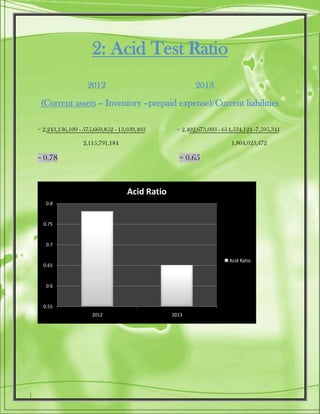

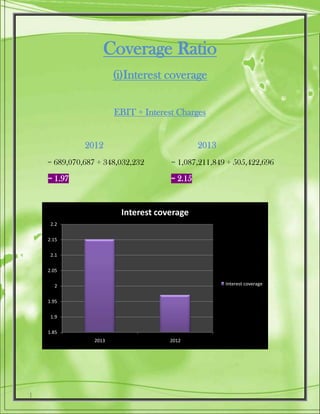

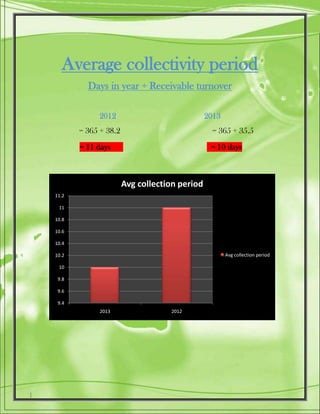

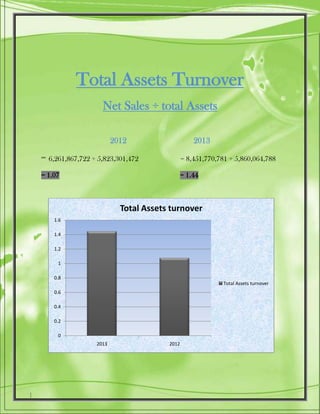

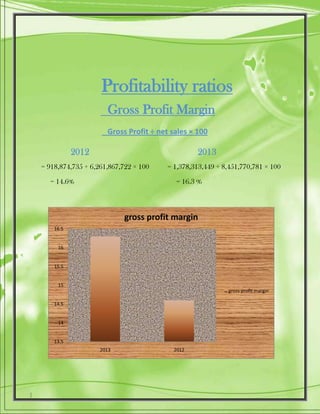

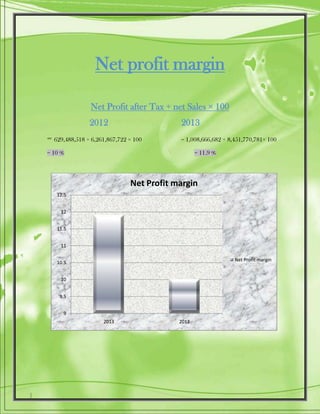

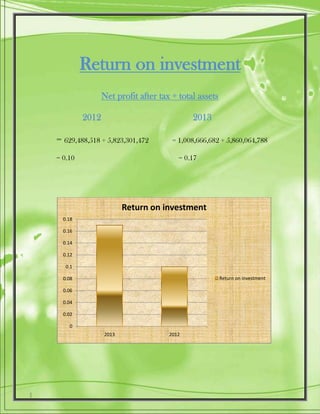

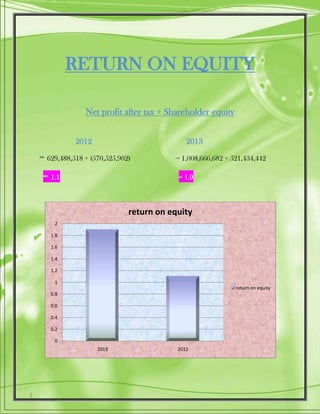

Kohinoor Mills Limited is a textile company incorporated in 1987 with the vision of becoming the most progressive and profitable textile organization in Pakistan. It has annual turnover of over Rs. 8 billion and employs over 1,400 people. The company's financial position strengthened in 2013, with profits increasing 60.2% to Rs. 1.008 billion on higher sales. Current and long-term liabilities decreased, while reserves and accumulated profits increased. Some financial ratios indicate room for improvement in liquidity and leverage.