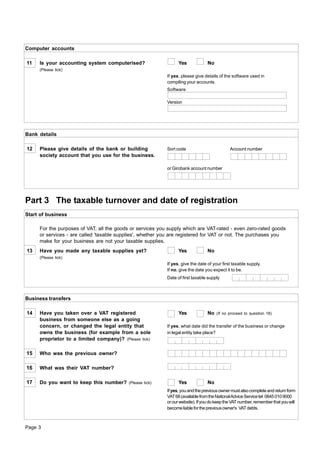

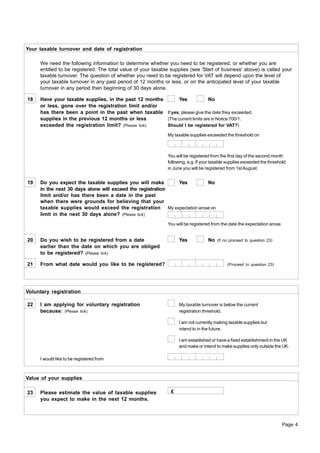

This document is an application form for registration for Value Added Tax (VAT) in the United Kingdom. It requests information about the applicant's business such as the business name and address, legal structure, activities, and bank account details. It also asks for estimates of taxable and exempt supplies to determine if the applicant needs to register for VAT. The applicant must sign a declaration that the information provided is true and complete.