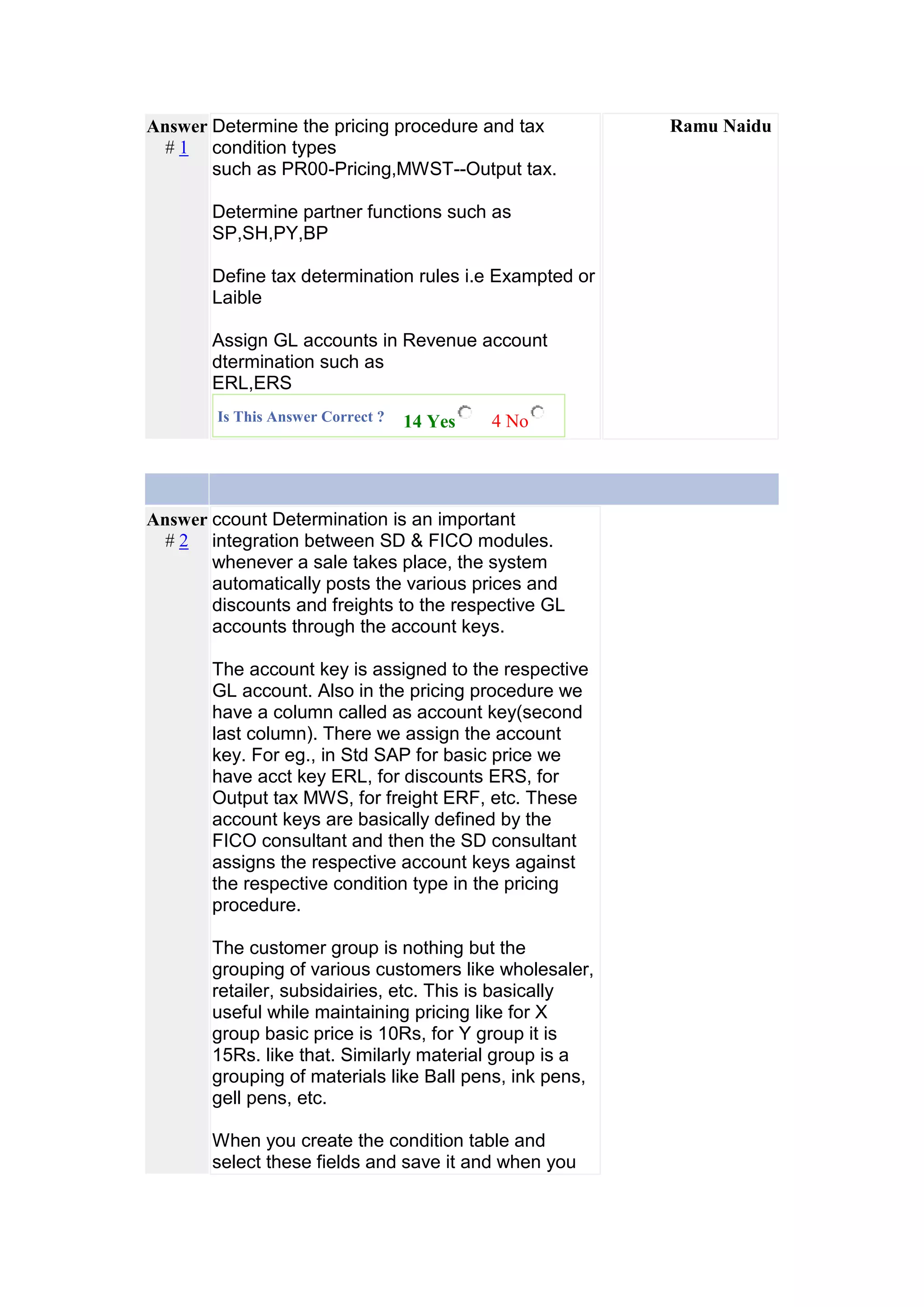

1. Account determination is the integration between SD and FICO modules that automatically posts prices, discounts, freight, and taxes to the appropriate GL accounts through account keys.

2. Account keys are defined in FICO and then assigned to condition types in pricing procedures in SD. Customer and material groups are used to group customers and materials for pricing purposes.

3. Account determination must be configured correctly for the system to generate accounting documents when invoices are saved, including maintaining account assignment groups in customer and material masters.