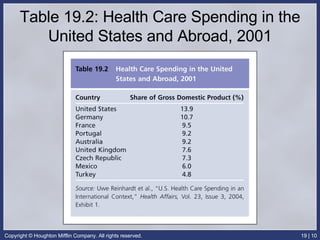

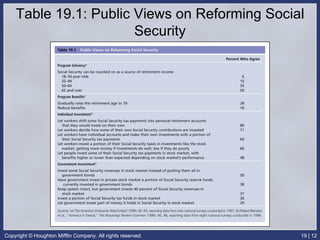

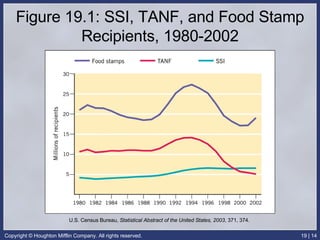

This document discusses social welfare programs in the United States. It outlines different types of programs, including majoritarian programs like Social Security that benefit most citizens without a means test, and means-tested programs like Medicaid that benefit a few citizens. It also discusses the role of non-governmental organizations in administering welfare programs and reforms to programs like Temporary Assistance for Needy Families (TANF) and Social Security.