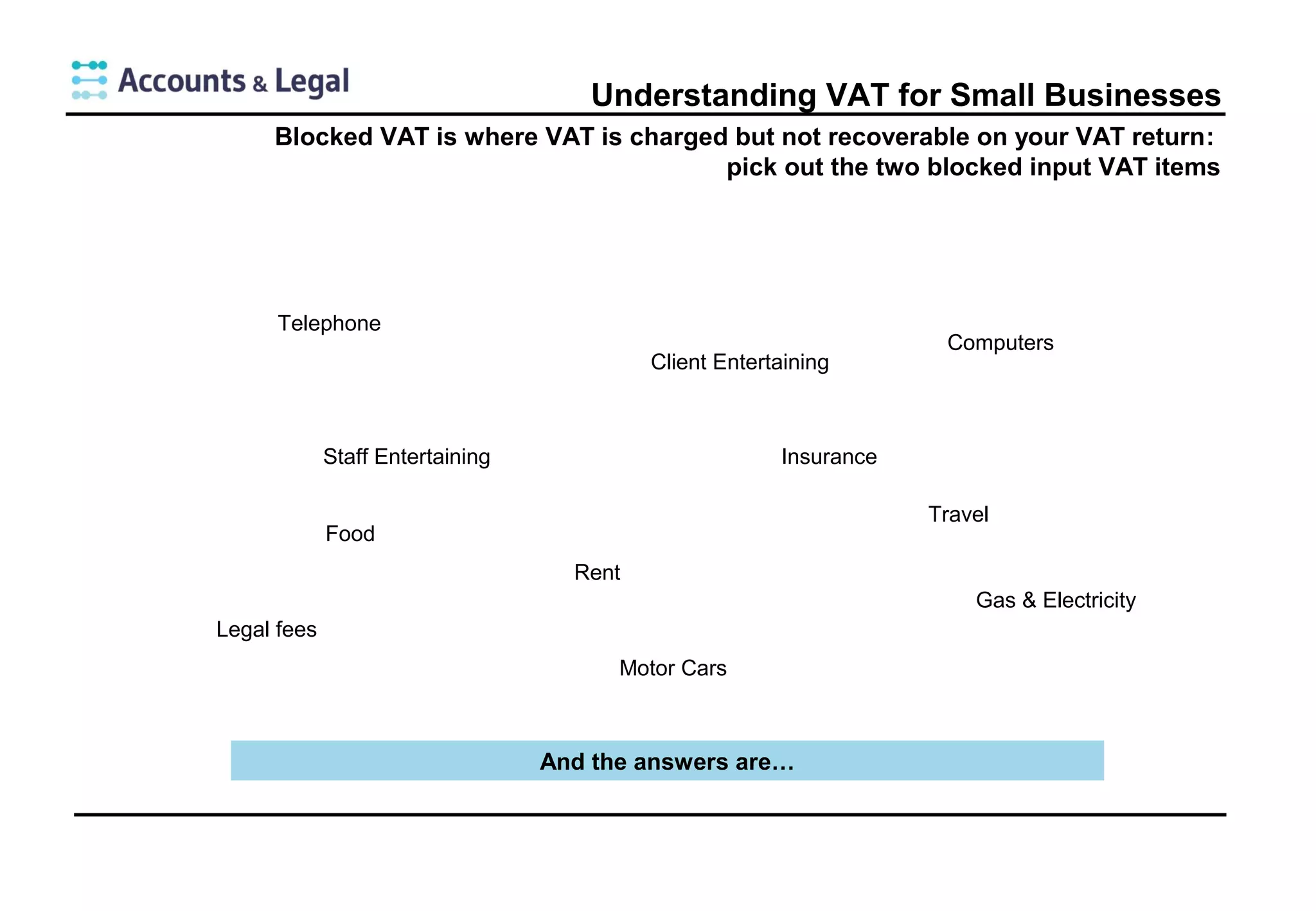

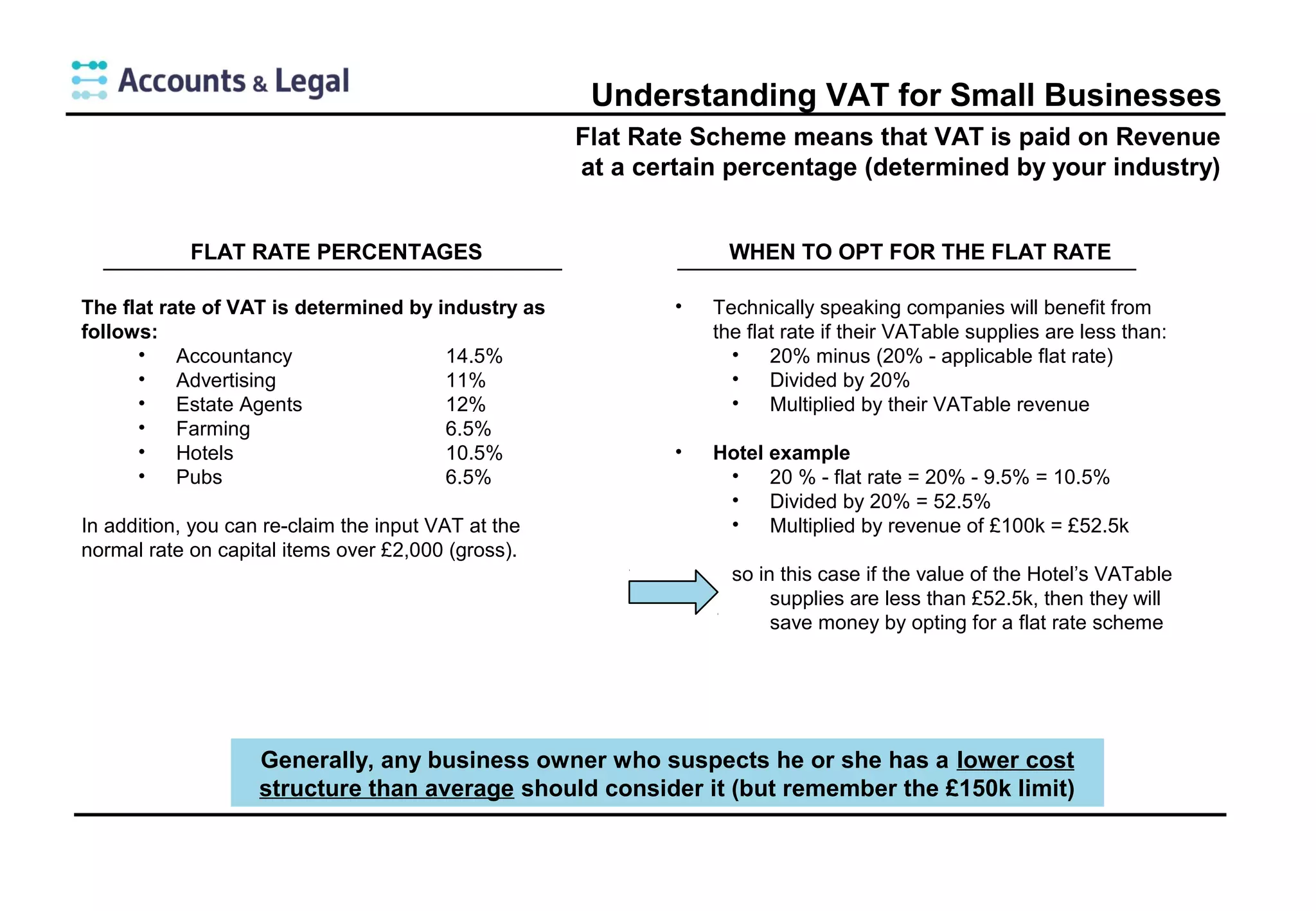

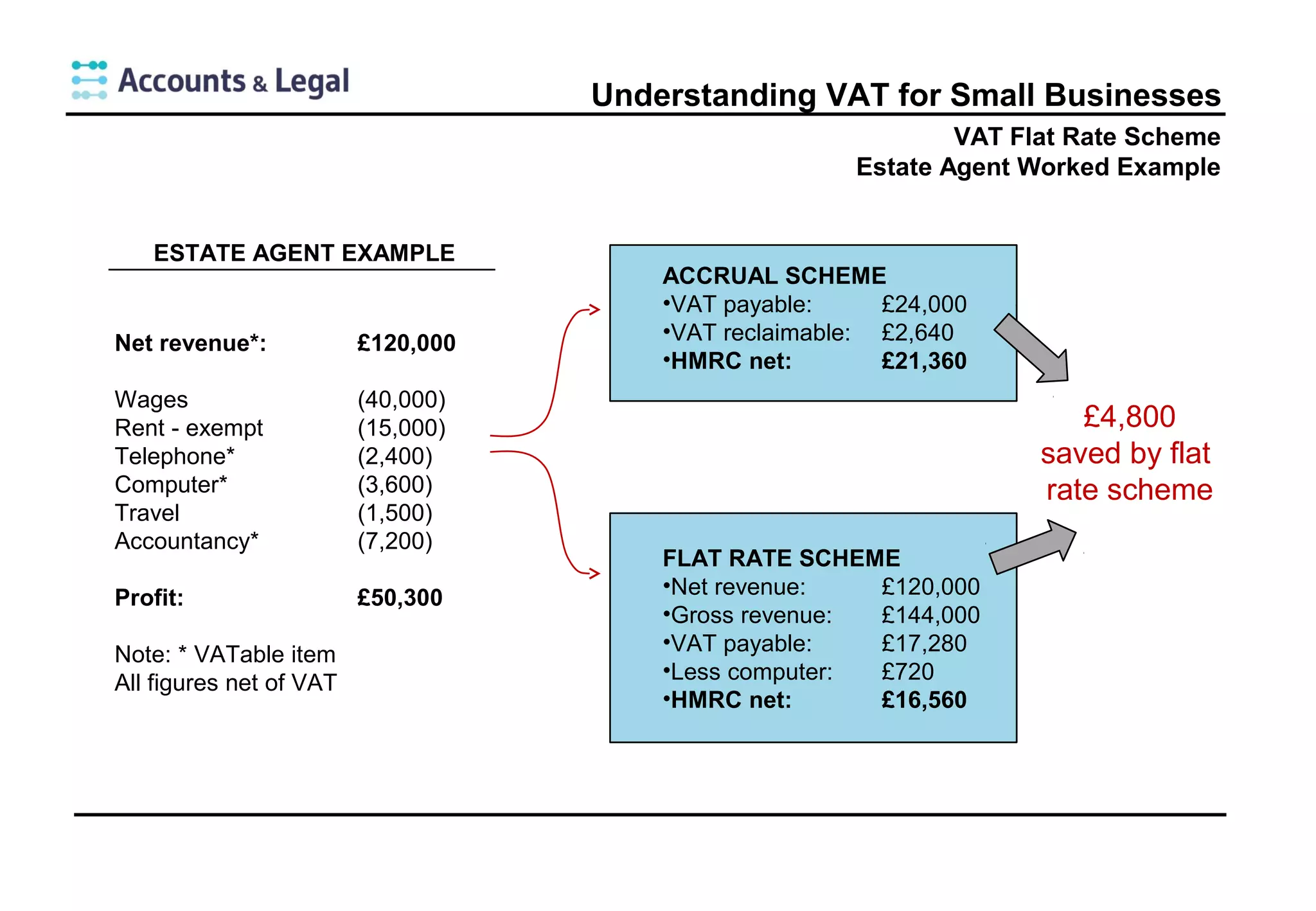

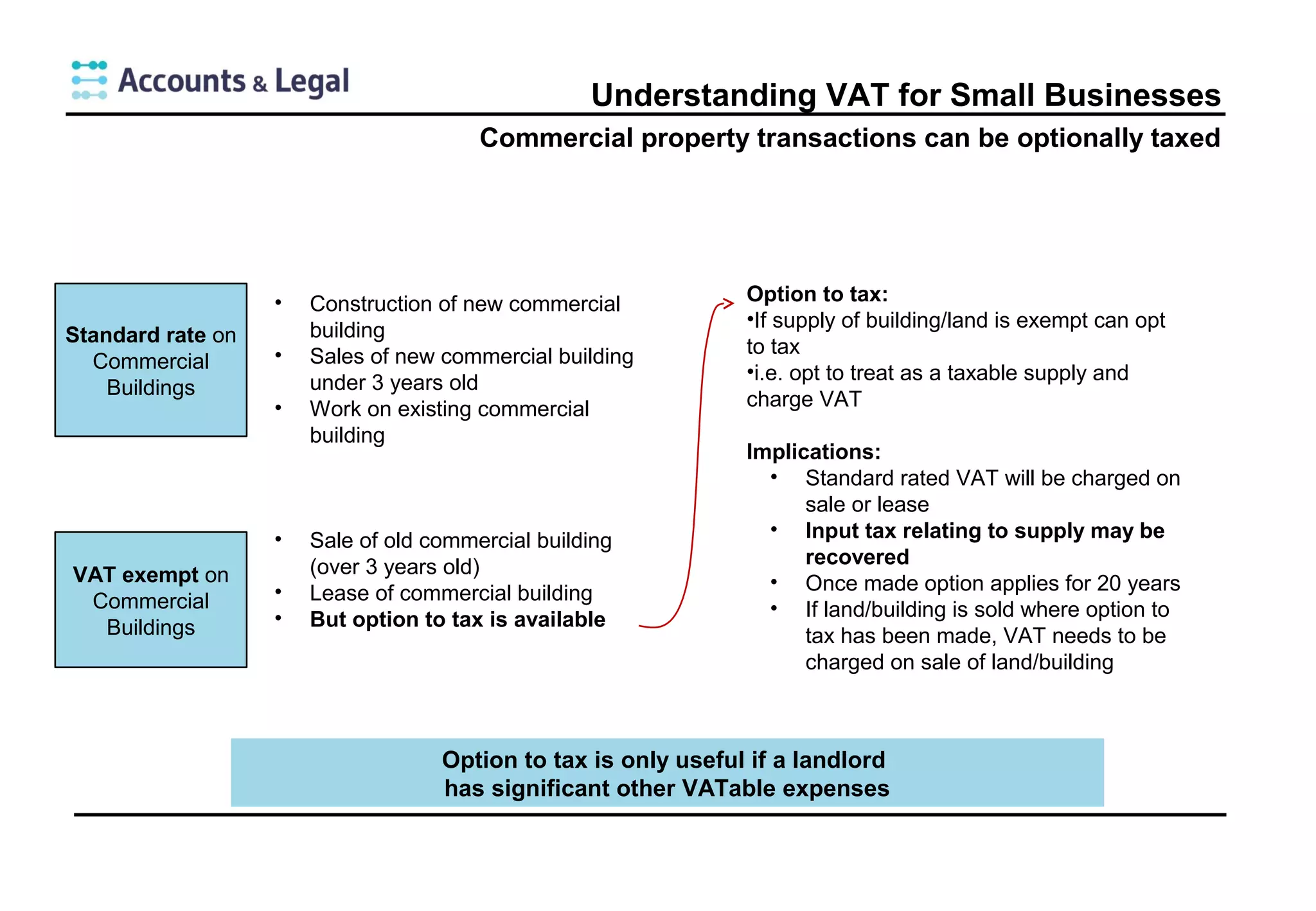

The document details the principles and workings of Value Added Tax (VAT) for small businesses, explaining how it operates for both VAT registered companies and consumers. It outlines various VAT rates, registration requirements, and guidance on when businesses should register, along with the implications of different VAT schemes. Additionally, it addresses the characteristics of VAT exempt and zero-rated products, as well as the complexities of reclaiming VAT and blocked input VAT items.