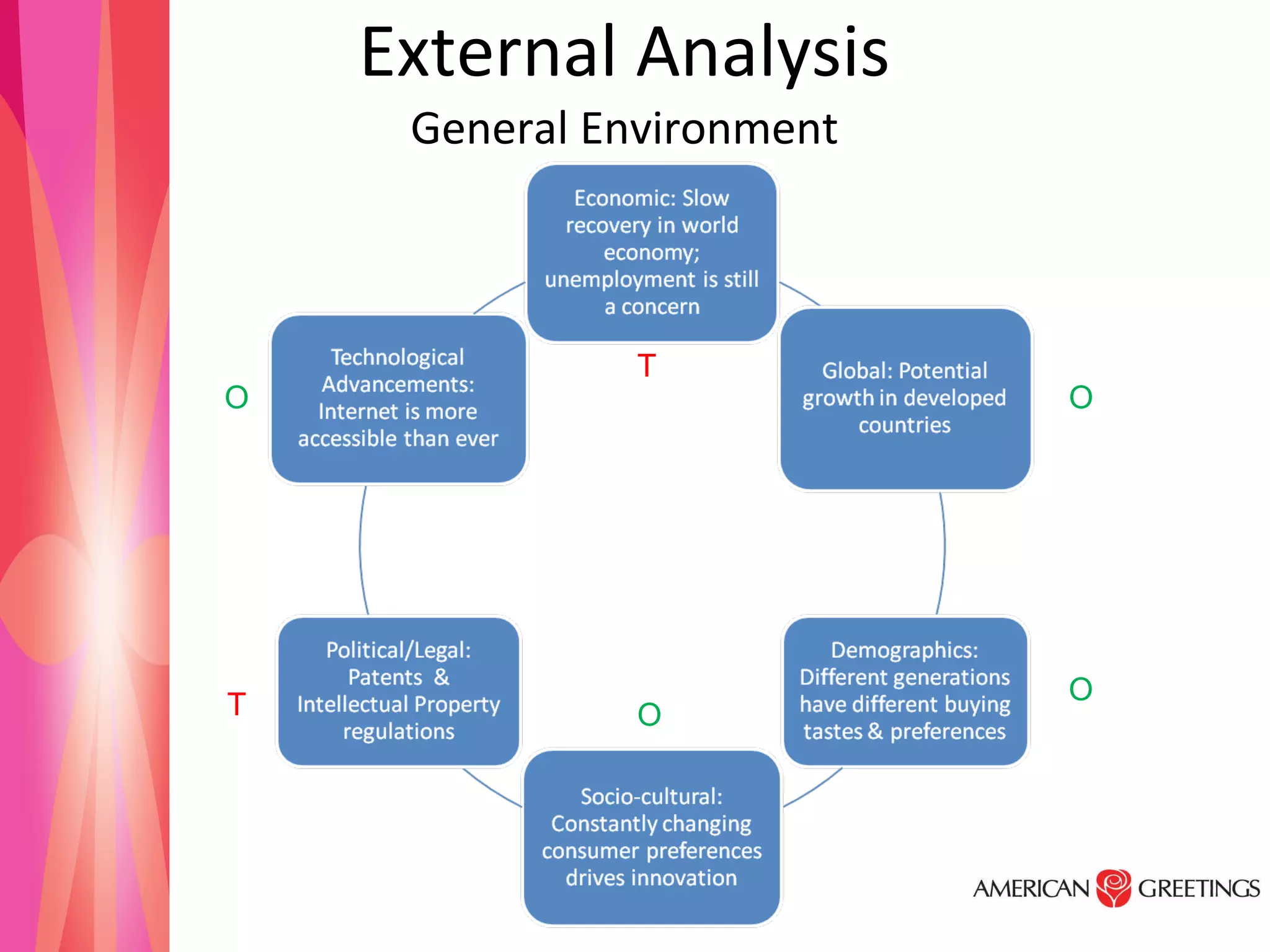

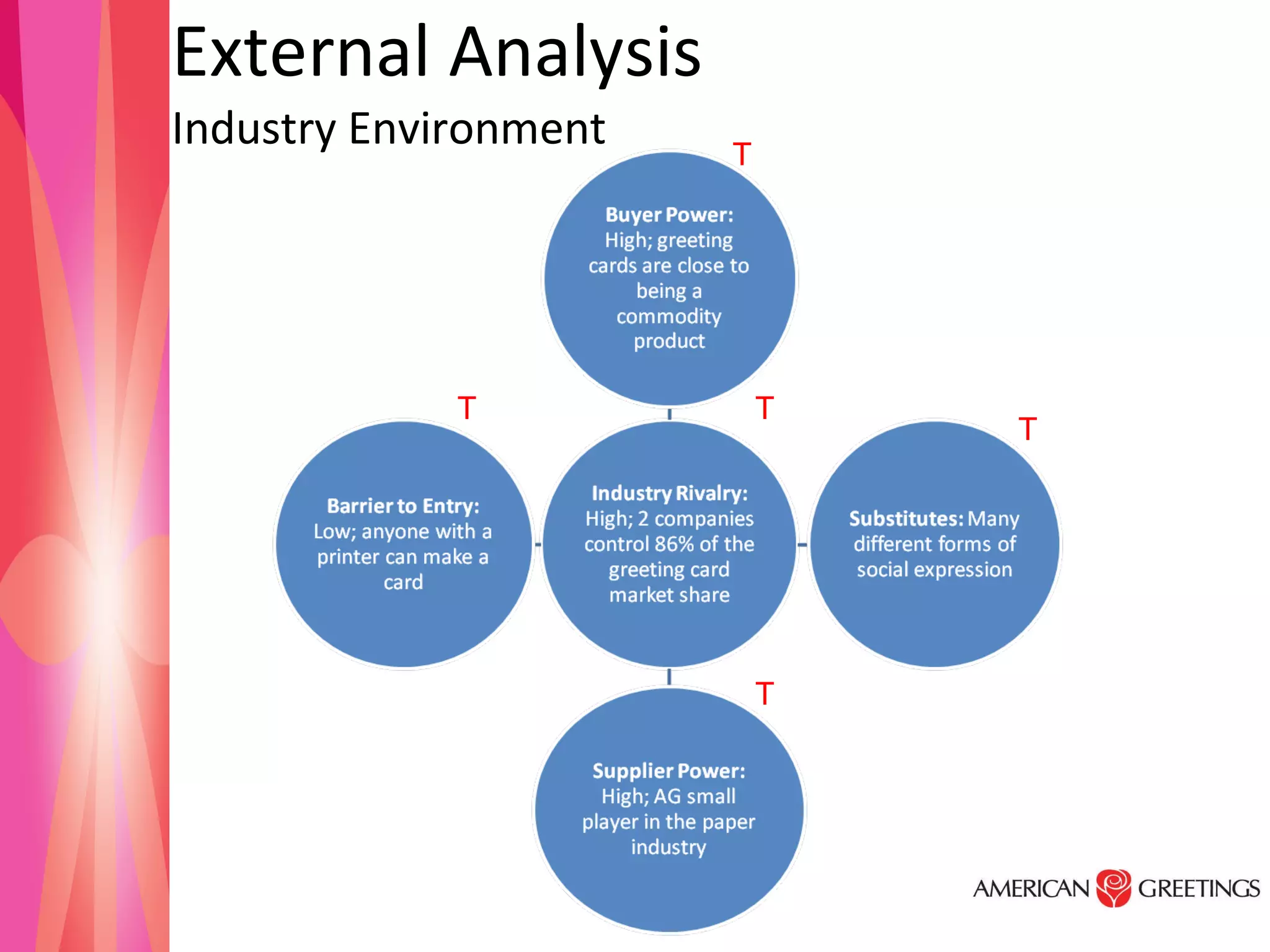

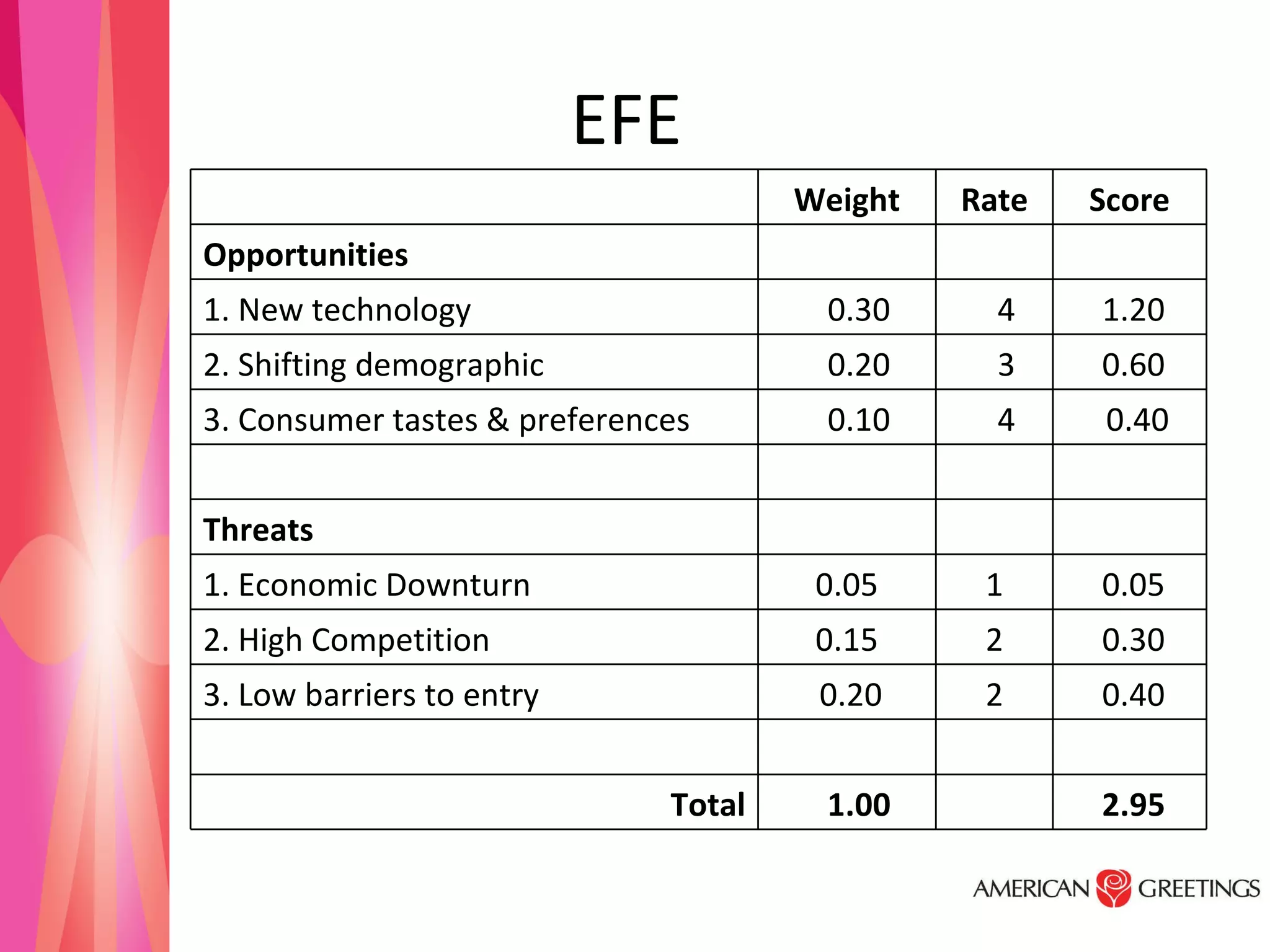

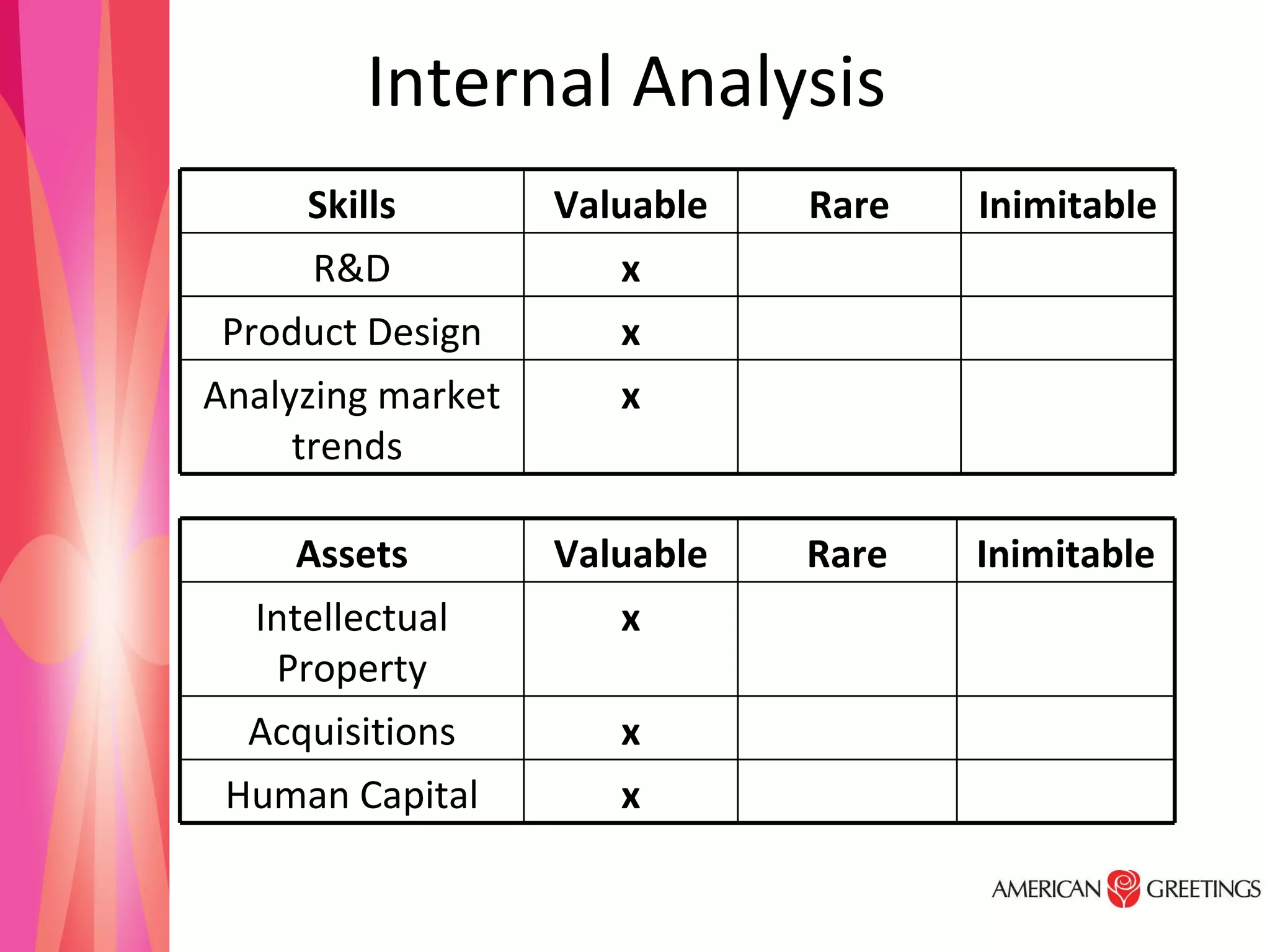

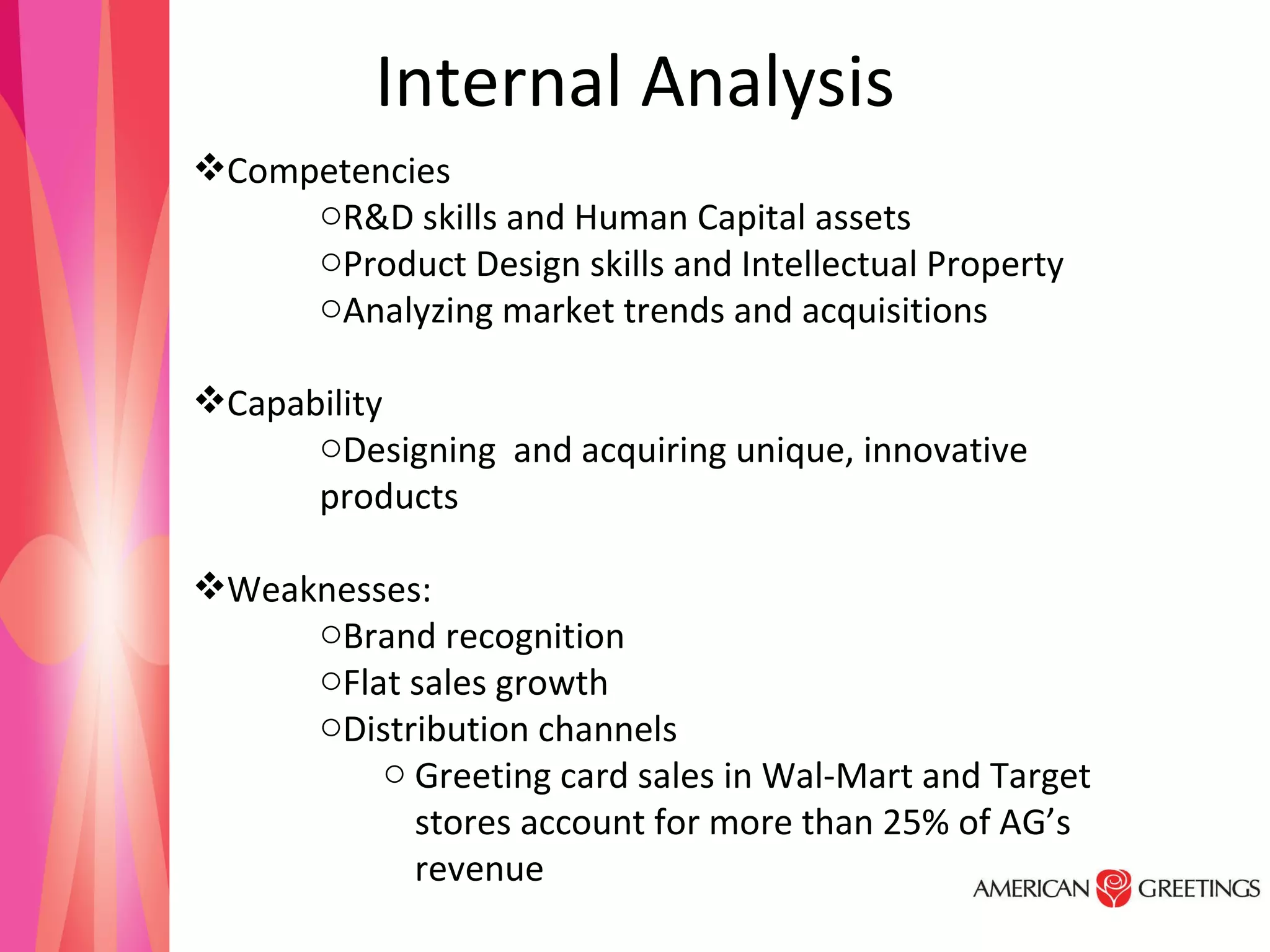

