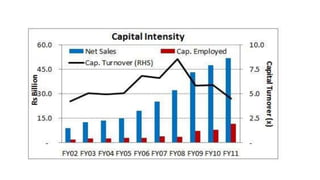

The document analyzes the financial performance of Voltas over several years. It examines the company's liquidity, turnover, profitability, and overall performance. Key points:

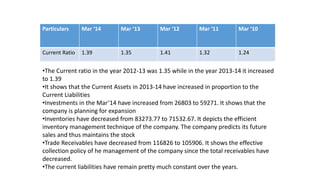

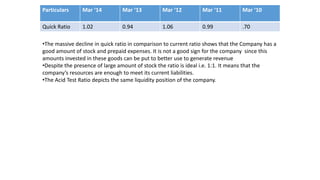

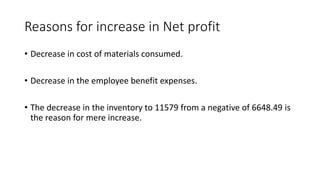

- The company's current and quick ratios show adequate liquidity to meet short-term obligations. Inventories and receivables decreased from prior years.

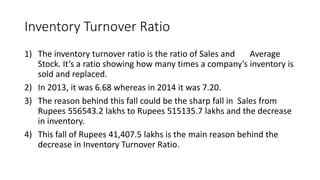

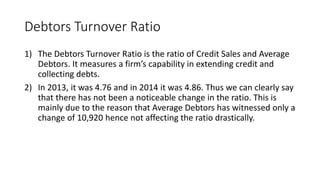

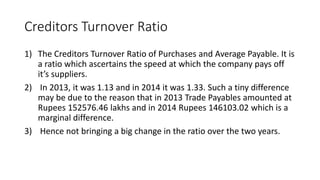

- Inventory turnover and debtors' turnover ratios remained relatively stable from 2013-2014. Creditors' turnover saw a small increase.

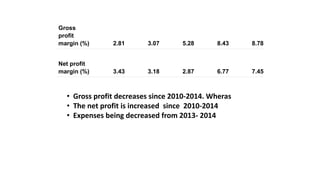

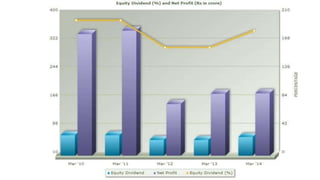

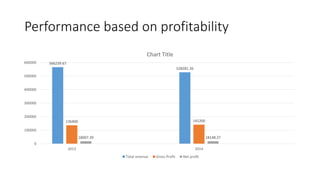

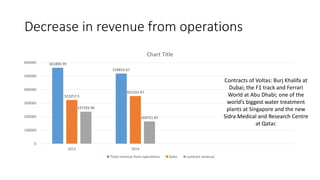

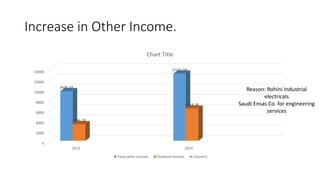

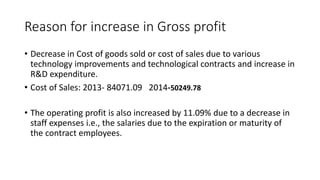

- Gross and net profit margins declined from 2010-2014 despite expenses decreasing from 2013-2014. Dividends per share and earnings per share increased.

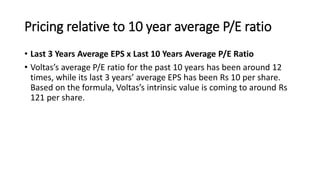

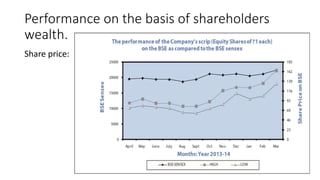

- Overall, the company's performance has been positive based on stable profitability, increased shareholders' returns