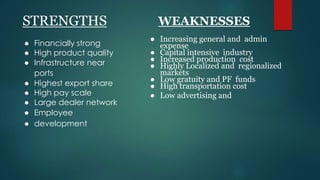

This document provides information on Lucky Cement, including its business profile, vision, mission, internal and external factor analyses, competitive profile, TOWS matrix, Porter's five forces analysis, and financial analysis. Lucky Cement was founded in 1993 and is one of the largest cement manufacturers in Pakistan. It has strong financial performance with increasing profits, assets, and revenues over recent years. However, it faces threats from government regulations and price competition from rivals. The document evaluates Lucky Cement's strengths and weaknesses and provides recommendations around increasing employee pay and benefits, market penetration in new regions, and contingency planning.