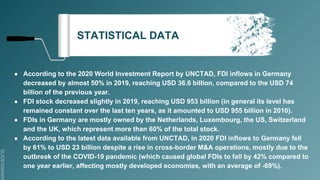

This document discusses foreign direct investment (FDI). It defines FDI as direct investment into a foreign country through means such as buying a company or expanding existing business operations. It notes that FDI is done by citizens and governments investing in other countries' industries. The document outlines several reasons for foreign investment including raising investment levels, upgrading technology, exploiting natural resources, and improving exports. It also discusses modes of FDI like mergers and acquisitions. Determinants of foreign investment mentioned include political stability, legal framework, market size, prices, and access to inputs. The document provides statistical data on FDI flows and stocks in Germany.