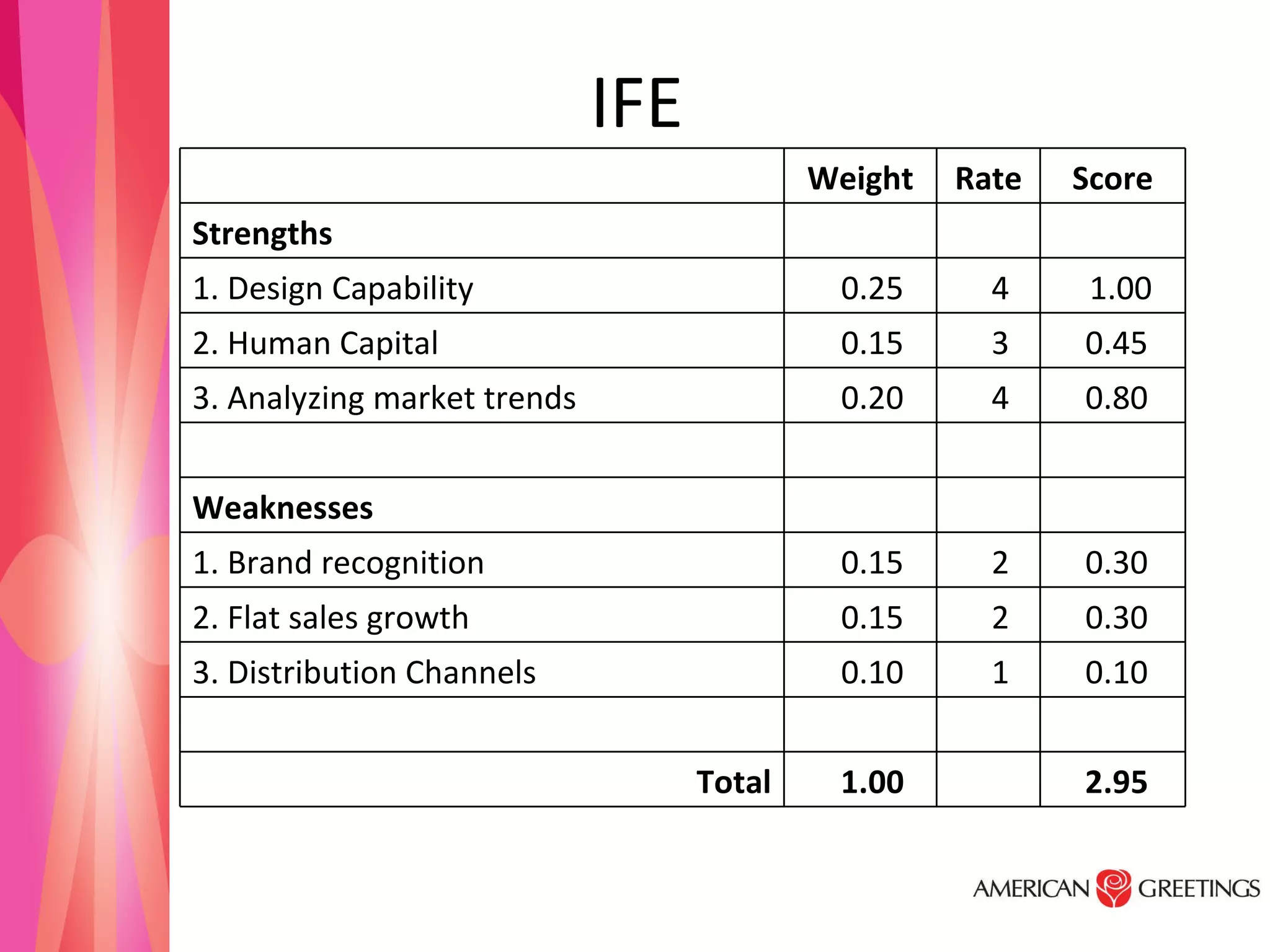

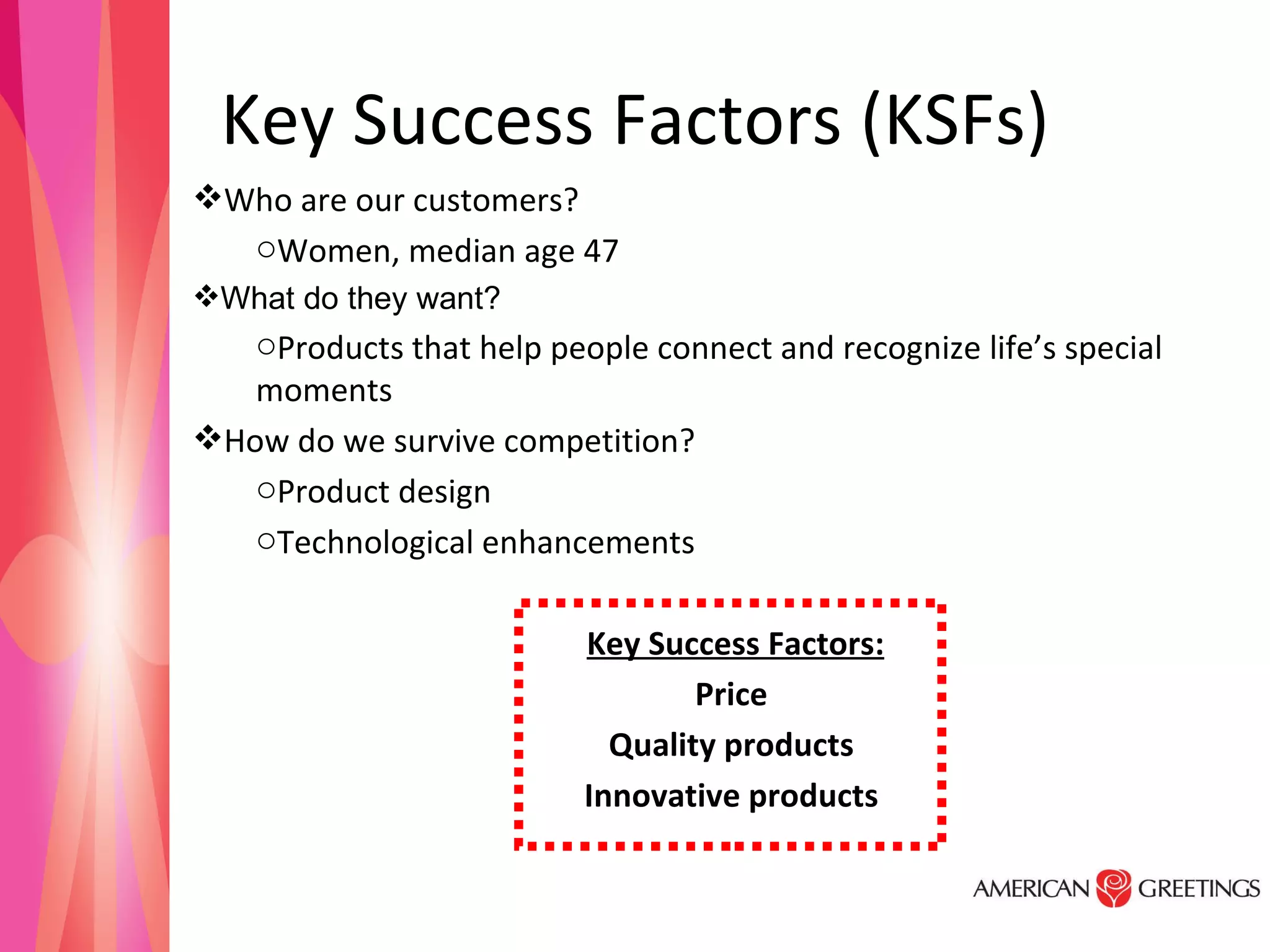

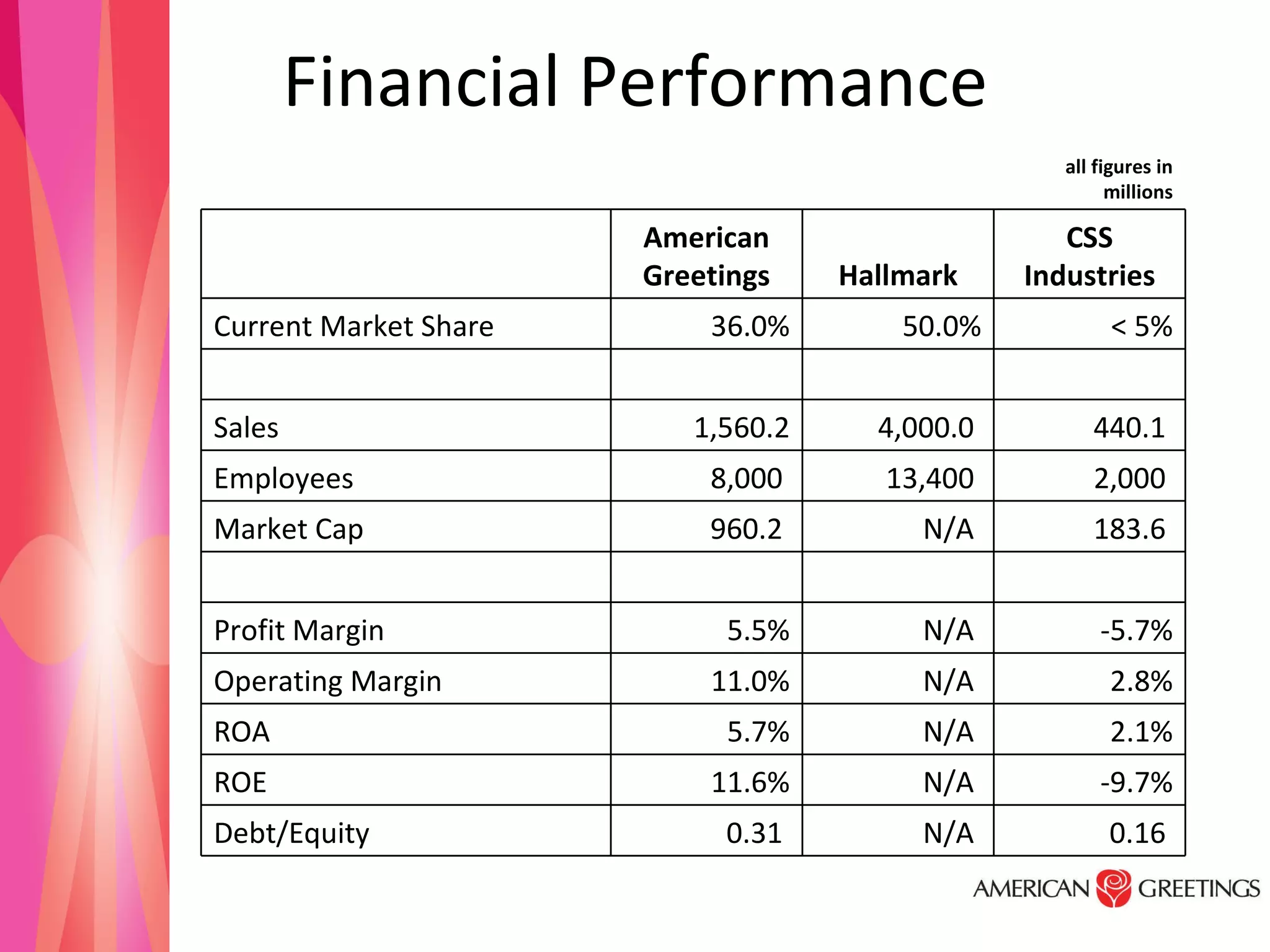

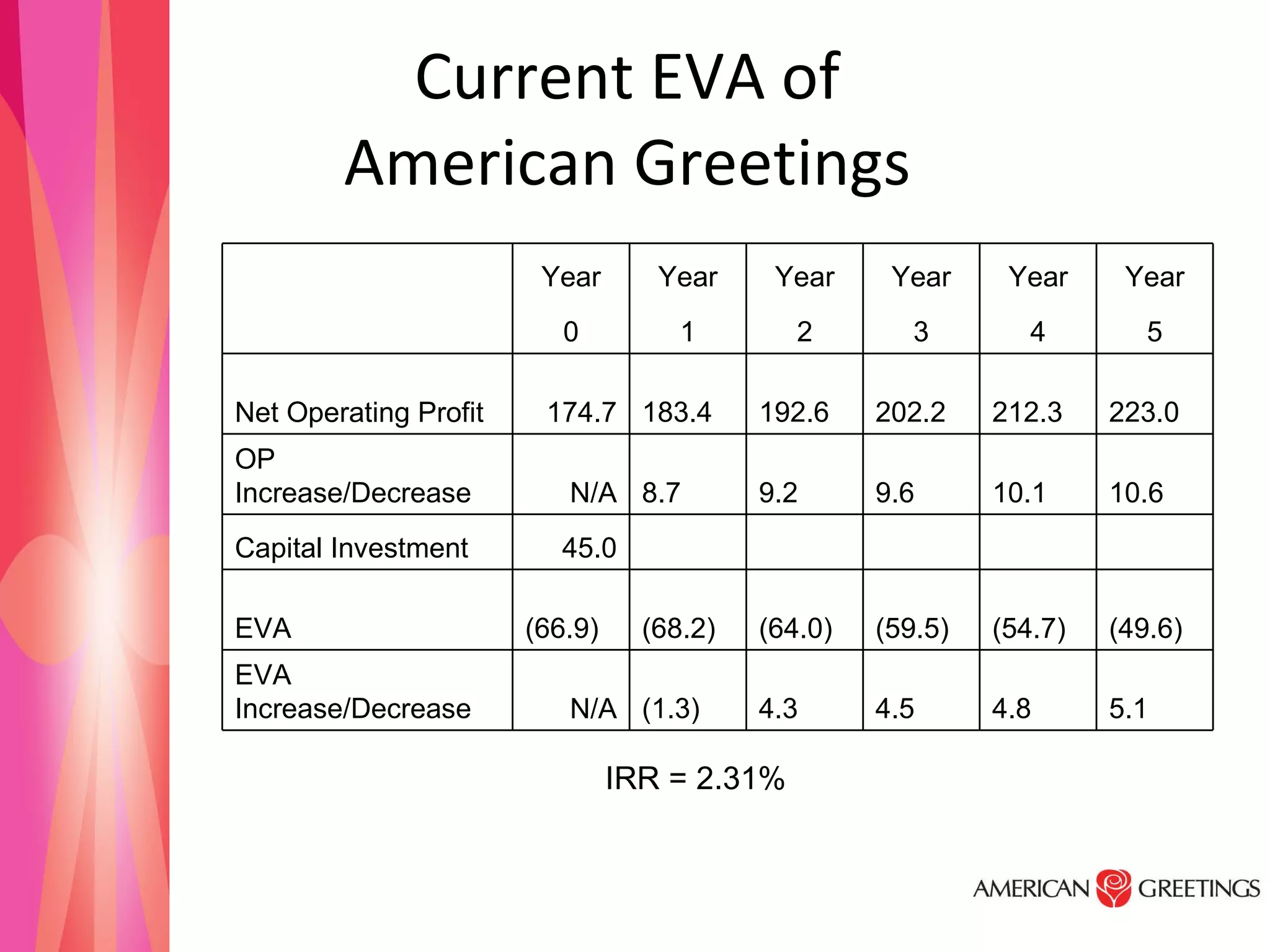

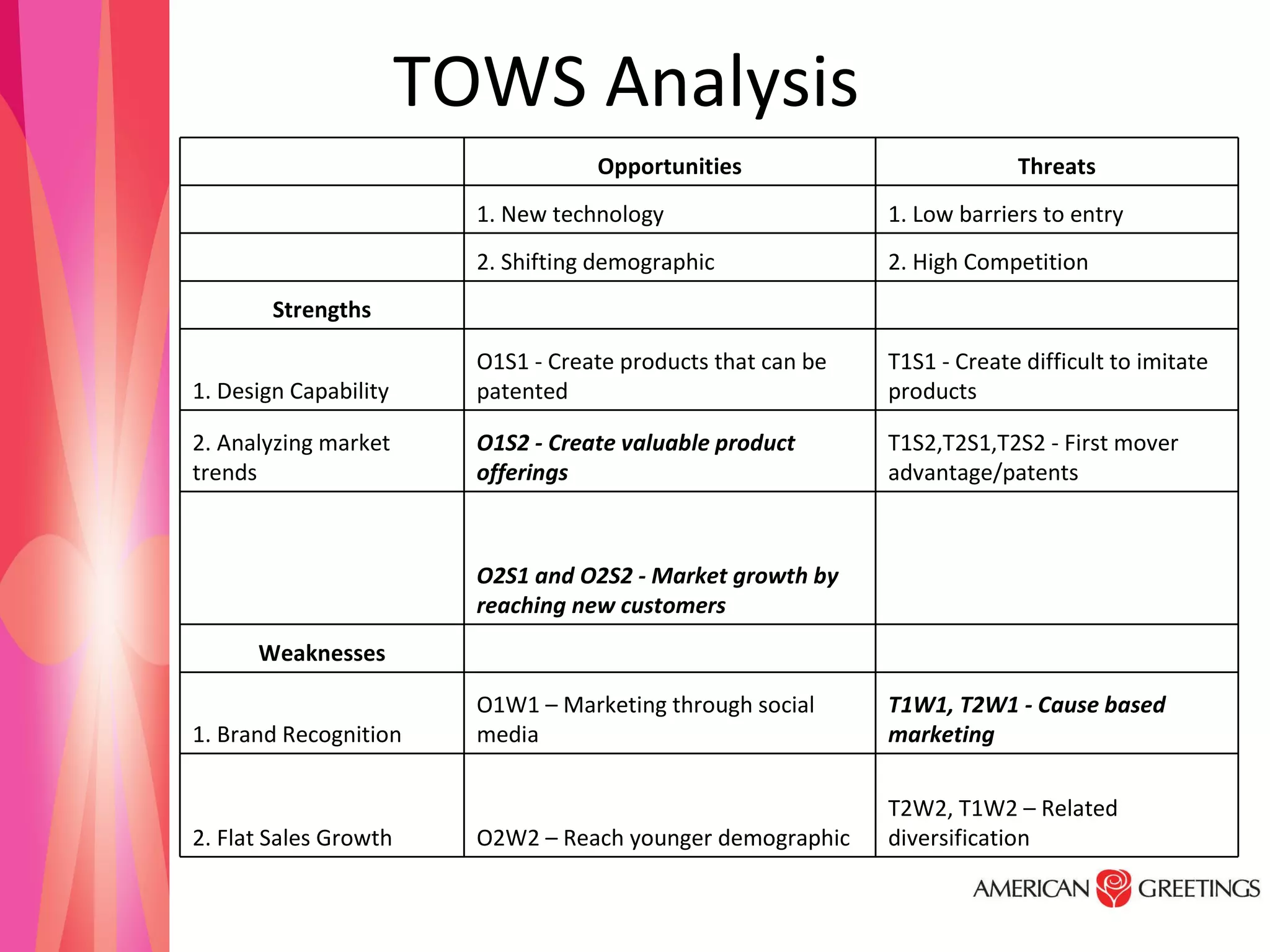

