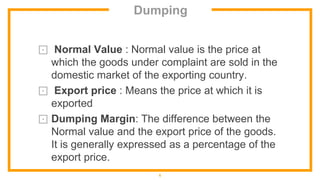

The document discusses anti-dumping duty, which is a protective tariff imposed on foreign imports that are priced below fair market value. Dumping occurs when goods are exported at a price lower than their normal value in the exporting country's domestic market. If the export price is lower than the normal value, it constitutes dumping. Anti-dumping duty aims to rectify trade distortions caused by dumping and its impact on domestic prices and unemployment in the importing country. The legal framework for anti-dumping duty in India is provided in the Customs Tariff Act and related rules. Recent news is mentioned that India has decided not to impose anti-dumping duties on imports of stainless steel products from 15 countries.