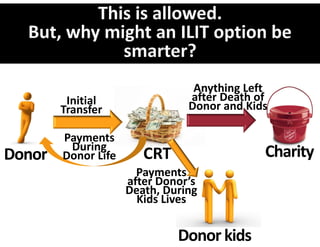

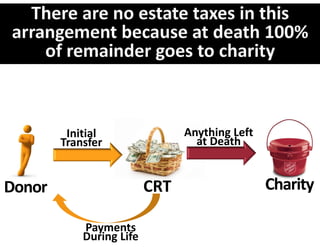

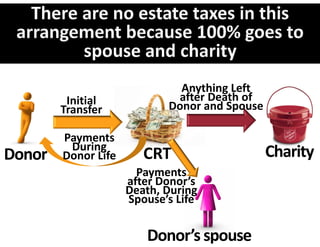

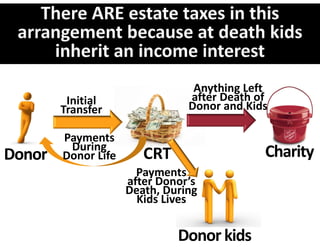

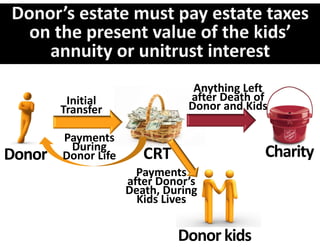

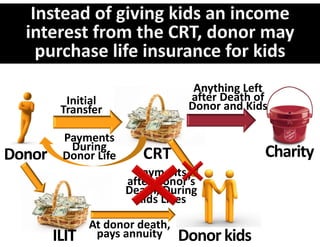

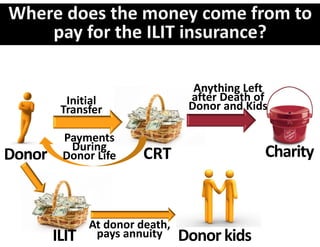

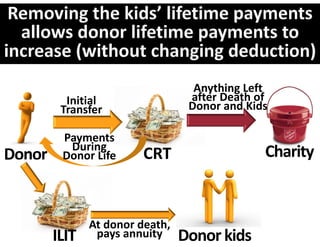

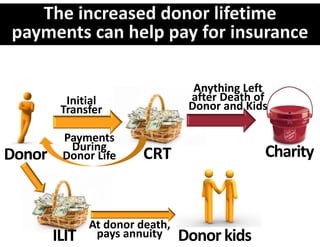

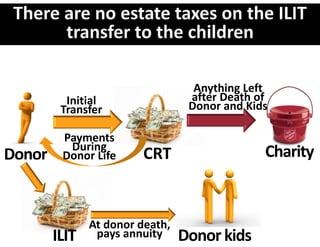

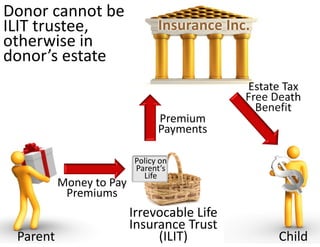

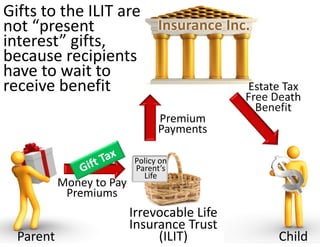

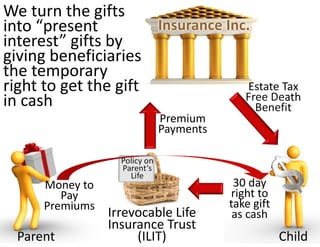

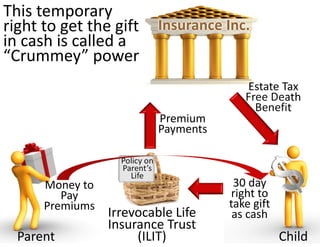

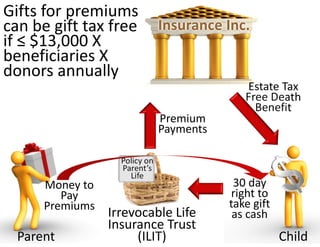

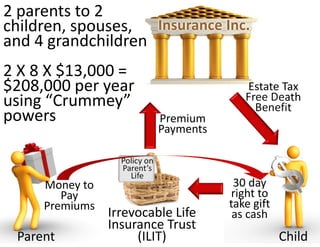

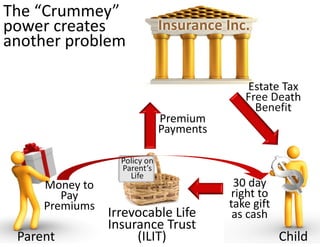

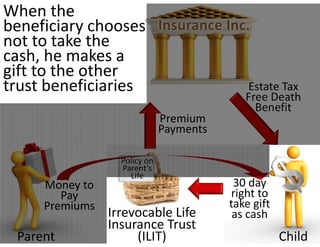

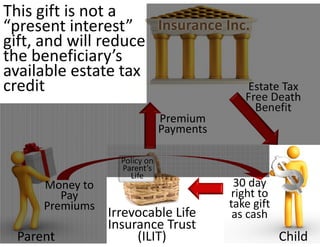

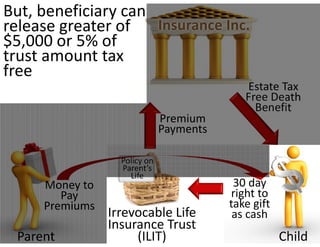

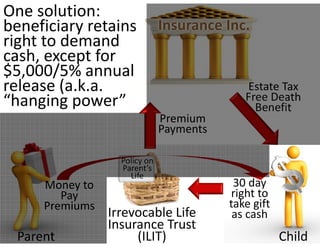

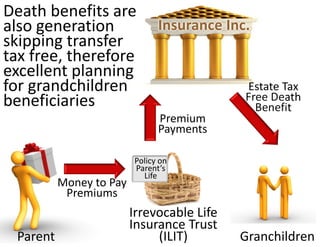

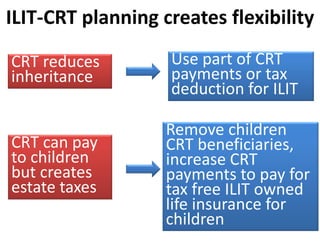

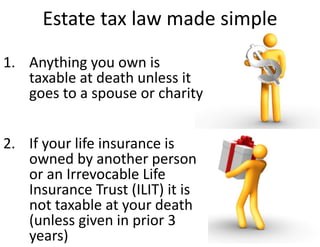

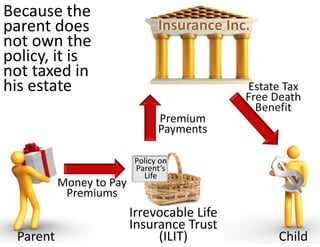

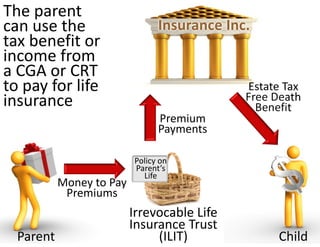

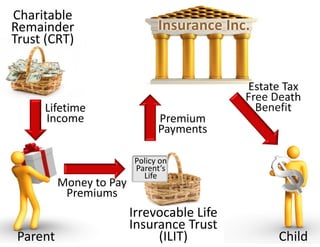

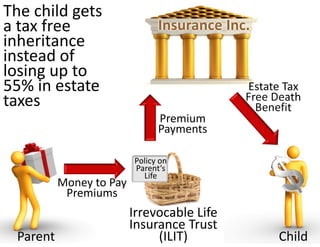