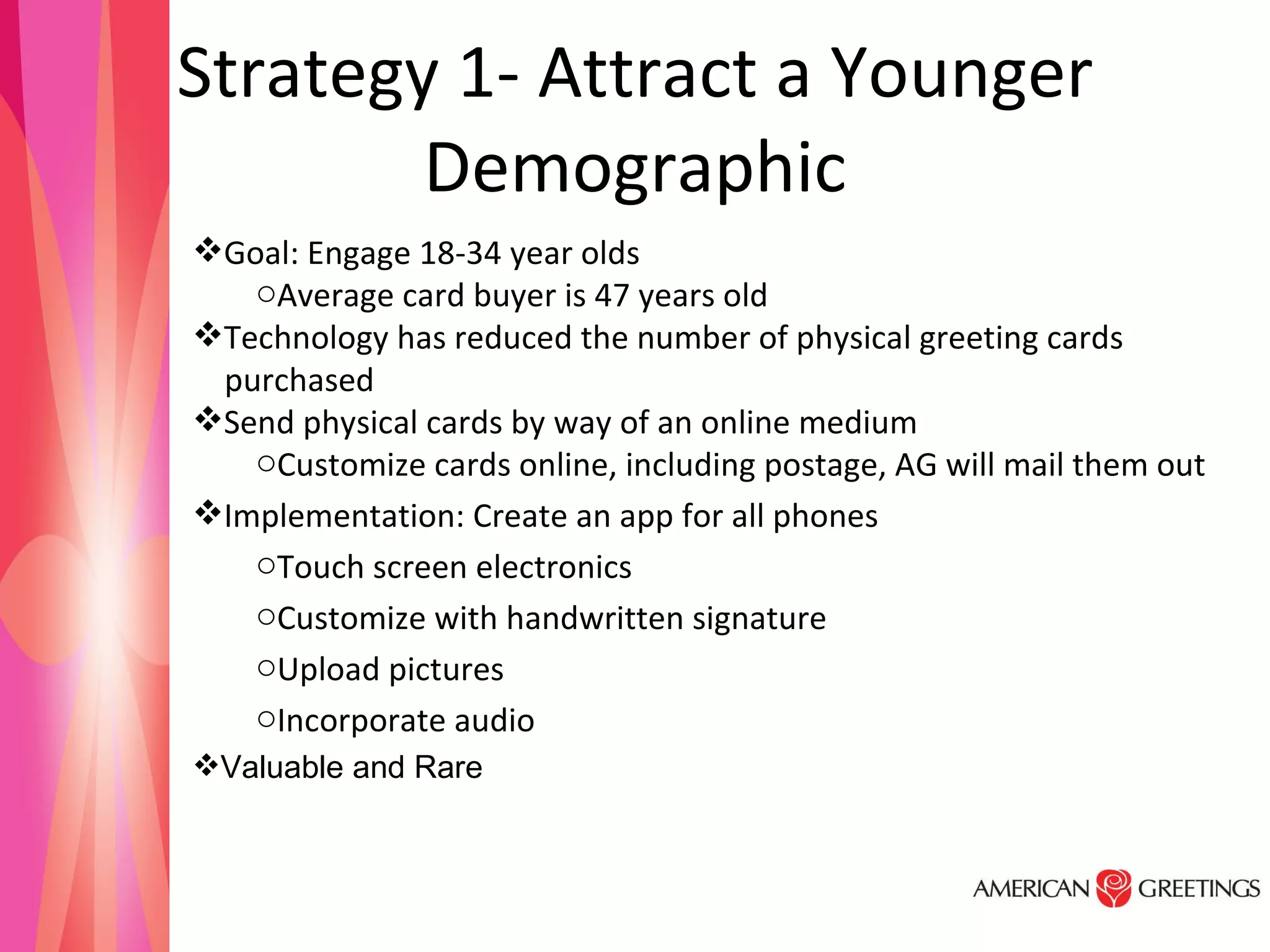

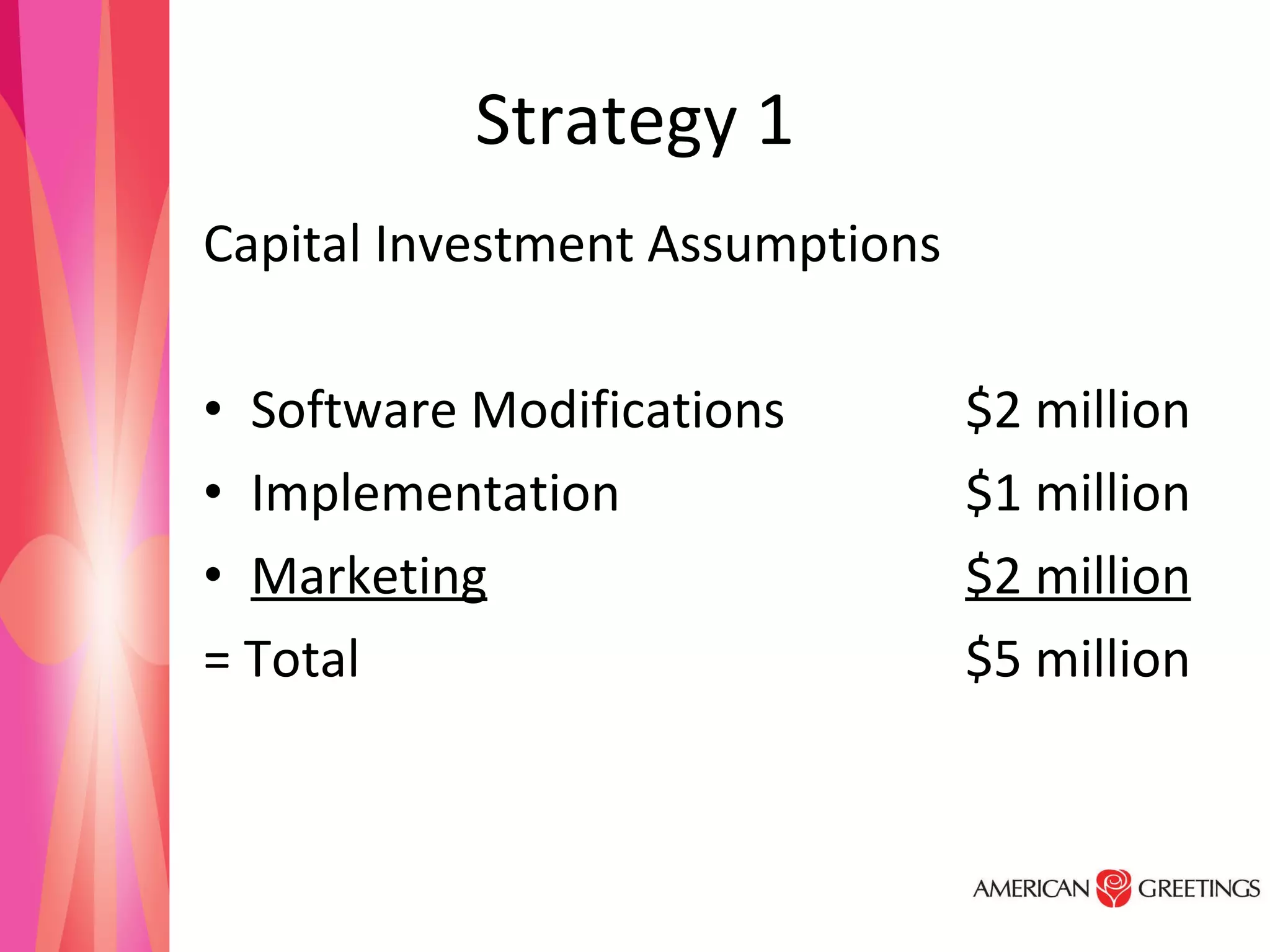

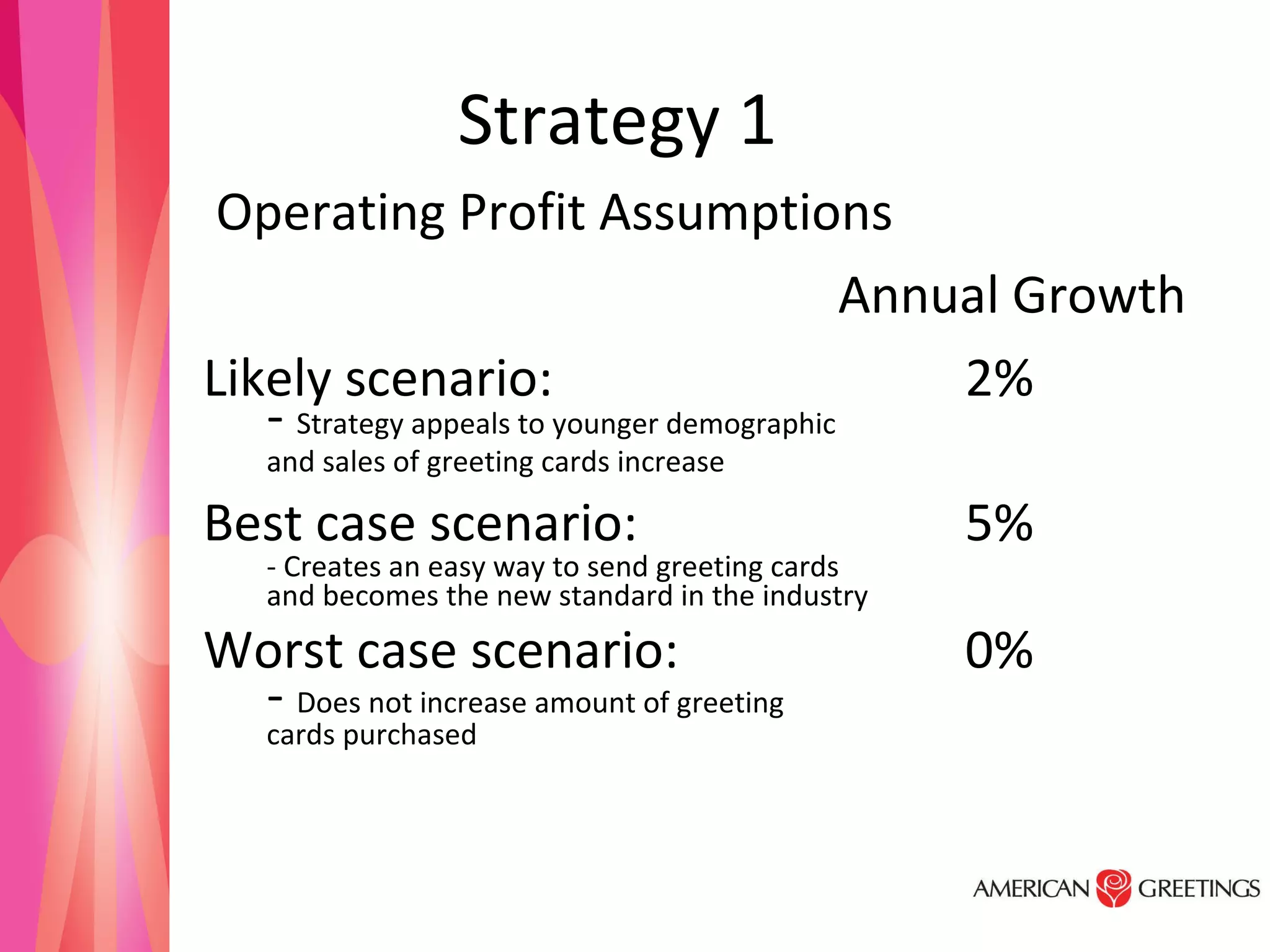

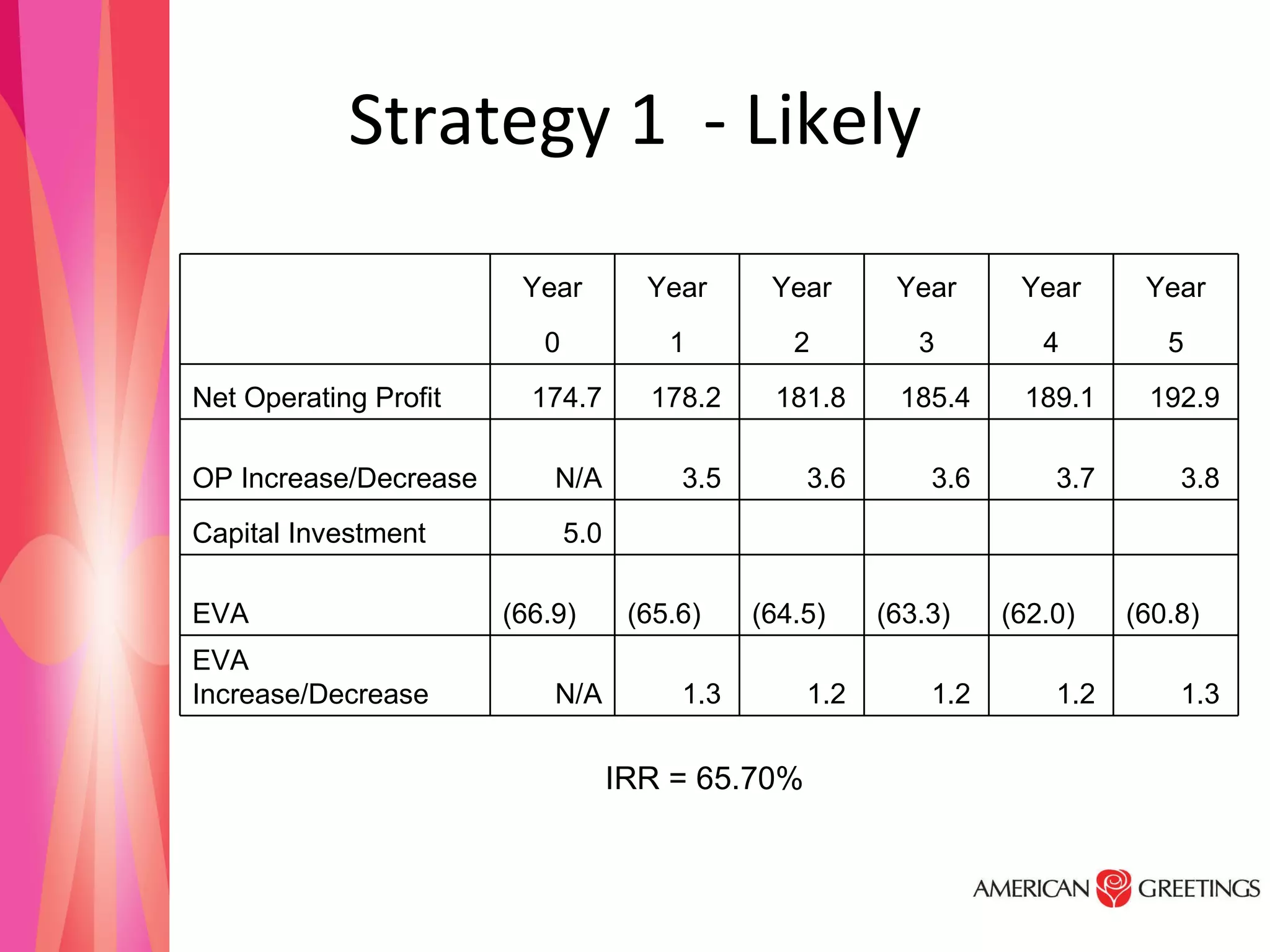

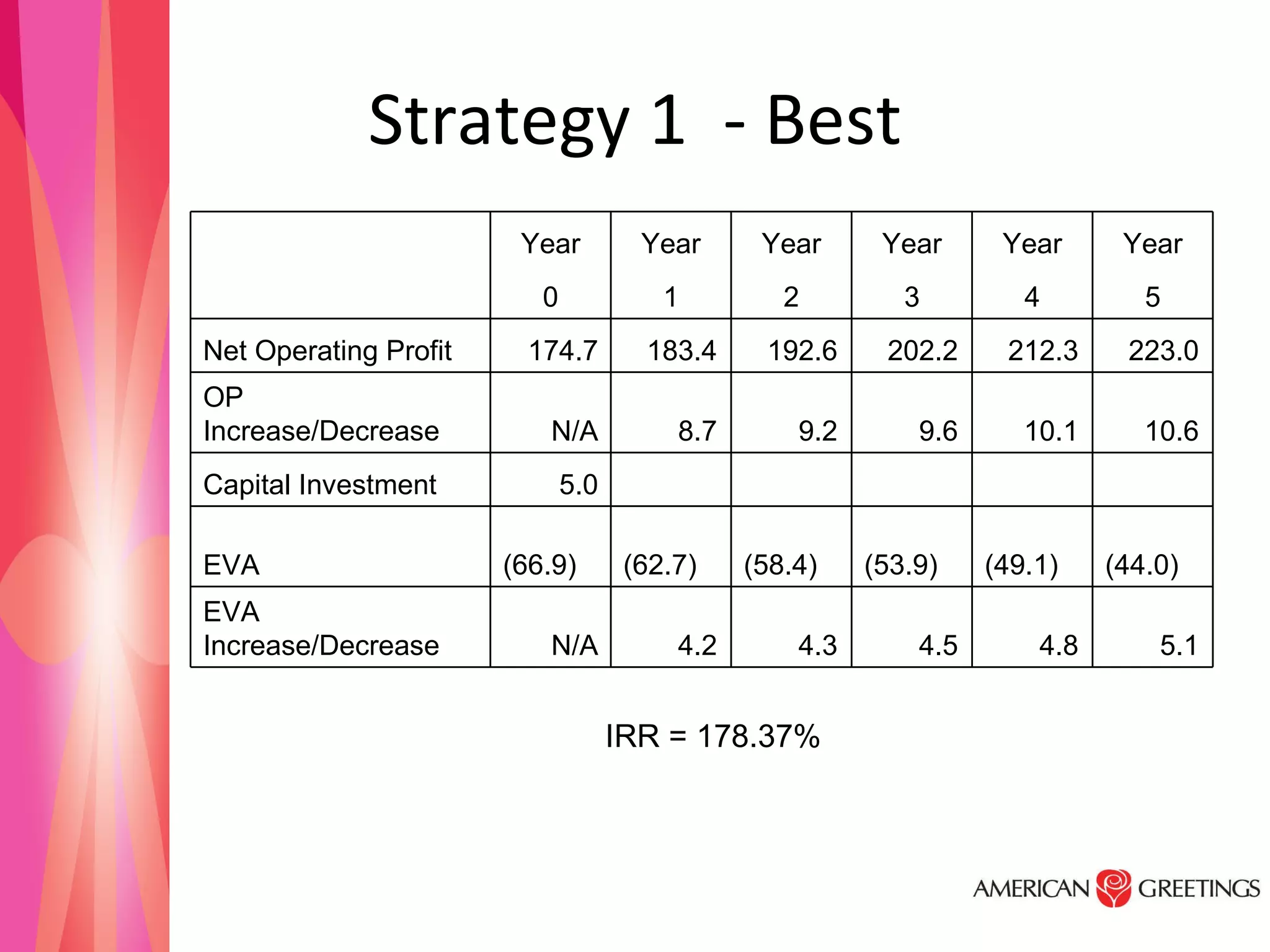

