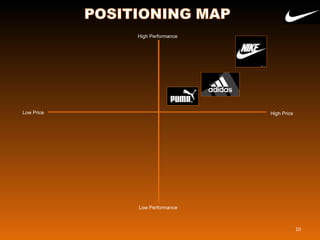

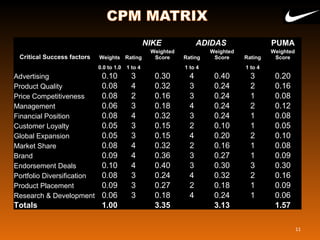

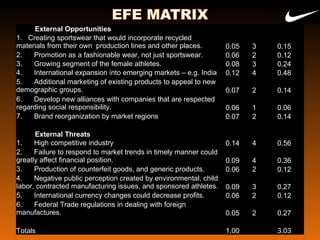

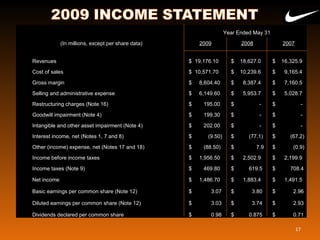

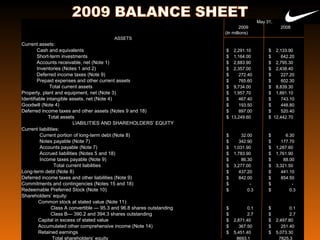

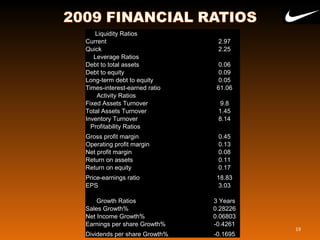

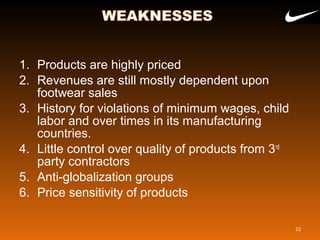

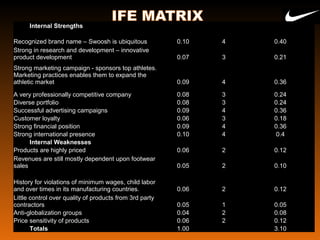

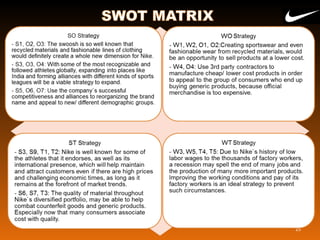

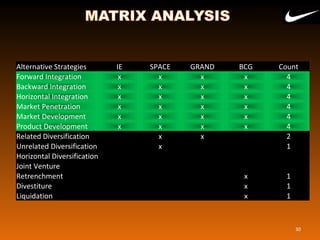

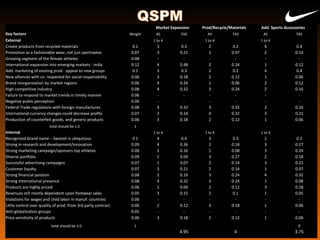

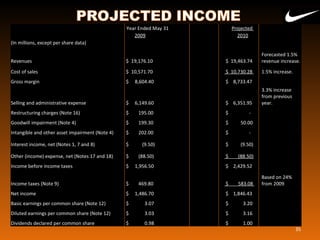

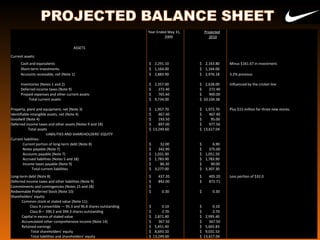

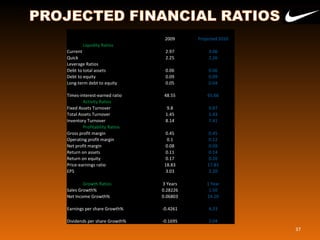

This document provides an analysis of Nike, Inc. for 2009. It includes sections on Nike's history, vision and mission statements, external and internal assessments, financial statements and ratios for 2009, and strategic recommendations. Key points analyzed include Nike's strong brand name, marketing campaigns, research and development capabilities, portfolio diversity and financial position as strengths, and high product pricing, revenue dependence on footwear, and manufacturing issues as weaknesses. Opportunities discussed are expanding into new markets and recycled materials, while threats include high competition and negative public perceptions. Overall recommendations are made to further promote a fashion image, expand into new markets and customer groups, and strengthen alliances regarding social responsibility.