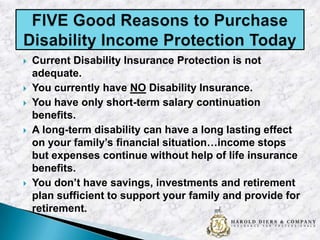

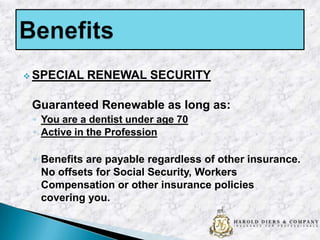

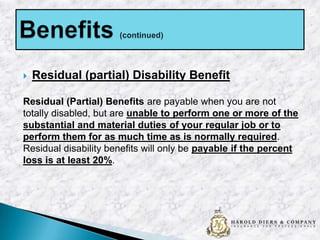

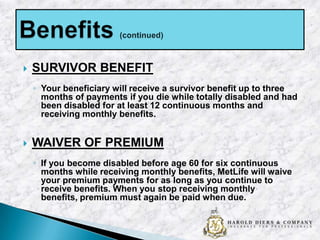

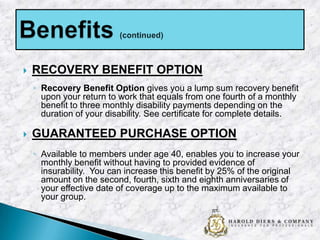

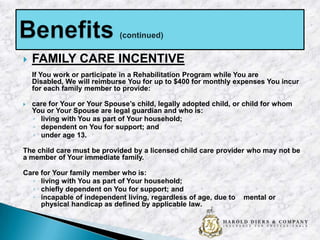

The document outlines a long-term disability insurance plan endorsed by the Nebraska and North Dakota dental associations, emphasizing the need to protect one's income-producing capability. It details various benefits, including total and residual disability coverage, waiver of premium, and additional benefits for specific circumstances, aimed at providing financial support to dentists in case of disability. Harold Diers & Co., Inc. is the administrator of the plan, offering services since 1941.