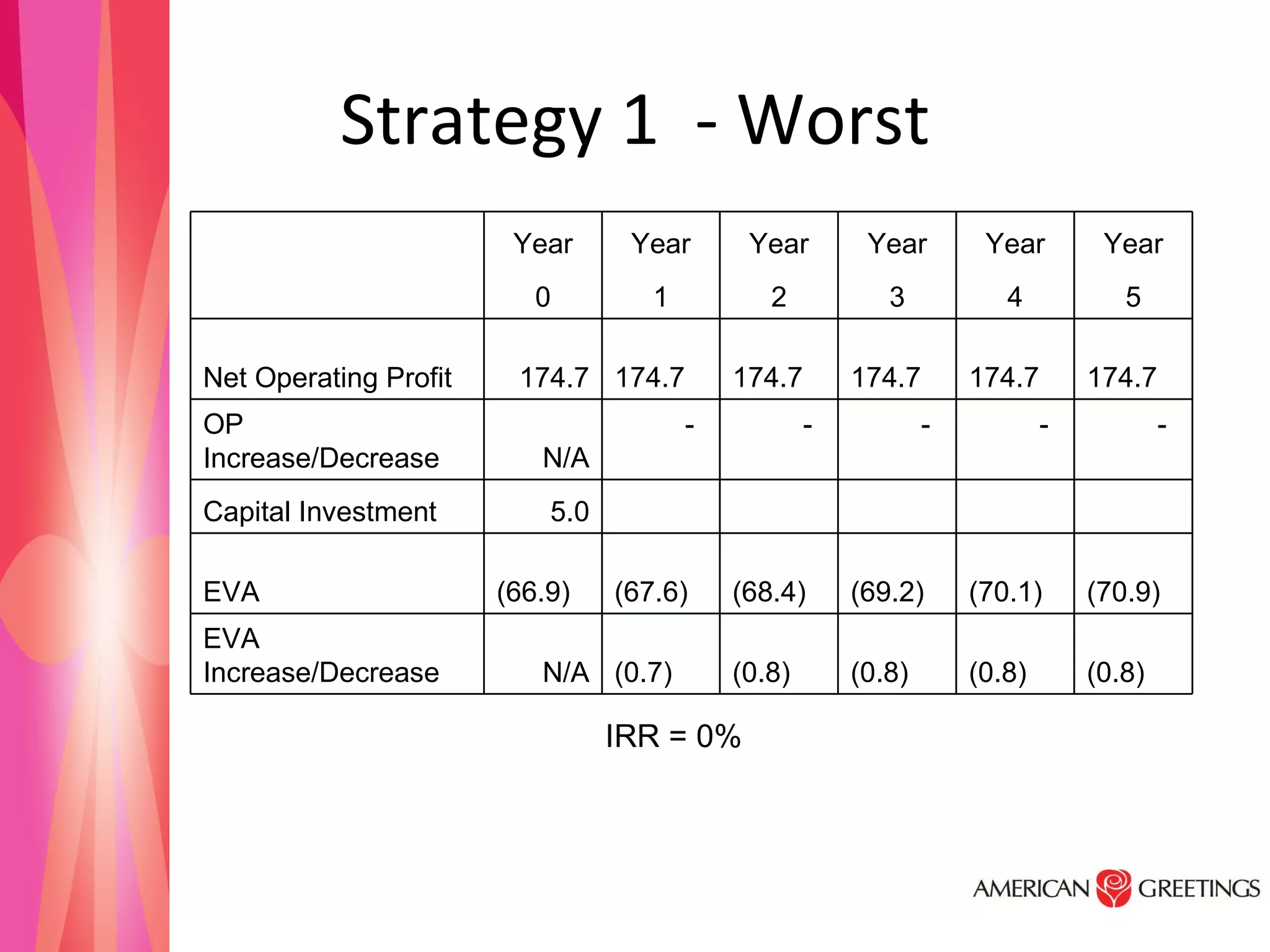

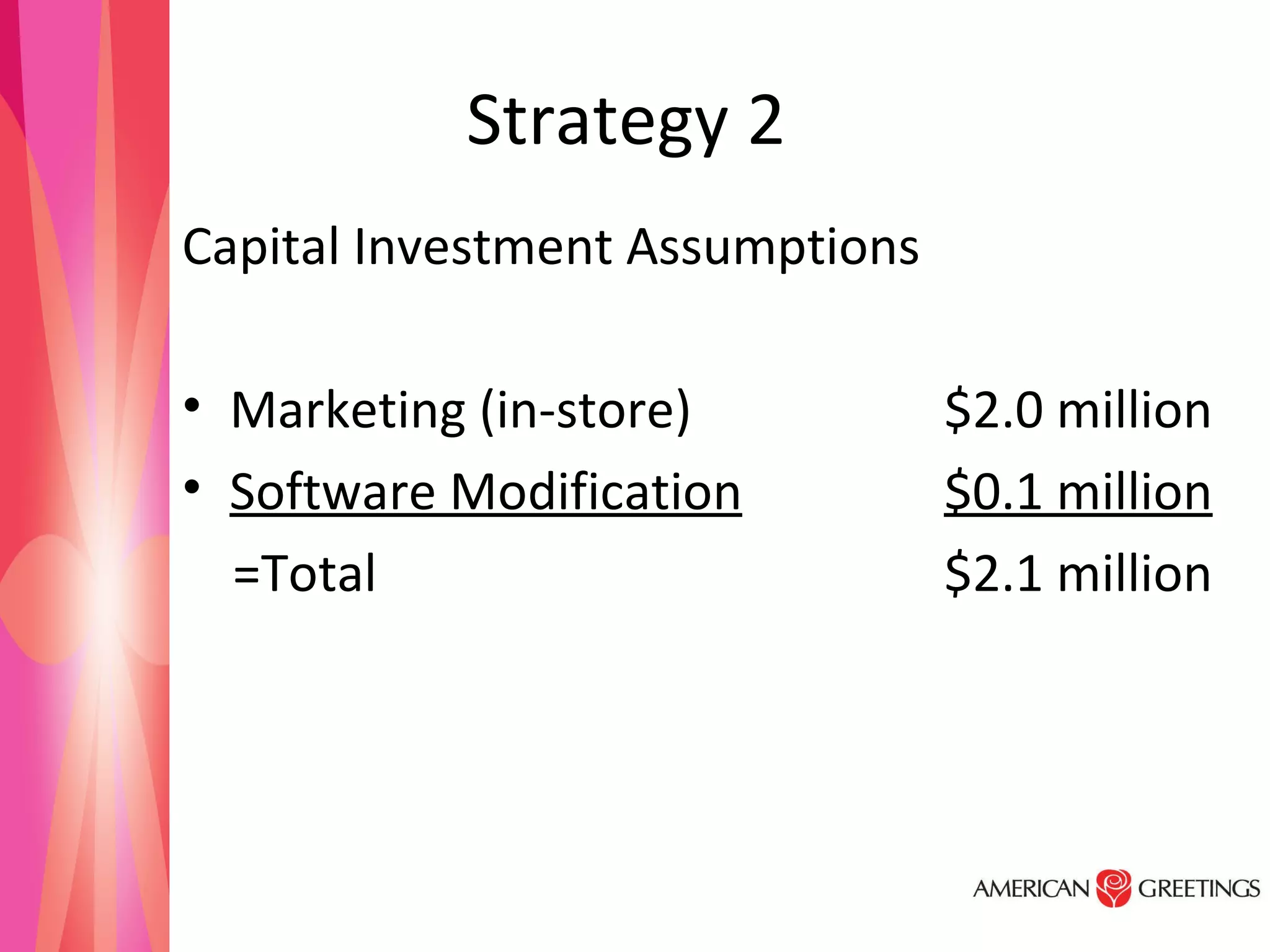

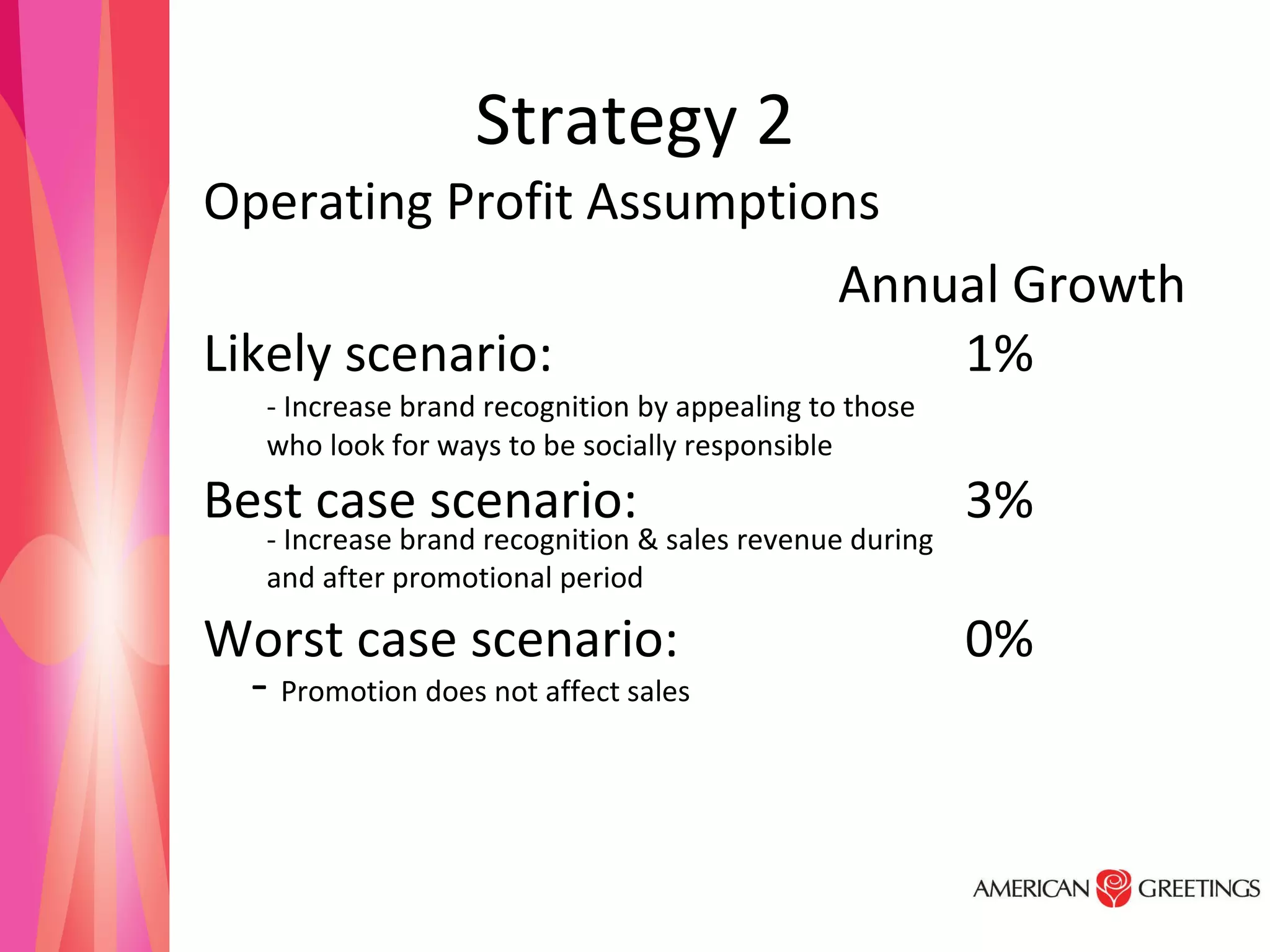

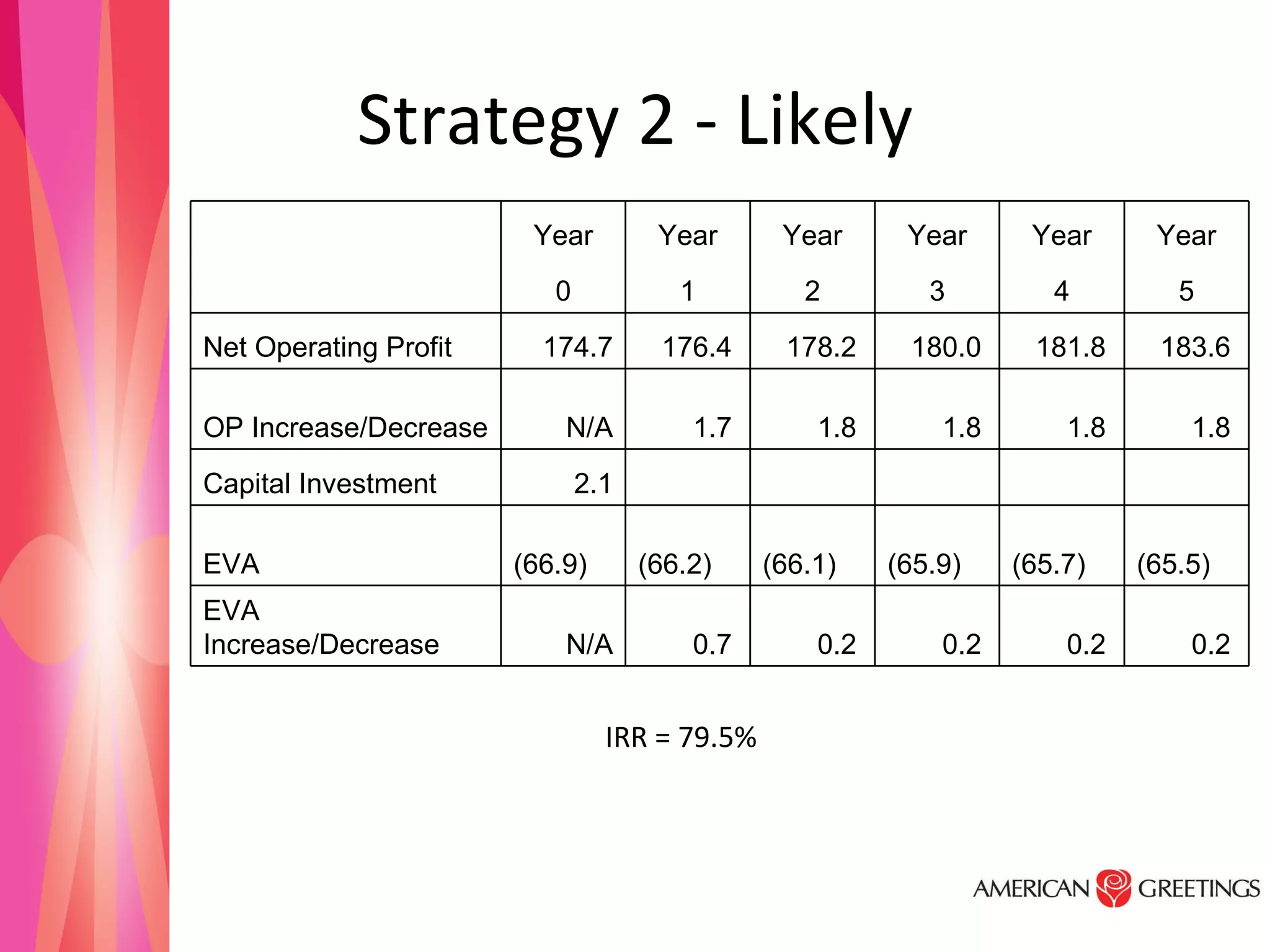

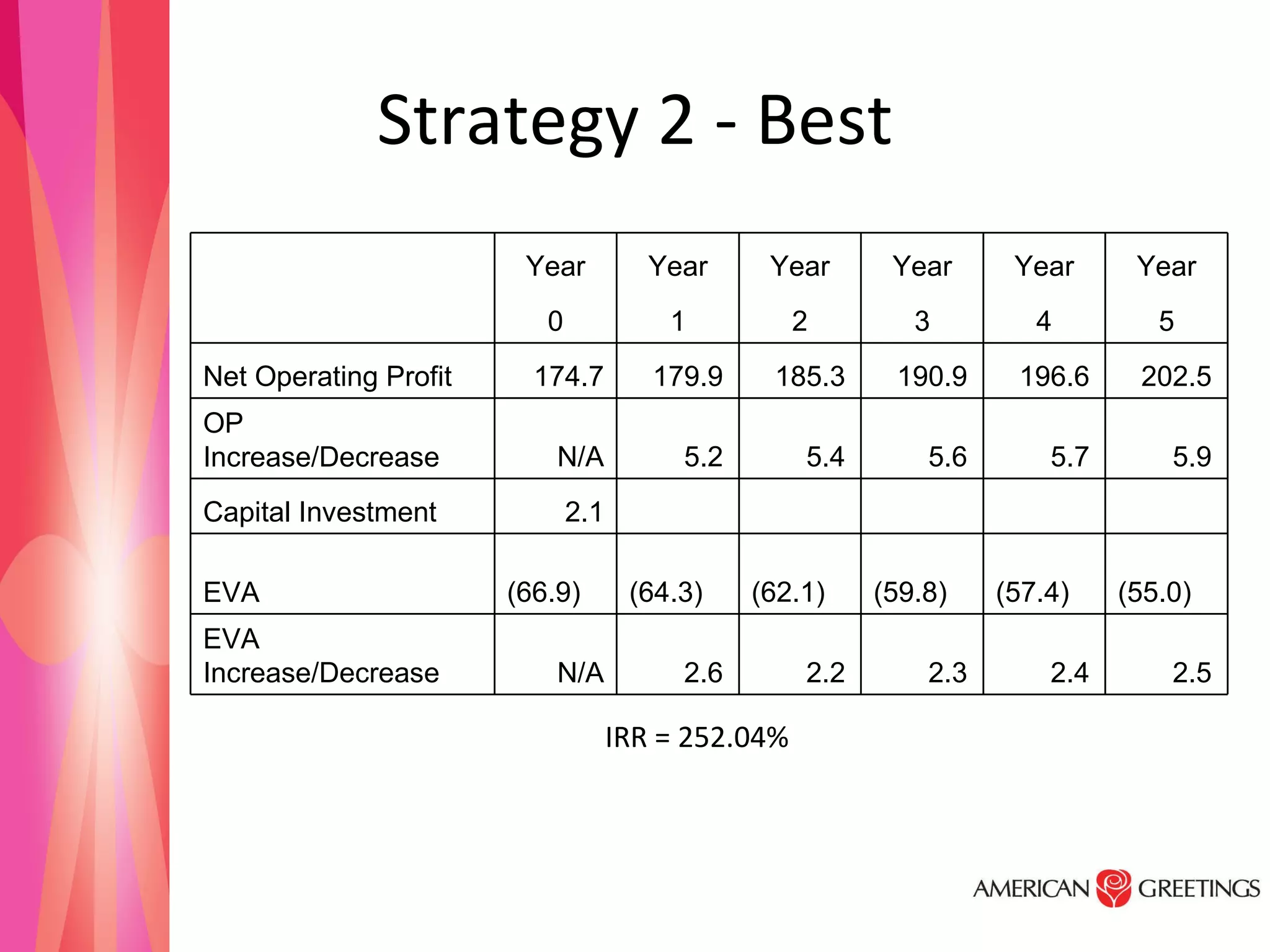