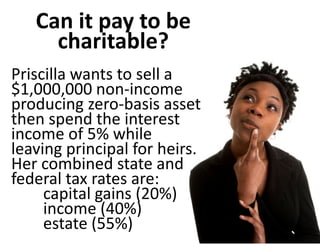

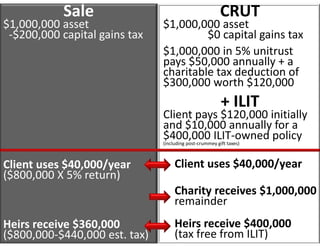

The document discusses the use of life insurance in charitable planning as a means to reduce taxes while providing for heirs. It explains how various charitable vehicles, such as charitable remainder trusts (CRTs) and irrevocable life insurance trusts (ILITs), can facilitate tax-free inheritances and enable philanthropic giving. Key concepts include the tax implications of ownership of life insurance policies and strategies for optimizing estate benefits for both heirs and charities.

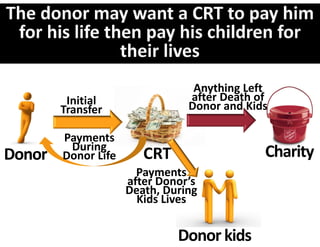

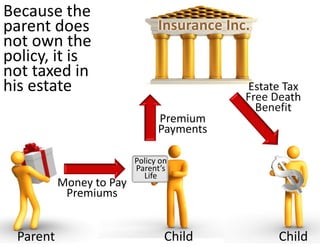

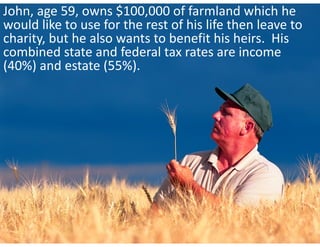

![Giving the remainder interest to charity creates a

deduction of $65,553 worth $26,221. This will

purchase a paid‐up policy of about $50,000. [Using a 2%

§7520 rate; the deduction falls as rates rise, but so does the price of the policy]

John keeps lifetime use of farm.

Charity gets farm at death.

Heirs get $50,000 tax free.](https://image.slidesharecdn.com/ilitcrtadvanced-120317131719-phpapp02/85/Life-Insurance-Charitable-Remainder-Trusts-16-320.jpg)