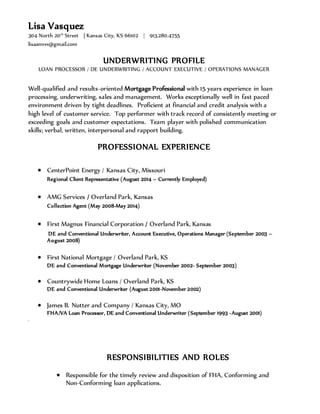

Lisa Vasquez has over 15 years of experience in loan processing, underwriting, sales, and management in the mortgage industry. She is proficient in financial and credit analysis with strong customer service skills. Vasquez has held roles as an underwriter, account executive, and operations manager at various mortgage companies in Kansas City. She is currently employed as a regional client representative at CenterPoint Energy, utilizing her polished communication and rapport building skills.