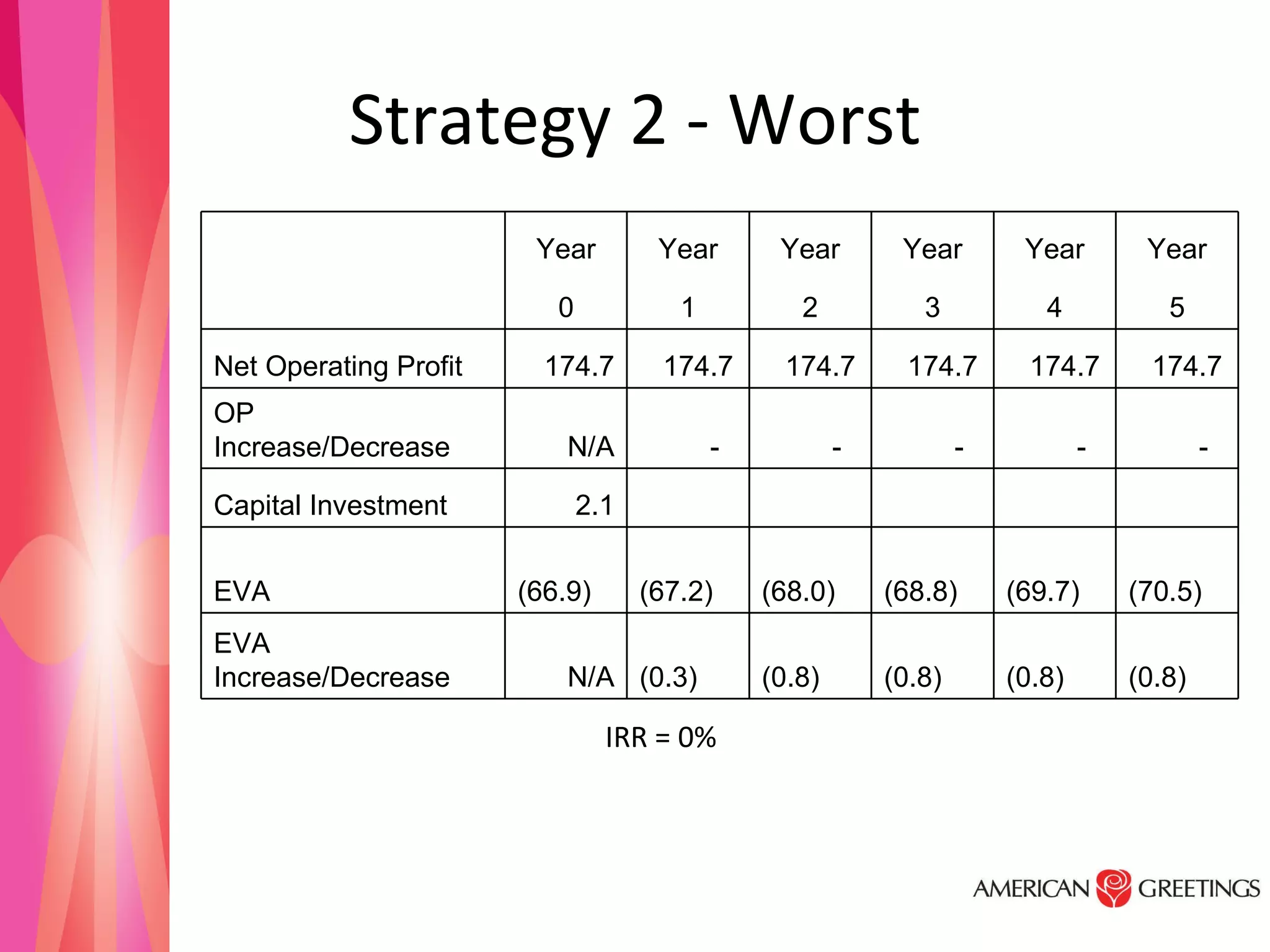

American Greetings is a leading greeting card manufacturer that operates predominantly in a single industry. It has 5 major greeting card brands and a family-oriented culture led by CEO Zev Weiss. The company's mission is to create innovative products that meet consumer needs to connect, express and celebrate. Its external environment presents opportunities from new technology and shifting demographics, while threats include economic downturns and high competition. Internally, it has strengths in design capability and analyzing market trends, but weaknesses in brand recognition and flat sales growth. Two potential strategies are presented: 1) attracting a younger demographic through a customizable mobile app and 2) a strategic partnership with a charity to boost brand recognition and sales. The recommendation is Strategy 1 to