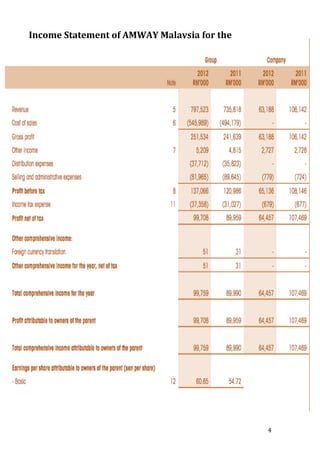

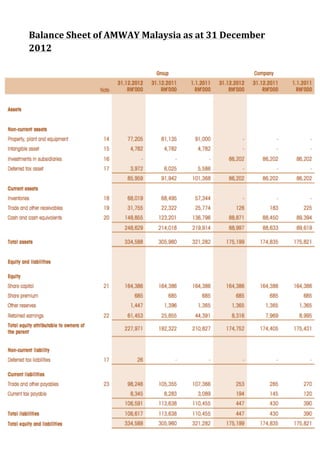

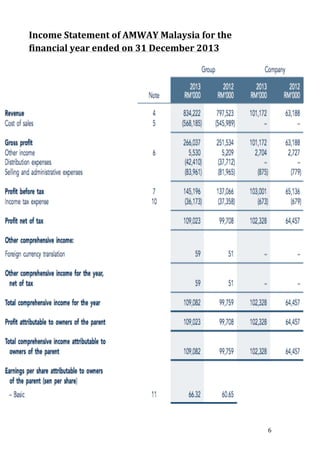

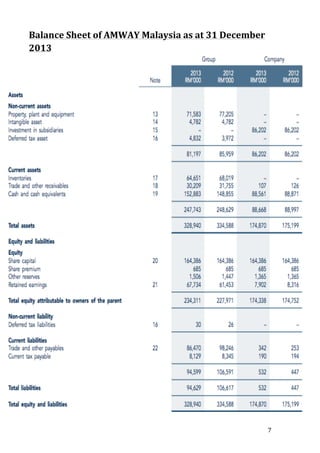

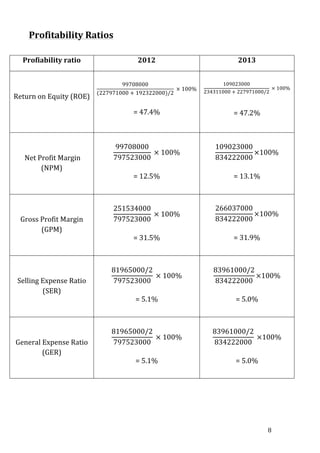

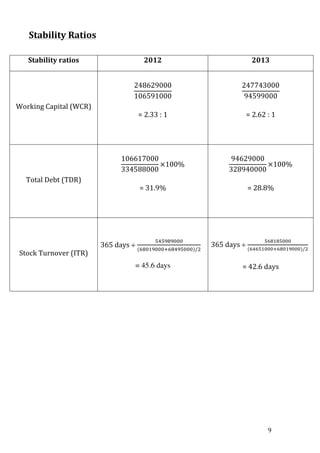

This document contains financial analysis of Amway Malaysia for the years 2012 and 2013. It includes the income statement, balance sheet, and calculation of various profitability and stability ratios. The profitability ratios like net profit margin, gross profit margin, and expense ratios improved from 2012 to 2013, indicating better management of costs. The stability ratios like working capital, debt, and inventory turnover also improved over this period. However, the P/E ratio of 18 times suggests the shares are overvalued currently. Overall, the financial health and performance of Amway Malaysia seems good based on the ratio analysis, but the shares may not be a good investment at the current price.