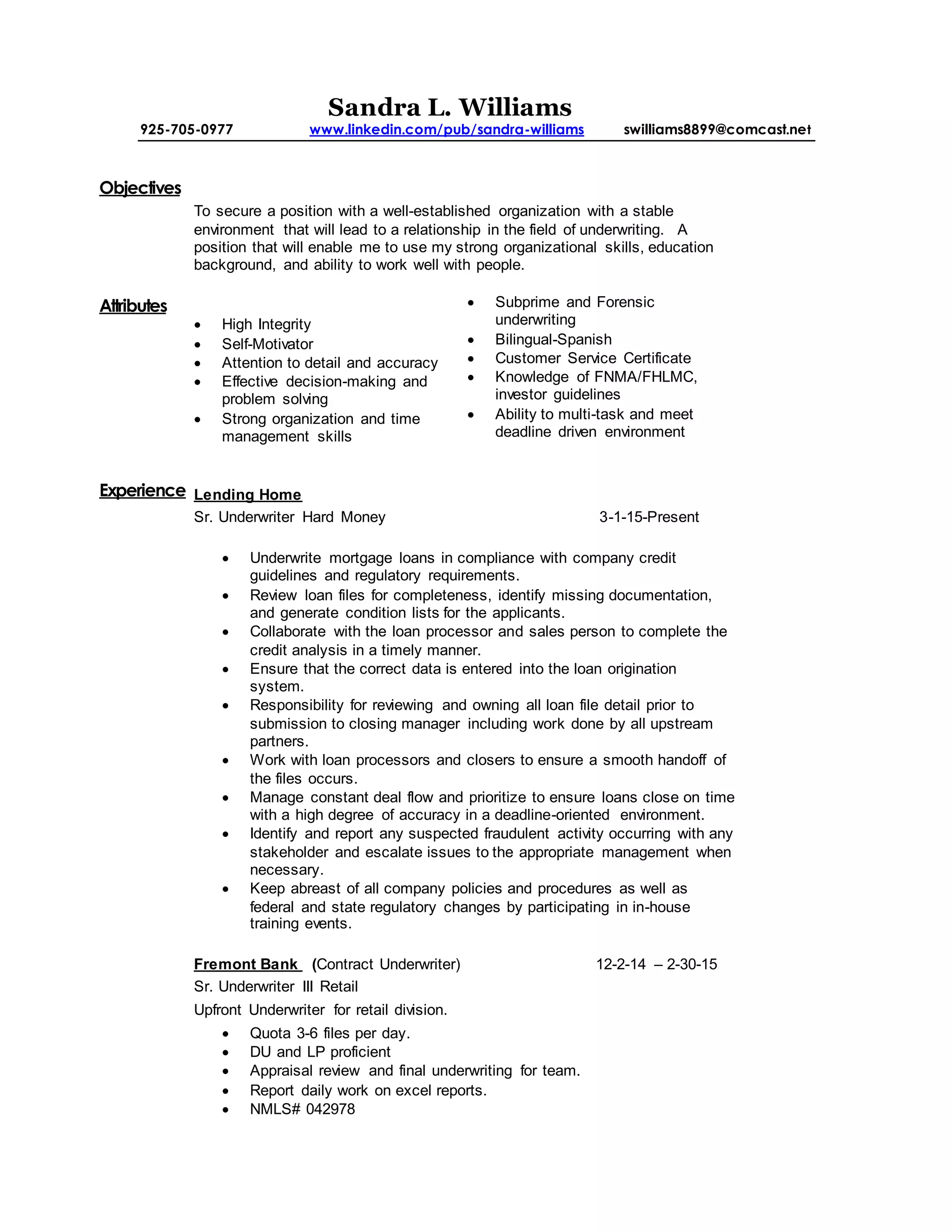

Sandra Williams is seeking a position as an underwriter with experience underwriting subprime, conventional, and FHA loans. She has over 15 years of underwriting experience at various mortgage companies. Her experience includes underwriting, reviewing loan files for completeness, ensuring data is entered correctly into origination systems, and collaborating with other departments. She is bilingual in Spanish and holds licenses and certificates in underwriting, real estate, and customer service.